Академический Документы

Профессиональный Документы

Культура Документы

Real Property Tax

Загружено:

Oman Paul Antiojo0 оценок0% нашли этот документ полезным (0 голосов)

283 просмотров18 страницReal Property Tax (RPT) is an annual imposition on lands, buildings and improvements. Provincial, city or municipal assessor shall undertake a general revision of real property assessment within (2) years after the effectivity of the code.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документReal Property Tax (RPT) is an annual imposition on lands, buildings and improvements. Provincial, city or municipal assessor shall undertake a general revision of real property assessment within (2) years after the effectivity of the code.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

283 просмотров18 страницReal Property Tax

Загружено:

Oman Paul AntiojoReal Property Tax (RPT) is an annual imposition on lands, buildings and improvements. Provincial, city or municipal assessor shall undertake a general revision of real property assessment within (2) years after the effectivity of the code.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 18

Real Property Tax

The Real Property Tax

The real property tax (RPT) is an annual

imposition on lands, buildings and

improvements.

RPT = FMV x AL = AV X RATE

Assessment Level

On land

Class Assessment

Levels

Residential 20%

Agricultural 40%

Commercial 50%

Industrial 50%

Mineral 50%

Timberland 20%

Assessment Level

On building and other structures

Residential

Fair market value Assessment

Levels

Over Not over

175,000 0%

175,000 300,000 10%

300,000 500,000 20%

500,000 750,000 25%

750,000 1,000,000 30%

1,000,000 2,000,000 35%

2,000,000 5,000,000 40%

5,000,000 10,000,000 50%

10,000,000 60%

Assessment Level

On building and other structures

Agricultural

Fair market value Assessment

Levels

Over Not over

300,000 25%

300,000 500,000 30%

500,000 750,000 35%

750,000 1,000,000 40%

1,000,000 2,000,000 45%

2,000,000 50%

Assessment Level

On building and other structures

Commercial/Industrial

Fair market value Assessment

Levels

Over Not over

300,000 30%

300,000 500,000 35%

500,000 750,000 40%

750,000 1,000,000 50%

1,000,000 2,000,000 60%

2,000,000 5,000,000 70%

5,000,000 10,000,000 75%

10,000,000 80%

Assessment Level

On building and other structures

Timberland

Fair market value Assessment

Levels

Over Not over

300,000 45%

300,000 500,000 50%

500,000 750,000 55%

750,000 1,000,000 60%

1,000,000 2,000,000 65%

2,000,000 70%

Assessment Level

On building and other structures

Machineries

Class Assessment levels

agricultural 40%

residential 50%

commercial 80%

industrial 80%

Assessment Level

On building and other structures

Special classes (land, buildings, machineries,

other improvements

Class Assessment levels

Cultural 15%

Scientific 15%

Hospital 15%

Local water district 10%

General Revisions of

Assessments and Property

Classification

The provincial, city or municipal assessor

shall undertake a general revision of real

property assessment within (2) years after the

effectivity of the Code and every three(3)

years thereafter.

Rates of Levy(Maximum)

Province - 1 % of Assessed Value

Cities/Municipalities within MMA - 2% of

Assessed Value

Additional Levy on RPT for the SEF – 1%

Additional ad Valorem Tax on Idle Lands – 5%

Idle Land Coverage

a) Agricultural land more than 1 hectare

in area, ½ of which remain

uncultivated.

b) Land other than agricultural more than

1,000 sq. meters in area ½ of which

remain unutilized

c) Residential lots in subdivisions

regardless of area

Distribution of Proceeds

In the case of provinces:

Province – 35%

Municipality – 40%

Barangay – 25%

In the case of cities

City – 70%

Barangays – 30% (released 5 days after end of every quarter)

50% shall accrue to the barangay where the property is located

50% shall accrue equally to all the component barangays of the city

In the case of a municipality within the MMA

Metropolitan Manila Development Authority – 35%

Municipality – 35%

Barangays – 30% (released 5 days after end of every quarter)

