Академический Документы

Профессиональный Документы

Культура Документы

Morning View 28jan2010

Загружено:

AndysTechnicalsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Morning View 28jan2010

Загружено:

AndysTechnicalsАвторское право:

Доступные форматы

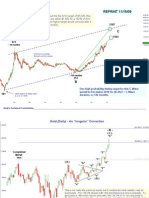

Ten Year Note Futures (Daily)

For several days the 118’05 to 118’11 zone was discussed as key resistance. Yesterday the Notes

peaked and reversed at 118’09, producing an unattractive daily candlestick in the process. It’s

certainly not the ugliest, or most ominous, candle we’ve ever seen, but there was certainly some

selling into the 61.8% retrace, at least on the “first go.”

117’12

This extremely ‘tight’ and well formed

channel is a strong indication of a

“corrective” move and not some sort of

impulsion higher.

Andy’s Technical Commentary__________________________________________________________________________________________________

Ten Year Note Futures (15 min)

[2] Short term counts like this are always “dicey” to judge, but one can see the

outline of a “five wave” move lower on the intraday charts. If this is correct, then

I’ve identified the 117’28.5 (61.8%) and 118’00 zone as the short term resistance

zone. If this was a “five” down, then the market shouldn’t better this area.

118’00

[1]

117’28.5

[.3]?

[4]

[3] [a]

[.b]

[.1]

[.2]

[.c]

[.a] [b]

[5]

(1) or (a)

Andy’s Technical Commentary__________________________________________________________________________________________________

Ten Year Note Futures (Daily)

Well, we’ve been talking about this level for several days now. The ten year note futures are now

knocking on the door of key resistance. I’m looking of reversal here very soon, expecting rates to

rise. Bulls now need to pay attention to the trend channel or any reversal action into 118’05 zone.

118’05

117’12

Reprinted from 1/26/2010 This extremely ‘tight’ and well formed

channel is a strong indication of a

“corrective” move and not some sort of

impulsion higher.

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z) S&P 500 (60 min.)

“c”

1050

Two days ago, we talked about chart support at 1084 and thought there would be

some buying soon. The market ricocheted off the 1083 level and looks like a wave

completed at 1083. First level of resistance for bears is 1103/1105. A break of that

[b] level would make the S&P look headed for 1129.25.

1129.25

[a]

(x)

[c]

(w)

[b]

1103/1105

[a]

1083

[c]

(y)

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z) S&P 500 (20 min.)

“c”

1050

There is still not a five wave move lower present on this chart, and

[b] the recent price action makes me favor a ‘complex’ count at this

point. One target for this model would be 1079 before getting some

sort of bounce. There is also “chart support” at 1084, so perhaps we

see some buying soon. The first resistance zones is easy to identify

at 1103-1105. If 1090 gets snapped this morning, then it will become

the near term point of resistance for new bears/shorts.

[a]

[a]

[c] (x)

[e]

[c]

(w)

[d]

[b]

1103/1105

[b]

1090

Reprinted from 1/26/2010 [a]

1079

[c]

(y)

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z) S&P 500 (60 min.) ~ Orthodox count “fifth extension”

“c”

1050

Some orthodox wave counters (Daneric) are still favoring this count. From my point

of view, there are now two flaws with the model: The wave-4 correction before the

(2) proposed “fifth extension” was smaller and less enduring than wave-2. This should

not be. Also, within the Wave (5), the third and fifth waves are basically the same

size. Where is the “extended wave” within Wave (5)? I gave this model the benefit

of the doubt two days ago, but now it goes into my trash can. There very well may

be a “five” developing here somehow, but it’s not this model.

(1)

(4)

[2]

(3)

[4]

[1]

[3]

[5]

(5)

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical

commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s interpretation of technical analysis. The

author may or may not trade in the markets discussed. The author may hold positions opposite of

what may by inferred by this report. The information contained in this commentary is taken from

sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy

or completeness thereof and is sent to you for information purposes only. Commodity trading

involves risk and is not for everyone.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading:

Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or options contracts, you should

consider your financial experience, goals and financial resources, and know how much you can

afford to lose above and beyond your initial payment to a broker. You should understand commodity

futures and options contracts and your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk

disclosure documents your broker is required to give you.

