Академический Документы

Профессиональный Документы

Культура Документы

Audit

Загружено:

shivangiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Audit

Загружено:

shivangiАвторское право:

Доступные форматы

Chap – 1 : Nature of Auditing

INTRODUCTION

— Professional judgment: He should apply relevant training, knowledge &

•‘AUDITING’ → Derived from Latin word → “ Audire” = To hear experience in making decisions.

— Professional skepticism: He should have questioning mind and be alert to

DEFINITION: conditions indicating doubts.

As per General Guidelines on Internal Auditing issued by ICAI, ► He should have a good knowledge of:

Auditing is defined as, — The general principles of law (Contracts Act, Partnership Act, etc.)

► a systematic and independent examination of data, statements, — The Nature of clients business

records, operations and performances (financial or otherwise) of an enterprise — General economic trends and scenario

► for a stated purpose. — Specific regulations & provisions (Companies Act, Trust Act, etc.)

► In any auditing situation, the auditor — Accounting & auditing concepts (AS, SAs, Principles, etc.)

-perceives and recognizes the propositions before — Data Processing i.e. computers

him for examination, ► He should continuously update his knowledge.

-collects evidence, ► He should have adequate practical experience under proper

-evaluates the same and supervision.

-on this basis formulates his judgment which is

communicated through his audit report. OBJECTIVES OF AUDIT:

Aspects of audit

1. Information conveyed by the statements is CLEAR and UNAMBIGUOUS. PRIMARY OBJECTIVE - EXPRESSION OF OPINION

2. Financial statements (hereafter referred as FS) are in CONFORMITY with (1) The objective of an audit of financial statements is to enable an auditor to

AS. express an opinion on such financial statements. His opinion helps

3. FS present TRUE and FAIR view of operational results. determination of true and fair view of the financial position and operating

4. None of the entries in books of entries are omitted. results of an enterprise.

5. The entries in books are adequately supported by evidence. (2) He should obtain reasonable assurance about whether financial

6. The Accounts have been drawn up with reference to entries in the books. statements as a whole are free from material misstatement. Auditor’s opinion is

not an absolute assurance due to inherent limitations of audit.

CUTE – CLEAR+ CONFORMITY+ TRUE and FAIR+ Evidence. (3) The auditor should review and assess the conclusions drawn from audit

evidences and on this basis form an overall conclusion as to whether:

(a) the financial information has been prepared using acceptable

THE AUDITOR accounting policies, which have been consistently applied;

(b) the financial information complies with relevant regulations and

1. The person conducting audit is known as the auditor; statutory requirements;

2. he makes a report to the person appointing him (c) there is adequate disclosure of all material matters relevant to the

3. in the form of an opinion on financial statements proper presentation of the financial information, subject to statutory

4. after due examination of accounting records and statements. requirements, where applicable.

5. Audit has to be conducted by a person having good knowledge of auditing (4) The audit report should contain a clear written expression of opinion on

& accounting concepts. the financial information.

6. In India, as per Companies Act, 2013 only Chartered Accountants can SECONDARY OBJECTIVE - DETECTION OF FRAUD &

conduct audit of companies. ERRORS

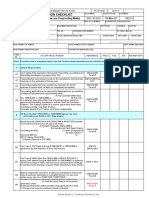

FUNCTIONAL CLASSIFICATION OF AUDITOR: (1) The auditor has to see that what the statements of account convey is true

S.NO INTERNAL AUDITOR EXTERNAL AUDITOR and not misleading and such errors & frauds do not exist as to distort what

the accounts really should convey.

(2) If an auditor has a suspicion of existence of any fraud then he must extend

1 They are company employees. They work for an outside audit firm.

his audit procedures to clear the doubts. His duty is to detect a fraud not to Procedural Errors.

1.An accounting system includes both records and procedures.

prevent it.

2 They will examine issues related They examine the financial records 2. Any breakdown in the laid down procedures may result in an error.

