Академический Документы

Профессиональный Документы

Культура Документы

Session 5 Istisna

Загружено:

Shaheena Sana0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров16 страницislamic banking modes

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документislamic banking modes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров16 страницSession 5 Istisna

Загружено:

Shaheena Sanaislamic banking modes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 16

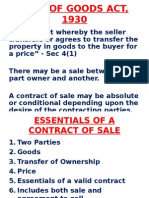

Modes of Financing Sale

Istisna

Islamic Modes/Instruments - Sale Contracts:

Istisna:

Introduction

Istisna is a sale transaction where commodity is transacted before it

comes into existence.

It is an order from purchaser to the manufacture to manufacture a

specific commodity or goods for the purchaser

Istisnas Contract: Contract of sale of specified items to be

manufactured or constructed, with an obligation on the part of the

manufacturer or builder to deliver them to the customer upon

completion.

Potential of Istisna:

Manufacturing of high tech. goods, building, roads, manufacturing, etc.

Micro enterprise financing

Pre-shipment financing for exports

Islamic Modes/Instruments - Sale Contracts:

Istisna:Shariah Legitimacy

The Prophet (PBUH) required that a pulpit

(platform) be built for preaching [Bukhari

2/908]

The Prophet (PBUH) required that a finger

ring be manufactured for Him [Bukhari 5/220

and Muslim 3/1655]

Islamic Modes/Instruments - Sale Contracts:

Istisna: Conditions

The subject of Istisna always requires manufacturing.

The manufacturer uses his own material to

manufacture a good to differentiate from Ijarah

Different from Murabahah as no offer and acceptance

is required. The contract reflects the same.

Kind, Quality and Quantity of subject matter must be

known and agreed in absolute term

If goods manufactured conform to the specifications

agreed upon, the purchaser cannot decline to accept

them unless there is defect in these goods [Option of

defect benefits the purchaser]

Buyer can refuse to accept goods if delivery is not made

within agreed time period (stipulated in the contract).

Islamic Modes/Instruments - Sale Contracts:

Istisna: Conditions

In parallel Istisna (sub-contracting), both contracts

have to be independent from each other

Istisna contract is applied to subject matter with

specification and not with designation

The subject matter has to be unique (ie. With no

substitute available in the market) or homogeneous.

Uniqueness differentiates from salam

Purchasing subject matter from the manufacturer and

again selling to him equals bai Innah, which is not

allowed. Purchaser has to take the goods from

manufacurer

It is not necessary that the seller himself manufactures

the product

Islamic Modes/Instruments - Sale Contracts:

Istisna: Price of Istisna

Price of good to be fixed in absolute and un-ambiguous

terms.

This can be cash, tangible goods, or usufruct

Price can also be usufruct of the asset related or not

related to subject matter [Building and renting house to

the manufacturer]

Bank can negotiate with various parties for placing order

to manufacture, ie. Bidding is allowed. However, only one

offer is eventually selected for conclusion of contract

Price of Istisna may be spot and deffered (installments)

therefore Istisna is applicable where Salam is not

applicable.

Islamic Modes/Instruments - Sale Contracts:

Istisna: Price of Istisna

Price once settled cannot be changed, however, huge

projects demand variation due to subsequent

modifications, etc. which is allowed by mutual consent.

The installments can be tied up with different stages of

manufacturing.

Bank may be paying or receiving urboun which is

allowed.

Price can be tied up with the time of delivery. FIs can

start paying with an advanced installment.

Price may also reduce if the delay in delivery is caused.

Islamic Modes/Instruments - Sale Contracts:

Istisna:

Revoking of Istisna

Istisna is a binding contract, unlike promise in

Murabahah

The contract of Istisna can be cancelled unilaterally

before the manufacturer starts the work.

Once the work has been started, Istisna cannot be

cancelled unilaterally.

Islamic Modes/Instruments - Sale Contracts:

Istisna:Delivery of Manufactured goods

Before delivery, goods will remain at the risk of seller

Possession of goods can be physical or constructive

When FI does not want to carry the risk of holding and

selling the manufactured goods, it can enter into

parallel Istisna

FI can also appoint the client its agent to sell the

manufactured goods.

