Академический Документы

Профессиональный Документы

Культура Документы

Reporting and Analyzing Receivables: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/Irwin

Загружено:

Yvonne Teo Yee VoonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Reporting and Analyzing Receivables: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/Irwin

Загружено:

Yvonne Teo Yee VoonАвторское право:

Доступные форматы

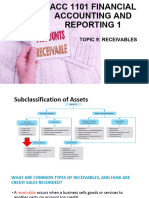

Chapter 7

Reporting and Analyzing Receivables

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Conceptual Learning Objectives

C1: Describe accounts receivable and

how they occur and are recorded

C2: Describe a note receivable and the

computation of its maturity date and

interest

C3: Explain how receivables can be

converted to cash before maturity

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Analytical Learning Objectives

A1: Compute accounts receivable

turnover and use it to help assess

financial condition

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Procedural Learning Objectives

P1: Apply the direct write-off and allowance

methods to account for accounts

receivable

P2: Estimate uncollectibles using methods

based on sales and accounts receivable

P3: Record the receipt of a note receivable

P4: Record the honoring and dishonoring of a

note and adjustments for interest

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Accounts Receivable

McGraw-Hill/Irwin

Amounts due from customers

for credit sales.

Credit sales require:

Maintaining a separate

account receivable for each

customer.

Accounting for bad debts

that result from credit sales.

The McGraw-Hill Companies, Inc., 2010

C1

Recognizing Accounts Receivable

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Sales on Credit

On

On July

July 16,

16, Barton,

Barton, Co.

Co. sells

sells $950

$950 of

of

merchandise

merchandise on

on credit

credit to

to Webster,

Webster, Co.,

Co., and

and

$1,000

$1,000 of

of merchandise

merchandise on

on account

account to

to Matrix,

Matrix, Inc.

Inc.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

McGraw-Hill/Irwin

Sales on Credit

The McGraw-Hill Companies, Inc., 2010

C1

Sales on Credit

On

On July

July 31,

31, Barton,

Barton, Co.

Co. collects

collects $500

$500 from

from Webster,

Webster,

Co.,

Co., and

and $800

$800 from

from Matrix,

Matrix, Inc.

Inc. on

on account.

account.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Sales on Credit

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Credit Card Sales

Advantages of allowing customers to use

credit cards:

Customers

Customers

credit

credit is

is

evaluated

evaluated by

by

the

the credit

credit

card

card issuer.

issuer.

Sales

Sales increase

increase by

by

providing

providing purchase

purchase

options

options to

to the

the

customer.

customer.

The

The risks

risks of

of extending

extending

credit

credit are

are transferred

transferred to

to

the

the credit

credit card

card issuer.

issuer.

McGraw-Hill/Irwin

Cash

Cash collections

collections

are

are quicker.

quicker.

The McGraw-Hill Companies, Inc., 2010

C1

Credit Card Sales

With

With bank

bank credit

credit cards,

cards, the

the seller

seller

deposits

deposits the

the credit

credit card

card sales

sales receipt

receipt

in

in the

the bank

bank just

just like

like itit deposits

deposits aa

customers

customers check.

check.

The

The bank

bank increases

increases the

the balance

balance in

in the

the

companys

companys checking

checking account.

account.

The

The company

company usually

usually pays

pays aa fee

fee of

of 1%

1%

to

to 5%

5% for

for the

the service.

service.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Credit Card Sales

On

On July

July 16,

16, 2010,

2010, Barton,

Barton, Co.

Co. has

has aa bank

bank credit

credit

card

card sale

sale of

of $500

$500 to

to aa customer.

customer. The

The bank

bank

charges

charges aa processing

processing fee

fee of

of 2%.

2%. The

The cash

cash is

is

received

received immediately.

immediately.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Credit Card Sales

On

On July

July 16,

16, 2010,

2010, Barton,

Barton, Co.

Co. has

has aa bank

bank credit

credit card

card

sale

sale of

of $500

$500 to

to aa customer.

customer. The

The bank

bank charges

charges aa

processing

processing fee

fee of

of 2%.

