Академический Документы

Профессиональный Документы

Культура Документы

CH - 17 - 11e Keown & TitmanTKM - Financial Forecasting Planning & Budgeting L-6

Загружено:

Adeel RanaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH - 17 - 11e Keown & TitmanTKM - Financial Forecasting Planning & Budgeting L-6

Загружено:

Adeel RanaАвторское право:

Доступные форматы

Chapter 17

Financial

Forecasting

and Planning

Copyright 2011 Pearson Prentice Hall. All rights reserved.

Slide Contents

Learning Objectives

1. An Overview of Financial Planning

2. Developing a Long-term Financial Plan

3. Developing a Short-Term Financial Plan

Key Terms

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-2

Learning Objectives

1. Understand the goals of financial

planning.

2. Use the percent of sales method to

forecast the financing requirements of a

firm including its discretionary financing

needs.

3. Prepare a cash budget and use it to

evaluate the amount and timing of a

firms short-term financing requirements.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-3

17.1 An Overview

of Financial

Planning

Copyright 2011 Pearson Prentice Hall. All rights reserved.

An Overview of Financial Planning

What is the primary objective of preparing

financial plans?

To estimate the future financing requirements

in advance of when the financing will be

needed.

The process of planning is critical to force

managers to think systematically about the

future, despite the uncertainty of future.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-5

An Overview of Financial Planning

(cont.)

Most firms engage in three types of

planning:

Strategic planning,

Long-term financial planning, and

Short-term financial planning

Strategic plan defines, in very general

terms, how the firm plans to make money

in the future. It serves as a guide for all

other plans.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-6

An Overview of Financial Planning

(cont.)

The long-term financial plan generally

encompasses a period of three to five

years and incorporates estimates of the

firms income statements and balance

sheets for each year of the planning

horizon.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-7

An Overview of Financial Planning

(cont.)

The short-term financial plan spans a

period of one year or less and is a very

detailed description of the firms

anticipated cash flows.

The format typically used is a cash

budget, which contains detailed revenue

projections and expenses in the month in

which they are expected to occur for each

operating unit of the company.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-8

17.2 Developing

a Long-Term

Financial Plan

Copyright 2011 Pearson Prentice Hall. All rights reserved.

Developing a Long-Term Financial

Plan

Forecasting a firms future financing needs

using a long-term financial plan can be

thought of in terms of three basic steps:

1. Construct a sales forecast

2. Prepare pro-forma financial statements

3. Estimate the firms financing needs

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-10

Developing a Long-Term Financial

Plan (cont.)

Step 1: Construct a Sales Forecast

Sales forecast is generally based on:

1. past trend in sales; and

2. the influence of any anticipated events that

might materially affect that trend.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-11

Developing a Long-Term Financial

Plan (cont.)

Step 2: Prepare Pro Forma Financial

Statements

Pro forma financial statements help forecast a

firms asset requirements needed to support

the forecast of revenues (step 1).

The most common technique is percent of

sales method that expresses expenses,

assets, and liabilities for a future period as a

percentage of sales.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-12

Developing a Long-Term Financial

Plan (cont.)

Step 3: Estimate the Firms Financing

Needs

Using the pro forma statements we can extract

the cash flow requirements of the firm.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-13

Financial Forecasting Example

Table 17-1 illustrates how Ziegen, Inc.

uses the percent of sales method to

construct pro forma income statement and

pro forma balance sheet.

The company uses the three-step

approach to financial planning.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-14

Financial Forecasting Example

(cont.)

Step 1: Forecast Revenues and Expenses

Zeigens financial analyst estimate the firm will

earn 5% on the projected sales of $12 million

in 2010.

Zeigen plans to retain half of its earnings and

distribute the other half as dividends.

See Table 17-1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-15

Financial Forecasting Example

(cont.)

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-16

Financial Forecasting Example

(cont.)

Step 2: Prepare Pro Forma Financial

Statements

The firms need for assets to support firm sales

is forecasted using percent of sales method,

where each item in the balance sheet is

assumed to vary in accordance with its percent

of sales for 2010.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-17

Financial Forecasting Example

(cont.)

Step 3: Estimate the Firms Financing

Requirements

This involves comparing the projected level of

assets needed to support the sales forecast to

the available sources of financing.

In essence, we now forecast the liabilities and

owners equity section of the pro forma balance

sheet.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-18

Sources of Spontaneous Financing

Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses

are typically the only liabilities that vary

directly with sales.

Accounts payable and accrued expenses

are referred to as sources of spontaneous

financing. The percent of sales method

can be used to forecast the levels of both

these sources of financing.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-19

Sources of Discretionary Financing

Raising financing with notes payable, long-

term debt and common stock requires

managerial discretion and hence these

sources of financing are called

discretionary sources of financing.

