Академический Документы

Профессиональный Документы

Культура Документы

Lec-8A - Business Cycle

Загружено:

MsKhan00780 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров15 страницPeak (trough): A relatively large positive (negative) deviation from trend. Peaks and troughs are referred to as turning points. Regularities in GDP fluctuations amplitude: maximum deviation from trend. Frequency: number of peaks in real GDP that occur per year.

Исходное описание:

Оригинальное название

Lec-8A - Business Cycle.ppt

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPeak (trough): A relatively large positive (negative) deviation from trend. Peaks and troughs are referred to as turning points. Regularities in GDP fluctuations amplitude: maximum deviation from trend. Frequency: number of peaks in real GDP that occur per year.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

5 просмотров15 страницLec-8A - Business Cycle

Загружено:

MsKhan0078Peak (trough): A relatively large positive (negative) deviation from trend. Peaks and troughs are referred to as turning points. Regularities in GDP fluctuations amplitude: maximum deviation from trend. Frequency: number of peaks in real GDP that occur per year.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 15

Business Cycle

Measurement

IU Main Campus

A. Z. Warsi

Intermediate Macroeconomic Theory

02/19/15

Regularities in GDP Fluctuations

Business Cycles:

Fluctuations about

trend in real GDP.

Peak (Trough): A

relatively large positive

(negative) deviation

from trend.

Peaks and troughs are

referred to as turning

points.

02/19/15

Regularities in GDP Fluctuations

Amplitude: The

maximum deviation from

trend.

Frequency: The number

of peaks in real GDP that

occur per year.

02/19/15

Observations from the U.S. Data

Consider the

percentage deviations

from trend in real

GDP over the period

1947 - 2006.

3 main observations:

Persistency

Irregularities

Comovement

02/19/15

Observations from the U.S. Data

Persistency: the

deviations from trend

are persistent in the

sense that when real

GDP is above (below)

trend, it tends to stay

above (below) trend.

This is important for

making economic

forecast over the short

run.

02/19/15

Observations from the U.S. Data

Irregularities:

Irregularities in the

amplitude and

frequency of

fluctuations in real

GDP about trend.

These imply that

forecasting is difficult

for longer term.

02/19/15

Observations from the U.S. Data

Macroeconomic variables usually fluctuate together in

patterns that exhibit strong regularities: Comovement

3 ways of describing comovement relative to real GDP:

Procyclical, countercyclical, acyclical

Leading, lagging, coincident

Variability relative to GDP

02/19/15

Observations from the U.S. Data

Procyclical variable: If

its deviations from trend

are positively correlated

with the deviations from

trend in real GDP.

Examples:

Real consumption, real

investment, real imports,

money supply,

employment and real

wage.

02/19/15

Observations from the U.S. Data

Countercyclical variable:

If its deviations from trend

are negatively correlated

with the deviations from

trend in real GDP.

Example:

Price level

02/19/15

Observations from the U.S. Data

Acyclical variable: If it

is neither procyclical or

countercyclical.

02/19/15

10

Observations from the U.S. Data

Degree of correlation between two variable x and y is

measured by the correlation coefficient ,

Cov

(x , y)

var(x ) var(y)

takes on values between 1 (perfectly negatively

correlated) and 1 (perfectly positively correlated).

02/19/15

11

Leading and Lagging

Leading variable: Its

peaks and troughs tend

to precede those of real

GDP.

This kind of variable

tends to aid in

predicting the future

path of real GDP.

Example: Money supply

02/19/15

12

Leading and Lagging

Lagging variable: Its

peaks and troughs tend

to lag before those of

real GDP.

Contrary, real GDP helps

to predict the future

path of such a variable.

02/19/15

13

Leading and Lagging

Coincident variable:

One that is neither

leads nor lags real GDP.

Examples:

Real consumption

Real investment

Price level

02/19/15

14

Variability relative to GDP

Variables that are more volatile than real GDP:

Real investment, real imports

Variables that are less volatile than real GDP:

Real consumption, price level, money supply and

employment

Cyclical variability is measured by the standard

deviation of the percentage deviations from trend.

02/19/15

15

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- David sm13 PPT 09Документ24 страницыDavid sm13 PPT 09Alejandro Perez SantanaОценок пока нет

- SG ch02Документ44 страницыSG ch02MsKhan0078Оценок пока нет

- The Brain DrainДокумент74 страницыThe Brain DrainJoydip ChandraОценок пока нет

- Optimal Decisions Using Marginal AnalysisДокумент9 страницOptimal Decisions Using Marginal AnalysisMsKhan0078Оценок пока нет

- Isoquant and IsocostДокумент59 страницIsoquant and IsocostMsKhan0078100% (5)

- Cost and Management AccountДокумент7 страницCost and Management AccountMsKhan0078Оценок пока нет

- MA121-1 3 4-hwДокумент19 страницMA121-1 3 4-hwMsKhan0078Оценок пока нет

- Cost and Management AccountingДокумент4 страницыCost and Management AccountingMsKhan0078Оценок пока нет