Payment of Istisna Price

FI

Istisna Sale

Transaction

Client

Deferred Delivery of Manufactured Goods

Istisna Price lumpsum or 5 Jun, 1 Jul , 1 Aug 06

Delivery of

Building

1 Aug 06

Bank

2

6

Delivery of

Commodity

1 Aug 06

Make corrections in dates

Client

1st June 06

Parallel Istisna

Or

Sub Contracting

Istisna Contract

Builder

Purchaser/

Seller

Pays 15Jun 1 Jul 1 Aug

Istisna Sale Contract 5 June 06

Islamic Modes/Instruments - Sale Contracts:

Istisna: Security/Collateral

Guarantee, mortgage or hypothecation to ensure the

delivery of good on agreed date

in the case of default in delivery, the guarantor (third

party) may be asked to deliver the same commodity

The buyer can sell the mortgaged property and use the

sale proceed to purchase the required good from the

market or to recover the price advanced by him.

Urboun can be obtained as down payment

Islamic Modes/Instruments - Sale Contracts:

Istisna: Case of Government project

Government wants to build a road and enters into an

Istisna contract under which bank has agreed to build

the road. By the end of December 2007 for Rs. 1200

million, payable in installments over 10 years.

Bank enters into a parallel Istisna contract with a contractor

building the road upto 31 December 2007 for Rs. 100 million

and pays the amount in four equal installments

Contractor hands over the road to bank on 31 December 2007.

Use of the road starts against payment of the toll

Government assign the toll receipts to the bank, and in case of

any short fall pays the difference amount

This can also be operated by the contractor on Build Operate

and Transfer (BOT) basis directly even if the financial

intermediary is not involved.

Islamic Modes/Instruments - Sale Contracts:

Istisna:

Difference Between Istina & Salam

ISTISNA

The subject of istisna is always a

thing to be manufactured.

SALAM

The subject can be any thing.

The price in istisna does not

necessarily need to be paid in full in

advance.

The price has to be paid in full in

advance.

Time of Delivery can be flexible

with reduction in price.

Fixed time of delivery is an

essential part of the sale

The contract can be cancelled

before the manufacturer starts

working.

The contract cannot be cancelled

unilaterally.

Islamic Modes/Instruments - Sale Contracts:

Istisna:

Risks in Istisna and their solutions

RISKS

Delivery Risk

Delay in manufacturing and

delivery of goods. Bank may be

sued by the orderer

Sale not permissible before

delivery

Sale of Istisna goods is not

allowed before taking

possession.

SOLUTIONS

MFI can reduce the Istisna price

as per Istisna agreement by

stipulating condition in the

contract

Bank can take promise to

purchase from the third party.

Also can make arrangement for

sale through agency.

Islamic Modes/Instruments - Sale Contracts:

Istisna:

Price Risk

Reduction in price of the

commodity by the customer on

delayed delivery.

Storage Risk

Istisna contracts end up in

deliveries and ownership of

commodities. These leads to

storage costs and associated risks.

Legal risk Defective legal documentation

Reduction in price clause can

be stipulated in the parallel Istisna

Storage cost may be recovered in

parallel transaction and risk can

be minimized by minimizing of

duration between two

transactions.

Written contract, compliance of

Shariah rules.

Вам также может понравиться

- Bai Istisna by Mufti MujeebДокумент16 страницBai Istisna by Mufti MujeebshagulhameedlОценок пока нет

- Alternative To The Conventional Manufacturing & Project FinancingДокумент16 страницAlternative To The Conventional Manufacturing & Project FinancingShahrukh Sohail100% (2)

- Lecture No 11-A-ISTISNAДокумент15 страницLecture No 11-A-ISTISNAIrfan HaiderОценок пока нет

- ISTISNAДокумент14 страницISTISNAm izazОценок пока нет

- Salam Contract: Instructor: Dr. Abidullah KhanДокумент18 страницSalam Contract: Instructor: Dr. Abidullah KhanMuhammad Awais Banglani Muhammad RafiqueОценок пока нет

- Baisalamistisna 110103082540 Phpapp02Документ29 страницBaisalamistisna 110103082540 Phpapp02maria9002Оценок пока нет

- Islamic Finance: By: Abdul MoueedДокумент30 страницIslamic Finance: By: Abdul MoueedALI SHER HaidriОценок пока нет

- Islamic Sales Contracts StructureДокумент54 страницыIslamic Sales Contracts StructureFaisal Mir100% (1)

- Salam and IstisnaДокумент24 страницыSalam and IstisnaM Fani MalikОценок пока нет

- Islamic Banking and FinanceДокумент1 страницаIslamic Banking and FinanceAsmat Ullah AchakzaiОценок пока нет

