Академический Документы

Профессиональный Документы

Культура Документы

Capital Structure

Загружено:

Neelu Ahluwalia0 оценок0% нашли этот документ полезным (0 голосов)

38 просмотров14 страницanalysis of EBIT EPS relationship.

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документanalysis of EBIT EPS relationship.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

38 просмотров14 страницCapital Structure

Загружено:

Neelu Ahluwaliaanalysis of EBIT EPS relationship.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 14

Capital Structure

EBIT – EPS Analysis

EBIT – EPS Analysis

• EBIT-EPS analysis is a very strong and important tool in

the hands of the finance manager. Under EBIT-EPS

analysis, an attempt is made to analyse the impact of

change in the capital structure on earnings available to

equity shareholders.

• Thus, EBIT-EPS analysis shows the relationship

between EBIT and EPS at various financing pattern i.e.

debt –equity ratio. The financing mix, which yields the

maximum EPS to equity shareholders under assumed

EBIT level, is regarded as the best mix or the optimum

capital structure.

Relationship between EBIT – EPS

There are two ways to analyse the relationship

of EBIT and EPS

Two ways to analyse EBIT

and EPS

1. Constant EBIT with 2. Varying EBIT with

changing Financing pattern changing Financing pattern

1. Constant EBIT with changing

Financing pattern

• Assuming EBIT constant analysis will be done to

see the impact of various financing patterns on

the return available to equity shareholders. The

return available to equity shareholders is the

residue part of the profit. The total operating

profit is divided into various claimants. These are

four claimants of EBIT as shown below:-

• Interest

• Tax

• Preference Dividend

• Residual Profit (Equity Dividend)

• Suppose ABC, Ltd which is expecting a EBIT of Rs. 1,50,000 per

annum on an investment of Rs. 5,00,000 is considering a

finalization of the capital structure or the financial plan. The

company has access to raise funds of varying amount by

issuing equity share capital, 12% preference share and 10%

debenture or any combination thereof. Suppose it analyzes

the following four options to raise the required funds of Rs.

5,00,000.

1. By issuing equity share capital at par.

2. 50% funds by equity share capital and 50% funds by

preference shares.

3. 50% funds by equity share capital, 25% by preference shares

and 25% by issue of 10% debentures.

4. 25% funds by equity share capital, 25% by preference shares

and 50% by the issue of 10% debentures.

Assuming tax @ 30% calculate EPS

OPTION 1 OPTION 2 OPTION 3 OPTION 4

What happens if the return on investment is

reduced from 30% TO 18 %?

OPTION 1 OPTION 2 OPTION 3 OPTION 4

• EBIT 90,000 90,000 90,000 90,000

• A company is expecting EBIT of Rs. 5,00,000 per annum

on investment of Rs. 10,00,000. Company is in need of

Rs. 8,00,000 for its expansion activities. Company can

raise this amount by either equity shares capital or 12%

preference share capital or 10% debentures. The

company is considering the following financing

patterns:

1. 10,00,000 through issue of Equity Shares at par;

2. 5,00,000 by issue of Equity Share Capital and

remaining 5,00,000 by issue of Debentures;

3. 5,00,000 through Equity Shares and 2,50,000 through

12% Preference Share Capital and remaining 2,50,000

through 10% Debentures.;

4. 5,00,000 through Debt and 2,50,000 through Equity

Shares and remaining 2,50,000 through 12%

Preference Share Capital.

• Find out the best financing mix assuming 50% tax rate.

2. Varying EBIT with different financing

patterns

• The assumption of constant EBIT is not

possible and realistic.

• A firm may not be able to estimate the EBIT

level accurately and it may be different from

expected one.

• Therefore, effect of financial leverage on EPS

must be analysed.

• Suppose there are three firms X Ltd, Y Ltd and

Z Ltd. Their financial positions is as follows:-

• EBIT – 10,000; 16,000 and 22,000

• TAX @ 30%

X LTD Y LTD Z LTD

SHARE CAPITAL 2,00,000 1,00,000 50,000

(OF RS 100 EACH)

6% DEBENTURES 0 1,00,000 1,50,000

TOTAL FUNDS 2,00,000 2,00,000 2,00,000

Financial break-even level

• In case the EBIT level of a firm is just sufficient to

cover the fixed financial charges then such level

of EBIT is known as financial break-even level.

• Financial break even level is such a level of EBIT at

which only the fixed financial charges of the firm

are covered and consequently the EPS is zero.

• If EBIT reduces below the financial break even

level, the EPS will be negative.

Financial break even level of EBIT can

be calculated as:

1. If the firm has employed debt only and no

preference shares:-

F. Break even EBIT = Interest Charge

2. If the firm has employed debt and preference

share capital, then

F. Break even EBIT = Int. Charge + pref divi/ (1-t)

Indifference Point/Level

• The indifference level of EBIT is one at which

the EPS under two or more capital structures

are same.

• Out of several financial plans available, the

firm may have two or more structures at

which EPS is same for a given EBIT.

• Such level of EBIT at which EPS is same is

known as Indifference level of EBIT.