(3) An auditor is not bound to be a detective or to approach his work with 3.Errors which occur in the implementation of the procedures may be termed as procedural

to company business and issue an opinion regarding the

practices and risks. financial statements of the company suspicion. He is a watch dog, but not a bloodhound. Any undetected fraud errors.

in accounts, which can’t be observed in normal course of examination of 4.This type of error cannot be located by any rigorous examination of the books of account.

3 Scope of work – Is determined .Scope of work – Is determined by

accounts, will not be construed as failure of audit, provided the auditor was not Eg:It is the normal procedure that goods when received should be inspected for quality by the

by MANAGEMENT the STATUTE.

negligent in the carrying out his normal work. Re-Kingston Cotton Mills Co. inspection department staff. If the storekeeper carried out this function it is indeed risky.

4 NOT INDEPENDENT with INDEPENDENT of the management Similarly, if the procedure requires that the timber godown should have been given periodical

regard to management of the of the organization.

(4) The ultimate responsibility for control over Frauds & errors is of the

insecticide treatment and management has ignored that, a great loss may be caused to the

organization. management. So, management should install controls to ensure compilation of timber by white ants.

reliable statements of account.

5 They may or may not be Only qualified professionals are ERRORS Frauds

qualified professionals. eligible to conduct External Audit.

As per SA 240 “The Auditor’s Responsibility to Consider Fraud and Error in an Audit of Financial

Statements”, Fraud is:

6 Appointed by – MANAGEMENT. Appointed by – OWNERS (SHARE

an intentional act by one or more individuals among management, those charged with

HOLDERS).

governance, employees or third parties,

7 They provide advice and other They are constrained from involving the use of deception

consulting assistance to supporting an audit client too to obtain an unjust or illegal advantage.

employees. closely Fraud involving one or more members of management or those charged with governance is

referred to as ‘management fraud’; fraud involving only employees of the entity is referred to as

QUALITIES OF AN AUDITOR: ‘employee fraud’. Risk of management fraud being undetected is higher than risk of employee

fraud being undetected.

► As per SA 200: As per SA 240, frauds can occur in two types:

— Integrity : Auditor should be straight forward, honest & sincere in (1) Fraudulent Financial Reporting

performing his duties. It involves intentional misstatements in financial statements with an intention to deceive

— Objectivity : He should be fair & unbiased in his approach. and conceal truth, by way of alteration of accounting records or documents, omission of

transactions or information or misapplication of accounting principles

— Independence: He should maintain an impartial attitude and be free of any

(2) Misappropriation of Assets

interest. His judgment should not be affected by the wishes or It involves theft of an entity’s assets accompanied by falsification of records to conceal the fact.

directions of another person.

TEMPLATE DESIGN © 2008

www.PosterPresentations.com

Вам также может понравиться

- Audit Preparation ListДокумент2 страницыAudit Preparation ListRajanОценок пока нет

- B Plan Mobile SalonДокумент4 страницыB Plan Mobile SalonShristi Gupta100% (1)

- ISD PCA ChecklistДокумент4 страницыISD PCA ChecklistPetrrОценок пока нет

- Iqa Audit Checklist Form 4 EempsdДокумент22 страницыIqa Audit Checklist Form 4 EempsdRonald PreОценок пока нет

- ISO 9001 Tips for Internal AuditingДокумент12 страницISO 9001 Tips for Internal Auditingabdul qudoosОценок пока нет

- Purchasing approval and vendor performance testingДокумент28 страницPurchasing approval and vendor performance testingLiew Chee KiongОценок пока нет

- Mock Exam QuestionsДокумент11 страницMock Exam QuestionsAlina TariqОценок пока нет

- Hyderabad 30062016Документ29 страницHyderabad 30062016Pratigya KoiralaОценок пока нет

- Policy On Prohibition of Child LaborДокумент2 страницыPolicy On Prohibition of Child LaborkkyuvarajОценок пока нет

- Audit Reviewer (Quiz)Документ12 страницAudit Reviewer (Quiz)Chrispy ChickenОценок пока нет

- Bank Audit 2015 PointsДокумент25 страницBank Audit 2015 PointsJAWED MOHAMMADОценок пока нет

