Академический Документы

Профессиональный Документы

Культура Документы

Mahale Project Reserve Bank of India 11

Загружено:

Patricia Joseph0 оценок0% нашли этот документ полезным (0 голосов)

30 просмотров12 страницhiii

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документhiii

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

30 просмотров12 страницMahale Project Reserve Bank of India 11

Загружено:

Patricia Josephhiii

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

A Project Report On

BACHELOR OF Commerce

Miss. Nilesha Namdev Mahale

Prof. S. P. Jadhav Sir Prof. Pooja Mehakarkar

Head Of Dept. Project Guide

R. A. Arts M. K. Commerce S. R. Rathi Science College.

2016-2017

Reserve Bank Of India

To regulate the issue of bank notes.

To maintain reserves with a view to securing

monetary stability.

To operate the credit & currency system of the

country.

Board of RBI

Bank affairs are governed by Central Board of

Directors

Central Board consists of Official and Non-Official

appointed by Govt. of India for a period of four years.

Official Directors include Governor and not more than

4 Deputy Governor.

RBI having four local boards in 4 regions to represent

territorial and economic interest of local co-operative

& indigenous banks.

Legal Framework

Umbrella Acts which form the basis of its very

foundation.

Acts which govern the specific function of apex body.

Acts which govern the Banking operation.

Acts which govern the individual institutions.

Main Functions of Reserve Bank of India

Maintenance of Price Level.

Regulator & Supervisor of the financial system.

Manager of Foreign Exchange.

Issuance & Replacement of Currency.

Functions of Various Departments of RBI

Urban Banks Department: RBI regulates the interest

rates on deposits & advances, also prescribing min

reserves & liabilities to be maintained. Also refinance

facilities to state co-operative banks.

Rural Planning & Credit Department: Facilitating

credit to rural, agriculture & small scale industries,

Policy on priority sector lending, support to NABARD

etc.

Foreign Exchange Department:

Timely realization of export proceeds and reviews

Licensing banks to deal in foreign exchange,

collecting data related to forex transactions from

authorized dealers on daily basis for exchange rate

management.

Also laying down policy guidelines for risk

management to forex transactions in bank

Department of Banking Supervision

Undertaking scheduled and on-site inspections of

banks

Determining the criteria for the appointment of

statutory auditors and assessing audit performance

and disclosure standards.

Dealing with financial sector frauds and attending the

complaints received against banks and FIs from

public, banks & Government.

Department of Banking Operations &

Development

To promote & foster a sound & competitive banking

system.

Laying down regulations relating to capital adequacy,

asset classification, provision for loan, investment

valuation, accounting & disclosure standards and risk

management systems.

Licensing of new banks, expansion of foreign and

domestic banks, approval for setting up of

subsidiaries.

Functions of Various Departments of RBI

Department of Information Technology:

Computerization in RBI

Legal Department: To tender legal advice on various

matters referred by the operational

departments/offices/associates of the reserve bank.

Department of Govt. and Bank Accounts: Acting as

a banker to the banks, administering public debt of

both central & state govt.

Functions of Various Departments of RBI

Monetary Policy Department: Preparation of

monetary budget, periodic review of monetary, review

of CRR & SLR stipulations, analysis of data on

developments in money market.

Internal Debt Management Dept.: Managing

Internal Debt, Auctioning the govt. Debt from time to

time, Introduction of new instruments, smoothening

the maturity structure of debt.

Department of Economic Analysis and Policy

Analyzing the basic issues & problems affecting the

Indian economy.

Serves as a primary source of data & information

relating to aspects of Indian economy.

Prepares monetary & credit aggregates, balance of

payments and external debt statistics, internal debt &

govt. finance statistics, and flow of funds & financial

savings.

