Академический Документы

Профессиональный Документы

Культура Документы

Super Project

Загружено:

Nirmalya ChandaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Super Project

Загружено:

Nirmalya ChandaАвторское право:

Доступные форматы

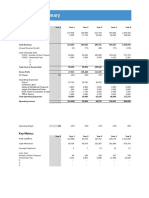

Super Project Valuation

ROFE?

ROFE is not a good way to measure project

feasibility doesn't account for time value of

money. Also uses profit before taxes.

Understates the impact of higher starting costs

in a project

Should use FCF and NPV analysis instead

NPV Calculation (Incremental

Accounting)

year 0

year 1

year 2

year 3

year 4

year 5

year 6

year 7

year 8

year 9

year 10

Net Revenue

2,112.00 2,304.00 2,496.00 2,688.00 2,880.00 2,880.00 3,072.00 3,072.00 3,264.00 3,264.00

CGS

1,100.00 1,200.00 1,300.00 1,400.00 1,500.00 1,500.00 1,600.00 1,600.00 1,700.00 1,700.00

Gross Profit

Advertising Expense -

1,012.0 1,104.0 1,196.0 1,288.0 1,380.0 1,380.0 1,472.0 1,472.0 1,564.0 1,564.0

0

0

0

0

0

0

0

0

0

0

1,100.00 1,050.00 1,000.00 900.00

700.00

700.00

730.00

730.00

750.00

750.00

230.00

230.00

240.00

240.00

250.00

250.00

Selling Expense

Gen. And Admins Cost

Research Expense

Start up Costs

15.00

Other(Explain) Test Market 360.00

Adjustments(Explain) erosion

Total Expenses other than COGS

180.00

200.00

210.00

220.00

1,295.0 1,250.0 1,210.0 1,120.0

1,000.0 1,000.0

360.00 0

0

0

0

930.00 930.00 970.00 970.00 0

0

Over Head Expenses

EBITDA

(360.00 (283.00 (146.00

)

)

)

(14.00) 168.00 450.00 450.00 502.00 502.00 564.00 564.00

Cumulative Depreciation

Depreciation

19.00

37.00

54.00

70.00

85.00

98.00

110.00

121.00

131.00

140.00

19.00

18.00

17.00

16.00

15.00

13.00

12.00

11.00

10.00

9.00

NPV Calculation (Incremental)

Discount Rate at

which NPV is

zero=10.33%

Feasibility

depending on

General Foods'

guidelines

Compare to

ROFE findings in

case

NPV Calculation (Facilities Used

Basis)

year 0

year 1

year 2

year 3

year 4

year 5

year 6

year 7

year 8

year 9

year 10

Net Revenue

2,112.00 2,304.00 2,496.00 2,688.00 2,880.00 2,880.00 3,072.00 3,072.00 3,264.00 3,264.00

CGS

1,100.00 1,200.00 1,300.00 1,400.00 1,500.00 1,500.00 1,600.00 1,600.00 1,700.00 1,700.00

Gross Profit

Advertising Expense -

1,012.0 1,104.0 1,196.0 1,288.0 1,380.0 1,380.0 1,472.0 1,472.0 1,564.0 1,564.0

0

0

0

0

0

0

0

0

0

0

1,100.00 1,050.00 1,000.00 900.00

700.00

700.00

730.00

730.00

750.00

750.00

230.00

230.00

240.00

240.00

250.00

250.00

Selling Expense

Gen. And Admins Cost

Research Expense

Start up Costs

15.00

Other(Explain) Test Market 360.00

Adjustments(Explain) erosion

Total Expenses other than COGS

180.00

200.00

210.00

220.00

1,295.0 1,250.0 1,210.0 1,120.0

1,000.0 1,000.0

360.00 0

0

0

0

930.00 930.00 970.00 970.00 0

0

Over Head Expenses

EBITDA

(360.00 (283.00 (146.00

)

)

)

(14.00) 168.00 450.00 450.00 502.00 502.00 564.00 564.00

Cumulative Depreciation

Depreciation

19.00

37.00

54.00

70.00

85.00

98.00

110.00

121.00

131.00

140.00

19.00

18.00

17.00

16.00

15.00

13.00

12.00

11.00

10.00

9.00

NPV Calculation (Facilities Used

Basis)

Discount rate

needed for which

NPV is zero=

3.18%

Feasible under

GF's guidelines?

