Академический Документы

Профессиональный Документы

Культура Документы

ELSS (Equity Linked Savings Scheme)

Загружено:

IciciprumfОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ELSS (Equity Linked Savings Scheme)

Загружено:

IciciprumfАвторское право:

Доступные форматы

ICICI Prudential Mutual Fund

Equity mutual fund

ICICI Prudential Mutual Fund

Equity mutual fund

WHAT ARE EQUITY LINKED SAVINGS SCHEMES (ELSS)?

While tax planning may seem to be a difficult

process, Mutual Funds offer you a simple way to

get tax benefits, while aiming to make the most of

the potential of the equity markets.

An Equity Linked Savings Scheme (ELSS) is an

open-ended Equity Mutual Fund that doesn't just

help you save tax, but also gives you an

opportunity to grow your money. It qualifies for tax

exemptions under section (u/s) 80C of the Indian

Income Tax Act,1961 .

ICICI Prudential Mutual Fund

Equity mutual fund

ICICI Prudential Mutual Fund

Equity mutual fund

Along with the tax deductions, an ELSS offers you the following

benefits:

An opportunity to grow your money by investing in the equity market.

Long-term capital gains from these funds are tax free in your hands.

The lock-in period is only 3 years.

You can also opt for a Dividend Payout option, thereby realizing some

potential gain during the lock-in period.

You can invest through a Systematic Investment Plan and bring

discipline to your tax planning.

# However, it must be noted that any dividend payment will be from the

NAV of the Scheme and therefore the NAV of the scheme will fall to the

extent of dividend payment. Also dividend payment is subject to

availability of distributable surplus and approval from Trustees.

ICICI Prudential Mutual Fund

Equity mutual fund

Points to remember while choosing an

appropriate ELSS

You must always remember to do thorough research

when you invest in an ELSS fund. You must look at the

long term performance of the fund before putting your

money in it. Also remember to look at the fund details

like the fund managers investment approach, portfolio

of the fund, the expense ratio of the fund and how

volatile the fund has been in the past.

ICICI Prudential Mutual Fund

Equity mutual fund

ICICI Prudential Mutual Fund

Equity mutual fund

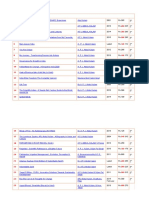

When you invest in certain schemes like ELSS, Public

Provident Fund, certain Bank Fixed Deposits etc. you can

claim up to Rs.1,50,000 as a deduction from your gross

total income in a financial year under Section 80C of

Income Tax Act, 1961. The Table below will help further

explain how this works

Particulars

Without Tax Saving Investments

u/s 80C

With Tax Saving

Investments u/s 80C

Gross Total Income

Rs.7,50,000

Rs.7,50,000

Exemption u/s 80C

Nil

Rs.1,50,000

Total Income

Rs.7,50,000

Rs.6,00,000

Tax on Total Income

Rs.75,000

Rs.45,000

Tax saved

Nil

Rs.30,000

ICICI Prudential Mutual Fund

Equity mutual fund

llustration of Tax exemption for an individual less than 60

years in receipt of salary income for the assessment year

2015-16 (FY 2014-2015). Along with the tax deductions, an

ELSS offers you the opportunity to grow your money by

investing in the equity market. Long-term capital gains from

these funds are tax free in your hands and the lock-in period is

only 3 years. Furthermore, you can also opt for a Dividend

Payout option, thereby realizing some potential gain during the

lock-in period, and also choose to invest through a Systematic

Investment Plan and bring discipline to your tax planning.