Вам также может понравиться

- Economics Project Cas Study: Central Banking Monetary Policy Indian Rupee Reserve Bank of India Act, 1934Документ4 страницыEconomics Project Cas Study: Central Banking Monetary Policy Indian Rupee Reserve Bank of India Act, 1934Aryan WinnerОценок пока нет

- RbiДокумент44 страницыRbiRohit MalviyaОценок пока нет

- RBI's Role as the Central Bank of India: Regulator, Supervisor and Developmental InstitutionДокумент11 страницRBI's Role as the Central Bank of India: Regulator, Supervisor and Developmental InstitutionAmit PirankarОценок пока нет

- D.Pradeep Kumar Exe-MBA, IIPM: Presented by .Документ12 страницD.Pradeep Kumar Exe-MBA, IIPM: Presented by .pradeep367380% (5)

- Reserve Bank of IndiaДокумент40 страницReserve Bank of IndiahakecОценок пока нет

- Economics Final Pro. 2sem-2Документ14 страницEconomics Final Pro. 2sem-2Thakur Manu PratapОценок пока нет

- Functions of Bangladesh BankДокумент33 страницыFunctions of Bangladesh Bankledpro100% (4)

- Rbi 1Документ40 страницRbi 1ankit_mathur71Оценок пока нет

- Central Bank of IndiaДокумент5 страницCentral Bank of Indiagauravbansall567Оценок пока нет

- Internship Report: NOON Business School University of SargodhaДокумент25 страницInternship Report: NOON Business School University of Sargodhaanees razaОценок пока нет

- RBI at a Glance: Central Bank of IndiaДокумент40 страницRBI at a Glance: Central Bank of Indiajyoti1234321Оценок пока нет

- SIP PROJECT Final RAVIДокумент49 страницSIP PROJECT Final RAVIRavi KhalkarОценок пока нет

- Bank Management PDFДокумент3 страницыBank Management PDFchahatОценок пока нет

- Ibps Po Mains Cracker - 2016Документ51 страницаIbps Po Mains Cracker - 2016Vimal PokalОценок пока нет

- Banking and Insurance Session IДокумент48 страницBanking and Insurance Session IAshish ShilpkarОценок пока нет

- PROF. S. K. Datta Buddh Pratap RathoreДокумент15 страницPROF. S. K. Datta Buddh Pratap RathoreBuddhapratap RathoreОценок пока нет

- Reserve Bank of IndiaДокумент32 страницыReserve Bank of IndiaAnkit GargОценок пока нет

- Kist Bank's Financial Performance AnalysisДокумент14 страницKist Bank's Financial Performance AnalysisDeepesh SharmaОценок пока нет

- Good MorningДокумент24 страницыGood MorningManoj KumarОценок пока нет

- RMCBДокумент36 страницRMCBSharvil Vikram SinghОценок пока нет

- Study Indian Economy RBI Central BankДокумент10 страницStudy Indian Economy RBI Central Bankpuneya sachdevaОценок пока нет

- Financial Statement Analysis of RNSBДокумент23 страницыFinancial Statement Analysis of RNSBHetalKacha100% (1)

- Prepared By:: An Internship Report of Nepal Rastra Bank (NRB)Документ25 страницPrepared By:: An Internship Report of Nepal Rastra Bank (NRB)Subin SthaОценок пока нет

- Current Statistics Handbook of Statistics On Indian Economy 2010-11 Database On Indian EconomyДокумент7 страницCurrent Statistics Handbook of Statistics On Indian Economy 2010-11 Database On Indian EconomyanjumanearaОценок пока нет

- RBI central bank of India regulates monetary policiesДокумент7 страницRBI central bank of India regulates monetary policiesloganathanОценок пока нет

- The Bank of Punjab Latest Internship Report With Three Years Financial DataДокумент23 страницыThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanОценок пока нет

- N.B.P FinalДокумент47 страницN.B.P Finalammar_acca100% (1)

- RBI Departments GuideДокумент55 страницRBI Departments GuideSharath Unnikrishnan Jyothi NairОценок пока нет

- Bfi RbiДокумент32 страницыBfi RbiLalit ShahОценок пока нет

- Structure and Functions of Reserve Bank of IndiaДокумент35 страницStructure and Functions of Reserve Bank of IndiashivaОценок пока нет

- Annual Reports - Annual Bank Supervision Report 2017Документ88 страницAnnual Reports - Annual Bank Supervision Report 2017Prem YadavОценок пока нет

- Main Functions Financial SupervisionДокумент9 страницMain Functions Financial SupervisionAjay MykalОценок пока нет