The retention of earnings is also a

discretionary source as it is the result of

firms discretionary dividend policy.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-20

Summarizing Ziegens Financial

Forecast

Discretionary Financing Needs (DFN)

= {Total Financing Needs} less {Projected

Sources of Financing}

= {$7.2 m (increase in assets)} {$2.4m in

spontaneous financing + $2.5m in short and

long-term debt + $1.8 million in equity}

= $7.2 million - $6.7 million = $500,000

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-21

Summarizing Ziegens Financial

Forecast (cont.)

The firm has to raise $500,000 with some

combination of borrowing (short-term or

long-term) or the issuance of stock.

Since they require a managerial decision,

they are referred to as the firms

discretionary financing needs (DFN).

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-22

Summarizing Ziegens Financial

Forecast (cont.)

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-23

Analyzing the Effects of Profitability and

Dividend Policy on the Firms DFN

After projecting DFN, we can easily

evaluate the sensitivity of DFN to changes

in key variables.

The table (on next slide) shows that as

dividend payout ratios and net profit

margin vary, DFN also changes

significantly from a negative $40,000 to

$764,000.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-24

Analyzing the Effects of Profitability and

Dividend Policy on the Firms DFN (cont.)

DFN for Various Net Profit Margins and

Dividend Payout Ratio (DPR)

Net Profit DPR =30% DPR=50% DPR=70%

Margin

1% $716,000 $740,000 $764,000

5% $380,000 $500,000 $620,000

10% $(40,000) $200,000 $440,000

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-25

Analyzing the Effects of Sales

Growth on a Firms DFN

Table 17-2 considers the impact of sales

growth rates of 0%, 20% and 40% on

DFN.

It is observed that DFN ranges from

($250,000) at 0% growth rate to

$1,250,000 at 40% growth rate. A

negative DFN indicates that the firm has

surplus dollars in financing.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-26

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-27

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-28

Checkpoint 17.1

Estimating Discretionary Financing Needs

The Pendleton Chemical Company manufactures a line of

personal health care products used in preventing the spread of

infectious diseases. The companys principal product is a germ-

killing hand sanitizer called Bacteria-X. In 2010, Pendleton

had $5 million in sales, and anticipates an increase of 15% in

2011. After performing an analysis of the firms balance sheet,

the firms financial manager prepared the following pro forma

income statement and balance sheet for next year:

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-29

Checkpoint 17.1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-30

Checkpoint 17.1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-31

Checkpoint 17.1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-32

Checkpoint 17.1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-33

Checkpoint 17.1

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-34

Checkpoint 17.1: Check Yourself

Pendletons management estimates that

under the most optimistic circumstances it

might experience a 40% rate of growth of

sales in 2011. Assuming that net income

is 5% of firm sales and that both current

and fixed assets are equal to a fixed

percent of sales (as found in the above

forecast), what do you estimate the firms

DFN to be under these optimistic

circumstances?

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-35

Step 1: Picture the Problem

The firms DFN is equal to the financing the

firm requires for the year that is not

provided by spontaneous sources such as

accounts payable and accrued expenses

plus retained earnings for the period.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-36

Step 2: Decide on a Solution

Strategy

We can calculate the DFN using the

following equation:

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-37

Line Performa Income Statement for 2011

Step 3: Solve 1

2

Growth Rate

Sales

40%

$7,000,000.00

3 Net Income

Performa Balance Sheet for 2011

Multiple Computation

4 Current Assets 0.20 $1,400,000.00

5 Net Fixed Assets 0.6 $4,200,000.00

6 Total 4+5 $5,600,000.00

7 Accounts Payable 0.2 $1,150,000.00

8 Accrued Expenses 0.1 $575,000.00

9 Notes Payable $500,000.00

10 Current Liabilities 7+8+9 $2,225,000.00

11 Long-term Debt $1,000,000.00

12 Common Stock (par) $100,000.00

13 Paid-in-capital $200,000.00

14 Retained Earnings $1,050,000.00

15 Common Equity 12+13+14 $1,350,000.00

$987,500 + Line3 - $287,500 17-38

Copyright 2011 Pearson Prentice Hall. All rights reserved.

Step 4: Analyze

If the firm experiences a 40% growth rate

in sales, Pendleton can expect to raise

$1,025,000 during the coming year.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-39

17.3 Developing

a Short-Term

Financial Plan

Copyright 2011 Pearson Prentice Hall. All rights reserved.

Developing a Short-Term Financial

Plan

Unlike a long-term financial plan that is

prepared using pro forma income

statements and balance sheets, short-term

financial plan is typically presented in the

form of a cash budget that contains details

concerning the firms cash receipts and

disbursements.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-41

Developing a Short-Term Financial

Plan (cont.)

Cash budget includes the following main

elements:

Cash receipts,

Cash disbursements,

Net change in cash, and

New financing needed.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-42

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-43

Uses of the Cash Budget

1. It is a useful tool for predicting the

amount and timing of the firms future

financing requirements.