2%. Barton

Barton remits

remits the

the credit

credit card

card

sale

sale to

to the

the credit

credit card

card company

company and

and waits

waits for

for the

the

payment

payment that

that is

is received

received on

on July

July 28.

28.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Installment Accounts Receivable

Amounts owed by customers from credit sales for

which payment is required in periodic amounts over

an extended time period. The customer is usually

charged interest.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Valuing Accounts Receivable

Some

Some customers

customers may

may not

not pay

pay

their

their account.

account. Uncollectible

Uncollectible

amounts

amounts are

are referred

referred to

to as

as bad

bad

debts.

debts. There

There are

are two

two methods

methods

of

of accounting

accounting for

for bad

bad debts:

debts:

Direct

Direct Write-Off

Write-Off Method

Method

Allowance

Allowance Method

Method

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Direct Write-Off Method

On

On August

August 4,

4, Barton

Barton determines

determines itit

cannot

cannot collect

collect $350

$350 from

from Martin,

Martin, Inc.,

Inc.,

aa credit

credit customer.

customer.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Direct Write-Off Method

On

On September

September 9,

9, Martin

Martin decides

decides to

to pay

pay

$200

$200 that

that was

was previously

previously written

written off.

off.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Matching vs. Materiality

Matching requires

expenses to be

reported in the same

accounting period as

the sales they help

produce.

McGraw-Hill/Irwin

Materiality states

that an amount can

be ignored if its

effect on the

financial statements

is unimportant to

users business

decisions.

The McGraw-Hill Companies, Inc., 2010

P1

Allowance Method

At

At the

the end

end of

of each

each period,

period, estimate

estimate total

total bad

bad debts

debts

expected

expected to

to be

be realized

realized from

from that

that periods

periods sales.

sales.

There

There are

are two

two advantages

advantages to

to the

the allowance

allowance method:

method:

1.

1. It

It records

records estimated

estimated bad

bad debts

debts expense

expense in

in the

the

period

period when

when the

the related

related sales

sales are

are recorded.

recorded.

2.

2. It

It reports

reports accounts

accounts receivable

receivable on

on the

the balance

balance

sheet

sheet at

at the

the estimated

estimated amount

amount of

of cash

cash to

to be

be

collected.

collected.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Recording Bad Debts Expense

At the end of its first year of operations 2010, Barton Co.

estimates that $3,000 of its accounts receivable will prove

uncollectible. The total accounts receivable balance at

December 31, 2010, is $278,000.

Contra-asset account

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Recording Bad Debts Expense

At the end of its first year of operations 2010, Barton Co.

estimates that $3,000 of its accounts receivable will prove

uncollectible. The total accounts receivable balance at

December 31, 2010, is $278,000.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Recording Bad Debts Expense

At the end of its first year of operations 2010, Barton Co.

estimates that $3,000 of its accounts receivable will prove

uncollectible. The total accounts receivable balance at

December 31, 2010, is $278,000.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Estimating Bad Debts Expense

1.

1.

2.

2.

Two

Two Methods

Methods

Percent

Percent of

of Sales

Sales Method

Method

Accounts

Accounts Receivable

Receivable Methods

Methods

Percent

Percent of

ofAccounts

Accounts

Receivable

Receivable

Aging

Aging of

ofAccounts

Accounts

Receivable

Receivable Method

Method

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Percent of Sales Method

Bad debts expense is computed

as follows:

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Percent of Sales Method

Barton has credit sales of

$1,400,000 in 2010.

Management estimates 0.5%

of credit sales will eventually

prove uncollectible.

What is Bad Debts Expense

for 2010?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Percent of Sales Method

Bartons accountant

computes estimated

Bad Debts Expense of

$7,000.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Percent of Accounts Receivable

Method

P2

Compute the estimate of the Allowance for

Doubtful Accounts.