50% shall accrue to the barangay where the property is located

50% shall accrue equally to all the component barangays of the municipality

Interests on Unpaid RPT

Interest – 2% per month not to exceed 36 months or

72%

Discounts for RPT

Prompt payment – 10% maximum

Advanced payment – 20% maximum

Payment of RPT in Installment

1st installment – on or before 31 March

2nd installment – on or before 30 June

3rd installment – on or before 30 September

4th installment – on or before 31 December

Exemptions from RPT

a) Real property owned by the Republic of the

Philippines

b) All charitable institutions, religious, non-profit

or religious cemeteries

c) All machineries and equipment used by local

water districts and GOCCs, generation and

transmission of electric power

d) Registered cooperatives

e) Machinery and equipment used for pollution

control and environmental protection

Remedies for Collection

of RPT

A. Administrative Remedies

1. Levy on real property, and

2. Sale of real property at public auction

B. Judicial Remedy

Strategies for RPT

Conduct house to house campaign on all delinquent real

property owners.

Send out notices to all delinquent real property owner and

issue destrain and levy letters.

Hold public auction on delinquent real property owner.

Conduct a physical inventory of all machinery and equipment

in industrial and commercial establishments and countercheck

this with that appearing in the Office of the City Assessor.

Verify from the tax declaration the total value of machinery and

equipment and counter check this with the financial statement.

Enforce additional 5% on the idle land tax.

Republic Asahi Glass Corporation

Tax Deficiency – RPT Machinery and Equipment

Total Market value per Tax Declaration P 585,353,560.00

=====================

Machinery and Equipment per F/S 4,207,497,000.00

Less 5% Depreciation 210,374,850.00

=====================

3,997,122,150.00

Add: Machinery in Transit 67,468,000.000

=====================

Assessment Level P 4,064,590,150.00

80%

=====================

Rate 3%

=====================

RPT Tax due 1998 P 97,550,163.60

Less: 1998 tax paid 16,682,576.52

=====================

Tax due P 80,867,587.08

Add:16% Penalty 12,938,813.93

=====================

Total Tax Due 1998 P 93,806,401.05

Вам также может понравиться

- 3 REB Practice QuestionsДокумент27 страниц3 REB Practice QuestionsPrince EG DltgОценок пока нет

- 015 June 10, 2023 Problem Solving PRCДокумент20 страниц015 June 10, 2023 Problem Solving PRCPrince EG DltgОценок пока нет

- Understanding Taxes and Estate TaxesДокумент56 страницUnderstanding Taxes and Estate TaxesJewel Mae MercadoОценок пока нет

- Estate TaxДокумент22 страницыEstate TaxCat ValentineОценок пока нет

- Amended Guidelines Abot-Kamay Pabahay Program'Документ30 страницAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteОценок пока нет

- Part II. Chapter 4 Appraisal Assessment of Real Property TaxДокумент69 страницPart II. Chapter 4 Appraisal Assessment of Real Property TaxRuiz, Cherryjane100% (1)

- Fundamentals of Property Ownership - Philippine Real Estate Broker ReviewerДокумент5 страницFundamentals of Property Ownership - Philippine Real Estate Broker ReviewerRhea SunshineОценок пока нет

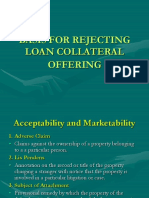

- REASONS REJECT LOAN COLLATERALДокумент6 страницREASONS REJECT LOAN COLLATERALLuningning CariosОценок пока нет

- Fundamental of Property OwnershipДокумент5 страницFundamental of Property OwnershipJosue Sandigan Biolon SecorinОценок пока нет

- Chapter 6-Income ApproachДокумент37 страницChapter 6-Income ApproachHosnii QamarОценок пока нет

- PROPERTY DOCUMENTATION AND REGISTRATION FinalДокумент7 страницPROPERTY DOCUMENTATION AND REGISTRATION FinalNeil Mervyn LisondraОценок пока нет

- 1.4 Real-Estate-Taxation With Problems and Answers - REBДокумент82 страницы1.4 Real-Estate-Taxation With Problems and Answers - REBgore.solivenОценок пока нет