- Bai Salam & IstisnaДокумент41 страницаBai Salam & IstisnaAlHuda Centre of Islamic Banking & Economics (CIBE)Оценок пока нет

- Rehmanwaheed 3180 17836 2 15. IstisnaДокумент13 страницRehmanwaheed 3180 17836 2 15. IstisnaSadia AbidОценок пока нет

- Islamic Sales Contract: BY Mufti Mahmood AhmadДокумент39 страницIslamic Sales Contract: BY Mufti Mahmood AhmadAbdul Maroof100% (1)

- Islamic Finance (Self Made Notes)Документ8 страницIslamic Finance (Self Made Notes)Muhammad Hamza AyoubОценок пока нет

- Risk Underlying Islamic Financial Modes (II)Документ32 страницыRisk Underlying Islamic Financial Modes (II)atiqa tanveerОценок пока нет

- 2 IstisnaSalamДокумент35 страниц2 IstisnaSalamismail malikОценок пока нет

- Presentation On Istisna Financing Risks & Mitigation: Risk ManagementДокумент9 страницPresentation On Istisna Financing Risks & Mitigation: Risk ManagementAhmed Shahir UsmaniОценок пока нет

- Lec 11 Istisna and SalamДокумент43 страницыLec 11 Istisna and SalamMuhammad Shahzeb KhanОценок пока нет

- Sale of Goods ActДокумент63 страницыSale of Goods ActNadeem Naddu100% (1)

- Prof - V.B. Shah Institute of ManagementДокумент18 страницProf - V.B. Shah Institute of ManagementDhaval SinojiaОценок пока нет

- Murabaha March 2012Документ19 страницMurabaha March 2012M Fani MalikОценок пока нет

- Islamic Modes of FinanceДокумент23 страницыIslamic Modes of FinanceKassahun EssaОценок пока нет

- Chap 3 Part 2Документ42 страницыChap 3 Part 2Intan SawalОценок пока нет

- SGA Chapter 1 & 2Документ44 страницыSGA Chapter 1 & 2Palkesh KhatriОценок пока нет

- Sale of Goods Act, 1930Документ23 страницыSale of Goods Act, 1930Sunil Shaw0% (1)

- Islamic JurisprudenceДокумент3 страницыIslamic JurisprudencefatincheguОценок пока нет

- Sale of Goods Act, 1930Документ49 страницSale of Goods Act, 1930Prashanth NairОценок пока нет

- Unit 2 - Sale of Goods Act 1930Документ31 страницаUnit 2 - Sale of Goods Act 1930aKsHaT sHaRmAОценок пока нет

- MurabahaДокумент21 страницаMurabahaFiza kamran100% (1)

- ISBF NotesДокумент13 страницISBF Notesmuneebmateen01Оценок пока нет

- Salam & Parallel Salam Transactions-CH.7Документ36 страницSalam & Parallel Salam Transactions-CH.7Yusuf Hussein0% (1)

- Sells Certain Specific Goods (Permissible Under Shariah and Law of The Country), To The Buyer atДокумент4 страницыSells Certain Specific Goods (Permissible Under Shariah and Law of The Country), To The Buyer atUzair SheikhОценок пока нет

- Primeasia University: Report On: Hire Purchase SystemДокумент14 страницPrimeasia University: Report On: Hire Purchase SystemRaisul IslamОценок пока нет

- Sale of Goods Act 1930Документ47 страницSale of Goods Act 1930suhasiniОценок пока нет

- Sales of Goods ActДокумент21 страницаSales of Goods ActSAMYUKKTHHA S (RA2252001040009)Оценок пока нет

- Islamic Modes of FinancingДокумент38 страницIslamic Modes of FinancingMuhammad Shahzeb KhanОценок пока нет

- CH 5 Hire Purchase (M.Y.khan) (M.Y.khan)Документ26 страницCH 5 Hire Purchase (M.Y.khan) (M.Y.khan)mr_gelda6183Оценок пока нет

- 4.3-Salam & IstisnaДокумент32 страницы4.3-Salam & IstisnaAllauddinaghaОценок пока нет

- Islamic Banking PracticesДокумент27 страницIslamic Banking PracticesAadil HanifОценок пока нет

- IBBs Support Function - Presentation - IstisnaSalam (22!04!2014)Документ38 страницIBBs Support Function - Presentation - IstisnaSalam (22!04!2014)Ahmed Shahir UsmaniОценок пока нет