2. It is a useful tool to monitor and control

the firms operations.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-44

Uses of the Cash Budget (cont.)

The actual cash receipts and

disbursements can be compared to

budgeted estimates, bringing to light any

significant differences.

In some cases, the differences may be

caused by cost overruns or poor collection

from credit customers. Remedial action

can then be taken.

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-45

Key Terms

Cash budget

Discretionary financing needs (DFN)

Discretionary sources of financing

Long-term financial plan

Percent of sales method

Pro forma balance sheet

Pro forma income statement

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-46

Key Terms (cont.)

Short-term financial plan

Sources of spontaneous financing

Strategic plan

Copyright 2011 Pearson Prentice Hall. All rights reserved.

17-47

Вам также может понравиться

- CSCP Study PlanДокумент5 страницCSCP Study PlanAdeel Rana100% (1)

- Exam Content Manual PreviewДокумент5 страницExam Content Manual PreviewAdeel RanaОценок пока нет

- Forman Christian College (A Chartered University) : Management Control SystemsДокумент5 страницForman Christian College (A Chartered University) : Management Control SystemsAdeel RanaОценок пока нет

- Budgeting Process and Profit Responsibility at Empire Glass CompanyДокумент18 страницBudgeting Process and Profit Responsibility at Empire Glass CompanySiti Fatimah100% (2)

- Rapidrill Case AnalysisДокумент8 страницRapidrill Case AnalysisAdeel RanaОценок пока нет

- Managerial Accounting Overview:: Group MembersДокумент52 страницыManagerial Accounting Overview:: Group MembersAdeel RanaОценок пока нет

- Managment Control System: Nawazish Mehdi Zaidi Muhammad Adeel Rana Asad Omer KhanДокумент48 страницManagment Control System: Nawazish Mehdi Zaidi Muhammad Adeel Rana Asad Omer KhanAdeel RanaОценок пока нет

- Budget 2017-18 Pakistan-SalientFeatures PDFДокумент21 страницаBudget 2017-18 Pakistan-SalientFeatures PDFDanish RehmanОценок пока нет

- The Cognitive School Analyzes Strategic Decision MakingДокумент27 страницThe Cognitive School Analyzes Strategic Decision MakingAdeel RanaОценок пока нет

- A Contingency Framework For The Design of Accounting Information SystemДокумент15 страницA Contingency Framework For The Design of Accounting Information SystemAdeel RanaОценок пока нет

- Budget 2017-18 Pakistan-SalientFeatures PDFДокумент21 страницаBudget 2017-18 Pakistan-SalientFeatures PDFDanish RehmanОценок пока нет

- Forman Christian College (A Chartered University) : Management Control SystemsДокумент5 страницForman Christian College (A Chartered University) : Management Control SystemsAdeel RanaОценок пока нет

- Banksinpakistan 120513140713 Phpapp01Документ11 страницBanksinpakistan 120513140713 Phpapp01Adeel RanaОценок пока нет

- Microeconomic Theory: Professor K. LeppelДокумент35 страницMicroeconomic Theory: Professor K. Leppelamedina8131Оценок пока нет

- Banking in PakistanДокумент11 страницBanking in PakistanAdeel RanaОценок пока нет

- Functionsofcommercialbanks 130523075925 Phpapp01 150913074827 Lva1 App6892Документ14 страницFunctionsofcommercialbanks 130523075925 Phpapp01 150913074827 Lva1 App6892Adeel RanaОценок пока нет

- Ordinance 62Документ202 страницыOrdinance 62Fahad AliОценок пока нет

- Commercial Banks: Roup Members: Kiran Faiz Sumera Razaque Danish Ali Geeta BaiДокумент45 страницCommercial Banks: Roup Members: Kiran Faiz Sumera Razaque Danish Ali Geeta BaiAdeel RanaОценок пока нет

- Microeconomic Theory: Professor K. LeppelДокумент35 страницMicroeconomic Theory: Professor K. Leppelamedina8131Оценок пока нет

- Fiscal Policy of Pakistan: Presented By: Zaheer-Ud-Din 15175 Ali Akber Lone 15638 Bilal Tahir 15379 Talha Bukhari 15038Документ27 страницFiscal Policy of Pakistan: Presented By: Zaheer-Ud-Din 15175 Ali Akber Lone 15638 Bilal Tahir 15379 Talha Bukhari 15038Adeel RanaОценок пока нет

- Bank Accounts GuideДокумент6 страницBank Accounts GuideHelloprojectОценок пока нет

- Micro Economics: DR Mohamed I. Migdad Professor in EconomicsДокумент75 страницMicro Economics: DR Mohamed I. Migdad Professor in EconomicsAdeel RanaОценок пока нет