ICICI Prudential Mutual Fund

Equity mutual fund

For more information you can contact us on:

Email: enquiry@icicipruamc.com

Website: http://www.icicipruamc.com/

ICICI Prudential Mutual Fund

Equity mutual fund

Thank you

Вам также может понравиться

- Key To Equity Success Is Investing Long Term at All TimesДокумент2 страницыKey To Equity Success Is Investing Long Term at All TimesIciciprumfОценок пока нет

- Key To Equity Success Is Investing Long Term at All TimesДокумент2 страницыKey To Equity Success Is Investing Long Term at All TimesIciciprumfОценок пока нет

- Good Days Ahead For Debt InvestorsДокумент2 страницыGood Days Ahead For Debt InvestorsIciciprumfОценок пока нет

- Key To Equity Success Is Investing Long Term at All TimesДокумент2 страницыKey To Equity Success Is Investing Long Term at All TimesIciciprumfОценок пока нет

- Equity May Be VolatileДокумент3 страницыEquity May Be VolatileIciciprumfОценок пока нет

- Assessing Risk-What Your Mutual Fund House DoesДокумент3 страницыAssessing Risk-What Your Mutual Fund House DoesIciciprumfОценок пока нет

- Types of Mutual FundДокумент13 страницTypes of Mutual FundIciciprumfОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- TN Vision 2023 PDFДокумент68 страницTN Vision 2023 PDFRajanbabu100% (1)

- Steven SheaДокумент1 страницаSteven Sheaapi-345674935Оценок пока нет

- Reflection On Sumilao CaseДокумент3 страницыReflection On Sumilao CaseGyrsyl Jaisa GuerreroОценок пока нет

- Nursing Education and Nursing Service ProgramsДокумент10 страницNursing Education and Nursing Service ProgramsLevy DuranОценок пока нет

- Ruahsur Vangin Basket-Ball Court Lungrem ChimДокумент4 страницыRuahsur Vangin Basket-Ball Court Lungrem ChimchanmariansОценок пока нет

- Matthew DeCossas SuitДокумент31 страницаMatthew DeCossas SuitJeff NowakОценок пока нет

- Deseret First Credit Union Statement.Документ6 страницDeseret First Credit Union Statement.cathy clarkОценок пока нет

- 1 Introduction To PPSTДокумент52 страницы1 Introduction To PPSTpanabo central elem sch.Оценок пока нет

- Seminar On DirectingДокумент22 страницыSeminar On DirectingChinchu MohanОценок пока нет

- Ulangan Harian Lesson 4 Kls 6Документ3 страницыUlangan Harian Lesson 4 Kls 6Megadevegaalgifari Minozholic Full100% (2)

- Ollie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Документ2 страницыOllie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Scribd Government DocsОценок пока нет

- Narrative ReportДокумент6 страницNarrative ReportAlyssa Marie AsuncionОценок пока нет

- List of Vocabulary C2Документ43 страницыList of Vocabulary C2Lina LilyОценок пока нет

- Hypnosis ScriptДокумент3 страницыHypnosis ScriptLuca BaroniОценок пока нет

- Abramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFДокумент424 страницыAbramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFptalus100% (2)

- Diane Mediano CareerinfographicДокумент1 страницаDiane Mediano Careerinfographicapi-344393975Оценок пока нет

- InnovationДокумент19 страницInnovationPamela PlamenovaОценок пока нет

- Adverbs Before AdjectivesДокумент2 страницыAdverbs Before AdjectivesJuan Sanchez PrietoОценок пока нет

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Документ19 страницPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoОценок пока нет

- 60617-7 1996Документ64 страницы60617-7 1996SuperhypoОценок пока нет

- ISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCДокумент2 страницыISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCdevaprОценок пока нет

- Sayyid DynastyДокумент19 страницSayyid DynastyAdnanОценок пока нет

- The BreakupДокумент22 страницыThe BreakupAllison CreaghОценок пока нет

- 5e - Crafting - GM BinderДокумент37 страниц5e - Crafting - GM BinderadadaОценок пока нет

- Multi Grade-ReportДокумент19 страницMulti Grade-Reportjoy pamorОценок пока нет

- Flabbergasted! - Core RulebookДокумент160 страницFlabbergasted! - Core RulebookRobert RichesonОценок пока нет

- KalamДокумент8 страницKalamRohitKumarSahuОценок пока нет

- K3VG Spare Parts ListДокумент1 страницаK3VG Spare Parts ListMohammed AlryaniОценок пока нет

- W 26728Документ42 страницыW 26728Sebastián MoraОценок пока нет

- Grossman 1972 Health CapitalДокумент33 страницыGrossman 1972 Health CapitalLeonardo SimonciniОценок пока нет