Академический Документы

Профессиональный Документы

Культура Документы

CH 11

Загружено:

Angelica AnneОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 11

Загружено:

Angelica AnneАвторское право:

Доступные форматы

Chapter 11

Income Taxation

of

Individuals

2005 Prentice Hall, Inc. 11 - 1

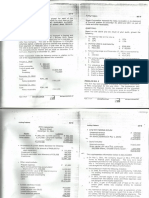

Individual Income Tax Model

Gross income

Less: Deductions for adjusted gross income

Equals: Adjusted Gross Income (AGI)

Less: Itemized or standard deduction

Less: Personal & dependency exemptions

Equals: Taxable income

2005 Prentice Hall, Inc. 11 - 2

Tax Model (continued)

Taxable income

Times: Tax rate

Equals: Gross income tax liability

Less: Tax credits

Plus: Additions to tax

Less: Tax prepayments

Equals: Net tax due or tax refund

2005 Prentice Hall, Inc. 11 - 3

Deductions For AGI

Deductions discussed in previous chapters

Retirement plan contributions including IRAs

Moving expenses

50% of self-employment taxes

Self-employed health insurance

Alimony paid

2005 Prentice Hall, Inc. 11 - 4

Deductions For AGI

Deductions discussed in this chapter

Educator expenses

Student loan interest expense

Tuition and fees deduction

Penalty on early withdrawals of savings

Health savings accounts

National guard & military reserve travel

2005 Prentice Hall, Inc. 11 - 5

Educator Expenses

Kindergarten through 12th grade teachers may

deduct up to $250 of unreimbursed expenses

for books, supplies, computer equipment,

software, and other supplemental materials

used in the classroom

Expired at end of 2003 but expected to be

extended retroactively by Congress

2005 Prentice Hall, Inc. 11 - 6

Student Loan Interest

Deduction allowed for interest paid on qualified

student loans incurred and used for tuition,

fees, room, board, books, and supplies

Deduction limit is $2,500

Limit is phased out for modified AGI of $50,000

- $65,000 ($100,000 - $130,000 for married

persons filing jointly)

Individuals claimed as dependents cannot take

deduction on their own tax return

Expenses paid by tax-exempt scholarships or

subject to education credits must be excluded

from loan amounts and related interest

2005 Prentice Hall, Inc. 11 - 7

Tuition & Fees Deduction

$4,000 deduction for 2004-2005 for tuition & fees

for taxpayer, spouse, and dependents

Income limits apply ($65,000 if single and $130,000 if

married filing jointly)

Deduction is reduced to $2,000 for singles with

income $65,000 - $80,000 ($130,000 - $160,000

for joint filers)

Individuals who are claimed as dependents cannot take

deduction on their own tax return

No double benefit - no deduction if expense is

deductible under any other provision (including

education credits)

2005 Prentice Hall, Inc. 11 - 8

Penalty on Early Withdrawals

Penalties assessed on premature withdrawals

from certificates of deposits or other savings

accounts are deductible

Gross interest income, unreduced by the

penalty, is included in taxable income

Deducting the penalty ensures that only net

interest income is included in taxable income

2005 Prentice Hall, Inc. 11 - 9

Health Savings Accounts

Taxpayers covered by high-deductible

medical insurance policies only may deduct

amounts set aside in an MSA or HSA

Contributions and earnings on MSAs and

HSAs are not taxed when withdrawn to pay

medical expenses

For MSAs, qualified policies are those with

deductibles of $1,700 - $2,600 for individuals

($3,450 - $5,150 for families) in 2004

Contributions to MSAs are limited to 65% of policy

deductible for individuals (75% for families)

