Академический Документы

Профессиональный Документы

Культура Документы

Modarabah and Deposit Management

Загружено:

aleenaaaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Modarabah and Deposit Management

Загружено:

aleenaaaАвторское право:

Доступные форматы

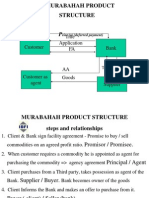

Modes of Financing Participatory Modes

Modarabah and Deposit Management

Islamic Modes/Instruments Participatory Modes:

Modarabah: [Shariah Standard N0. 13]

A trustee-type finance contract

Profit sharing is agreed between two parties

Losses are borne by the provider of funds

UNLESS

Parties to Mudaraba:

Rabb-ul-Mal (Bank) Rabb-ul-Mal (Customer)

Mudarib (Customer) Mudarib (Bank)

Types of Mudaraba:

Restricted Mudaraba:

Unrestricted Mudaraba:

Islamic Modes/Instruments Participatory Modes:

Modarabah: Conditions of Mudarabah:

Legal capacity of the two parties to appoint

agent and accept agency

Trust contract Mudarib is not liable for

losses UNLESS negligence/misconduct is

proved [Limited liability of Mudarib]

Nature of Contract Non-binding can be

terminated unilaterally, except when the

Mudarib has already commenced the

business binding up to the date of actual

or constructive liquidation.

Islamic Modes/Instruments Participatory Modes:

Mudarabah: Conditions of Mudarabah:

Management and work - exclusive

responsibility of Mudarib

Capital is invested in broadly defined

activities. [specific conditions can apply if

already provided in the contract]

Capital, preferably in cash.

Terms of profit are pre-agreed and

customized for each investment.

Islamic Modes/Instruments Participatory Modes:

Modarabah: Conditions of Mudaraba:

Bank can contract Mudaraba with more than

one person

Each one of clients act as mudarib.

Capital to be utilized by all of them jointly.

All the mudribs shall run the business as

partners among themselves.

Share of mudarib shall be distributed among

them according to the agreed proportion.

Modarabah More than one Mudarib

Proposal of

work

Provision of

capital

1. The Project

Mudarib

2

Mudarib

Mudarib

Share of

profit

Bank (Rabul Maal)

Share of

profit

3. Accruing Profits

4. Capital

Recovery of

capital

Islamic Modes/Instruments Participatory Modes:

Modarabah: Conditions of Mudaraba:

Rab ul Maals More than one [Deposit

Management Relevance].

Pool their funds.

Within pool All are partners.

Profit distributed as per the tenor and amount

of funds.

A special weightage system is built to

distribute the profit

Modarabah More than one Rab ul Maal

Provision of

capital

Proposal of

Work

1. The Project

Rab Maal

2

Rabul Maal

Rab Maal

Share of

profit

Bank (Mudarib)

Share of

profit

3. Accruing Profits

Recovery of

capital

4. Capital

Islamic Modes/Instruments Participatory Modes:

Distribution of Profit:

Bank and client should agree, right at the conclusion of

contract, on a definite proportion. [However, proportion can

be changed for a further definite period]

No lump sum amount of profit.

Mudaribs share can be tied up with the nature of business eg.

40% if does cloth business, 50% if deal in wheats business,

30% if does at his own [but need to be provided in the

contract]

Distribution of profit depends at the time of physical or

constructive liquidation of business. Reserves can be created

with permission of financier which can be used for meeting

losses.

Mudarib cannot claim any periodical salary or fee if already

being provided share in profit (However, under a separate

contract which can be terminated without affecting the

Mudarabah contract, Mudarib may be compensated for

expenses on business trip [Opinions].

Islamic Modes/Instruments Participatory Modes:

Distribution of the profit:

If losses in one transaction and profit in some other

- the profit shall set aside the losses first and the

balance would be distributed.

At the time of liquidation [Constructive OR Actual]:

If losses > profits, the difference subtracted from capital

If ratio of profit distribution is not decided at the

time of contract, then as per customary practice

One partner can donate a part or whole of his profit

to the other

If no such practice, the Mudarabah contract

becomes void - Mudarib receives remuneration of

his services equivalent to market price

Islamic Modes/Instruments Participatory Modes:

Distribution of the profit:

If provided in contract, one of the parties

may get additional profit if it crosses certain

agreed ceiling, otherwise if within that

ceiling, then as per agreed ratio.