- Export Finance-Countertrade and ForfaitingДокумент26 страницExport Finance-Countertrade and ForfaitingRajat LoyaОценок пока нет

- House FinancingДокумент32 страницыHouse FinancingRowena YenXinОценок пока нет

- Murabaha - Concept & AAOIFIДокумент21 страницаMurabaha - Concept & AAOIFIHasan Irfan SiddiquiОценок пока нет

- Unit 3 BFSДокумент69 страницUnit 3 BFSCHANDAN CHANDUОценок пока нет

- Group OneДокумент14 страницGroup OneOmer WarsamehОценок пока нет

- Islamic Banking-Ijarah & Murabaha ( )Документ52 страницыIslamic Banking-Ijarah & Murabaha ( )Naveed Abdullah100% (1)

- Unit 3Документ9 страницUnit 3Nitin K.SОценок пока нет

- Sale of Goods Act 1930Документ168 страницSale of Goods Act 1930IrayaОценок пока нет

- Islamic Financial Contracts MurabahaДокумент20 страницIslamic Financial Contracts MurabahaFBusinessОценок пока нет

- Islamic Financial Products and Processes: Ameenullah SheikhДокумент18 страницIslamic Financial Products and Processes: Ameenullah SheikhhamzaОценок пока нет

- SogДокумент46 страницSogaksr27Оценок пока нет

- Secured Transactions: UCC Title 9Документ17 страницSecured Transactions: UCC Title 9Rebel X86% (7)

- Salam, Istisna, SarfДокумент42 страницыSalam, Istisna, SarfSari ManiraОценок пока нет

- Monetary CreditДокумент31 страницаMonetary Creditmartin ngipolОценок пока нет

- Bba 4 Semester (Morning) SESSION 2014-2018 Submitted byДокумент11 страницBba 4 Semester (Morning) SESSION 2014-2018 Submitted byAnonymous qBJv2A8RAОценок пока нет

- Lease Options: Own A Property For £1!: Property Investor, #5От EverandLease Options: Own A Property For £1!: Property Investor, #5Оценок пока нет

- The 98 Best Real Estate Investing Strategies: Real Estate Investing, #5От EverandThe 98 Best Real Estate Investing Strategies: Real Estate Investing, #5Оценок пока нет

- Perception & DMДокумент15 страницPerception & DMShaheena SanaОценок пока нет

- Ridha Rahim Research Methodology MSMS-2019: Basic and Applied Research, N.D)Документ14 страницRidha Rahim Research Methodology MSMS-2019: Basic and Applied Research, N.D)Shaheena SanaОценок пока нет

- Compensation Management SystemДокумент10 страницCompensation Management SystemShaheena SanaОценок пока нет

- Bella's CasestudyДокумент4 страницыBella's CasestudyShaheena Sana100% (1)

- Description:: Software Development EngineerДокумент3 страницыDescription:: Software Development EngineerShaheena SanaОценок пока нет

- International Human Resource ManagementДокумент4 страницыInternational Human Resource ManagementShaheena SanaОценок пока нет

- Shifa International Hospital Problem Identification and Its SolutionДокумент12 страницShifa International Hospital Problem Identification and Its SolutionShaheena SanaОценок пока нет

- Self EfficacyДокумент80 страницSelf EfficacyShaheena SanaОценок пока нет

- Job Opportunity: Sui Northern GasДокумент3 страницыJob Opportunity: Sui Northern GasShaheena SanaОценок пока нет

- Shaheena Hafeez S19MSMS011 HR Communication Strategy of Zong Internal CommunicationДокумент5 страницShaheena Hafeez S19MSMS011 HR Communication Strategy of Zong Internal CommunicationShaheena SanaОценок пока нет

- Impact of Job Stress On Employee Performance: Research PaperДокумент21 страницаImpact of Job Stress On Employee Performance: Research PaperShaheena SanaОценок пока нет

- Ostracism 1Документ13 страницOstracism 1Shaheena SanaОценок пока нет

- RMM Lecture 30 Data Transformation AДокумент26 страницRMM Lecture 30 Data Transformation AShaheena SanaОценок пока нет

- Instructor Hamza Ejaz: Project Organization, Approach To Planning & Control, & Multiple Project Progress ControlДокумент19 страницInstructor Hamza Ejaz: Project Organization, Approach To Planning & Control, & Multiple Project Progress ControlShaheena SanaОценок пока нет