- Loksewa Sarathi Banking NoteДокумент37 страницLoksewa Sarathi Banking NotePankaj YadavОценок пока нет

- RBI's Introductory Presentation on the Indian Economy and Banking SectorДокумент18 страницRBI's Introductory Presentation on the Indian Economy and Banking SectorSurendhar RayuduОценок пока нет

- Summer Internship ReportДокумент31 страницаSummer Internship ReportHimanshi SinghОценок пока нет

- Reserve Bank of IndiaДокумент14 страницReserve Bank of Indiabathinisridhar100% (2)

- RBI's Structure and FunctionsДокумент30 страницRBI's Structure and FunctionsMALKANI DISHA DEEPAKОценок пока нет

- RukmaniKhatri Roll No.168 - PDFsaveДокумент11 страницRukmaniKhatri Roll No.168 - PDFsaveSusmita AcharyaОценок пока нет

- Central BankДокумент35 страницCentral BankanujОценок пока нет

- Analyzing NPA Management of Co-operative BanksДокумент16 страницAnalyzing NPA Management of Co-operative BanksSandesh RaoОценок пока нет

- Internship Report of BOPДокумент52 страницыInternship Report of BOPRani Bakhtawer100% (1)

- Document (15) - 1Документ72 страницыDocument (15) - 1Snehal BhorkhadeОценок пока нет

- Banking Theory Law and PracticeДокумент17 страницBanking Theory Law and PracticeDr.Satish RadhakrishnanОценок пока нет

- The Reserve Bank of India: A Brief History and Overview of FunctionsДокумент24 страницыThe Reserve Bank of India: A Brief History and Overview of Functionsmontu9Оценок пока нет

- Floating Exchange Rates Impact on Bangladesh EconomyДокумент34 страницыFloating Exchange Rates Impact on Bangladesh EconomyAsif AshrafОценок пока нет

- Sidharth PPT.XДокумент50 страницSidharth PPT.XSidharth SumanОценок пока нет

- Project Report On Banking - FormatДокумент2 страницыProject Report On Banking - FormatSumit AgrawalОценок пока нет

- The Effect of Capital Adequacy On Performance of State Bank of India, CoimbatoreДокумент38 страницThe Effect of Capital Adequacy On Performance of State Bank of India, Coimbatorewasim musthaqОценок пока нет

- V2i5 0056 PDFДокумент7 страницV2i5 0056 PDFHjha JhaОценок пока нет

- Reserve Bank of IndiaДокумент19 страницReserve Bank of IndiabhoomiОценок пока нет

- Summer Internship Report (Sanket Yadav) PDFДокумент54 страницыSummer Internship Report (Sanket Yadav) PDFtejasОценок пока нет

- Financial Market and Commercial Banking Code: RMB FM 03: UNIT-2Документ118 страницFinancial Market and Commercial Banking Code: RMB FM 03: UNIT-2Ankur SharmaОценок пока нет

- Non Performing Assets 111111Документ23 страницыNon Performing Assets 111111renika50% (2)

- Banglladesh Bank DPTДокумент40 страницBanglladesh Bank DPTMorshedul ArefinОценок пока нет

- Final Internship Report On Bop New 2003Документ65 страницFinal Internship Report On Bop New 2003Saba RiazОценок пока нет

- Tabarsum NON PERFORMING ASSETS AXIS BANKДокумент73 страницыTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementОт EverandRegional Rural Banks of India: Evolution, Performance and ManagementОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- ICAEW ACA Business Planning Banking: Professional LevelОт EverandICAEW ACA Business Planning Banking: Professional LevelОценок пока нет

- Public Financial Management Systems—Viet Nam: Key Elements from a Financial Management PerspectiveОт EverandPublic Financial Management Systems—Viet Nam: Key Elements from a Financial Management PerspectiveОценок пока нет

- Presentation1 Deepali Raut 11Документ6 страницPresentation1 Deepali Raut 11Patricia JosephОценок пока нет

- Presentation1 Deepali Raut 11Документ6 страницPresentation1 Deepali Raut 11Patricia JosephОценок пока нет

- Poly Project Front Page 11221122Документ1 страницаPoly Project Front Page 11221122Patricia JosephОценок пока нет