2005 Prentice Hall, Inc. 11 - 10

Health Savings Accounts

HSAs are similar to MSAs but with different

limits

In 2004, individuals with deductibles of at least

$1,000 ($2,000 for families) can qualify for a

deduction equal to lesser of $2,250 ($4,500 for

families) or the annual policy deductible

Distributions not spent on qualifying

expenses are included in income and subject

to a 10% penalty for HSAs and 15% penalty

for MSAs

2005 Prentice Hall, Inc. 11 - 11

Special Travel Deduction

For nonreimbursed travel expenses to

attend National Guard or military reserve

meetings more than 100 miles from home

Maximum deduction is general

government per diem rate for the area

Excess expenses can be deducted as

miscellaneous itemized deductions

(subject to 2% of AGI floor)

2005 Prentice Hall, Inc. 11 - 12

Filing Status

Taxpayers filing status determines

standard deduction and tax rate schedule

Marital status determined on the last day

of the tax year

Separated spouses are considered

married until divorce becomes final

2005 Prentice Hall, Inc. 11 - 13

Filing Status - Married

Can file jointly if both spouses are US

citizens or US residents (or if

nonresident alien agrees to be taxed on

worldwide income)

If the couple file separately, both must

itemize deductions or both must use the

standard deduction

2005 Prentice Hall, Inc. 11 - 14

Surviving Spouse

Marital status is determined at the date of death

so a joint return can be filed for the year in which

a spouse dies

A surviving spouse may continue to use the tax

rates and standard deduction for married persons

filing jointly for the next 2 years only if a

dependent child lives with the taxpayer

2005 Prentice Hall, Inc. 11 - 15

Filing Status Unmarried

Unmarried taxpayers file as

Head of household - an unmarried person

who provides more than half of the cost of

maintaining a home in which a child or other

qualifying relative lives for more than half the

year

Single

2005 Prentice Hall, Inc. 11 - 16

Head of Household

Qualifying relatives

1. Unmarried child who lives with the taxpayer for

more than half of the taxable year (does not

need to be taxpayers dependent)

2. A parent of the taxpayer who is a dependent

(does not need to live in taxpayer's home)

3. Other qualifying relatives must live with the

taxpayer for more than half the year and be a

dependent

2005 Prentice Hall, Inc. 11 - 17

Head of Household

Qualifying relatives include brothers, sisters,

parents, grandparents, nieces and nephews

by blood, aunts and uncles (defined as

brother or sister of father or mother)

Cousins and more distant relatives are not

included in the definition of qualifying relatives

2005 Prentice Hall, Inc. 11 - 18

Abandoned Spouse

A taxpayer who is married but whose spouse

did not live with him or her at any time during

the last six months of the tax year and who

provides more than half the cost of maintaining

the home in which a dependent child lives

A qualifying abandoned spouse uses head of

household tax rates and standard deduction

2005 Prentice Hall, Inc. 11 - 19

Exemptions

Each taxpayer (who is not a dependent) is

entitled to one personal exemption

Exemption deduction is $3,100 for 2004

Additional exemptions allowed for each

person who is considered a dependent

Anyone who is claimed as a dependent

cannot claim a personal exemption

2005 Prentice Hall, Inc. 11 - 20

Dependency Exemptions

An individual qualifies as a dependent only if

all 5 of the requirements are satisfied:

1. Relative or member-of-household test

2. The support test

3. Gross income test

4. Joint return test

5. Citizenship or residency test

2005 Prentice Hall, Inc. 11 - 21

Relative or

Member-of-Household Test

The dependent must be either be a

qualifying relative (including a child,

grandchild, brother, sister, parent,

grandparent, niece, nephew, aunt and uncle)

or

A member of the taxpayers household for

the entire taxable year

2005 Prentice Hall, Inc. 11 - 22

The Support Test

Taxpayer must provide more than 50% of

the dependent's total support

Support includes amounts spent for food,

clothing, shelter, medical care, education

and capital expenditures such as a car

Value of services and scholarship funds are

omitted in determining support received by

a student

Nontaxable income used for support must

be included in support determination

2005 Prentice Hall, Inc. 11 - 23

Multiple Support Agreement

Multiple support agreements allow one

member of group of support providers to

claim the exemption when

Together the group meets the support test

All other dependency tests are met

Member who claims exemption must provide

more than 10% of the total support and other

members providing 10% support agree to

exemption

2005 Prentice Hall, Inc. 11 - 24

Gross Income Test

The dependent's gross income from

taxable sources must be less than the

exemption amount ($3,100 for 2004)