Islamic Modes/Instruments Participatory Modes:

Mudarabah: Mudarabah Financing Agreement

Parties

Description of project (DOP) [/feasibility/cash

flow/revenue projection]

Account opened with Institution in name of

Client

Client asset finance as per DOP means the

sum estimated by the Client as necessary to

acquire the assets required for the Project as

disclosed on the Project Information Form

Exhibit A

Islamic Modes/Instruments Participatory Modes:

Mudarabah: Mudarabah Financing Agreement

Management Services

Profit and participation in profit amount of

gross profit available for distribution after

deduction of permissible expenses as may be

agreed between the client and the Institution

and profit to be distributed as per agreed ratio

and periodicity of profit distribution

Losses by the institution and Mudarib loses

management fee, unless

Clients Information Information disclosed by

the client, Client Financials (Balance Sheet,

P&L), Draw Down Dates

Guarantees to cover the negligence and

misconduct of Mudarib.

Islamic Modes/Instruments Participatory Modes:

Modarabah: Mudarabah Financing Agreement

Project Information Form being a narrative

description of the Project

Cash Flow and Revenue Projection for Project,

and Management Services

Authorized signatories

Accounts to be audited by the CA approved by

the bank

Client Information Form

Duration

Termination date

Islamic Modes/Instruments Participatory Modes:

The following are applicable generally but more

relevant to deposit mgmt:

Mudaribs right to profit arises as soon as

profits are realized

Such entitlement is not absolute till the time

of liquidation due to retention practice.

The practice distribute a part of realized

profits on account as interim profits which

will be revised when actual or constructive

valuation takes place.

Islamic Modes/Instruments Participatory Modes:

The following are more relevant to deposit mgmt:

If Mudarib has mixed his funds with the

funds of Rab-ul-Maal, The Mudarib takes two

positions:

Becomes Mudarib in respect of funds of capital

provider

Becomes partner in respect of his funds

Profit in such case will be distributed as

under:

Mudarabah profit to be distributed as per

agreed ratio.

Partnership remaining profit in proportion to

amounts contributed [Deposit Management

weightage system].

Islamic Modes/Instruments Participatory Modes:

Modarabah:

Termination (Liquidation) of Mudaraba:

Basically, Non-binding nature, except in

circumstances discussed earlier

Otherwise, Agreement of both parties is

required

In practice, prior notice is required to be

served

The funds of Mudaraba have been

exhausted due to losses.

The death of Mudarib or liquidation of the

institution working as Mudarib.

Islamic Modes/Instruments Participatory Modes:

Modarabah:

Termination (Liquidation) of Mudaraba:

If the assets of the Mudaraba are in cash at

the time of termination, these shall be

returned, and profit if any, shall be

distributed between the parties according

to the agreed ratio.

If the assets of the Mudaraba are not in the

cash form, the Mudarib shall be given an

opportunity to sell them to arrive at the

actual profit.

Islamic Modes/Instruments Participatory Modes:

Deposit Management in

Islamic Banking

Distribution of Profit & Loss Among Liability Holders

Bank:

Conventionally, a financial intermediary accepting

deposits and granting loans is known to be a bank

An Islamic Bank, a banking company raising funds

(accepting deposits, etc.) and investing in Shariah

compliant manner to earn profit to be distributed

among managers and fund providers

Resources

Surplus Pockets

B

A

N

K

Investments

Deficient Pockets

Distribution of Profit & Loss Among Liability Holders

Financial Statements of a bank Balance Sheet:

Report of conditions Amount and composition of

fund sources (financial inputs - Liabilities) the bank

has drawn upon to finance its various investing

activities (financial outputs - Assets) at any given

point of time.

Liabilities: Claim of fund providers on bank yield

cost to the bank

Assets: Financial assets owned by a bank yield

income to the bank

Financial Statements of a bank Income Statement:

Report of income Summary of income realized

and expenses incurred during a given time period

Distribution of Profit & Loss Among Liability Holders

Balance Sheet of ABC Bank as on December 2xx35

LIABILITIES

ASSETS

Particulars

(Rs.)