- Land Ownership and Property Acquisition in The PhilippinesДокумент4 страницыLand Ownership and Property Acquisition in The PhilippinesNathaniel RasosОценок пока нет

- PD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Документ2 страницыPD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Rocky MarcianoОценок пока нет

- Real Estate Broker Board ExamДокумент2 страницыReal Estate Broker Board ExamTheSummitExpressОценок пока нет

- Real Estate Taxation - 12.11.15 (Wo Answers)Документ7 страницReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoОценок пока нет

- Republic Act No. 7279Документ25 страницRepublic Act No. 7279Sharmen Dizon GalleneroОценок пока нет

- Finals ElectiveДокумент126 страницFinals ElectiveCristine TabilismaОценок пока нет

- Real Estate Service Act REM1Документ29 страницReal Estate Service Act REM1Francis L100% (1)

- Real Property Appraisal and Assessment Manual Key PointsДокумент40 страницReal Property Appraisal and Assessment Manual Key PointsElsieRaquiño100% (1)

- Broker Reviewer 2022Документ8 страницBroker Reviewer 2022Janzel SantillanОценок пока нет

- Registration and DocumentationДокумент6 страницRegistration and DocumentationMichelle GozonОценок пока нет

- BIR RR 07-2003Документ8 страницBIR RR 07-2003Brian BaldwinОценок пока нет

- Philippine Valuation Standards and Tax ReformsДокумент154 страницыPhilippine Valuation Standards and Tax ReformsVinz Molina100% (1)

- Real Propert Y: TaxationДокумент41 страницаReal Propert Y: TaxationFreeza Masculino FabrigasОценок пока нет

- Urban and Land Use, Planning, Development and ZoningДокумент5 страницUrban and Land Use, Planning, Development and ZoningJen ManriqueОценок пока нет

- Real Estate Brokerage Practice ExamДокумент67 страницReal Estate Brokerage Practice ExamLeslie Anne De JesusОценок пока нет

- Estate Tax Version 1.0Документ73 страницыEstate Tax Version 1.0sujulove forever100% (3)

- CH 01Документ64 страницыCH 01Kh H100% (1)

- CONDOMINIUM CONCEPTS. - Note # 1Документ4 страницыCONDOMINIUM CONCEPTS. - Note # 1Jay JQОценок пока нет

- A.2 Usprcp Rec CodeДокумент25 страницA.2 Usprcp Rec Codebhobot riveraОценок пока нет

- Philippine Valuation Standards - Concepts and Code of ConductДокумент56 страницPhilippine Valuation Standards - Concepts and Code of Conductkim ranОценок пока нет

- PARA SeminarДокумент2 страницыPARA SeminarShielaMarie MalanoОценок пока нет

- Real Estate Service Act (Resa Law) Republic Act 9646Документ18 страницReal Estate Service Act (Resa Law) Republic Act 9646Mike Angelow EsperaОценок пока нет

- 3.1n Theories & Principles - UnlockedДокумент11 страниц3.1n Theories & Principles - Unlockedccc100% (1)

- CRES Subj 6 CONDOMINIUM CONCEPT - Edtpg 141-145 2Документ5 страницCRES Subj 6 CONDOMINIUM CONCEPT - Edtpg 141-145 2Richard VillaverdeОценок пока нет

- Toaz - Info Exam Final Coaching 2014 Mock Board Part I Answers PRДокумент5 страницToaz - Info Exam Final Coaching 2014 Mock Board Part I Answers PRLouie CoОценок пока нет

- Fundamentals of Property OwnershipДокумент4 страницыFundamentals of Property OwnershipCedric Recato DyОценок пока нет

- Notes On Fundamentals of Property OwnershipДокумент17 страницNotes On Fundamentals of Property OwnershipJoshua ArmestoОценок пока нет

- ReviewerДокумент160 страницReviewerGDLT ytОценок пока нет

- Real Estate Service Act of The Philippines PDFДокумент15 страницReal Estate Service Act of The Philippines PDFVener Angelo MargalloОценок пока нет