The gross income test is waived for

Child of taxpayer who is under age 19 at

year end or

Child of taxpayer who is under age 24 at

year end and was a full-time student for at

least 5 months during the year

2005 Prentice Hall, Inc. 11 - 25

Phaseout of Exemptions

Both personal and dependency exemptions

are phased out at a rate of 2% (4% for MFS)

for each $2,500 (or fraction thereof) of AGI

above thresholds

$142,700 if single

$178,350 if head of household

$214,050 if married filing jointly

$107,025 if married filing separately

2005 Prentice Hall, Inc. 11 - 26

Exemption Phaseout

(1) (AGI threshold AGI)/$2,500 = Phaseout Factor

(always round up to next whole number)

(2) Phaseout Factor x 2% = Phaseout Percentage

(3) Exemption Amount x (1 Phaseout Percentage)

= Adjusted Exemption Deduction

Once AGI exceeds the threshold AGI by more than

$122,500 ($61,250 for MFS) the exemption

deduction is completely phased out

2005 Prentice Hall, Inc. 11 - 27

Standard Deductions

Standard Deductions

$9,700 married filing a joint return

$4,850 married filing separately

$7,100 head of household

$4,850 single individual

Add on standard deduction if taxpayer is elderly

(age 65 or older) or blind

$1,200 if single or head of household

$950 if married

2005 Prentice Hall, Inc. 11 - 28

Dependents Standard Deduction

Dependents standard deduction is limited to the

greater of:

(1) $800 or

(2) Earned income + $250 (up to otherwise

allowable standard deduction)

Earned income includes salary and wages

Earned income does not include interest income,

dividend income, capital gains, or income as

beneficiary of a trust

2005 Prentice Hall, Inc. 11 - 29

Itemized Deductions

Itemized deductions provide tax benefit

only to the extent that, in total, they

exceed the taxpayers standard deduction

Taxpayers can maximize use of the

standard deduction and itemized

deductions by timing certain deductible

payments

2005 Prentice Hall, Inc. 11 - 30

Medical Expenses

Medical expenses paid for the taxpayer, spouse

and dependents, after reduction for insurance

reimbursements, are deductible only to the

extent they exceed 7.5% of AGI for the year

Qualified medical costs includes prescription

drugs and insulin, costs of a hospital, clinic,

doctor, dentist, eyeglasses, contract lenses,

transportation for medical care and health

insurance costs

2005 Prentice Hall, Inc. 11 - 31

Medical Expenses

Health insurance premiums for taxpayers

and their dependents are deductible only if

paid from after-tax income

Premiums paid through an employer-

sponsored cafeteria plan are not deductible

Premiums for disability insurance and for

loss of life, limb or income are not deductible

Premiums for long-term care insurance are

deductible, subject to limits based on age

2005 Prentice Hall, Inc. 11 - 32

Taxes

Deductible taxes include

State, local, and foreign real property taxes

State and local personal property taxes

State, local, and foreign income taxes

Other federal, state, local, and foreign taxes

incurred in a business or other income-

producing activity

2005 Prentice Hall, Inc. 11 - 33

Nondeductible Taxes

Federal income taxes

Employee's share of payroll taxes

Federal excise taxes not incurred for

business

State and local sales taxes on goods for

personal use

Assessments on property that increase

property value

2005 Prentice Hall, Inc. 11 - 34

Interest Expense

Deductible interest includes

Investment interest

Home mortgage interest

No deduction for most other personal interest

such as interest on auto loans, life insurance

loans, credit card debt, and delinquent tax

payments (except previously mentioned

student loan interest)