Particulars

(Rs.)

Deposits

5000

Cash in hand

1000

Other banks accounts

2000

Murabahah financing

5000

Total liabilities

7000

Ijarah financing

3000

Equity [paid up capital + 3000

reserves + retained

earnings

Other assets

1000

Liabilities and equity

Total assets

10000

10000

Parties on the liability side and their relationship: Depositors - No voting

rights, Shareholders (Shirkah of JSC) owners of bank, and Management

of bank

Complete Liability side of a Bank

Bank

(Mudarib)

Depositors

Pool (Rabul

Maals)

M

U

S

H

A

R

Mudarabah

Shareholders

Capital

Islamic Modes/Instruments Participatory Modes:

Deposit Management in Islamic Banking

Restricted Vs Unrestricted Accounts

Most of the Islamic Banks are following Profit

Sharing mechanism called Mudarabah +

Musharakah model or simply Mudarabah model.

Following is the process flow of the Mudarabah

model.

Creation of Pool

The Bank will create Depositors Pool.

The Pool will have categories based on the

tenor of the deposit. :

Three Month

Six Month

One Year

Distribution of Profit & Loss Among Liability Holders

Deposit Management in Islamic Banking

Assume that following investment is made by the

depositors;

Three Months

Rs. 4,000

Six Months

Rs. 3,500

One Year

Rs. 2,500

Rs. 10,000

All the funds are kept in the pool of depositors

The customers would be assigned a specific

weights based on the investment category:

Three Month

0.60

Six Month

0.70

One Year

1.00

Distribution of Profit & Loss Among Liability Holders

Deposit Management in Islamic Banking

Assume that Bank deploys Rs. 10,000/- for a period

of one year and earns a profit of Rs. 1,000. Profit

would be shared as follows:

Bank Rs. 500

Pool Rs. 500

Profit Sharing among the Depositors:

Rs. 500 earned by the Pool would be

distributed as per the amounts and weightage

assigned at beginning of the month.

Relationship within the Pool would be

governed by the rules of Musharakah

Distribution of Profit & Loss Among Liability Holders

Deposit Management in Islamic Banking

Deposit

(Rs.)

Weight

Weighted

Average

Profit

(Rs.)

Rate

(%)

4000

0.6

2400

163

4.08

3500

0.7

2450

167

4.76

2500

1.0

2500

170

6.80

7350

500

10000

Islamic Modes/Instruments Participatory Modes:

Deposit Management in Islamic Banking

Islamic bank A joint stock company Owners are

partners through partnership deed.

Account holders are not partners in the company no

voting right or management.

The deposit management - Musharakah - combination

of Shirkah and Mudarabah

Shirkah is the partnership of owners of bank

Mudaraba is the business contract between

depositors and the banks management

Bank therefore is Mudarib as well as partner in the

process.

Summarized: we are looking at the Musharakah of the

depositors pool and the banks equity. [Take note of

both sides of the balance sheet].

Islamic Modes/Instruments Participatory Modes:

Deposit Management in Islamic Banking

Shariah Position Of Deposits recognized by Islamic Banks:

The common misconception regarding deposits Amanah.

Deposits resemble more to qard (loan) than Amanah.

Because,

Amanah cannot be used by the holder.

Therefore any benefit drawn from such deposit is not

permissible.

He cannot be held responsible for any loss or damage

suffered by Amanah without his negligence, in this case

100% return is not guaranteed.

Example of Syedna Zubair bin Awwam (RA) [Reported in AlBukhari and Tabaqaat-e-Ibn-e-Saad]

Pakistan:

Current account on the basis of Qard.

Saving and Investment accounts are taken on the basis of

Mudarabah/Musharakah.

