Академический Документы

Профессиональный Документы

Культура Документы

Case Study LonePine

Загружено:

Gaurav AroraАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case Study LonePine

Загружено:

Gaurav AroraАвторское право:

Доступные форматы

Case Study

on

Lone Pine Cafe(A)

Prepared by:

Isha Das

Gaurav Arora

Akhilesh Purohit

Akshay Dewan

Lone Pine Cafe(A)

Balance Sheet

As on 2nd November 2009

Assets Liabilities

Current Assets:

Cash: $ 48000 Bank Loan Payable: $ 21000

Loan received: $ 21000 Owners Equity: $ 48000

Cash in Hand: $ 69000

*Less assets: $ 60328 Total: $ 69000

Checking Cash

$ 8672

Assets created

a.Prepaid rent: $ 1500

b.Equipment: $ 53200

c.Cash register: $ 1400

d.License: $ 1428

e.Food: $ 2800

Assets Created Total value

*Cash Deductions:

f. Rent: $ 1500

g.Equipments: $ 53200

h.Food: $2800

i. License: $ 1428

j. Cash register: $ 1400

Deductions: $ 60328

Total Assets:

Checking Cash: $ 8672

Assets Created : $ 60328

Total : $ 69000

$ 60328

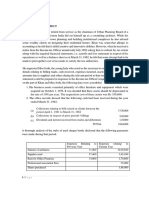

Lone Pine Cafe(A)

Balance Sheet

As on 30th March 2010

Assets

Liabilities

a.

b.

c.

d.

e.

Checking account: $ 1030

Supplies : $ 1583

Accounts Receivable: $ 870

Cash in Register : $ 311

Cash Register : $1400

Bank Loan payable: $ 18900

Equipment: $ 50755

(Bank loan of $ 2100 paid out of $21000)

(Equipment depreciation of $ 2445)

Liabilities: $ 20483

f.

License: $ 833

Owners Equity= Assets total value-Liabilities

(License depreciation : $ 595)

= $37146

g.

Food: $ 2430

h.

Prepaid rent(one day 31st March): $ 48

Total Liabilities = Owners Equity+

Liabilities

= $ 57629

i.

Less : Cash deduction(rent): $48

Assets Total value

$ 57629

Owners equity is calculated after deducting the total liabilities from total assets

value , computed to be $ 37146 as on 30th March-2010.

Each partner is entitled to get One third of the amount i.e $ 12382.

Notes: If the theft of cash $311 and the cash register is done by Mr. Antoine and/or Mrs.

Landers the equity would not be shared equally and the fair cost of cash register and

the cash available in the cash register would be deducted from their part of share of

equity.

Thank You

Вам также может понравиться

- Lone Pine Cafe-CaseДокумент28 страницLone Pine Cafe-CaseNadya Rizkita100% (2)

- Lone Pine Cafe Balance SheetsДокумент15 страницLone Pine Cafe Balance SheetsCynthia Anggi Maulina100% (1)

- Lone Pine Cafe Balance Sheets Case StudyДокумент13 страницLone Pine Cafe Balance Sheets Case StudyCynthia Anggi Maulina100% (1)

- Lone - Pine - Cafe - Case - Study Final XXДокумент25 страницLone - Pine - Cafe - Case - Study Final XXRamesh SinghОценок пока нет

- Prepare A Balance Sheet For The Lone Pine Café As of November 2, 2009Документ2 страницыPrepare A Balance Sheet For The Lone Pine Café As of November 2, 2009Lynnard Philip PanesОценок пока нет

- Basic Concepts of Accounting (Balance Sheet)Документ12 страницBasic Concepts of Accounting (Balance Sheet)badtzmaru0506Оценок пока нет

- Lone Pine Cafe Case SolutionДокумент5 страницLone Pine Cafe Case SolutionShammika Krishna75% (4)

- Lone Pine Cafe - NewДокумент10 страницLone Pine Cafe - Newaayush.tandon2838Оценок пока нет