- Balkan IzationДокумент1 страницаBalkan IzationAdeel RanaОценок пока нет

- NTS Contents For 2018 Test SNGPL TestДокумент1 страницаNTS Contents For 2018 Test SNGPL Testabuzaralmani100% (1)

- Ordinance 62Документ202 страницыOrdinance 62Fahad AliОценок пока нет

- Process 2Документ2 страницыProcess 2Adeel RanaОценок пока нет

- Useful McqsДокумент15 страницUseful McqsAdeel RanaОценок пока нет

- Commercial Banks: Sector UpdateДокумент19 страницCommercial Banks: Sector UpdateAdeel RanaОценок пока нет

- Muscat Vs PakistanДокумент3 страницыMuscat Vs PakistanAdeel RanaОценок пока нет

- Report and GovernanceДокумент3 страницыReport and GovernanceAdeel RanaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

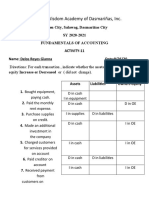

- Legacy of Wisdom Academy of Dasmariñas, IncДокумент4 страницыLegacy of Wisdom Academy of Dasmariñas, InczavriaОценок пока нет

- Conceptual Framework For Financial ReportingДокумент20 страницConceptual Framework For Financial ReportingSamuel GlovaОценок пока нет

- 1st PB-TAДокумент12 страниц1st PB-TAGlenn Patrick de LeonОценок пока нет

- Project On NJ India Invest PVT LTDДокумент77 страницProject On NJ India Invest PVT LTDrajveerpatidar69% (26)

- Dipped PLC Annual ReportДокумент252 страницыDipped PLC Annual ReportDulakshiОценок пока нет

- Midterm Exam BuscomДокумент8 страницMidterm Exam BuscomJustine FloresОценок пока нет

- Fsa Solved ProblemsДокумент27 страницFsa Solved ProblemsKumarVelivela100% (1)

- Accounting Conventions and EquationДокумент33 страницыAccounting Conventions and EquationanuragОценок пока нет

- Gi A Kì TCDN ML32KET307GKДокумент3 страницыGi A Kì TCDN ML32KET307GKMai Nữ Song NgânОценок пока нет

- Full Download Financial Accounting Fundamentals 6th Edition Wild Solutions Manual PDF Full ChapterДокумент36 страницFull Download Financial Accounting Fundamentals 6th Edition Wild Solutions Manual PDF Full Chapterinstallgustoayak100% (16)

- NCBA Financial Management (Financial Analysis)Документ9 страницNCBA Financial Management (Financial Analysis)Joanne Alexis BiscochoОценок пока нет

- 10 Merchant BankingДокумент68 страниц10 Merchant Bankingpoojamacwan67% (3)

- BST 2024 Paper 2Документ9 страницBST 2024 Paper 2sd8543326Оценок пока нет

- Bondor Steel PDFДокумент63 страницыBondor Steel PDFriad riduОценок пока нет

- FABM2 Module 05 (Q1-W6)Документ12 страницFABM2 Module 05 (Q1-W6)Christian ZebuaОценок пока нет

- Case StudyДокумент34 страницыCase Studymarksman_para90% (10)

- Risk Management: Atty. Fernando S. PeñarroyoДокумент48 страницRisk Management: Atty. Fernando S. PeñarroyoEmmanuel CaguimbalОценок пока нет

- GR 9 Teachers GuideДокумент107 страницGR 9 Teachers GuideAmogelang Katlego MakhalemeleОценок пока нет

- Fundamentals of Investment - Vanita TripathiДокумент624 страницыFundamentals of Investment - Vanita Tripathiarnavkumardse76% (34)

- 032016Документ107 страниц032016Aditya MakwanaОценок пока нет

- 2018 q2 Servus Financial StatementsДокумент13 страниц2018 q2 Servus Financial Statements1flailstarОценок пока нет

- J&J 5th EditionДокумент13 страницJ&J 5th EditionNicholas Malvin SaputraОценок пока нет

- Case Study of Takeover of Raasi Cements by India CementsДокумент8 страницCase Study of Takeover of Raasi Cements by India Cementszain100% (1)

- Sample ReportДокумент47 страницSample ReportJituОценок пока нет

- Coca Cola India RatioДокумент15 страницCoca Cola India RatioKaran VermaОценок пока нет

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisДокумент58 страницCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCArmen CruzОценок пока нет

- ch12 SolДокумент12 страницch12 SolJohn Nigz PayeeОценок пока нет

- Ratio AnalysisДокумент61 страницаRatio AnalysisHariharan KanagasabaiОценок пока нет

- Nabil ProfitabilityДокумент44 страницыNabil Profitabilityabhishek shah100% (2)

- Bank of Baroda MergerДокумент3 страницыBank of Baroda MergerShubham DoshiОценок пока нет