Bad Debts Expense is computed as:

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Percent of Accounts Receivable

Barton

Barton has

has $100,000

$100,000 in

in

accounts

accounts receivable

receivable and

and aa $900

$900

credit

credit balance

balance in

in Allowance

Allowance for

for

Doubtful

Doubtful Accounts

Accounts on

on

December

December 31,

31, 2010.

2010. Past

Past

experience

experience suggests

suggests that

that 4%

4% of

of

receivables

receivables are

are uncollectible.

uncollectible.

What

What is

is Bartons

Bartons Bad

Bad Debts

Debts

Expense

Expense for

for 2010?

2010?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Percent of Accounts Receivable

Desired balance in Allowance for

Doubtful Accounts.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Aging of Accounts Receivable

Method

P2

Each

Eachreceivable

receivable is

isgrouped

groupedby

by

how

how long

longititis

ispast

pastits

itsdue

duedate.

date.

Each age group is multiplied

by its estimated bad debts

percentage.

Estimated

Estimatedbad

baddebts

debtsfor

foreach

each

group

groupare

aretotaled.

totaled.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Aging of Accounts Receivable

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Aging of Accounts Receivable

Bartons

Bartons unadjusted

unadjusted balance

balance

in

in the

the allowance

allowance account

account is

is

$900.

$900.

We

We estimated

estimated the

the proper

proper

balance

balance to

to be

be $5,320.

$5,320.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Writing Off a Bad Debt

With

With the

the allowance

allowance method,

method, when

when an

an

account

account is

is determined

determined to

to be

be uncollectible,

uncollectible,

the

the debit

debit goes

goes to

to Allowance

Allowance for

for Doubtful

Doubtful

Accounts.

Accounts.

Barton

Barton determines

determines that

that Martins

Martins $300

$300

account

account is

is uncollectible.

uncollectible.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Recovery of a Bad Debt

Subsequent

Subsequent collections

collections on

on accounts

accounts written

written

off

off require

require that

that the

the original

original write-off

write-off entry

entry be

be

reversed

reversed before

before the

the cash

cash collection

collection is

is

recorded.

recorded.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Summary

% of Sales

% of Receivables

Aging of

Receivables

Emphasis on

Matching

Emphasis on

Realizable Value

Emphasis on

Realizable Value

Accts.

Rec.

Accts.

Rec.

Sales

Bad

Debts

Exp.

Income

Income

Statement

Statement

Focus

Focus

McGraw-Hill/Irwin

All. for

Doubtful

Accts.

Balance

Balance

Sheet

SheetFocus

Focus

All. for

Doubtful

Accts.

Balance

Balance

Sheet

SheetFocus

Focus

The McGraw-Hill Companies, Inc., 2010

P3

Lets look at

notes receivable!

P3

Notes Receivable

A note is a

written

promise to

pay a specific

amount at a

specific future

date.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Notes Receivable

$1,000.00

Term

Ninety days

Payee

July 10, 2010

after date I promise to pay to

the order Barton Company, Los Angeles, CA

One

of thousand and no/100 --------------------------------- Dollars

Payable First National Bank of Los Angeles, CA

Maker

at

Value received with interest12%

at

per

annum

Oct. 8, 2010

No. 42

Due

Julia Browne

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Notes Receivable

$1,000.00

Ninety days

July 10, 2010

after date I promise to pay to

thePrincipal

order Barton Company, Los Angeles, CA

One

of thousand and no/100 --------------------------------- Dollars

Payable First National

InterestBank

Rateof Los Angeles, CA

at

Value received with interest12%

at

per

annum

Oct. 8, 2010

No. 42

Due

Julia Browne

Due Date

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Interest Computation

Even

Even for

for

maturities

maturities less

less

than

than one

one year,

year,

the

the rate

rate is

is

annualized.

annualized.

McGraw-Hill/Irwin

IfIf the

the note

note is

is

expressed

expressed in

in

days,

days, base

base aa

year

year on

on 360

360

days.

days.