- Sa 250Документ2 страницыSa 250Akash PatelОценок пока нет

- Introduction To Internal AuditДокумент17 страницIntroduction To Internal AuditChica Amelia SupriyadiОценок пока нет

- Auditing ReportДокумент47 страницAuditing ReportNoj WerdnaОценок пока нет

- AUDITING AND ASSURANCE STANDARDS GUIDEДокумент19 страницAUDITING AND ASSURANCE STANDARDS GUIDEPankaj KumarОценок пока нет

- ISO9001 Internal Audit ChecklistДокумент24 страницыISO9001 Internal Audit ChecklistFatimaezzahraa BouaalamОценок пока нет

- NEOM - Ariba Registration Guide (En) - Mar 2021Документ17 страницNEOM - Ariba Registration Guide (En) - Mar 2021OmaisОценок пока нет

- Saudi Aramco Test Report Punch List FormДокумент1 страницаSaudi Aramco Test Report Punch List FormAnonymous S9qBDVkyОценок пока нет

- How To Budget An ISO 45001 Implementation ProjectДокумент12 страницHow To Budget An ISO 45001 Implementation ProjectShahnawaz PathanОценок пока нет

- Audit TermsДокумент30 страницAudit TermsZeeshan Shafique100% (1)

- HFY 3800 0000 VED 192 QC PD 0010 - A Surface Prepa and Painting Proce - Code BДокумент72 страницыHFY 3800 0000 VED 192 QC PD 0010 - A Surface Prepa and Painting Proce - Code BMohamed FarisОценок пока нет

- CAL-000 Test and Calibrated EquipmentДокумент6 страницCAL-000 Test and Calibrated EquipmentEllis HowardОценок пока нет

- Factsheet Internal Audit Engagement Work Papers 230404 204818Документ4 страницыFactsheet Internal Audit Engagement Work Papers 230404 204818valesta valestaОценок пока нет

- Pub100373 PDFДокумент12 страницPub100373 PDFedgelcer100% (1)

- Welcome To Presentation By: Knowledge SeekersДокумент39 страницWelcome To Presentation By: Knowledge Seekersfaraazxbox1Оценок пока нет

- Internal Quality Audit Rev 00Документ26 страницInternal Quality Audit Rev 00Keith AmorОценок пока нет

- Lecture 12 - Standards On Auditing (SA 560, 570 and 580)Документ7 страницLecture 12 - Standards On Auditing (SA 560, 570 and 580)Harshit Jain100% (1)

- Audit Plan Template For Internal Audit of Medical CollegeДокумент5 страницAudit Plan Template For Internal Audit of Medical CollegeJayabrata MajumdarОценок пока нет

- Inspection and Test Plan (Itp) For Fabrication Pressure Vessel Inspection and Test Plan (ITP) For Fabrication Pressure VesselДокумент1 страницаInspection and Test Plan (Itp) For Fabrication Pressure Vessel Inspection and Test Plan (ITP) For Fabrication Pressure VesselNikki RobertsОценок пока нет

- Pentair Noida ARG-407503 WI-820614 Audit ReportДокумент13 страницPentair Noida ARG-407503 WI-820614 Audit ReportHolly SmithОценок пока нет

- ISO 9001 Audit of Rove Hotels LLC Identifies Risk and Opportunity Management Needs ImprovementДокумент3 страницыISO 9001 Audit of Rove Hotels LLC Identifies Risk and Opportunity Management Needs ImprovementOmar MuktharОценок пока нет

- ISO 9001 Internal Audit Checklist GuidanceДокумент4 страницыISO 9001 Internal Audit Checklist GuidanceemilianoОценок пока нет

- ISACA CPE CertificateДокумент6 страницISACA CPE CertificateAlexander KnorrОценок пока нет

- Saic A 1017Документ1 страницаSaic A 1017jerinОценок пока нет

- Saudi Aramco Inspection Checklist: Welding Overlay Workmanship Assessment SAIC-W-2027 31-Aug-11 MechДокумент1 страницаSaudi Aramco Inspection Checklist: Welding Overlay Workmanship Assessment SAIC-W-2027 31-Aug-11 MechAnonymous 4e7GNjzGWОценок пока нет