2005 Prentice Hall, Inc. 11 - 35

Investment Interest Expense

Investment interest includes interest on loans to

acquire or hold investment property and margin

account interest paid to a broker

Investment interest expense is only deductible

to the extent of net investment income

Net investment income = excess of investment

income over investment expenses

Excess is carried forward (indefinitely) subject

to same limit in future years

2005 Prentice Hall, Inc. 11 - 36

Investment Interest Expense

Investment income includes gross income from

interest, annuities, and short-term capital gains

from investment property

Long-term capital gains or dividends taxed at

favorable rates are excluded unless election

made to forgo the favorable rate

Investment expenses includes safe deposit box

rental fees, investment counsel fees, brokerage

account maintenance fees

Limited to the lesser of total investment

expenses or net miscellaneous itemized

deductions after reduction for 2% AGI floor

2005 Prentice Hall, Inc. 11 - 37

Qualified Residence Interest

Interest paid for acquisition debt or home

equity debt for up to 2 qualified residences

Interest on acquisition debt of up to $1 million

principal amount (combined limit for 2 homes)

is deductible

Acquisition debt includes mortgage to buy,

construct, or improve the residence

2005 Prentice Hall, Inc. 11 - 38

Qualified Residence Interest

Interest on up to $100,000 principal amount

of home equity loan is deductible

Loan proceeds can be used for any purpose

Points (loan origination fees) paid on initial

home mortgages are deductible

Points paid to refinance an exiting loan must

be amortized over life of loan

2005 Prentice Hall, Inc. 11 - 39

Charitable Contributions

Congress allows individuals, corporations,

estates and trusts to deduct contributions to

certain qualified organizations

Partnerships and S corporations pass the

contributions through to their partners and

shareholders who then claim the deductions

on their own income tax returns

2005 Prentice Hall, Inc. 11 - 40

Charitable Contributions

Qualified charitable organizations

Governmental units (federal, state and local

governments) and entities formed and operated

exclusively for religious, charitable, scientific, literary

or educational purposes, including churches,

nonprofit hospitals, school and universities, libraries,

and social service agencies

Direct contributions to needy individuals are not

deductible

2005 Prentice Hall, Inc. 11 - 41

Charitable Contributions

No deduction allowed to the extent that valuable

goods or services are received in return for the

contribution

Exception - contributors to universities who

receive preferred rights to purchase tickets for

university athletic events may deduct 80% of the

amount of their contribution

Individuals can deduct up to 50% of AGI

Excess contributions may be carried forward up

to 5 years

2005 Prentice Hall, Inc. 11 - 42

Charitable Contributions

No deduction for contributions of the

taxpayers services and rent-free use of the

taxpayers property

Out-of-pocket costs incurred for volunteer

work for a qualifying charity are deductible

Property other than long-term capital gain

property is valued at lesser of FMV or basis

2005 Prentice Hall, Inc. 11 - 43

Contributions of LTCG Property

LTCG property is valued at FMV (which is usually

greater than adjusted basis)

Tangible personalty given to a charity which does

not use the property in its tax-exempt activity is

valued at the lower adjusted basis

Deduction for LTCG property valued at FMV is

limited to 30% of AGI

30% limit can be avoided (and 50% AGI limit

applied) if taxpayer elects to use lower basis

If made, election applies to all LTCG contributions

that year

2005 Prentice Hall, Inc. 11 - 44

Charitable Contributions

Stocks or other income producing property

that have declined in value should be sold so

that the loss can be claimed with the sale

proceeds donated

Fees incurred for appraisals of donated

property may be deducted as a

miscellaneous itemized deductions

2005 Prentice Hall, Inc. 11 - 45

Casualty and Theft Losses

Loss is the lesser of

Assets adjusted basis or

Decline in assets fair market value as a result

of the casualty

Loss is reduced for any insurance proceeds

received

$100 floor applies to each casualty

Deductible only to extent total losses exceed

10% of AGI

2005 Prentice Hall, Inc. 11 - 46

Miscellaneous Deductions

Only excess over 2% of AGI is deductible

Unreimbursed employee business expenses

Job hunting expenses (in searching for a new job

in current line of business)

