Академический Документы

Профессиональный Документы

Культура Документы

Capital Adequacy

Загружено:

Muhammad YasirАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Adequacy

Загружено:

Muhammad YasirАвторское право:

Доступные форматы

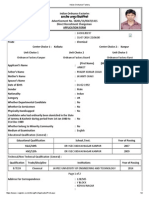

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

CAPITAL ADEQUACY

(LEVERAGE)

IN BANKS

Typical Balance Sheet of a Bank

Assets

Liabilities& Equity

Loans and advances 200

Lease Financing

Deposits-Current,

Saving, Term etc 360

50

Share Capital

30

Investments in Shares 50

Bonds, etc.

Reserves

06

R/E

04

FAs.

100

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

WHAT IS RISK OF FAILURE

Probability that the Bank will fail.

Will not honour commitments

Commitments to whom

-

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

KEY FINANCIAL RISKS

Credit risk and counterparty risk

Liquidity or funding risk

Settlement/payments risk

Market or price risk

Interest rate risk

Capital or gearing risk

Operational risk

Sovereign and political risks.

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Liquidity or funding risk

liquidity for normal operating

to fund its day-to-day operations

Deposit with drawls

Loans disbursements

Investing opportunities

Liquid vs illiquid assets- effect on profitability

Maturity gaps vs Maturity matching

Maturity profile of a banks liabilities understates actual liquidity

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Capital or gearing risk

Principal function of capital is to act as a buffer to support /

absorb losses

Highly geared Banks must have reputation for sound RM

Thresh hold for tolerance is low

More risk more capital as warranted by Basel risk assets ratio

ROE = ROA*(gearing multiplier)

Minimum ratio prescribed to constrain the gearing of leverage to

manageable levels ---10% in Pakistan

Prompt corrective actions are taken by the regulator for violation

Typical Balance Sheet of a Bank

Assets

Liabilities& Equity

Loans and advances 180

Lease Financing

Deposits-Current,

Saving, Term etc 360

50

Share Capital

Investments in Shares 50

Bonds, etc.

Reserves

FAs.

100

R/E

30

06

(16)

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Capital /assets ratio

C =Core Capital / Assets

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Capital to assets ratio

or gearing

Core capital

Assets

C/As

40

400

10%

20

380

5.26%

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Need for redefining

Core capital- what is actually available to act as buffer for

meeting emergency or loss situation

real source is the risk associated with assets whose value may

depreciate due to a multitude of reasons

Therefore we must define risk adjusted assets

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Capital

Tier 1 capital PUC, share premium, reserve for bonus shares,

general reserves, R/E net of losses minus good will, shortfall in

provisions, remaining deficit on account of revaluation of AFS

securities. (details in SBP guidelines)

Tier 2 capitalProvisions for loan and lease losses, revaluation

reserves, exchange translation reserves, undisclosed reserves and

subordinated debt.

Tier 3 capital--- short-term subordinated debt solely for the

purpose of meeting a proportion of the capital requirements for

market risk.

Total capital is sum total of the 3 minus prescribed deductions

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Qualifying Conditions

Total of Tier 2 and Tier 3 capital should be less that or equal to

Tier 1 capital PUC, share premium, reserve for bonus shares,

general reserves, R/E net of losses. (details in SBP guidelines)

Provisions for loan and lease losses will not include specific

provisions against identified loans losses, and are freely available

to meet any loss

Revaluation Reserves created by revaluation of fixed assets and

equity instruments only and up to 45% of value.

Undisclosed Reserves should be unencumbered and certified by

auditors and accepted by SBP

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Qualifying Conditions

Subordinated debt will be limited to a maximum of 50% of the

amount of Tier 1 capital and will also include rated and listed

subordinated debt instruments4 (like TFCs/Bonds) raised in the

capital market. It should be fully paid up, unsecured, subordinated

as to payment of principal and profit, to all other indebtedness of

the bank including deposits, and should not be redeemable before

maturity without prior approval of SBP

The Tier 3 capital shall be solely for the purpose of meeting

capital requirement for market risk.