The McGraw-Hill Companies, Inc., 2010

P3

Computing Maturity and Interest

On

On March

March 1,

1, 2010,

2010,

Matrix,

Matrix, Inc.

Inc. purchased

purchased aa

copier

copier for

for $12,000

$12,000 from

from

Office

Office Supplies,

Supplies, Inc.

Inc.

Matrix

Matrix gave

gave Office

Office

Supplies

Supplies aa 9%

9% note

note due

due

in

in 90

90 days

days in

in payment

payment

for

for the

the copier.

copier.

What

What is

is the

the maturity

maturity date

date

of

of the

the note?

note?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Computing Maturity and Interest

The note is due and payable on May 30, 2010.

How much interest will Matrix pay to Office

Supplies, Inc. on this note?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Computing Maturity and Interest

Total interest due

at May 30.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Recognizing Notes Receivable

Here

Here are

are the

the entries

entries to

to record

record the

the note

note on

on

March

March 1,

1, and

and the

the settlement

settlement on

on May

May 30,

30, 2010.

2010.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Recording a Dishonored Note

On

On May

May 30,

30, 2010,

2010, Matrix

Matrix informs

informs us

us that

that the

the

company

company is

is unable

unable to

to pay

pay the

the note

note or

or interest.

interest.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Recording End-of-Period Interest

Adjustments

When

When aa note

note receivable

receivable

is

is outstanding

outstanding at

at the

the

end

end of

of an

an accounting

accounting

period,

period, the

the company

company

must

must prepare

prepare an

an

adjusting

adjusting entry

entry to

to

accrue

accrue interest

interest income.

income.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Recording End-of-Period Interest

Adjustments

On

On December

December 1,

1, 2010,

2010, Matrix,

Matrix, Inc.

Inc. purchased

purchased aa

copier

copier for

for $12,000

$12,000 from

from Office

Office Supplies,

Supplies, Inc.

Inc. Matrix

Matrix

issued

issued aa 9%

9% note

note due

due in

in 90

90 days

days in

in payment

payment for

for the

the

copier.

copier. What

What adjusting

adjusting entry

entry is

is required

required on

on

December

December 31,

31, the

the end

end of

of the

the companys

companys accounting

accounting

period?

period?

$12,000 9% 30/360 = $90

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Recording End-of-Period Interest

Adjustments

Recording collection on note at maturity.

Days in December

Minus the date of the note

Day remaining in December

Days in January

Days in February

Days in March until maturity

Period of the note in days

McGraw-Hill/Irwin

31

(1)

30

31

28

1

90

The McGraw-Hill Companies, Inc., 2010

C3

Disposing of Receivables

McGraw-Hill/Irwin

Companies sometimes want to convert

receivables to cash before they are

due.

They can sell or factor receivables.

They may pledge receivables as

security for a loan.

The McGraw-Hill Companies, Inc., 2010

A1

Accounts Receivable Turnover

This ratio provides useful information for

evaluating how efficient management has

been in granting credit to produce revenue.

Net sales

Average accounts receivable

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

End of Chapter 7

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Вам также может понравиться

- Chapter 8 Accounts Receivable and Further Record-Keeping: Discussion QuestionsДокумент3 страницыChapter 8 Accounts Receivable and Further Record-Keeping: Discussion Questionskiet100% (1)

- Topic9 Account ReceivableДокумент52 страницыTopic9 Account ReceivableAbd AL Rahman Shah Bin Azlan ShahОценок пока нет

- Fundamental Financial Accounting Concepts 8th Edition Edmonds Test Bank DownloadДокумент147 страницFundamental Financial Accounting Concepts 8th Edition Edmonds Test Bank DownloadKeith Meacham100% (23)

- Adjusting Accounts and Preparing Financial Statements: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент58 страницAdjusting Accounts and Preparing Financial Statements: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- Chap 008Документ51 страницаChap 008Chan Ka KeiОценок пока нет

- Libby Chapter 6 Study NotesДокумент6 страницLibby Chapter 6 Study NoteshatanoloveОценок пока нет