- Impactofictineducation 131020100612 Phpapp02Документ18 страницImpactofictineducation 131020100612 Phpapp02Patricia JosephОценок пока нет

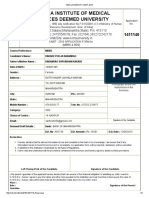

- KIMS University Application Form 2015Документ2 страницыKIMS University Application Form 2015Patricia JosephОценок пока нет

- Poly Project Front Page 1122Документ1 страницаPoly Project Front Page 1122Patricia JosephОценок пока нет

- Conceptual Study of 'Snehe Cha Kalyaukte' in Kushtha with Clinical Evaluation of Vajraka Ghrita in Atopic DermatitisДокумент16 страницConceptual Study of 'Snehe Cha Kalyaukte' in Kushtha with Clinical Evaluation of Vajraka Ghrita in Atopic DermatitisPatricia JosephОценок пока нет

- PSM PPT Washim Dist DT 19 11 2016 Swati Dhoble 11111Документ19 страницPSM PPT Washim Dist DT 19 11 2016 Swati Dhoble 11111Patricia JosephОценок пока нет

- HDFC Bank Report MbaДокумент82 страницыHDFC Bank Report Mba8542ish83% (18)

- MAHATMA GANDHI - ppt1111Документ27 страницMAHATMA GANDHI - ppt1111Patricia JosephОценок пока нет

- Impactofictineducation 131020100612 Phpapp02Документ18 страницImpactofictineducation 131020100612 Phpapp02Patricia JosephОценок пока нет

- Big Data Seminar Report on Issues, Challenges and SolutionsДокумент7 страницBig Data Seminar Report on Issues, Challenges and SolutionsPatricia JosephОценок пока нет

- PSM PPT Washim Dist DT 19 11 2016 Swati Dhoble 11111Документ19 страницPSM PPT Washim Dist DT 19 11 2016 Swati Dhoble 11111Patricia JosephОценок пока нет

- Seminar Report Solar TowerДокумент24 страницыSeminar Report Solar TowerPatricia Joseph100% (1)

- Swine Flu Guidance Under 40 CharactersДокумент17 страницSwine Flu Guidance Under 40 CharactersPatricia JosephОценок пока нет

- Presentation1 pptx1Документ2 страницыPresentation1 pptx1Patricia JosephОценок пока нет

- Advanced Active MaterialsДокумент21 страницаAdvanced Active MaterialsRajeswari DhamotharanОценок пока нет

- Underwater Welding Seminar Report SummaryДокумент5 страницUnderwater Welding Seminar Report SummaryPatricia JosephОценок пока нет

- "Om Fancy Jewellers": Project Report ONДокумент53 страницы"Om Fancy Jewellers": Project Report ONPatricia JosephОценок пока нет

- Greeting Card Math Christmas Card BoxДокумент28 страницGreeting Card Math Christmas Card BoxPatricia JosephОценок пока нет

- R A College LogoДокумент1 страницаR A College LogoPatricia JosephОценок пока нет

- Underwater Welding Seminar11Документ18 страницUnderwater Welding Seminar11Patricia JosephОценок пока нет

- Management of Nursing Service and Education FileДокумент1 страницаManagement of Nursing Service and Education FilePatricia JosephОценок пока нет

- MAHATMA GANDHI - ppt1111Документ27 страницMAHATMA GANDHI - ppt1111Patricia JosephОценок пока нет

- UGProspectus17-18 English PDFДокумент53 страницыUGProspectus17-18 English PDFPatricia JosephОценок пока нет

- Effective - Presentation - PPT BED SHAMALДокумент6 страницEffective - Presentation - PPT BED SHAMALPatricia JosephОценок пока нет

- Presentation1 21212121212121Документ1 страницаPresentation1 21212121212121Patricia JosephОценок пока нет

- New New 11 111Документ9 страницNew New 11 111Patricia JosephОценок пока нет

- New New 11 111Документ9 страницNew New 11 111Patricia JosephОценок пока нет

- 9 Negotiable Instruments Law and Anti Bouncing Checks Law and EstafaДокумент13 страниц9 Negotiable Instruments Law and Anti Bouncing Checks Law and EstafaLeo Sandy Ambe CuisОценок пока нет