Вам также может понравиться

- Wells Fargo Statement - Oct 2022Документ6 страницWells Fargo Statement - Oct 2022pradeep yadavОценок пока нет

- Rocky Owns and Operates Balboa S Gym Located in Philadelphia TheДокумент1 страницаRocky Owns and Operates Balboa S Gym Located in Philadelphia TheBube KachevskaОценок пока нет

- Chapter 10 Exercise 6Документ11 страницChapter 10 Exercise 6Tri HartonoОценок пока нет

- Solved Compare Long Run Market Expectations of Inflation With A Consumer SurveyДокумент1 страницаSolved Compare Long Run Market Expectations of Inflation With A Consumer SurveyM Bilal SaleemОценок пока нет

- Morning View 25jan2010Документ5 страницMorning View 25jan2010AndysTechnicalsОценок пока нет

- Morning View 29jan2010Документ5 страницMorning View 29jan2010AndysTechnicalsОценок пока нет

- Morning View 3feb2010 - S&P GoldДокумент6 страницMorning View 3feb2010 - S&P GoldAndysTechnicalsОценок пока нет

- S&P 500 (Daily) - Sniffed Out Some Support .Документ4 страницыS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsОценок пока нет

- Morning Update 3 Mar 10Документ5 страницMorning Update 3 Mar 10AndysTechnicalsОценок пока нет

- Morning View 21jan2010Документ6 страницMorning View 21jan2010AndysTechnicalsОценок пока нет

- Morning View 26jan2010Документ8 страницMorning View 26jan2010AndysTechnicalsОценок пока нет

- Morning View 24 Feb 10Документ4 страницыMorning View 24 Feb 10AndysTechnicalsОценок пока нет

- Morning Update 2 Mar 10Документ4 страницыMorning Update 2 Mar 10AndysTechnicalsОценок пока нет

- Wednesday Update 10 March 2010Документ6 страницWednesday Update 10 March 2010AndysTechnicalsОценок пока нет

- Market Discussion 5 Dec 10Документ9 страницMarket Discussion 5 Dec 10AndysTechnicalsОценок пока нет

- Morning View 23 Feb 10Документ6 страницMorning View 23 Feb 10AndysTechnicalsОценок пока нет

- Morning View 27jan2010Документ6 страницMorning View 27jan2010AndysTechnicals100% (1)

- S&P Futures 3 March 10 EveningДокумент2 страницыS&P Futures 3 March 10 EveningAndysTechnicalsОценок пока нет

- Crude Oil 31 October 2010Документ8 страницCrude Oil 31 October 2010AndysTechnicalsОценок пока нет

- Morning View 17 Feb 10Документ10 страницMorning View 17 Feb 10AndysTechnicalsОценок пока нет

- Market Discussion 12 Dec 10Документ9 страницMarket Discussion 12 Dec 10AndysTechnicalsОценок пока нет

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Документ7 страницS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsОценок пока нет

- Morning View 5mar2010Документ7 страницMorning View 5mar2010AndysTechnicalsОценок пока нет

- Morning View 20jan2010Документ8 страницMorning View 20jan2010AndysTechnicalsОценок пока нет

- S&P 500 Update 4 Apr 10Документ10 страницS&P 500 Update 4 Apr 10AndysTechnicalsОценок пока нет

- Market Commentary 27NOV11Документ5 страницMarket Commentary 27NOV11AndysTechnicalsОценок пока нет

- Copper Report 31 Jan 2010Документ8 страницCopper Report 31 Jan 2010AndysTechnicalsОценок пока нет

- Market Commentary 25SEP11Документ8 страницMarket Commentary 25SEP11AndysTechnicalsОценок пока нет

- Market Commentary 11mar12Документ7 страницMarket Commentary 11mar12AndysTechnicalsОценок пока нет

- Morning View 12feb2010Документ8 страницMorning View 12feb2010AndysTechnicalsОценок пока нет

- Market Commentary 1JUL12Документ8 страницMarket Commentary 1JUL12AndysTechnicalsОценок пока нет

- 1148 - Mes Anchor Bolt Inspection ReportДокумент2 страницы1148 - Mes Anchor Bolt Inspection ReportMitendra Kumar ChauhanОценок пока нет

- General Growth Properties 7 Jan 09Документ4 страницыGeneral Growth Properties 7 Jan 09AndysTechnicalsОценок пока нет

- Market Discussion 19 Dec 10Документ6 страницMarket Discussion 19 Dec 10AndysTechnicalsОценок пока нет

- Morning View 19 Feb 10Документ4 страницыMorning View 19 Feb 10AndysTechnicalsОценок пока нет

- 12 Speed Structure DiagramsДокумент6 страниц12 Speed Structure DiagramsrohankharadkarОценок пока нет

- Market Commentary 5aug12Документ7 страницMarket Commentary 5aug12AndysTechnicalsОценок пока нет

- Market Commentary 29apr12Документ6 страницMarket Commentary 29apr12AndysTechnicalsОценок пока нет

- 452 00005 DB9 Female Connector DatasheetДокумент1 страница452 00005 DB9 Female Connector DatasheetIrakОценок пока нет