Compare to ROFE

in case

NPV Calculation (Fully allocated

basis)

year 0

year 1

year 2

year 3

year 4

year 5

year 6

year 7

year 8

year 9

year 10

Net Revenue

2,112.00 2,304.00 2,496.00 2,688.00 2,880.00 2,880.00 3,072.00 3,072.00 3,264.00 3,264.00

CGS

1,100.00 1,200.00 1,300.00 1,400.00 1,500.00 1,500.00 1,600.00 1,600.00 1,700.00 1,700.00

Gross Profit

Advertising Expense -

1,012.0 1,104.0 1,196.0 1,288.0 1,380.0 1,380.0 1,472.0 1,472.0 1,564.0 1,564.0

0

0

0

0

0

0

0

0

0

0

1,100.00 1,050.00 1,000.00 900.00

700.00

700.00

730.00

730.00

750.00

750.00

230.00

230.00

240.00

240.00

250.00

250.00

Selling Expense

Gen. And Admins Cost

Research Expense

Start up Costs

15.00

Other(Explain) Test Market 360.00

Adjustments(Explain) erosion

Total Expenses other than COGS

180.00

200.00

210.00

220.00

1,295.0 1,250.0 1,210.0 1,120.0

1,000.0 1,000.0

360.00 0

0

0

0

930.00 930.00 970.00 970.00 0

0

Over Head Expenses

EBITDA

90.00

90.00

90.00

90.00

90.00

(360.00 (283.00 (146.00

)

)

)

(14.00) 168.00 360.00 360.00 412.00 412.00 474.00 474.00

Cumulative Depreciation

Depreciation

90.00

19.00

37.00

54.00

70.00

85.00

98.00

110.00

121.00

131.00

140.00

19.00

18.00

17.00

16.00

15.00

13.00

12.00

11.00

10.00

9.00

NPV Calculation (Fully Allocated

Basis)

NPV vs Discount Rate

NPV

0%

(100.00)

(200.00)

(300.00)

(400.00)

(500.00)

(600.00)

(700.00)

(800.00)

(900.00)

(1,000.00)

5%

10%

15%

Discount Rate

20%

25%

30%

Discount rate

needed for which

NPV is zero=0.57%

Feasibility?

Compare to ROFE

in case

NPV Valuation Summary

Essentially compare and contrast the different

accounting method's NPV stats

Final NPV Analysis

Talk about what we included and didn't include

Didn't charge for the test market or the facilities

used and why

Used the overhead expenses because it's

reasonable to assume that as sales for Super

increase it'll cost more to run their day to day

operations

Final NPV Analysis

year 0

year 1

year 2

year 3

year 4

year 5

year 6

year 7

year 8

year 9

year 10

Net Revenue

2,112.00 2,304.00 2,496.00 2,688.00 2,880.00 2,880.00 3,072.00 3,072.00 3,264.00 3,264.00

CGS

1,100.00 1,200.00 1,300.00 1,400.00 1,500.00 1,500.00 1,600.00 1,600.00 1,700.00 1,700.00

Gross Profit

Advertising Expense -

1,012.0 1,104.0 1,196.0 1,288.0 1,380.0 1,380.0 1,472.0 1,472.0 1,564.0 1,564.0

0

0

0

0

0

0

0

0

0

0

1,100.00 1,050.00 1,000.00 900.00

700.00

700.00

730.00

730.00

750.00

750.00

230.00

230.00

240.00

240.00

250.00

250.00

Selling Expense

Gen. And Admins Cost

Research Expense

Start up Costs

15.00

Other(Explain) Test Market

Adjustments(Explain) erosion

Total Expenses other than COGS

180.00

-

200.00

210.00

220.00

1,295.0 1,250.0 1,210.0 1,120.0

1,000.0 1,000.0

0

0

0

0

930.00 930.00 970.00 970.00 0

0

Over Head Expenses

EBITDA

90.00

-

Cumulative Depreciation

Depreciation

90.00

90.00

90.00

90.00

90.00

(283.00 (146.00

)

)

(14.00) 168.00 360.00 360.00 412.00 412.00 474.00 474.00

19.00

37.00

54.00

70.00

85.00

98.00

110.00

121.00

131.00

140.00

19.00

18.00

17.00

16.00

15.00

13.00

12.00

11.00

10.00

9.00

Final NPV Analysis

Discount rate

needed for

which NPV is

zero=11.63%

Assuming

these things,

project feasible

according to

General Foods'

guidelines.