Islamic Modes/Instruments Participatory Modes:

Deposit Management in Islamic Banking

Shariah Position Of Deposits recognized by Islamic Banks:

Malaysia:

Current Account Al-Wadiah Yad Dhamanah (Guaranteed

custody) [Specific permission for use of funds, withdrawal

facility on demand, no payment of profit, etc. allowed]

Saving Account Al-Wadiah Yad Dhamanah (Guaranteed

custody) [Specific permission for use of funds, withdrawal

facility on demand, no payment of profit, saving pass book /

cheque book and clearing etc. allowed, Bank on its discretion

rewards the customers]

General & Special Investment Account Al Mudarabah/

Trustee Profit Sharing [Profit sharing and loss bearing basis,

different tenors, different weightages]

Islamic Modes/Instruments Participatory Modes:

Deposit Management in Islamic Banking

Rules of Loss between the Bank and the

Pool are the same as of Mudarabah, ie all

financial Losses would be borne by the

Pool as Rabul Mal and share holders

according to the investment ratio

Other Conditions

The Bank would cover all expenses from its

own share of profit within the Mudarabah

arrangement.

Weightage can only be amended at the

beginning of the month.

Islamic Modes/Instruments Participatory Modes:

Accounting Treatment in Mudarabah

Recognition of Mudarabah capital at the time of contracting

Recognized when paid to mudarib or placed under his

disposition

If paid in installments, each installment recognized when

paid

It is presented as mudarabah financing. If capital is

provided in the form of non-monetary capital it is reported as

non-monetary asset

Measurement of mudarabah capital at the time of contracting

Capital provided in cash is measured by the amount paid or

amount placed under disposition of mudarib

Capital provided in kind is measured at fair value of asset

and any difference between the fair value and book value is

recognized as profit or loss

Expense incurred is not considered as part of mudarabah

capital unless agreed by all parties

Islamic Modes/Instruments Participatory Modes:

Accounting Treatment in Mudarabah

Measurement at the end of financial period

Same criteria as at the time of reporting. However, any

payment made to the bank is deducted from

mudarabah capital

Any loss at the inception of work shall be borne by the

Islamic bank in its P&L A/c. If loss occurs after the

inception of work, it shall affect the measurement of

mudarabah capital (ie. Amount of mudarabah capital

will be reduced accordingly)

If whole of the capital is lost without any misconduct

or negligence of mudarib, the mudarabah shall be

terminated and Islamic bank shall recognize as loss

If in above situation the mudarib is responsible, then it

shall be recognized as receivable from the mudarib

Islamic Modes/Instruments Participatory Modes:

Accounting Treatment in Mudarabah

Recognition of banks share in profit or loss

Profit or loss on mudarabah transaction which

commence and end during the same financial period is

recognized at the time of liquidation (constructive or

actual)

Share of profit that continues for more than one

financial period is recognized to the extent of profit

distribution and any loss is deducted from mudarabah

capital

Share of profit is recognized as a receivable from

mudarib if mudarib does not pay after liquidation or

settlement of business account has been made

Loss is recognized at the time of liquidation by

reducing the mudarabah capital

Вам также может понравиться

- Diminishing MusharakahДокумент19 страницDiminishing MusharakahKhalid WaheedОценок пока нет

- Islamic Modes For Agricultural Financing: PRODUCTS - Diminishing MusharakahДокумент19 страницIslamic Modes For Agricultural Financing: PRODUCTS - Diminishing MusharakahAlHuda Centre of Islamic Banking & Economics (CIBE)Оценок пока нет

- Lecture-3-Mudaraba As A Mode of Islamic FinanceДокумент38 страницLecture-3-Mudaraba As A Mode of Islamic FinanceJaved AnwarОценок пока нет

- Musharaka Mode of Islamic BankingДокумент25 страницMusharaka Mode of Islamic BankingNaveed SaeedОценок пока нет

- Mudarba & MusharkaДокумент27 страницMudarba & Musharkakamranp1100% (1)

- Problems and Their Solution in MudarabahДокумент43 страницыProblems and Their Solution in Mudarabahatiqa tanveerОценок пока нет

- FSA 4 Financing ActivitiesДокумент51 страницаFSA 4 Financing Activitiessubhrodeep chowdhuryОценок пока нет

- 05 Islamic Banking - DepositsДокумент20 страниц05 Islamic Banking - DepositsAmirah ShukriОценок пока нет

- Chapter 6Документ21 страницаChapter 6Abdiwahab AbdikadirОценок пока нет

- Financial Instrument v.03Документ49 страницFinancial Instrument v.03ashaheen2704Оценок пока нет

- MudarabahДокумент25 страницMudarabahDanish Riaz Shaikh100% (1)