Investment-related expenses

Hobby expenses (up to hobby income)

Tax preparation and planning advice

2005 Prentice Hall, Inc. 11 - 47

Phaseout of

Itemized Deductions

Totaldeductions phased out by 3% of AGI in

excess of $142,700 in 2004 ($71,350 if MFS)

Exception - deductions not phased out for

Medical expenses

Investment interest

Casualty and theft losses

Total deductions are not reduced by more than

80% regardless of type

2005 Prentice Hall, Inc. 11 - 48

Tax Rates for

Married Filing a Joint Return

For married filing a joint return for 2004

10% on first $14,300 taxable income

15% on $14,301 - $58,100

25% on $58,101 - $117,250

28% on $117,251 - $178,650

33% on $178,651 - $319,100

35% over $319,100

2005 Prentice Hall, Inc. 11 - 49

Tax Rates for

Married Filing Separately

For married filing separately for 2004

10% on first $7,150 taxable income

15% on $7,151 - $29,050

25% on $29,051 - $58,625

28% on $58,626 - $89,325

33% on $89,326 - $159,550

35% over $159,551

2005 Prentice Hall, Inc. 11 - 50

Tax Rates for Single Individuals

For single individuals for 2004

10% on first $7,150 taxable income

15% on $7,151 - $29,050

25% on $29,051 - $70,350

28% on $70,351 - $146,750

33% on $146,751 - $319,100

35% over $319,100

2005 Prentice Hall, Inc. 11 - 51

Tax Rates for Head of Household

For head of household for 2004

10% on first $10,200 taxable income

15% on $10,201 - $38,900

25% on $38,901 - $100,500

28% on $100,501 - $162,700

33% on $162,701 - $319,100

35% over $319,100

2005 Prentice Hall, Inc. 11 - 52

Special Tax Rates

28% rate applies to LTCG from collectibles and

Section 1202 small business stock

25% rate applies to unrecaptured Section 1250

gain

15% rate on LTCG from the sale of capital assets

(applies to taxpayers in higher tax brackets)

5% rate applies to taxpayers in 10% or 15% tax

brackets

Dividend income is taxed using the capital gain

rate of 15% (5% for low-income taxpayers)

2005 Prentice Hall, Inc. 11 - 53

Credits vs. Deductions

Deductions only reduce tax liability by a

percentage based on the taxpayers

marginal tax rate

Credits are direct dollar-for-dollar

reductions in the gross tax liability

Tax credits have the same dollar value

to all taxpayers, regardless of their

marginal tax brackets

2005 Prentice Hall, Inc. 11 - 54

Child Tax Credit

$1,000 nonrefundable tax credit for each

qualifying child under age 17

Qualifying children include the taxpayers son,

daughter, stepson, stepdaughter, grandchild, or eligible

foster child that the taxpayer claims as a dependent

Phased out at rate of $50 for every $1,000 (or

part thereof) of AGI in excess of

$110,000 if married filing jointly ($55,000 if MFS)

$75,000 if single or head of household

2005 Prentice Hall, Inc. 11 - 55

Education Credits

Two elective nonrefundable tax credits are

provided for college or vocational tuition and fees

for the taxpayer, spouse, or dependents

Hope Scholarship Credit 100% of first $1,000

and 50% of second $1,000 tuition and fees for first

2 years only (maximum $1,500 per student)

Lifetime Learning Credit 20% of up to $10,000

tuition and fees (maximum $2,000 per taxpayer in

2004)

A student who is a dependent cannot claim the

credit

2005 Prentice Hall, Inc. 11 - 56

Education Credits

Expenses paid with a Pell Grant,

scholarship, or employer-provided

educational assistance do not qualify

The election is separate for each student, so

a parent may choose one credit for one child

and a different credit for a second child

Both credits phase out over modified AGI of

$42,000 - $52,000 if single

$85,000 - $105,000 if married filing jointly

2005 Prentice Hall, Inc. 11 - 57

Earned Income Credit

The purpose is to reduce the impact of payroll

taxes for low-income individuals

Credit is equal to a percentage of earned income

below a maximum

With one qualifying child maximum credit is

$2,604 ($7,660 x 34%)