Вам также может понравиться

- Colorscope 20101029 v0 1 ABДокумент20 страницColorscope 20101029 v0 1 ABirquadri0% (1)

- Colorscope 20101029 v0 1 ABДокумент19 страницColorscope 20101029 v0 1 ABrahulrao70% (1)

- Free Elective Exercise No. 1-BalancedДокумент17 страницFree Elective Exercise No. 1-BalancedLoi PanlaquiОценок пока нет

- Mercury Athletic Footwear Acquisition AnalysisДокумент8 страницMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- Mercuryathleticfootwera Case AnalysisДокумент8 страницMercuryathleticfootwera Case AnalysisNATOEEОценок пока нет

- BASIC MODEL - Construction.Документ10 страницBASIC MODEL - Construction.KAVYA GUPTAОценок пока нет

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnДокумент10 страницAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Corporate FinanceДокумент2 страницыCorporate Financenatasya angelОценок пока нет

- Chapter V Financial Aspect Feasibility StudyДокумент4 страницыChapter V Financial Aspect Feasibility StudyCyrene JamesОценок пока нет

- Group 1 - Financial Plan For Projectv0.2Документ20 страницGroup 1 - Financial Plan For Projectv0.2ntadbmОценок пока нет

- 911 BIZ201 Assessment 3 Student WorkbookДокумент7 страниц911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaОценок пока нет

- New DollДокумент2 страницыNew DollJuyt HertОценок пока нет

- YeahДокумент59 страницYeahPrinceОценок пока нет

- Akansh Arora FM AssignmentДокумент17 страницAkansh Arora FM AssignmentAKANSH ARORAОценок пока нет

- Executive SummaryДокумент12 страницExecutive SummaryShehbaz HameedОценок пока нет

- PUP Financial Forecasting TechniquesДокумент7 страницPUP Financial Forecasting TechniquesHambeca PHОценок пока нет

- Free Book On Basic Financial ModellingДокумент100 страницFree Book On Basic Financial ModellingCareer and TechnologyОценок пока нет

- Blue Star Q1FY14 Result UpdateДокумент5 страницBlue Star Q1FY14 Result UpdateaparmarinОценок пока нет

- Financial Template RsДокумент11 страницFinancial Template Rsginish12Оценок пока нет

- Key RatiosДокумент2 страницыKey RatiosKhalid MahmoodОценок пока нет

- Prospective Analysis - ForecastingДокумент17 страницProspective Analysis - ForecastingqueenbeeastОценок пока нет

- FinancialsДокумент9 страницFinancialsAdewunmi EzekielОценок пока нет

- Blue Star, 1Q FY 2014Документ14 страницBlue Star, 1Q FY 2014Angel BrokingОценок пока нет

- Samsung C&T: Growth Back On TrackДокумент5 страницSamsung C&T: Growth Back On TrackksathsaraОценок пока нет

- ATH Technologies: Case-3 Strategic ImplementationДокумент8 страницATH Technologies: Case-3 Strategic ImplementationSumit RajОценок пока нет

- Airthread DCF Vs ApvДокумент6 страницAirthread DCF Vs Apvapi-239586293Оценок пока нет

- 22 22 YHOO Merger Model Transaction Summary AfterДокумент101 страница22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Оценок пока нет

- Income Statement For StartupsДокумент3 страницыIncome Statement For StartupsBiki BhaiОценок пока нет

- Dolphin Sea Food Restaurant: Gulistan E Jauhar KarachiДокумент19 страницDolphin Sea Food Restaurant: Gulistan E Jauhar KarachitariqОценок пока нет

- Basic - Model - FSA - 2Документ8 страницBasic - Model - FSA - 2AhisjОценок пока нет