- A Conceptual Study On Occupational Stress (Job Stress/Work Stress) and Its ImpactsДокумент10 страницA Conceptual Study On Occupational Stress (Job Stress/Work Stress) and Its ImpactsShaheena SanaОценок пока нет

- Instructor Hamza Ejaz: Conflicts in ProjectsДокумент13 страницInstructor Hamza Ejaz: Conflicts in ProjectsShaheena SanaОценок пока нет

- Managing Project Changes: Instructor Hamza EjazДокумент16 страницManaging Project Changes: Instructor Hamza EjazShaheena SanaОценок пока нет

- Research Methods: FieldworkДокумент21 страницаResearch Methods: FieldworkShaheena SanaОценок пока нет

- People Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JДокумент10 страницPeople Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JTrexPutiОценок пока нет

- Weak VerbsДокумент3 страницыWeak VerbsShlomoОценок пока нет

- Usaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanДокумент40 страницUsaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanKevin Nyasongo NamandaОценок пока нет

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersДокумент13 страницMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkОценок пока нет

- Hassan I SabbahДокумент9 страницHassan I SabbahfawzarОценок пока нет

- Research ProposalДокумент21 страницаResearch Proposalkecy casamayorОценок пока нет

- Persephone and The PomegranateДокумент3 страницыPersephone and The PomegranateLíviaОценок пока нет

- Level 2 TocДокумент5 страницLevel 2 TocStephanie FonsecaОценок пока нет

- Baggage Handling Solutions LQ (Mm07854)Документ4 страницыBaggage Handling Solutions LQ (Mm07854)Sanjeev SiwachОценок пока нет

- Joseph Minh Van Phase in Teaching Plan Spring 2021Документ3 страницыJoseph Minh Van Phase in Teaching Plan Spring 2021api-540705173Оценок пока нет

- 4th Exam Report - Cabales V CAДокумент4 страницы4th Exam Report - Cabales V CAGennard Michael Angelo AngelesОценок пока нет

- First Summative Test in TLE 6Документ1 страницаFirst Summative Test in TLE 6Georgina IntiaОценок пока нет

- Consti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellДокумент6 страницConsti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellAleezah Gertrude RegadoОценок пока нет

- Spiritual Fitness Assessment: Your Name: - Date: - InstructionsДокумент2 страницыSpiritual Fitness Assessment: Your Name: - Date: - InstructionsLeann Kate MartinezОценок пока нет

- Adidas Case StudyДокумент5 страницAdidas Case StudyToSeeTobeSeenОценок пока нет

- Journey Toward OnenessДокумент2 страницыJourney Toward Onenesswiziqsairam100% (2)

- Online MDP Program VIIIДокумент6 страницOnline MDP Program VIIIAmiya KumarОценок пока нет

- Lunacy in The 19th Century PDFДокумент10 страницLunacy in The 19th Century PDFLuo JunyangОценок пока нет

- 1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreДокумент2 страницы1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreShelene CathlynОценок пока нет

- Running Wild Lyrics: Album: "Demo" (1981)Документ6 страницRunning Wild Lyrics: Album: "Demo" (1981)Czink TiberiuОценок пока нет

- I See Your GarbageДокумент20 страницI See Your GarbageelisaОценок пока нет

- TATA Steel - Group 8Документ95 страницTATA Steel - Group 8Wasim Khan MohammadОценок пока нет

- Assets Book Value Estimated Realizable ValuesДокумент3 страницыAssets Book Value Estimated Realizable ValuesEllyza SerranoОценок пока нет

- Scott Kugle-Framed, BlamedДокумент58 страницScott Kugle-Framed, BlamedSridutta dasОценок пока нет

- NEERJA 7th April 2016 Pre Shoot Draft PDFДокумент120 страницNEERJA 7th April 2016 Pre Shoot Draft PDFMuhammad Amir ShafiqОценок пока нет

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityДокумент15 страницOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraОценок пока нет

- 755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsДокумент3 страницы755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsuhjdrftОценок пока нет

- 12.2 ModulesДокумент7 страниц12.2 ModulesKrishna KiranОценок пока нет

- Iraq-A New Dawn: Mena Oil Research - July 2021Документ29 страницIraq-A New Dawn: Mena Oil Research - July 2021Beatriz RosenburgОценок пока нет

- Our Identity in Christ Part BlessedДокумент11 страницOur Identity in Christ Part BlessedapcwoОценок пока нет