- Accounts Receivable Vs Accounts PayableДокумент12 страницAccounts Receivable Vs Accounts PayableRaviSankarОценок пока нет

- Inclass Ex CH 9 FA21Документ4 страницыInclass Ex CH 9 FA21Thomas TermoteОценок пока нет

- Principles of Financial Accounting 12Th Edition Needles Test Bank Full Chapter PDFДокумент67 страницPrinciples of Financial Accounting 12Th Edition Needles Test Bank Full Chapter PDFBrianHunterfeqs100% (5)

- Principles of Financial Accounting 12th Edition Needles Test BankДокумент67 страницPrinciples of Financial Accounting 12th Edition Needles Test Bankmarthajessegvt100% (26)

- Financial AccountingДокумент66 страницFinancial AccountingFaisal SaleemОценок пока нет

- Financial Shenanigans What Are Financial Shenanigans?Документ9 страницFinancial Shenanigans What Are Financial Shenanigans?Qorry NittyОценок пока нет

- Exam task calculations and theoretical questionsДокумент4 страницыExam task calculations and theoretical questionsАдам РузвельтОценок пока нет

- Chapter 6Документ43 страницыChapter 6Awrangzeb AwrangОценок пока нет

- ACC101 - Accounting for ReceivablesДокумент15 страницACC101 - Accounting for Receivablesinfinite_dreamsОценок пока нет

- CH 7 PresentationДокумент32 страницыCH 7 PresentationJes KnehansОценок пока нет

- Accounting T- Receivables EssayДокумент5 страницAccounting T- Receivables EssayagamdeepОценок пока нет

- Notes in Fi3Документ5 страницNotes in Fi3Gray JavierОценок пока нет

- Exercise Receivables 1Документ8 страницExercise Receivables 1Asyraf AzharОценок пока нет

- Financial and Managerial Accounting 10th Edition Needles Test Bank DownloadДокумент68 страницFinancial and Managerial Accounting 10th Edition Needles Test Bank Downloadelainecannonjgzifkyxbe100% (23)

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonДокумент6 страницAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenОценок пока нет

- Carrington Ltd's Switch to AfterpayДокумент11 страницCarrington Ltd's Switch to AfterpayKJSAdОценок пока нет

- Financial Accounting An Introduction To Concepts Methods and Uses 14th Edition Weil Test Bank 1Документ96 страницFinancial Accounting An Introduction To Concepts Methods and Uses 14th Edition Weil Test Bank 1kathleen100% (39)

- Revenue Recognition, Construction ContractsДокумент5 страницRevenue Recognition, Construction Contractsclarissay_1Оценок пока нет

- Financial Accounting An Introduction To Concepts Methods and Uses 14Th Edition Weil Test Bank Full Chapter PDFДокумент36 страницFinancial Accounting An Introduction To Concepts Methods and Uses 14Th Edition Weil Test Bank Full Chapter PDFnancy.lee736100% (10)

- Welcomeback: Workshop SixДокумент55 страницWelcomeback: Workshop SixLeah StonesОценок пока нет

- Resume CH 8 IFRSДокумент5 страницResume CH 8 IFRSDeswita CeisiОценок пока нет

- Pa2 ReceivablesДокумент75 страницPa2 ReceivablesGOTU COURSEОценок пока нет

- Fundamental Accounting Principles Canadian Vol 1 Canadian 14th Edition Larson Test BankДокумент39 страницFundamental Accounting Principles Canadian Vol 1 Canadian 14th Edition Larson Test Bankoxheartpanch07mce100% (21)

- Financial & Managerial Accounting: Information For DecisionsДокумент80 страницFinancial & Managerial Accounting: Information For DecisionsErineОценок пока нет

- Accounts Receivable Recognition, Measurement and Estimating Bad DebtsДокумент4 страницыAccounts Receivable Recognition, Measurement and Estimating Bad DebtsMisiah Paradillo JangaoОценок пока нет