- NHDC-Solution-xls Analisis VPN TIR NHDCДокумент4 страницыNHDC-Solution-xls Analisis VPN TIR NHDCDaniel Infante0% (1)

- UtkarshVikramSinghChauhan TATASTEELДокумент12 страницUtkarshVikramSinghChauhan TATASTEELUtkarsh VikramОценок пока нет

- Session 5 Feasibility Study GuideДокумент7 страницSession 5 Feasibility Study GuideDiaa QishtaaОценок пока нет

- Group 2 - VNM - Ver1Документ11 страницGroup 2 - VNM - Ver1Ánh Lê QuỳnhОценок пока нет

- Capital Budgeting Techniques for Restaurant ExpansionДокумент15 страницCapital Budgeting Techniques for Restaurant ExpansionVinu DОценок пока нет

- 3.8L Agarbatti MakingДокумент9 страниц3.8L Agarbatti MakingVedant AssociatesОценок пока нет

- Writting Assignement Unit 6Документ3 страницыWritting Assignement Unit 6Paw Akou-edi100% (1)

- KUANGLU RESTAURANT , BUSINESS PLANДокумент10 страницKUANGLU RESTAURANT , BUSINESS PLANDonjulie HoveОценок пока нет

- IBF Term ReportДокумент12 страницIBF Term ReportSaad A MirzaОценок пока нет

- 6.86L Agarbatti ManufacturingДокумент9 страниц6.86L Agarbatti ManufacturingVedant AssociatesОценок пока нет

- Income StatementДокумент3 страницыIncome StatementBiki BhaiОценок пока нет

- Investment Appraisal Relevant Cash Flows AnswersДокумент8 страницInvestment Appraisal Relevant Cash Flows AnswersdoannamphuocОценок пока нет

- Term Paper On Investment Management: Presented byДокумент42 страницыTerm Paper On Investment Management: Presented byChinmoy Prasun GhoshОценок пока нет

- Balance Sheet StatementДокумент8 страницBalance Sheet StatementsantasantitaОценок пока нет

- Financial Projections TemplateДокумент28 страницFinancial Projections TemplatepooliglotaОценок пока нет

- Phuket Beach HotelДокумент15 страницPhuket Beach HotelKarlo Prado67% (3)

- Burton ExcelДокумент128 страницBurton ExcelJaydeep SheteОценок пока нет

- Group Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDДокумент16 страницGroup Project On Corporate Finance BSRM Xtreme & GPH Ispat LTDTamim ChowdhuryОценок пока нет

- I. Financial AssumptionsДокумент14 страницI. Financial AssumptionsJaera shopaholicОценок пока нет

- 10.40L Masala MakingДокумент10 страниц10.40L Masala MakingVedant AssociatesОценок пока нет

- Financial PlanДокумент18 страницFinancial Planashura08Оценок пока нет

- New ExcelДокумент25 страницNew Excelred8blue8Оценок пока нет

- BSBFIM601___Task_1.docxДокумент10 страницBSBFIM601___Task_1.docxKitpipoj PornnongsaenОценок пока нет

- Bank of Kigali Announces Q1 2010 ResultsДокумент7 страницBank of Kigali Announces Q1 2010 ResultsBank of KigaliОценок пока нет

- Chapter 6 PDFДокумент23 страницыChapter 6 PDFreyОценок пока нет

- Accrual Accounting and ValuationДокумент49 страницAccrual Accounting and ValuationSonyaTanSiYing100% (1)

- Buiness ProjectДокумент3 страницыBuiness Projectapi-273351602Оценок пока нет

- Shoppers Stop 4qfy11 Results UpdateДокумент5 страницShoppers Stop 4qfy11 Results UpdateSuresh KumarОценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- 2 2 and - 2 3-TemplatesДокумент10 страниц2 2 and - 2 3-TemplatesNirmalya ChandaОценок пока нет

- Test 3 SPR 2010 KEYДокумент8 страницTest 3 SPR 2010 KEYShivya GuptaОценок пока нет

- Proforma Income Statement Play TIme ToyДокумент6 страницProforma Income Statement Play TIme ToyNirmalya ChandaОценок пока нет

- Super Project Valuation NPV AnalysisДокумент12 страницSuper Project Valuation NPV AnalysisNirmalya ChandaОценок пока нет