With two or more qualifying children maximum

credit is $4,300 ($10,750 x 40%)

Smaller credit available to taxpayers without

children

2005 Prentice Hall, Inc. 11 - 58

Earned Income Credit

This is a refundable credit

Taxpayers with investment income of $2,650 or

more are not eligible

Anyone who can be claimed as a dependent is

not eligible

A taxpayer without a qualifying child, must be

between the ages of 25 through 64 to be eligible

2005 Prentice Hall, Inc. 11 - 59

Dependent Care Credit

Nonrefundable credit for taxpayers who pay

for child or dependent care so they can work

Credit percentage varies from 20% to 35% of

up to $4,000 for one qualifying child or $6,000

for 2 or more qualifying children under 13

35% if AGI does not exceed $15,000

Reduced by 1% for each $2,000 (or fraction

thereof) AGI exceeds $15,000

20% if AGI exceeds $43,000

2005 Prentice Hall, Inc. 11 - 60

Retirement Contributions Credit

To encourage participation by low-income

wage earners, a credit for up to $2,000

contributed to employer-sponsored retirement

plans or IRAs is available

Credit varies with AGI

50% credit for joint filers with AGI up to $30,000

($15,000 if single)

20% for joint filers with AGI of $30,000 - $32,500

($15,000 - $16,250 if single)

10% for joint filers with AGI of $32,500 - $50,000

($16,250 - $25,000 if single)

Dependents or full-time students are not eligible

2005 Prentice Hall, Inc. 11 - 61

Excess Payroll Tax Credit

Taxpayers working for more than one

employer during the year with earnings

exceeding the Social Security ceiling

($87,900 for 2004) usually have too much tax

withheld

Employee is allowed a credit for any excess

Social Security taxes withheld

2005 Prentice Hall, Inc. 11 - 62

Alternative Minimum Tax

The purpose of the alternative minimum tax is

to ensure high-income taxpayers pay their fair

share of tax

Certain deductions are disallowed or reduced

and certain exempt income items are subject

to the AMT

IF AMT is greater than the regular tax,

taxpayers pay the larger amount

Rate is 26% on first $175,000 and 28% on

excess for individuals

2005 Prentice Hall, Inc. 11 - 63

AMT Model

Taxable income

Plus/minus Adjustments to taxable income

Plus: Tax preferences

Less: Allowable exemptions

Equals: Alternative minimum taxable income

Times: AMT tax rates

Equals: Tentative minimum tax (TMT)

Less: Regular income tax

Equals: AMT

2005 Prentice Hall, Inc. 11 - 64

AMT Exemptions

AMT exemptions for 2004 are

$58,000 if married filing jointly

$29,000 if married filing separately

$40,250 if single or head of household

Exemptions begin to phase out when AMTI

reaches $112,500 for singles and $150,000 for

married filing jointly ($75,000 if MFS) at a rate of

$1 for every $4 above the threshold

2005 Prentice Hall, Inc. 11 - 65

Alternative Minimum Tax

Itemized deductions are different from those

calculated for regular income tax

Medical expenses must exceed 10% AGI

Taxes, home equity loan interest, and

miscellaneous itemized deductions are not

deductible

Tax preferences that are added include

Nontaxable interest on private activity bonds

Bargain element of incentive stock options

2005 Prentice Hall, Inc. 11 - 66

Payment of Income Tax

Estimated quarterly payments are made by

persons with large amounts of income from

sources not subject to withholding

Due on April 15, June 15, September 15 of

current year and January 15 of following year

If payments are not 90% or more of the total

tax owed (or an amount required based on

the prior years tax), a penalty may be

charged, unless balance due is less than

$1,000

2005 Prentice Hall, Inc. 11 - 67

Filing Requirements

Any taxpayer whose gross income is less than

the sum of their standard deduction and their

personal exemption (but not dependency

exemptions) does not have to file a tax return

$7,950 in 2004 for a single individual

Returns should be filed if

Net self-employment income is $400 or more

A child claimed as a dependent has unearned

income only of over $800

Any married person filing separately has

income over $3,100

2005 Prentice Hall, Inc. 11 - 68

The End

2005 Prentice Hall, Inc. 11 - 69

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Forecasting Methods and Principles: Evidence-Based ChecklistsДокумент30 страницForecasting Methods and Principles: Evidence-Based ChecklistsTahmid SadmanОценок пока нет