- (WWW - Entrance-Exam - Net) - MU BE in IT 7th Sem. Data Warehousing, Mining and Business Intelligence Sample Paper 6Документ2 страницы(WWW - Entrance-Exam - Net) - MU BE in IT 7th Sem. Data Warehousing, Mining and Business Intelligence Sample Paper 6saurAbhОценок пока нет

- 1458G5 CaixaДокумент1 страница1458G5 Caixaalbert.sureda.spamОценок пока нет

- Gold Report 29 Nov 2009Документ11 страницGold Report 29 Nov 2009AndysTechnicalsОценок пока нет

- Sp500 Update 11sep11Документ6 страницSp500 Update 11sep11AndysTechnicalsОценок пока нет

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartДокумент8 страницREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsОценок пока нет

- Market Commentary 21feb11Документ10 страницMarket Commentary 21feb11AndysTechnicalsОценок пока нет

- Hydraulic Motors: Concentric ABДокумент47 страницHydraulic Motors: Concentric ABJose RodriguezОценок пока нет

- Anna University ME 9301 Design of Jigs. Fixtures and Press Tools Question PaperДокумент5 страницAnna University ME 9301 Design of Jigs. Fixtures and Press Tools Question PaperMuruga AnanthОценок пока нет

- Market Commentary 20NOV11Документ7 страницMarket Commentary 20NOV11AndysTechnicalsОценок пока нет

- Market Update 21 Nov 10Документ10 страницMarket Update 21 Nov 10AndysTechnicalsОценок пока нет

- 0452 Accounting: MARK SCHEME For The October/November 2012 SeriesДокумент7 страниц0452 Accounting: MARK SCHEME For The October/November 2012 SeriesYeОценок пока нет

- Understanding Different PhasesДокумент14 страницUnderstanding Different PhasesSumanth Gowda PОценок пока нет

- Market Update 18 July 10Документ10 страницMarket Update 18 July 10AndysTechnicalsОценок пока нет

- 09 Ec4t4r PDFДокумент26 страниц09 Ec4t4r PDFณัฐกรานต์ ไชยหาวงศ์Оценок пока нет

- Tactical Asset Allocation: Andrei SimonovДокумент52 страницыTactical Asset Allocation: Andrei SimonovlowsterОценок пока нет

- Ee Gate 2021Документ21 страницаEe Gate 2021smith polОценок пока нет

- Sp500 Update 5sep11Документ7 страницSp500 Update 5sep11AndysTechnicalsОценок пока нет

- 435 - Problem Set 2 (Solution)Документ3 страницы435 - Problem Set 2 (Solution)Md Borhan Uddin 2035097660Оценок пока нет

- Fundamental Analysis PDFДокумент7 страницFundamental Analysis PDFMonil BarbhayaОценок пока нет

- 15 Feb 2021-22 GE - 1 Time TableДокумент3 страницы15 Feb 2021-22 GE - 1 Time TableNikhilОценок пока нет

- Final Report SAMPLEДокумент36 страницFinal Report SAMPLEmumarОценок пока нет

- Economy RC 1Документ80 страницEconomy RC 1Yến ĐỗОценок пока нет

- test 01 (economy) - đọcДокумент27 страницtest 01 (economy) - đọcThuyhuyen VoОценок пока нет

- Hacker 3 RCДокумент290 страницHacker 3 RCjennyphuong0802Оценок пока нет

- Market Commentary 1JUL12Документ8 страницMarket Commentary 1JUL12AndysTechnicalsОценок пока нет

- Market Commentary 22JUL12Документ6 страницMarket Commentary 22JUL12AndysTechnicalsОценок пока нет

- Market Commentary 5aug12Документ7 страницMarket Commentary 5aug12AndysTechnicalsОценок пока нет

- Market Commentary 29apr12Документ6 страницMarket Commentary 29apr12AndysTechnicalsОценок пока нет

- Market Commentary 1apr12Документ8 страницMarket Commentary 1apr12AndysTechnicalsОценок пока нет

- Market Commentary 10JUN12Документ7 страницMarket Commentary 10JUN12AndysTechnicalsОценок пока нет

- Market Commentary 17JUN12Документ7 страницMarket Commentary 17JUN12AndysTechnicalsОценок пока нет

- Dollar Index (DXY) Daily ContinuationДокумент6 страницDollar Index (DXY) Daily ContinuationAndysTechnicalsОценок пока нет

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportДокумент6 страницS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 11mar12Документ7 страницMarket Commentary 11mar12AndysTechnicalsОценок пока нет