- Amway Store ListДокумент4 страницыAmway Store ListSarah ChaveniaОценок пока нет

- Valuation of BondsДокумент27 страницValuation of BondsAbhinav Rajverma100% (1)

- Loan Sanction-Letter181240016761170869Документ3 страницыLoan Sanction-Letter181240016761170869Sanjay MohapatraОценок пока нет

- Guingona Vs City Fiscal of ManilaДокумент4 страницыGuingona Vs City Fiscal of ManilaLouОценок пока нет

- Exercise # 5Документ1 страницаExercise # 5Mara Shaira SiegaОценок пока нет

- IIBF CCP EXAM RECOLLECTED QUESTIONSДокумент5 страницIIBF CCP EXAM RECOLLECTED QUESTIONSMr VIJAYОценок пока нет

- Internship Report of ADBLДокумент41 страницаInternship Report of ADBLconXn Communication & CyberОценок пока нет

- Chapter 1 - IntroductionДокумент26 страницChapter 1 - IntroductionMinh UyênОценок пока нет

- Summary of Account As On 27-07-2023 I. Operative Account in INRДокумент2 страницыSummary of Account As On 27-07-2023 I. Operative Account in INRrp63337651Оценок пока нет

- 12.tazama Recon-31st December 2021Документ13 страниц12.tazama Recon-31st December 2021Gift ChaliОценок пока нет

- PdsДокумент14 страницPdsanurag_gu08100% (2)

- Finance Assistant True or False Test: Key Terms & ConceptsThe title is less than 40 characters and starts with "TITLEДокумент8 страницFinance Assistant True or False Test: Key Terms & ConceptsThe title is less than 40 characters and starts with "TITLEVon Eric DamirezОценок пока нет

- 04+Practical+Example+1+ LVOДокумент4 страницы04+Practical+Example+1+ LVOpearphelokazi45Оценок пока нет

- Dutch-Bangla Bank Limited: Agent Banking DivisionДокумент1 страницаDutch-Bangla Bank Limited: Agent Banking DivisionMd Shemul MiahОценок пока нет

- Seminar PPT Nandhini S MCom 1st YearДокумент11 страницSeminar PPT Nandhini S MCom 1st YearnandhiniОценок пока нет

- UNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationДокумент15 страницUNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenОценок пока нет

- CAIIB BFM Sample Questions by MuruganДокумент158 страницCAIIB BFM Sample Questions by MurugangmechОценок пока нет

- Credit Investigation QuestionnaireДокумент7 страницCredit Investigation QuestionnaireArlyn BautistaОценок пока нет

- Reserve Bank of Australia Corporate Plan 2019/20Документ21 страницаReserve Bank of Australia Corporate Plan 2019/20LutfilОценок пока нет

- Combatting Terrorist FinancingДокумент26 страницCombatting Terrorist FinancingHEHEHEОценок пока нет

- Fees and charges for AmBank credit cardsДокумент2 страницыFees and charges for AmBank credit cardssmsd onlineОценок пока нет

- Chase BillДокумент4 страницыChase BillYu ShilohОценок пока нет

- Characteristic Features of Financial InstrumentsДокумент17 страницCharacteristic Features of Financial Instrumentsmanoranjanpatra93% (15)

- Profit Maximization is Key to Business Efficiency and Risk ProtectionДокумент4 страницыProfit Maximization is Key to Business Efficiency and Risk Protectionekta gudadeОценок пока нет

- Ajiboye Oluwatoyin C.VДокумент2 страницыAjiboye Oluwatoyin C.Vajiboye_oluwatoyinОценок пока нет

- Inclusive Finance India Report 2022Документ153 страницыInclusive Finance India Report 2022MrigankОценок пока нет

- Arvind 190101010048 State Bank of India. What Is Online SBI ?Документ2 страницыArvind 190101010048 State Bank of India. What Is Online SBI ?arvind singhalОценок пока нет

- DFPI Orders Silicon Valley Bank 03102023Документ2 страницыDFPI Orders Silicon Valley Bank 03102023Jillian SmithОценок пока нет

- Finacle 10 X MenuДокумент10 страницFinacle 10 X MenuGandi rameshОценок пока нет