- Information For DecisionsДокумент50 страницInformation For Decisionssaeed786786Оценок пока нет

- BIll Discounting PDFДокумент36 страницBIll Discounting PDFharshithaОценок пока нет

- Sales Revenue ReceivablesДокумент67 страницSales Revenue ReceivablesBorutoОценок пока нет

- Accounts Receivable QuizzerДокумент4 страницыAccounts Receivable Quizzerknorrpampapakang67% (3)

- Solution To Case 25 Accounts Receivable Management A Switch in Time Saves Nine What Are The Elements of A Good Credit PolicyДокумент8 страницSolution To Case 25 Accounts Receivable Management A Switch in Time Saves Nine What Are The Elements of A Good Credit Policyanika fierroОценок пока нет

- Accounting for Current Liabilities, Provisions and ContingenciesДокумент15 страницAccounting for Current Liabilities, Provisions and ContingenciesPillos Jr., ElimarОценок пока нет

- FINANCIAL SHENANIGANS Kel 3Документ17 страницFINANCIAL SHENANIGANS Kel 3Qorry NittyОценок пока нет

- 2 Receivable Reviewer Set 1 Key PDFДокумент15 страниц2 Receivable Reviewer Set 1 Key PDFJOSCEL SYJONGTIANОценок пока нет

- Current Liabilities ERДокумент11 страницCurrent Liabilities ERStevenkyОценок пока нет

- Final Accounts With Adjustments - Principles of AccountingДокумент9 страницFinal Accounts With Adjustments - Principles of AccountingAbdulla Maseeh100% (1)

- ORACLE BUSINESS COLLEGE SCHOOL – WANDEGEYAДокумент31 страницаORACLE BUSINESS COLLEGE SCHOOL – WANDEGEYAkimuli FreddieОценок пока нет

- Self Study Chapter 18 2Документ18 страницSelf Study Chapter 18 2Scott ShearerОценок пока нет

- Chapter 9 PowerpointДокумент43 страницыChapter 9 Powerpointapi-248607804Оценок пока нет

- ReceivablesДокумент20 страницReceivablessheik abdullaОценок пока нет

- IAcctg1 Accounts Receivable ActivitiesДокумент10 страницIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiОценок пока нет

- 1Документ19 страниц1Angelica Castillo0% (1)

- Philippine School of Business Administration: Cpa ReviewДокумент6 страницPhilippine School of Business Administration: Cpa ReviewYukiОценок пока нет

- Chapter 8 ReceivablesДокумент23 страницыChapter 8 ReceivablesNutchanan PrateepusanonОценок пока нет

- Microfinance Software RequirementsДокумент14 страницMicrofinance Software Requirementsshruti_04Оценок пока нет

- Kieso15e ContinuingCase Sols Vol1Документ41 страницаKieso15e ContinuingCase Sols Vol1HảiAnhInviОценок пока нет

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodДокумент6 страницUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)Оценок пока нет

- Receivable and Payable ManagementДокумент2 страницыReceivable and Payable ManagementJames MartinОценок пока нет

- Chapter 9 NotesДокумент15 страницChapter 9 NotesMohamed AfzalОценок пока нет

- JPA Week 1 Intermediate Accounting 2 Summer StudyДокумент5 страницJPA Week 1 Intermediate Accounting 2 Summer StudyDaniella Mae ElipОценок пока нет

- College Accounting 14th Edition Price Test BankДокумент97 страницCollege Accounting 14th Edition Price Test BankJacobFoxgipbn100% (13)

- Acc CH 4Документ16 страницAcc CH 4Tajudin Abba RagooОценок пока нет

- Lecture 12 - Law of Contracts (4A)Документ6 страницLecture 12 - Law of Contracts (4A)Yvonne Teo Yee VoonОценок пока нет

- Lecture 10 - Law of Contracts (3A)Документ7 страницLecture 10 - Law of Contracts (3A)Yvonne Teo Yee VoonОценок пока нет