- Islamic Modes of Finance: Theory and Key Shariah PrinciplesДокумент40 страницIslamic Modes of Finance: Theory and Key Shariah PrinciplesnuasyamОценок пока нет

- Depositaries and Mutual Funds: MBA III Semester Finance Elective Merchant Banking and Financial Services Ranjani JДокумент36 страницDepositaries and Mutual Funds: MBA III Semester Finance Elective Merchant Banking and Financial Services Ranjani Jwelcome2jungleОценок пока нет

- Mudarabah and Its Application in Islamic BankingДокумент26 страницMudarabah and Its Application in Islamic Bankingsaif khanОценок пока нет

- KUPres 7 Nov 2010Документ63 страницыKUPres 7 Nov 2010Hasan Irfan SiddiquiОценок пока нет

- Assignment 2 - FIN 545Документ7 страницAssignment 2 - FIN 545tuna100% (3)

- Working Capital ManagementДокумент36 страницWorking Capital ManagementManjunath LeoОценок пока нет

- MF IntroductionДокумент21 страницаMF Introductionutsav mandalОценок пока нет

- What Is Relationship Banking?Документ36 страницWhat Is Relationship Banking?llllkkkkОценок пока нет

- Mudharabah FinancingДокумент4 страницыMudharabah FinancingHisyamОценок пока нет

- BAW 4614 Advanced Financial Accounting ReportingДокумент52 страницыBAW 4614 Advanced Financial Accounting ReportingTEE YAN YING UnknownОценок пока нет

- 7SOGSS FM LECTURE 7 Sources of Finance 1Документ60 страниц7SOGSS FM LECTURE 7 Sources of Finance 1Right Karl-Maccoy HattohОценок пока нет

- Syllabus Summary Course: Financial Statement Analysis and Valuation (F-401)Документ8 страницSyllabus Summary Course: Financial Statement Analysis and Valuation (F-401)Md Ohidur RahmanОценок пока нет

- Financial Appraisal: - Adequacy of Rate of Return - Financing PatternДокумент26 страницFinancial Appraisal: - Adequacy of Rate of Return - Financing PatternTibebu MerideОценок пока нет

- Mutual Fund: An OverviewДокумент54 страницыMutual Fund: An Overviewnikitashah14Оценок пока нет

- Hassan Faraz - 27th July 2021Документ48 страницHassan Faraz - 27th July 2021shah zaibОценок пока нет

- Reporting and Analysing LiabilitiesДокумент52 страницыReporting and Analysing LiabilitiesSuptoОценок пока нет

- Off Balance Sheet Transactions For Islamic BanksДокумент25 страницOff Balance Sheet Transactions For Islamic BanksSyed MohiuddinОценок пока нет

- Murabahah Product Structure: Title Application FAДокумент26 страницMurabahah Product Structure: Title Application FAUmair UddinОценок пока нет

- Features of An Islamic BankДокумент17 страницFeatures of An Islamic BankHafsa MemonОценок пока нет

- Rehmanwaheed - 3180 - 17836 - 2 - 11. MudarabahДокумент21 страницаRehmanwaheed - 3180 - 17836 - 2 - 11. MudarabahSadia AbidОценок пока нет

- MusharakaДокумент34 страницыMusharakaAbdul HafeezОценок пока нет

- BTLPДокумент282 страницыBTLPBijay PoudelОценок пока нет

- Islamic Banking Lecture 5 & 6Документ33 страницыIslamic Banking Lecture 5 & 6Soban MamoonОценок пока нет

- Welcome To The Presentation: Sanzida Begum ID: 17002Документ11 страницWelcome To The Presentation: Sanzida Begum ID: 17002Sanzida BegumОценок пока нет

- Lecture Notes - Due DiligenceДокумент9 страницLecture Notes - Due DiligenceHimanshu DuttaОценок пока нет

- Capital and Its Types: Name: Saroop Cms:42529 Section: B Semester: 6 Assignment:2Документ9 страницCapital and Its Types: Name: Saroop Cms:42529 Section: B Semester: 6 Assignment:2Sanjna ChimnaniОценок пока нет

- Features of An Islamic Bank.Документ15 страницFeatures of An Islamic Bank.atifkhan8905722Оценок пока нет