- Lone Pine CafeДокумент16 страницLone Pine CafeJayraj KhuntiОценок пока нет

- Lone Pine CafeДокумент16 страницLone Pine CafeJayraj KhuntiОценок пока нет

- TN Cô Cho ThêmДокумент3 страницыTN Cô Cho ThêmDĩm MiОценок пока нет

- Date Account Debit Credit: A. Cooper 1Документ3 страницыDate Account Debit Credit: A. Cooper 1Cooper89Оценок пока нет

- Mailin MoonДокумент2 страницыMailin MoonTushaldeep SinghОценок пока нет

- F5-Individual Activity Accomplishment ReportДокумент11 страницF5-Individual Activity Accomplishment ReportRoemyr BellezasОценок пока нет

- Accounting-Lone Pine Cafe CaseДокумент28 страницAccounting-Lone Pine Cafe CaseMuadz Akbar100% (1)

- Accounting Midterm Test JounalsДокумент4 страницыAccounting Midterm Test JounalsEzequiel ZubkoОценок пока нет

- Accounting AssДокумент2 страницыAccounting Assremou95Оценок пока нет

- 4 Books of Prime Entry - PPSXДокумент13 страниц4 Books of Prime Entry - PPSXAbdelwahab Ahmed IbrahimОценок пока нет

- Kuis Completing The Accounting Cycle - Service CompanyДокумент1 страницаKuis Completing The Accounting Cycle - Service CompanysyafiraОценок пока нет

- 2010 Yr 9 POA AnsДокумент67 страниц2010 Yr 9 POA AnsMuhammad SamhanОценок пока нет

- Case Study - Lone Pine Cafe (A)Документ6 страницCase Study - Lone Pine Cafe (A)rdx216Оценок пока нет

- FA - Hand Out - Page 6 & 7 - SolvedДокумент8 страницFA - Hand Out - Page 6 & 7 - SolvedaqibazizkhanОценок пока нет

- Bu I 3 CH A Bài NLKT TAДокумент7 страницBu I 3 CH A Bài NLKT TATiêu Vân GiangОценок пока нет

- Prob Set 1Документ6 страницProb Set 1Nikki BulanteОценок пока нет

- 2020 AnswerДокумент15 страниц2020 Answertanjimalomturjo1Оценок пока нет

- Accounting HMWKДокумент5 страницAccounting HMWKyaoyao3905Оценок пока нет

- Basic Financial Statements: SolutionsДокумент19 страницBasic Financial Statements: SolutionsPrramakrishnanRamaKrishnanОценок пока нет

- Understanding Company Transactions and Financial StatementsДокумент4 страницыUnderstanding Company Transactions and Financial StatementsNeo AhmadОценок пока нет

- Assets: Liabilities:: Account ReceivableДокумент3 страницыAssets: Liabilities:: Account Receivable111290Оценок пока нет

- Mock Test (Final Exam) Time: 60 Minutes: InstructionsДокумент1 страницаMock Test (Final Exam) Time: 60 Minutes: InstructionsVương AnhОценок пока нет

- Sample Mid Term Exam QuestionsДокумент15 страницSample Mid Term Exam QuestionsThat kid 246Оценок пока нет

- Case Study on the Financial Struggles of Lone Pine CafeДокумент19 страницCase Study on the Financial Struggles of Lone Pine CafeVishwasKariyaОценок пока нет

- 202221040Документ5 страниц202221040R A.Оценок пока нет

- GSLC Acct6300 Week 3 Session 6Документ2 страницыGSLC Acct6300 Week 3 Session 6Whisky XDОценок пока нет

- GSLC Acct6300 Week 3 Session 6Документ2 страницыGSLC Acct6300 Week 3 Session 6Whisky XDОценок пока нет

- Olimpiade Akuntansi Tingkat Nasional 2017(Soal SMKДокумент31 страницаOlimpiade Akuntansi Tingkat Nasional 2017(Soal SMKAdit BoyОценок пока нет

- Balance Sheet Group ProjectДокумент1 страницаBalance Sheet Group ProjectPunjab PB23Оценок пока нет

- Exercise 1Документ4 страницыExercise 1Quang Anh ChuОценок пока нет

- CH 01Документ2 страницыCH 01vivien0% (1)