- Bugtong Jobeth P. Case StudyДокумент3 страницыBugtong Jobeth P. Case StudyAngelica AnneОценок пока нет

- Letter of Request - AVSCДокумент2 страницыLetter of Request - AVSCAngelica AnneОценок пока нет

- Gen. Tiburcio de Leon National High School Senior High School DepartmentДокумент45 страницGen. Tiburcio de Leon National High School Senior High School DepartmentAngelica AnneОценок пока нет

- Strategy Formulation ReportДокумент43 страницыStrategy Formulation ReportAngelica AnneОценок пока нет

- Submitted By: Dela Cruz, Janella T. Masters in Business AdministrationДокумент21 страницаSubmitted By: Dela Cruz, Janella T. Masters in Business AdministrationAngelica AnneОценок пока нет

- Product Cost QTY Total Lip and Cheek TintДокумент6 страницProduct Cost QTY Total Lip and Cheek TintAngelica AnneОценок пока нет

- GM Sung Chon Hong: Not Valid Without A SealДокумент1 страницаGM Sung Chon Hong: Not Valid Without A SealAngelica AnneОценок пока нет

- Certificate of BaptismДокумент2 страницыCertificate of BaptismAngelica AnneОценок пока нет

- Differentiate Matter, Molecule, AtomДокумент9 страницDifferentiate Matter, Molecule, AtomAngelica AnneОценок пока нет

- BackboardДокумент9 страницBackboardAngelica AnneОценок пока нет

- Billing StatementДокумент1 страницаBilling StatementAngelica AnneОценок пока нет

- Cris MundoДокумент4 страницыCris MundoAngelica AnneОценок пока нет

- JobSpecification EntryLevelElectricalEngineerДокумент2 страницыJobSpecification EntryLevelElectricalEngineerAngelica AnneОценок пока нет

- Objective:: Angelica B. Dela CruzДокумент2 страницыObjective:: Angelica B. Dela CruzAngelica AnneОценок пока нет

- Pamantasan NG Lungsodngvalenzuela: Poblacion II, Malinta, Valenzuela CityДокумент1 страницаPamantasan NG Lungsodngvalenzuela: Poblacion II, Malinta, Valenzuela CityAngelica AnneОценок пока нет

- Pamantasan NG Lungsodngvalenzuela: Poblacion II, Malinta, Valenzuela CityДокумент1 страницаPamantasan NG Lungsodngvalenzuela: Poblacion II, Malinta, Valenzuela CityAngelica AnneОценок пока нет

- Progress Report 5Документ2 страницыProgress Report 5Angelica AnneОценок пока нет

- Angelica B. Dela Cruz: ObjectiveДокумент2 страницыAngelica B. Dela Cruz: ObjectiveAngelica AnneОценок пока нет

- Mission VisionДокумент1 страницаMission VisionAngelica AnneОценок пока нет

- Income Taxation Answer Key Only 1 1Документ60 страницIncome Taxation Answer Key Only 1 1Paul Justin Sison Mabao88% (32)

- Chapter 15 28-36Документ2 страницыChapter 15 28-36Angelica AnneОценок пока нет

- Chapt-11 Income Tax - IndividualsДокумент10 страницChapt-11 Income Tax - Individualshumnarvios100% (4)

- Business Law Preboard FinalДокумент7 страницBusiness Law Preboard Finalxxxxxxxxx100% (1)