- Forms of Islamic BankingДокумент55 страницForms of Islamic BankingMuhammad Talha KhanОценок пока нет

- Apply Principles of Professional Practice To Work in The Financial Services IndustryДокумент46 страницApply Principles of Professional Practice To Work in The Financial Services Industryd.achmarОценок пока нет

- MudarabahДокумент21 страницаMudarabahAli Raza0% (1)

- Pt7 - Lending To Business CustomersДокумент38 страницPt7 - Lending To Business Customerssavira andayaniОценок пока нет

- CF Unit 2Документ30 страницCF Unit 2Saravanan ShanmugamОценок пока нет

- Commercial Banking Lending Policies of BanksДокумент47 страницCommercial Banking Lending Policies of Banksrahul8909Оценок пока нет

- Long Term Sources of FundsДокумент63 страницыLong Term Sources of FundsAnonymous 9YyCbPAОценок пока нет

- 20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanДокумент54 страницы20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanPriyanka VashistОценок пока нет

- Financial Accounting: Session - 17: Accounting For DebtДокумент11 страницFinancial Accounting: Session - 17: Accounting For DebtSuraj KumarОценок пока нет

- Islamic Modes For Agricultural Financing: PRODUCTS - Diminishing MusharakahДокумент15 страницIslamic Modes For Agricultural Financing: PRODUCTS - Diminishing MusharakahAlHuda Centre of Islamic Banking & Economics (CIBE)Оценок пока нет

- Advocates and Partnership NotesДокумент5 страницAdvocates and Partnership Notespauline1988Оценок пока нет

- DYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Документ14 страницDYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Jonnafe Almendralejo IntanoОценок пока нет

- Insolvency and Bankruptcy CodeДокумент18 страницInsolvency and Bankruptcy CodeSudip Issac SamОценок пока нет

- Chapter 10 Investments in Debt SecuritiesДокумент24 страницыChapter 10 Investments in Debt SecuritiesChristian Jade Lumasag NavaОценок пока нет

- Practical Application of Mudarabah and MusharakahДокумент7 страницPractical Application of Mudarabah and MusharakahFaizan Ch50% (2)

- Financial MGTДокумент1 страницаFinancial MGTtuhin khanОценок пока нет

- 10 - Overview of Financing ChoicesДокумент11 страниц10 - Overview of Financing ChoicesAmarnath JvОценок пока нет

- WK 5 - 6 Company AccountsДокумент41 страницаWK 5 - 6 Company AccountsmensahshadrachnyarkoОценок пока нет

- Chapter4. BankingДокумент38 страницChapter4. BankingdhitalkhushiОценок пока нет

- Accounting For Companies-1Документ50 страницAccounting For Companies-1daniel.maina2005Оценок пока нет

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- Analysis of Coupled Microstrip Lines With DGS UWB PDFДокумент5 страницAnalysis of Coupled Microstrip Lines With DGS UWB PDFaleenaaaОценок пока нет

- Analysis of Coupled Microstrip Lines With DGS UWB Printed FilterДокумент5 страницAnalysis of Coupled Microstrip Lines With DGS UWB Printed FilteraleenaaaОценок пока нет

- LogoДокумент2 страницыLogoaleenaaaОценок пока нет

- Taming Control Flow: A Structured Approach To Eliminating Goto StatementsДокумент12 страницTaming Control Flow: A Structured Approach To Eliminating Goto StatementsaleenaaaОценок пока нет

- Commercial and Investment Banking: by Asiya SohailДокумент14 страницCommercial and Investment Banking: by Asiya SohailaleenaaaОценок пока нет

- Statement For Contract # 1003901674: Muhammad JavedДокумент15 страницStatement For Contract # 1003901674: Muhammad JavedaleenaaaОценок пока нет

- Presented By: Helical and Cavity Backed Helical AntennaДокумент12 страницPresented By: Helical and Cavity Backed Helical AntennaaleenaaaОценок пока нет

- Lecture 10,11Документ46 страницLecture 10,11aleenaaaОценок пока нет

- C C C C C C C C C CДокумент5 страницC C C C C C C C C CaleenaaaОценок пока нет

- Bridge Rectifiers: Presented To: Sir Abbas Presented By: Shabana HafeezДокумент23 страницыBridge Rectifiers: Presented To: Sir Abbas Presented By: Shabana HafeezaleenaaaОценок пока нет