- Long Pine Cafe 2-3 Balance SheetДокумент5 страницLong Pine Cafe 2-3 Balance Sheetlouiegoods24Оценок пока нет

- Tutorial 2 - WorksheetДокумент6 страницTutorial 2 - WorksheetMadelineОценок пока нет

- Business Processes 2: Assignment 1.2Документ4 страницыBusiness Processes 2: Assignment 1.2yuvrajbanga007Оценок пока нет

- Chapter 3 Homework Template (Fixed)Документ8 страницChapter 3 Homework Template (Fixed)chanyoung4951Оценок пока нет

- Exerciseon Principles of AccountingДокумент1 страницаExerciseon Principles of AccountingBedri M AhmeduОценок пока нет

- BD21060 Aman Assignment3Документ3 страницыBD21060 Aman Assignment3Aman KundraBD21060Оценок пока нет

- Total Cash P 4,950,000Документ44 страницыTotal Cash P 4,950,000Angel Nicole OriasОценок пока нет

- On August 31 The Balance Sheet of La Brava VeterinaryДокумент1 страницаOn August 31 The Balance Sheet of La Brava Veterinarytrilocksp SinghОценок пока нет

- Accounting I Final Packet TemplateДокумент62 страницыAccounting I Final Packet TemplateIronEzio56Оценок пока нет

- CH 3.2 AcctДокумент6 страницCH 3.2 AcctTyler GipsonОценок пока нет

- ch01 PDFДокумент2 страницыch01 PDFDanish BaigОценок пока нет

- Contributed / Share Capital: Transaction As On: 1st Jan 2010Документ18 страницContributed / Share Capital: Transaction As On: 1st Jan 2010sanjeevОценок пока нет

- Soal Penyisihan SMK Oan2017 PDFДокумент31 страницаSoal Penyisihan SMK Oan2017 PDFnuria amaliaОценок пока нет

- Lone Pine CafeДокумент4 страницыLone Pine CafeRahul TiwariОценок пока нет

- Irene's Coin Laundry Trial BalanceДокумент2 страницыIrene's Coin Laundry Trial BalanceSmile Smile100% (1)

- Cash Book WorksheetДокумент4 страницыCash Book Worksheetanastasiarobinson21000Оценок пока нет

- Acct 450 Final Quiz Chpts 13 9 10Документ6 страницAcct 450 Final Quiz Chpts 13 9 10Kim TranОценок пока нет

- IoT PlatformsДокумент11 страницIoT PlatformsGaurav AroraОценок пока нет

- First Principles of EconomicsДокумент38 страницFirst Principles of EconomicsGaurav AroraОценок пока нет

- Economic Models and Mathematical ToolsДокумент28 страницEconomic Models and Mathematical ToolsGaurav AroraОценок пока нет

- BPM Session 1Документ48 страницBPM Session 1Gaurav AroraОценок пока нет

- Cola QuesДокумент4 страницыCola QuesGaurav AroraОценок пока нет

- ODC ProjectДокумент18 страницODC ProjectGaurav AroraОценок пока нет

- LATIF KHAN FINANCIALSДокумент2 страницыLATIF KHAN FINANCIALSGaurav AroraОценок пока нет

- How Internet Advertising Influences Consumer BehaviorДокумент51 страницаHow Internet Advertising Influences Consumer BehaviorNisha Agarwal 3100% (1)

- Trade UnionДокумент23 страницыTrade UnionGaurav AroraОценок пока нет

- Introduction to Trade Unions: What They Are and Their ObjectivesДокумент10 страницIntroduction to Trade Unions: What They Are and Their ObjectivesGaurav AroraОценок пока нет

- Cost Minimization of MaxCity ClinicДокумент15 страницCost Minimization of MaxCity ClinicGaurav AroraОценок пока нет

- Supply, Demand and Market EquilibriumДокумент33 страницыSupply, Demand and Market EquilibriumGaurav AroraОценок пока нет

- Job Analysis Process and MethodsДокумент10 страницJob Analysis Process and MethodsGaurav AroraОценок пока нет