- Market Commentary 16jan12Документ7 страницMarket Commentary 16jan12AndysTechnicalsОценок пока нет

- Market Commentary 18mar12Документ8 страницMarket Commentary 18mar12AndysTechnicalsОценок пока нет

- Market Commentary 25mar12Документ8 страницMarket Commentary 25mar12AndysTechnicalsОценок пока нет

- Market Commentary 19DEC11Документ9 страницMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 6NOVT11Документ4 страницыMarket Commentary 6NOVT11AndysTechnicalsОценок пока нет

- Market Commentary 20NOV11Документ7 страницMarket Commentary 20NOV11AndysTechnicalsОценок пока нет

- Market Commentary 27NOV11Документ5 страницMarket Commentary 27NOV11AndysTechnicalsОценок пока нет

- Copper Commentary 11dec11Документ6 страницCopper Commentary 11dec11AndysTechnicalsОценок пока нет

- Market Commentary 25SEP11Документ8 страницMarket Commentary 25SEP11AndysTechnicalsОценок пока нет

- Sp500 Update 23oct11Документ7 страницSp500 Update 23oct11AndysTechnicalsОценок пока нет

- Sp500 Update 11sep11Документ6 страницSp500 Update 11sep11AndysTechnicalsОценок пока нет

- Market Commentary 30OCT11Документ6 страницMarket Commentary 30OCT11AndysTechnicalsОценок пока нет

- Sp500 Update 5sep11Документ7 страницSp500 Update 5sep11AndysTechnicalsОценок пока нет

- Copper Commentary 2OCT11Документ8 страницCopper Commentary 2OCT11AndysTechnicalsОценок пока нет

- CV - New Format - SabbirДокумент3 страницыCV - New Format - SabbirmizanОценок пока нет

- AuditingДокумент99 страницAuditingWen Xin GanОценок пока нет

- EurobondsДокумент217 страницEurobondslovergal1992Оценок пока нет

- Status Report June 2019Документ14 страницStatus Report June 2019the kingfishОценок пока нет

- Chapter 2 Ca AnswersДокумент9 страницChapter 2 Ca Answersfaaltu accountОценок пока нет

- Lecture Note 03 - Bond Price VolatilityДокумент53 страницыLecture Note 03 - Bond Price Volatilityben tenОценок пока нет

- NMC GOLD FINANCE LIMITED - Forensic Report 1Документ11 страницNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotОценок пока нет

- Cost - CH-1 Cma-IiДокумент14 страницCost - CH-1 Cma-IiShimelis TesemaОценок пока нет

- Detailed Course Outlines of Term VI - 2018-19Документ78 страницDetailed Course Outlines of Term VI - 2018-19vimanyu vermaОценок пока нет

- Sap FiglДокумент55 страницSap Figlheshamali99100% (2)

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiДокумент38 страницDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89Оценок пока нет

- CEB Architecture High Impact CapabilityДокумент12 страницCEB Architecture High Impact CapabilityCody LeeОценок пока нет

- FDIДокумент15 страницFDIpankajgaur.iabm30982% (11)

- Quotation - Hemas, SERVICE AND REPAIRS PDFДокумент2 страницыQuotation - Hemas, SERVICE AND REPAIRS PDFW GangenathОценок пока нет

- Sales CasesДокумент36 страницSales Casesknicky Francisco0% (1)

- State Life Insurance Corporation of PakistanДокумент6 страницState Life Insurance Corporation of PakistanjahanloverОценок пока нет

- Kiwi Property Annual Report 2020 FINAL PDFДокумент40 страницKiwi Property Annual Report 2020 FINAL PDFNam PhamОценок пока нет

- HeДокумент59 страницHearthur the great75% (8)

- International Finance W2013Документ20 страницInternational Finance W2013Bahrom Maksudov0% (1)

- Chapter 9Документ33 страницыChapter 9Annalyn Molina0% (1)

- Caam RM1000Документ2 страницыCaam RM1000NinerMike MysОценок пока нет

- Portfolio RevisionДокумент11 страницPortfolio Revisionveggi expressОценок пока нет

- Crescent Standard Modaraba: Managed by B.R.R. Investment (Private) LimitedДокумент10 страницCrescent Standard Modaraba: Managed by B.R.R. Investment (Private) Limiteds_kha100% (2)

- Financial Appraisal of ProjectДокумент22 страницыFinancial Appraisal of ProjectMahmudur RahmanОценок пока нет

- Solved International Paint Company Wants To Sell A Large Tract ofДокумент1 страницаSolved International Paint Company Wants To Sell A Large Tract ofAnbu jaromiaОценок пока нет

- Chapter 2Документ25 страницChapter 2heobenicerОценок пока нет