- Puppet Demo Aim A 05Документ8 страницPuppet Demo Aim A 05aleenaaaОценок пока нет

- Financial Reporting Strathmore University Notes and Revision KitДокумент551 страницаFinancial Reporting Strathmore University Notes and Revision KitLazarus AmaniОценок пока нет

- Word Bank Impact PPPДокумент23 страницыWord Bank Impact PPPdewangga04radenОценок пока нет

- Gym Business Plan ExampleДокумент36 страницGym Business Plan ExamplecobbymarkОценок пока нет

- Chapter 4 Measuring Financial PerformanceДокумент4 страницыChapter 4 Measuring Financial Performanceabdiqani abdulaahi100% (1)

- Project Report PDFДокумент73 страницыProject Report PDFAkhilaSedimbi100% (1)

- KPMG Ind As Illustrattive Financial Statements 2019Документ217 страницKPMG Ind As Illustrattive Financial Statements 2019Utsav HiraniОценок пока нет

- Instructions:: Question Paper Booklet CodeДокумент20 страницInstructions:: Question Paper Booklet CodeadiОценок пока нет

- FM Rocks Book by CA Swapnil PatniДокумент124 страницыFM Rocks Book by CA Swapnil Patniraj bawaОценок пока нет

- 2020 BF - BS - BEC - HRM 120 Sessional ExamДокумент19 страниц2020 BF - BS - BEC - HRM 120 Sessional Examisaiahsinkala101Оценок пока нет

- AgriPinay Simple Business PlanДокумент6 страницAgriPinay Simple Business PlanKristy Dela PeñaОценок пока нет

- Case MDPK Pertemuan 2Документ15 страницCase MDPK Pertemuan 2anggi anythingОценок пока нет

- Goods and Services Tax (GST) in IndiaДокумент30 страницGoods and Services Tax (GST) in IndiarupalОценок пока нет

- Pacific Airlines Operated Both An Airline and Several Rental CarДокумент1 страницаPacific Airlines Operated Both An Airline and Several Rental CarAmit PandeyОценок пока нет

- Fundamentals of Accountancy Lesson 1Документ6 страницFundamentals of Accountancy Lesson 1Rojane L. AlcantaraОценок пока нет

- Department of Education: Caraga Region Schools Division of Surigao Del SurДокумент2 страницыDepartment of Education: Caraga Region Schools Division of Surigao Del SurSim BelsondraОценок пока нет

- 3271010Документ4 страницы3271010mohitgaba19Оценок пока нет

- Detailed Lesson Plan in Fundamentals of AccountancyДокумент5 страницDetailed Lesson Plan in Fundamentals of AccountancyKrisha Joy CofinoОценок пока нет

- Sip Report AuditДокумент23 страницыSip Report AuditDhiraj singhОценок пока нет

- Foreign Exchange Exercise SP2017!3!1 2Документ5 страницForeign Exchange Exercise SP2017!3!1 2Stephen Ondiek0% (2)

- Hul Annual Report 2017 18 - tcm1255 523195 - enДокумент184 страницыHul Annual Report 2017 18 - tcm1255 523195 - enArnav ChakrabortyОценок пока нет

- Numerical Reasoning Formulas PDFДокумент7 страницNumerical Reasoning Formulas PDFandreea_zgrОценок пока нет

- Waterways Continuous ProblemДокумент18 страницWaterways Continuous ProblemAboi Boboi60% (5)

- Capital Structure of TCSДокумент36 страницCapital Structure of TCSpassinikunj50% (2)

- Taxation Ans AnsДокумент10 страницTaxation Ans AnsTebashiniОценок пока нет

- LESSON 3 PAS 8, 10, and 24Документ46 страницLESSON 3 PAS 8, 10, and 24Beatriz Jade TicobayОценок пока нет

- New Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)Документ2 страницыNew Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)En-en FrioОценок пока нет

- Disposable Plastic SyringesДокумент1 страницаDisposable Plastic Syringeseiribooks0% (2)

- Topic 3-DeprДокумент28 страницTopic 3-DeprMichael.land65Оценок пока нет