• PQR Ltd is expecting an EBIT of Rs. 55,00,000

after implementing the plan of expansion for

50,00,000. the funds can be further raised by

issue of equity shares of 5,000 each or by

issue of 10% debenture. Find out the EPS

under these two alternatives plans if capital

structure stands at 10,000 shares.

Вам также может понравиться

- AFM Model Test PaperДокумент16 страницAFM Model Test PaperNeelu AhluwaliaОценок пока нет

- Mba Iv - B Macr - Ms 222 Assignment - 1Документ2 страницыMba Iv - B Macr - Ms 222 Assignment - 1Neelu AhluwaliaОценок пока нет

- Cfs NumericalsДокумент12 страницCfs NumericalsNeelu AhluwaliaОценок пока нет

- Funds Flow Statement: Numerical 1Документ4 страницыFunds Flow Statement: Numerical 1Neelu AhluwaliaОценок пока нет

- 15 Factors Affecting Entrepreneurial GrowthДокумент22 страницы15 Factors Affecting Entrepreneurial GrowthNeelu AhluwaliaОценок пока нет

- 15 Factors Affecting Entrepreneurial GrowthДокумент4 страницы15 Factors Affecting Entrepreneurial GrowthNeelu AhluwaliaОценок пока нет

- Questionnaire: Personality FactorДокумент4 страницыQuestionnaire: Personality FactorNeelu AhluwaliaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- COGELSA Food Industry Catalogue LDДокумент9 страницCOGELSA Food Industry Catalogue LDandriyanto.wisnuОценок пока нет

- TT Class XII PDFДокумент96 страницTT Class XII PDFUday Beer100% (2)

- XI STD Economics Vol-1 EM Combined 12.10.18 PDFДокумент288 страницXI STD Economics Vol-1 EM Combined 12.10.18 PDFFebin Kurian Francis0% (1)

- Emergency and Safety ProceduresДокумент22 страницыEmergency and Safety Procedurespaupastrana94% (17)

- 7Документ101 страница7Navindra JaggernauthОценок пока нет

- We Move You. With Passion.: YachtДокумент27 страницWe Move You. With Passion.: YachthatelОценок пока нет

- Petitioner's Response To Show CauseДокумент95 страницPetitioner's Response To Show CauseNeil GillespieОценок пока нет

- EW160 AlarmsДокумент12 страницEW160 AlarmsIgor MaricОценок пока нет

- Bank of AmericaДокумент1 страницаBank of AmericaBethany MangahasОценок пока нет

- Economies and Diseconomies of ScaleДокумент7 страницEconomies and Diseconomies of Scale2154 taibakhatunОценок пока нет

- UCAT SJT Cheat SheetДокумент3 страницыUCAT SJT Cheat Sheetmatthewgao78Оценок пока нет

- Binder 1Документ107 страницBinder 1Ana Maria Gálvez Velasquez0% (1)

- 87 - Case Study On Multicomponent Distillation and Distillation Column SequencingДокумент15 страниц87 - Case Study On Multicomponent Distillation and Distillation Column SequencingFranklin Santiago Suclla Podesta50% (2)

- MBA - Updated ADNU GSДокумент2 страницыMBA - Updated ADNU GSPhilip Eusebio BitaoОценок пока нет

- PlsqldocДокумент21 страницаPlsqldocAbhishekОценок пока нет

- Pthread TutorialДокумент26 страницPthread Tutorialapi-3754827Оценок пока нет

- HP Sustainability Impact Report 2018Документ147 страницHP Sustainability Impact Report 2018Rinaldo loboОценок пока нет

- QG To AIS 2017 PDFДокумент135 страницQG To AIS 2017 PDFMangoStarr Aibelle VegasОценок пока нет

- MLT Torque Ring Field Make-Up HandbookДокумент44 страницыMLT Torque Ring Field Make-Up HandbookKolawole Adisa100% (2)

- Tenancy Law ReviewerДокумент19 страницTenancy Law ReviewerSef KimОценок пока нет

- CRC Implementation Code in CДокумент14 страницCRC Implementation Code in CAtul VermaОценок пока нет

- Insurance Smart Sampoorna RakshaДокумент10 страницInsurance Smart Sampoorna RakshaRISHAB CHETRIОценок пока нет

- Acevac Catalogue VCD - R3Документ6 страницAcevac Catalogue VCD - R3Santhosh KumarОценок пока нет

- Codex Standard EnglishДокумент4 страницыCodex Standard EnglishTriyaniОценок пока нет

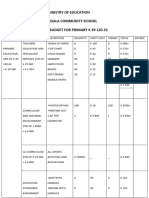

- Ministry of Education Musala SCHДокумент5 страницMinistry of Education Musala SCHlaonimosesОценок пока нет

- Majalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFДокумент1 страницаMajalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFBalqis Ar-Rubayyi' Binti HasanОценок пока нет

- Frigidaire Parts and Accessories CatalogДокумент56 страницFrigidaire Parts and Accessories CatalogPedro RuizОценок пока нет

- Conflict WaiverДокумент2 страницыConflict WaiverjlurosОценок пока нет

- Toa Valix Vol 1Документ451 страницаToa Valix Vol 1Joseph Andrei BunadoОценок пока нет