- Lecture 11 - Law of ContractsДокумент12 страницLecture 11 - Law of ContractsYvonne Teo Yee VoonОценок пока нет

- Lecture 7 - Law of ContractsДокумент19 страницLecture 7 - Law of ContractsYvonne Teo Yee VoonОценок пока нет

- Reporting and Analyzing Equity: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент58 страницReporting and Analyzing Equity: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- Contract Capacity and MinorsДокумент10 страницContract Capacity and MinorsYvonne Teo Yee VoonОценок пока нет

- Lecture 8 - Law of Contracts (2A)Документ14 страницLecture 8 - Law of Contracts (2A)Yvonne Teo Yee VoonОценок пока нет

- Lecture 5 - Criminal LawДокумент15 страницLecture 5 - Criminal LawYvonne Teo Yee VoonОценок пока нет

- Lecture 16 - Business OrganisationsДокумент9 страницLecture 16 - Business OrganisationsYvonne Teo Yee VoonОценок пока нет

- Lecture 3 - The U.S. ConstitutionДокумент11 страницLecture 3 - The U.S. ConstitutionYvonne Teo Yee VoonОценок пока нет

- Lecture 6 - Law of ContractsДокумент11 страницLecture 6 - Law of ContractsYvonne Teo Yee VoonОценок пока нет

- Lecture 1 - Introduction To LawДокумент5 страницLecture 1 - Introduction To LawYvonne Teo Yee VoonОценок пока нет

- Lecture 2 - Civil Dispute ResolutionДокумент16 страницLecture 2 - Civil Dispute ResolutionYvonne Teo Yee VoonОценок пока нет

- Lecture 4 - Criminal LawДокумент11 страницLecture 4 - Criminal LawYvonne Teo Yee VoonОценок пока нет

- Reporting and Analyzing Long-Term Liabilities: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент47 страницReporting and Analyzing Long-Term Liabilities: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- Reporting and Analyzing Inventories: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент61 страницаReporting and Analyzing Inventories: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- Lecture 15 - Protection of Intellectual PropertyДокумент11 страницLecture 15 - Protection of Intellectual PropertyYvonne Teo Yee VoonОценок пока нет

- Lecture 14 - Employment LawДокумент12 страницLecture 14 - Employment LawYvonne Teo Yee VoonОценок пока нет

- Analyzing and Recording Transactions: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент40 страницAnalyzing and Recording Transactions: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- Lecture 13 - Tort LawДокумент7 страницLecture 13 - Tort LawYvonne Teo Yee VoonОценок пока нет

- Reporting and Analyzing Long-Term Assets: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент71 страницаReporting and Analyzing Long-Term Assets: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- The Impact of Taxes in MalaysiaДокумент3 страницыThe Impact of Taxes in MalaysiaYvonne Teo Yee VoonОценок пока нет

- FA John Topic 6 2014Документ38 страницFA John Topic 6 2014Yvonne Teo Yee VoonОценок пока нет

- Reporting and Analyzing Merchandising Operations: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinДокумент45 страницReporting and Analyzing Merchandising Operations: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonОценок пока нет

- FA John Topic 1 2014Документ50 страницFA John Topic 1 2014Yvonne Teo Yee VoonОценок пока нет

- 12 Podar International School QPДокумент2 страницы12 Podar International School QPAkshat KhetanОценок пока нет

- Mba Project For FinalisationДокумент75 страницMba Project For FinalisationrgkusumbaОценок пока нет

- Huzafa Tuition Centre Income Statement & Balance Sheet 2019Документ2 страницыHuzafa Tuition Centre Income Statement & Balance Sheet 2019Huzafa Tuition CentreОценок пока нет

- TransNum Jun 25 123309Документ5 страницTransNum Jun 25 123309Mary StevensonОценок пока нет

- PT Adem Segara-Neraca Saldo PT Adem SegaraДокумент2 страницыPT Adem Segara-Neraca Saldo PT Adem Segaraprafly986Оценок пока нет