- Real Property TaxationДокумент125 страницReal Property TaxationLaw_Portal100% (5)

- SOREV Income Approach DiagnosticДокумент4 страницыSOREV Income Approach DiagnosticReyn شكرا100% (1)

- Income ApproachДокумент9 страницIncome ApproachRoselle AbuelОценок пока нет

- REM 12 Ethical Standard For Real Estate PracticeДокумент27 страницREM 12 Ethical Standard For Real Estate PracticeJosue Sandigan Biolon Secorin100% (1)

- Fundamentals of Real Property Appraisal and AssessmentДокумент43 страницыFundamentals of Real Property Appraisal and AssessmentFrancis L100% (1)

- Taxation WorkshopДокумент83 страницыTaxation WorkshopLaw_Portal100% (1)

- Real Estate Taxation - 12.11.15Документ8 страницReal Estate Taxation - 12.11.15Juan Frivaldo100% (2)

- Real Estate PracticeДокумент5 страницReal Estate PracticeDa Yani ChristeeneОценок пока нет

- Real Estate Sale Taxes ExplainedДокумент7 страницReal Estate Sale Taxes ExplainedJessa CaberteОценок пока нет

- Coverage of Examination (Broker)Документ2 страницыCoverage of Examination (Broker)Jasielle Leigh UlangkayaОценок пока нет

- Real Estate Appraisal ReviewerДокумент1 страницаReal Estate Appraisal ReviewerventuristaОценок пока нет

- BOARD OF ACCOUNTANCY ResolutionДокумент9 страницBOARD OF ACCOUNTANCY ResolutionKristine Loide A. Timtim-Rojas100% (1)

- Philippine real estate appraisal seminar conceptsДокумент9 страницPhilippine real estate appraisal seminar conceptsDiwaОценок пока нет

- RPT and Local Business TaxДокумент48 страницRPT and Local Business TaxGeng SimbolОценок пока нет

- What Is Real Property TaxДокумент7 страницWhat Is Real Property TaxAnonymous yNGRjeq1hyОценок пока нет

- How Do You Compute The Assessed Value?: Assessed Value Fair Market Value X Assessment LevelДокумент7 страницHow Do You Compute The Assessed Value?: Assessed Value Fair Market Value X Assessment Leveljulie anne mae mendozaОценок пока нет

- What You Need To Know About Real Property Tax (RPT) in The PhilippinesДокумент10 страницWhat You Need To Know About Real Property Tax (RPT) in The PhilippinesAngelie LapeОценок пока нет

- An Analysis On Patronage Politics and Its Relationship To The Issue of Cavite Provincial Capitol S Employment Rate (2001 2010)Документ89 страницAn Analysis On Patronage Politics and Its Relationship To The Issue of Cavite Provincial Capitol S Employment Rate (2001 2010)Oman Paul AntiojoОценок пока нет

- Debate 101Документ8 страницDebate 101Oman Paul AntiojoОценок пока нет

- Una Noche Con Gabriela en ChileДокумент5 страницUna Noche Con Gabriela en ChileOman Paul AntiojoОценок пока нет

- An Analysis On Patronage Politics in Its Relationon The Issue of The Cavite Provincial Capitol's Employment Rate For The Year 2001 - 2010Документ76 страницAn Analysis On Patronage Politics in Its Relationon The Issue of The Cavite Provincial Capitol's Employment Rate For The Year 2001 - 2010Oman Paul AntiojoОценок пока нет

- Chapter Three: Foreign Policy Decision MakingДокумент16 страницChapter Three: Foreign Policy Decision MakingOman Paul AntiojoОценок пока нет

- Alternative Revenues Raising Mechanism - City of Dasmarinas, CaviteДокумент15 страницAlternative Revenues Raising Mechanism - City of Dasmarinas, CaviteOman Paul AntiojoОценок пока нет

- Criminal Law Pge 10-13 and 17Документ5 страницCriminal Law Pge 10-13 and 17Oman Paul AntiojoОценок пока нет