- Cash BudgetДокумент50 страницCash BudgetMsKhan0078Оценок пока нет

- Question 3 - CVP AnalysisДокумент13 страницQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- MGT ACC3Документ46 страницMGT ACC3MsKhan0078Оценок пока нет

- P10 CMA RTP Dec2013 Syl2012Документ44 страницыP10 CMA RTP Dec2013 Syl2012MsKhan0078Оценок пока нет

- Practice Questions and AnswersДокумент100 страницPractice Questions and AnswersMsKhan0078100% (3)

- BHM 107accg Manual 2Документ200 страницBHM 107accg Manual 2MsKhan0078100% (1)

- Questions On Cash Budgets 1 1Документ12 страницQuestions On Cash Budgets 1 1MsKhan0078100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Final PPT of FTPДокумент29 страницFinal PPT of FTPamansrivastava007Оценок пока нет

- Udom Selection 2013Документ145 страницUdom Selection 2013Kellen Hayden100% (1)

- 2016-10-26 Memo Re Opposition To MTDДокумент64 страницы2016-10-26 Memo Re Opposition To MTDWNYT NewsChannel 13Оценок пока нет

- Economia - 2018-03Документ84 страницыEconomia - 2018-03Hifzan ShafieeОценок пока нет

- Existentialist EthicsДокумент6 страницExistentialist EthicsCarlos Peconcillo ImperialОценок пока нет

- Climate Resilience FrameworkДокумент1 страницаClimate Resilience FrameworkJezzica BalmesОценок пока нет

- IBRO 2011 Inter Regional PosterДокумент1 страницаIBRO 2011 Inter Regional PosterInternational Brain Research OrganizationОценок пока нет

- Case Study FutureForm CitizenMДокумент3 страницыCase Study FutureForm CitizenMOrçun Cavit AlpОценок пока нет

- Trends and Challenges Facing The LPG IndustryДокумент3 страницыTrends and Challenges Facing The LPG Industryhailu ayalewОценок пока нет

- Environmental Change and ComplexityДокумент7 страницEnvironmental Change and ComplexityIffah Nadzirah100% (2)

- KGBV Bassi Profile NewДокумент5 страницKGBV Bassi Profile NewAbhilash MohapatraОценок пока нет

- 520082272054091201Документ1 страница520082272054091201Shaikh AdilОценок пока нет

- Vespers Conversion of Saint PaulДокумент7 страницVespers Conversion of Saint PaulFrancis Carmelle Tiu DueroОценок пока нет

- Treasury Management - PrelimДокумент5 страницTreasury Management - PrelimAlfonso Joel GonzalesОценок пока нет

- PAS 26 Accounting and Reporting by Retirement Benefit PlansДокумент25 страницPAS 26 Accounting and Reporting by Retirement Benefit Plansrena chavezОценок пока нет

- Pearbudget: (Easy Budgeting For Everyone)Документ62 страницыPearbudget: (Easy Budgeting For Everyone)iPakistan100% (3)

- Qualified Written RequestДокумент9 страницQualified Written Requestteachezi100% (3)

- TrerwtsdsДокумент167 страницTrerwtsdsvinicius gomes duarteОценок пока нет

- The Customary of The House of Initia Nova - OsbДокумент62 страницыThe Customary of The House of Initia Nova - OsbScott KnitterОценок пока нет

- University of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONДокумент5 страницUniversity of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDavid OparindeОценок пока нет

- Torrens System: Principle of TsДокумент11 страницTorrens System: Principle of TsSyasya FatehaОценок пока нет

- Social Inequality and ExclusionДокумент3 страницыSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Power Sector Assets v. CIR GR 198146 8 Aug 2017Документ19 страницPower Sector Assets v. CIR GR 198146 8 Aug 2017John Ludwig Bardoquillo PormentoОценок пока нет

- Tales From The SSRДокумент48 страницTales From The SSRBrad GlasmanОценок пока нет

- Microsoft 365 Migration Checklist For MSPs Dec2022Документ15 страницMicrosoft 365 Migration Checklist For MSPs Dec2022bhavesh_pathakОценок пока нет

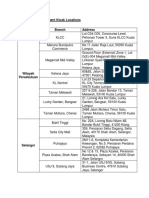

- Debit Card Replacement Kiosk Locations v2Документ3 страницыDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- File:///d - /... SER/Desktop/LABOR LAW/Cases/G.R. No. 196036, October 23, 2013 - ELIZABETH M..TXT (8/24/2020 9:55:51 PM)Документ6 страницFile:///d - /... SER/Desktop/LABOR LAW/Cases/G.R. No. 196036, October 23, 2013 - ELIZABETH M..TXT (8/24/2020 9:55:51 PM)Russ TuazonОценок пока нет

- Reflection (The Boy Who Harnessed The Wind)Документ1 страницаReflection (The Boy Who Harnessed The Wind)knightapollo16Оценок пока нет

- Applicability of ESIC On CompaniesДокумент5 страницApplicability of ESIC On CompaniesKunalKumarОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj SakariaОценок пока нет