- Blueprint Banking and Cash ManagementДокумент56 страницBlueprint Banking and Cash ManagementChris LoureyОценок пока нет

- Accounting 5 CFAS Chapter 17Документ27 страницAccounting 5 CFAS Chapter 17박은하Оценок пока нет

- Uber Finance Analysis: Profit Ratios, Capital Structure & Covid ImpactДокумент12 страницUber Finance Analysis: Profit Ratios, Capital Structure & Covid ImpactAlina khanОценок пока нет

- Microsoft Word - Form Electronic Funds Transfer (EFT) Settlement 20th AnnivДокумент2 страницыMicrosoft Word - Form Electronic Funds Transfer (EFT) Settlement 20th Annivannekay dacresОценок пока нет

- Finance ProjectДокумент6 страницFinance ProjectPradeep Mib2022Оценок пока нет

- 41 New Products of SBI (As On 30.09.2010)Документ10 страниц41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatОценок пока нет

- Sarana Meditama Metropolitan (Q4 - 2014)Документ72 страницыSarana Meditama Metropolitan (Q4 - 2014)Wihelmina DeaОценок пока нет

- 100% Net Investment IncomeДокумент3 страницы100% Net Investment IncomeFarabee FerdousОценок пока нет

- Financial Performance Analysis of Kotak Mahindra BankДокумент60 страницFinancial Performance Analysis of Kotak Mahindra Bankvaibhav pachputeОценок пока нет

- MBS Data: Agency Mortgage-Backed Securities (MBS) Purchase ProgramДокумент572 страницыMBS Data: Agency Mortgage-Backed Securities (MBS) Purchase ProgramTheBusinessInsiderОценок пока нет

- OrderForm Pipeline-Forecaster VNДокумент1 страницаOrderForm Pipeline-Forecaster VNshengchanОценок пока нет

- Payslip Januari 2022 (All Majalengka)Документ24 страницыPayslip Januari 2022 (All Majalengka)rendra darminОценок пока нет

- Name of The Company Address of Company Year Ended Pan No. Partner Name SignatureДокумент21 страницаName of The Company Address of Company Year Ended Pan No. Partner Name SignatureIvan Caldas GranadosОценок пока нет

- Transaction Dispute Form July2012Документ1 страницаTransaction Dispute Form July2012Thesa Putungan-SalcedoОценок пока нет

- Bus Com 10Документ6 страницBus Com 10Chabelita MijaresОценок пока нет

- Kisi KisiДокумент14 страницKisi KisiHairun NisaОценок пока нет

- Analyze Non-Current LiabilitiesДокумент58 страницAnalyze Non-Current LiabilitiesAngel RosalesОценок пока нет

- Weekly Journal Week 2: Ms. Fairuze Chowdhury Lecturer Department of BBA in Marketing & International BusinessДокумент3 страницыWeekly Journal Week 2: Ms. Fairuze Chowdhury Lecturer Department of BBA in Marketing & International BusinessSky PunkerОценок пока нет

- Advance Chapter 4Документ17 страницAdvance Chapter 4abel habtamuОценок пока нет

- Dhis Special Transactions 2019 by Millan Solman PDFДокумент158 страницDhis Special Transactions 2019 by Millan Solman PDFQueeny Mae Cantre ReutaОценок пока нет

- Comparative Study Between HDFC & ICICIДокумент55 страницComparative Study Between HDFC & ICICINamit Dehariya100% (5)

- Pay Ikeja Electric Bill Online or Via Bank in LagosДокумент2 страницыPay Ikeja Electric Bill Online or Via Bank in LagosDele OlatunjiОценок пока нет

- Pacra PreДокумент24 страницыPacra PreAli HusanenОценок пока нет

- Setyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Документ2 страницыSetyo Anung Dewantoko: Astra Graphia TBK Jakarta - 09/2012 To 07/2019Green Sustain EnergyОценок пока нет

- Accounting I Exam 3Документ19 страницAccounting I Exam 3Sapna SharmaОценок пока нет