- Alternative Revenues Raising Mechanism - City of Dasmarinas, CaviteДокумент15 страницAlternative Revenues Raising Mechanism - City of Dasmarinas, CaviteOman Paul AntiojoОценок пока нет

- Income Tax - Guidelines Financial Year 2022-23Документ13 страницIncome Tax - Guidelines Financial Year 2022-23Pradeep KVKОценок пока нет

- Say Good Bye To Physical Cash and Welcome To Central Bank Digital CurrencyДокумент44 страницыSay Good Bye To Physical Cash and Welcome To Central Bank Digital CurrencyJohn TaskinsoyОценок пока нет

- VAT Guide For VendorsДокумент106 страницVAT Guide For VendorsUrvashi KhedooОценок пока нет

- GSTN NotesДокумент2 страницыGSTN NotesAshna BagdiОценок пока нет

- Nego TranscriptДокумент15 страницNego TranscriptResci Angelli Rizada-NolascoОценок пока нет

- Chapter 6Документ18 страницChapter 6marieieiemОценок пока нет

- DRC 03-04-05 User Manual FinalДокумент53 страницыDRC 03-04-05 User Manual FinalRajesh Mn RajОценок пока нет

- RTMF 990Документ49 страницRTMF 990Craig MaugerОценок пока нет

- GermanДокумент28 страницGermanVaibhavi SinghОценок пока нет

- Preview 31Документ16 страницPreview 31kakabadzebaiaОценок пока нет

- JIB-PMES Promulgation No. 163 Rates of Hourly Pay and Allowances 2011-2012Документ2 страницыJIB-PMES Promulgation No. 163 Rates of Hourly Pay and Allowances 2011-2012mtipladyОценок пока нет

- Barangay clearance and certification fee ordinanceДокумент2 страницыBarangay clearance and certification fee ordinanceGiezlRamos-PolcaОценок пока нет

- Hotel 60433 DikonversiДокумент2 страницыHotel 60433 DikonversiPuteri LucianaОценок пока нет

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Документ38 страницCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaОценок пока нет

- M.Qasim RazaДокумент7 страницM.Qasim Razamuhammad waqasОценок пока нет

- MCQ Donorx27s TaxesДокумент6 страницMCQ Donorx27s TaxesMary Joyce GarciaОценок пока нет

- Cash Receipts Journal (CRJ)Документ1 страницаCash Receipts Journal (CRJ)KristineMarzanОценок пока нет

- Operating Expense Formula Excel TemplateДокумент5 страницOperating Expense Formula Excel TemplateJaspreet GillОценок пока нет

- Customer Perception Towards Mobile Wallets Among YouthДокумент7 страницCustomer Perception Towards Mobile Wallets Among YouthMoideenОценок пока нет

- Icitss Project FileДокумент21 страницаIcitss Project FileShrey JainОценок пока нет

- GST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateДокумент17 страницGST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateshyamОценок пока нет

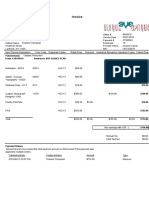

- Invoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANДокумент2 страницыInvoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANUniqueEye OptiqueОценок пока нет

- Purchase Order - Report PDFДокумент2 страницыPurchase Order - Report PDFAnonymous dnflChvoCoОценок пока нет

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesДокумент2 страницыFixedline and Broadband Services: Your Account Summary This Month'S ChargesJeneshОценок пока нет

- Easypaisa-All Pricing and CommissioningДокумент17 страницEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- Payment Advice DetailsДокумент2 страницыPayment Advice DetailsVishal KambleОценок пока нет

- Ellis S Frison IRS DecisionДокумент5 страницEllis S Frison IRS DecisionLilly EllisОценок пока нет

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JДокумент3 страницыYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JhanhОценок пока нет

- Asim Hassan 4Документ1 страницаAsim Hassan 4Muhammad Aasim HassanОценок пока нет

- Historical Development of Taxing System in IndiaДокумент17 страницHistorical Development of Taxing System in IndiasenthamilanОценок пока нет