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Risk Adjusted Assets

On balance sheet

Off balance sheet

INSTITUTE OF BUSINESS FINANCE

AND INDUSTRY

Risk based Capital /assets ratio

Total risk based Capital ratio = Total capital (tier 1+tier 2)

Risk adjusted assets

Tier 1 (core ) ratio

=Core capital (tier 1)

Risk adjusted assets

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Van Conversion Bible - The Ultimate Guide To Converting A CampervanДокумент170 страницThe Van Conversion Bible - The Ultimate Guide To Converting A CampervanPil100% (3)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- GTT NO96 LNG TanksДокумент5 страницGTT NO96 LNG TanksEdutamОценок пока нет

- Project of Consumer BehaviourДокумент28 страницProject of Consumer BehaviourNaveed JuttОценок пока нет

- Indian Ordnance FactoryДокумент2 страницыIndian Ordnance FactoryAniket ChakiОценок пока нет

- ABAP On HANA Interview QuestionsДокумент26 страницABAP On HANA Interview QuestionsNagesh reddyОценок пока нет

- Consumer Research ProcessДокумент78 страницConsumer Research ProcessShikha PrasadОценок пока нет

- OSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Документ1 544 страницыOSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Oscar Behrens ZepedaОценок пока нет

- Technical Specification For Flue Gas Desulfurization of Thermal Power Plant Limestone / Lime - Gypsum MethodДокумент17 страницTechnical Specification For Flue Gas Desulfurization of Thermal Power Plant Limestone / Lime - Gypsum Methodpramod_tryОценок пока нет

- Section 12-22, Art. 3, 1987 Philippine ConstitutionДокумент3 страницыSection 12-22, Art. 3, 1987 Philippine ConstitutionKaren LabogОценок пока нет

- ABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Документ21 страницаABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Avdhesh GuptaОценок пока нет

- Logbook) Industrial Attachment Brief To Students-3Документ6 страницLogbook) Industrial Attachment Brief To Students-3geybor100% (1)

- AutoCAD Civil 3D Performance Optimization 2Документ5 страницAutoCAD Civil 3D Performance Optimization 2Renukadevi RptОценок пока нет

- 2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP GlycerinДокумент1 страница2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP Glycerinchristian muñozОценок пока нет

- Philips Chassis Lc4.31e Aa Power Dps 181 PDFДокумент9 страницPhilips Chassis Lc4.31e Aa Power Dps 181 PDFAouadi AbdellazizОценок пока нет

- Occupational Stress Questionnaire PDFДокумент5 страницOccupational Stress Questionnaire PDFabbaskhodaei666Оценок пока нет

- La Naval Drug Co Vs CA G R No 103200Документ2 страницыLa Naval Drug Co Vs CA G R No 103200UE LawОценок пока нет

- Circular Motion ProblemsДокумент4 страницыCircular Motion ProblemsGheline LexcieОценок пока нет

- VOID BEQUESTS - AssignmentДокумент49 страницVOID BEQUESTS - AssignmentAkshay GaykarОценок пока нет

- Water Cooled Centrifugal Chiller (150-3000RT)Документ49 страницWater Cooled Centrifugal Chiller (150-3000RT)remigius yudhiОценок пока нет

- Project Proposal - Articulation SessionsДокумент8 страницProject Proposal - Articulation SessionsJhay-are PogoyОценок пока нет

- BancassuranceДокумент41 страницаBancassuranceanand_lamaniОценок пока нет

- Tamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Документ12 страницTamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Latest Laws TeamОценок пока нет

- D.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Документ5 страницD.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Pritam Kumar Singh100% (1)

- 1 General: Fig. 1.1 Industrial RobotДокумент40 страниц1 General: Fig. 1.1 Industrial RobotArunОценок пока нет

- Lab ManualДокумент15 страницLab ManualsamyukthabaswaОценок пока нет

- Inkt Cables CabinetsДокумент52 страницыInkt Cables CabinetsvliegenkristofОценок пока нет

- LOVДокумент43 страницыLOVMei FadillahОценок пока нет

- Jicable DAS For Power Industry Applications 2015-A3-4Документ6 страницJicable DAS For Power Industry Applications 2015-A3-4Richard KluthОценок пока нет

- Stps 20 H 100 CTДокумент8 страницStps 20 H 100 CTPablo Cruz ArchundiaОценок пока нет