- AP 1stpreboardДокумент16 страницAP 1stpreboardAngelica AnneОценок пока нет

- LassstДокумент30 страницLassstAngelica AnneОценок пока нет

- Chapter 16 2-5Документ2 страницыChapter 16 2-5Angelica Anne100% (2)

- Objective:: Angelica B. Dela CruzДокумент2 страницыObjective:: Angelica B. Dela CruzAngelica AnneОценок пока нет

- HappyДокумент2 страницыHappyAngelica AnneОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- F&A Best - SAPOSTДокумент23 страницыF&A Best - SAPOSTsheikh arif khan100% (2)

- Industrial Development Bank of India LimitedДокумент29 страницIndustrial Development Bank of India LimitedJason RoyОценок пока нет

- Blake and Scott FS AnalysisДокумент38 страницBlake and Scott FS AnalysisFaker PlaymakerОценок пока нет

- BA 323 Study GuideДокумент7 страницBA 323 Study GuideTj UlianОценок пока нет

- Cgtmse MДокумент82 страницыCgtmse MAnonymous EtnhrRvz0% (1)

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Документ20 страницCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariОценок пока нет

- Membership Updated Form 06.10.22Документ5 страницMembership Updated Form 06.10.22Sirajia CngОценок пока нет

- BCom CAmCOM (BPCG) PDFДокумент176 страницBCom CAmCOM (BPCG) PDFRudresh SanuОценок пока нет

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Документ247 страницLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoОценок пока нет

- Finance Module 8 Capital Budgeting - InvestmentДокумент8 страницFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- Chapter 5Документ9 страницChapter 5AMIR EFFENDIОценок пока нет

- Business Studies Paper 1 June 2011 PDFДокумент5 страницBusiness Studies Paper 1 June 2011 PDFPanashe MusengiОценок пока нет

- Arbitage TheoryДокумент9 страницArbitage Theorymahesh19689Оценок пока нет

- Brand ExtensionДокумент6 страницBrand Extensionmukhtal8909Оценок пока нет

- سلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارДокумент30 страницسلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارIlhem BelabbesОценок пока нет

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Документ3 страницыInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiОценок пока нет

- Collection of Sum of Money - Assignment BДокумент5 страницCollection of Sum of Money - Assignment BMark ValenciaОценок пока нет

- An Appraisal of Banker Customer Relationship in NigeriaДокумент60 страницAn Appraisal of Banker Customer Relationship in NigeriaAkin Olawale Oluwadayisi87% (15)

- Construction Contracts ProblemsДокумент14 страницConstruction Contracts ProblemsAngela A. MunsayacОценок пока нет

- Final Project Report of Summer Internship (VK)Документ56 страницFinal Project Report of Summer Internship (VK)Vikas Kumar PatelОценок пока нет

- Cambodian Standard On Auditing - English VersionДокумент51 страницаCambodian Standard On Auditing - English Versionpostbox855100% (8)

- Ready, Steady,: ForexДокумент25 страницReady, Steady,: ForexSrini VasanОценок пока нет

- SBT PDFДокумент9 страницSBT PDFrijulalktОценок пока нет

- Chapter 2 Audit of CashДокумент11 страницChapter 2 Audit of Cashadinew abeyОценок пока нет

- The Financial BehaviorДокумент12 страницThe Financial BehaviorAkob KadirОценок пока нет

- 7th NFC Award 2010Документ4 страницы7th NFC Award 2010humayun313Оценок пока нет

- Ic Exam Review: VariableДокумент122 страницыIc Exam Review: VariableJL RangelОценок пока нет

- David M. Dodson Case Analysis: Financial Problems Related To The PurchaseДокумент3 страницыDavid M. Dodson Case Analysis: Financial Problems Related To The PurchaseAryanОценок пока нет

- Syndicate 6 - Gainesboro Machine Tools CorporationДокумент12 страницSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickОценок пока нет

- Literature Review On Cooperative BanksДокумент7 страницLiterature Review On Cooperative Banksafmzyywqyfolhp100% (1)