- Quality Audit NotesДокумент17 страницQuality Audit NotesFlex GodОценок пока нет

- SAIC L 2031 (Comments)Документ2 страницыSAIC L 2031 (Comments)Anton Thomas PunzalanОценок пока нет

- ISA 610 Using The Work of Internal AuditorsДокумент4 страницыISA 610 Using The Work of Internal AuditorsNURUL FAEIZAH BINTI AHMAD ANWAR / UPMОценок пока нет

- Lecture 17 - Standards On Auditing (SA 330 and 450)Документ6 страницLecture 17 - Standards On Auditing (SA 330 and 450)Aruna RajappaОценок пока нет

- Business Process Audit Cycle: AuditorДокумент2 страницыBusiness Process Audit Cycle: AuditorRavi javaliОценок пока нет

- Module On Internal AuditДокумент15 страницModule On Internal AuditM Kamran AkhtarОценок пока нет

- The Program of QmsДокумент16 страницThe Program of QmsHamza Sharif AdamОценок пока нет

- Audit Plan TemplateДокумент3 страницыAudit Plan TemplateWalid MarhabaОценок пока нет

- I A Awareness Presentation Internal Audit ProcessesДокумент30 страницI A Awareness Presentation Internal Audit ProcessesYogesh CheedellaОценок пока нет

- US Audit Learning Framework Overview: The Better The Question. The Better The Answer. The Better The World WorksДокумент5 страницUS Audit Learning Framework Overview: The Better The Question. The Better The Answer. The Better The World WorksMateoLagardoОценок пока нет

- SOP HTA Internal AuditДокумент13 страницSOP HTA Internal Auditjulita08Оценок пока нет

- PPQCДокумент14 страницPPQCখালিদহাসানОценок пока нет

- Saic A 1002Документ2 страницыSaic A 1002Sajid ShaikhОценок пока нет

- Audit checklist templates for quality, EMS and OH&S management systemsДокумент4 страницыAudit checklist templates for quality, EMS and OH&S management systemssrsureshrajanОценок пока нет

- Saudi Aramco Hardness Testing Procedure ReviewДокумент3 страницыSaudi Aramco Hardness Testing Procedure ReviewphilipyapОценок пока нет

- Saudi Aramco Inspection Checklist: Top Coating Application (Intumescent Fireproofing Matls) 15-Nov-17Документ5 страницSaudi Aramco Inspection Checklist: Top Coating Application (Intumescent Fireproofing Matls) 15-Nov-17Abdul HannanОценок пока нет

- Pankaj Sir Revision Charts-1-26 PDFДокумент26 страницPankaj Sir Revision Charts-1-26 PDFVaibhav GuptaОценок пока нет

- Process Audit ReportДокумент2 страницыProcess Audit ReportOlexei SmartОценок пока нет

- INSPECTION BODY SELF-ASSESSMENT CHECKLISTДокумент34 страницыINSPECTION BODY SELF-ASSESSMENT CHECKLISTBobby IM SibaraniОценок пока нет

- Auditing and PrinciplesДокумент16 страницAuditing and PrinciplesMilena RancicОценок пока нет

- Comprehensive Compliance NimonikДокумент29 страницComprehensive Compliance NimonikJamsari Sulaiman100% (1)

- Internal Audit Manual - Government of MacedoniaДокумент174 страницыInternal Audit Manual - Government of Macedoniaoptical420Оценок пока нет

- Internal ControlДокумент14 страницInternal ControlHemangОценок пока нет

- Saudi Aramco Inspection Checklist: Buttering and / or Weld Build-Up - Offshore Structures SAIC-W-1311 WeldДокумент1 страницаSaudi Aramco Inspection Checklist: Buttering and / or Weld Build-Up - Offshore Structures SAIC-W-1311 Weldkartik_harwani4387Оценок пока нет

- Apa Sponsorship BookletДокумент22 страницыApa Sponsorship BookletTrouvaille BaliОценок пока нет

- Ikea 6Документ39 страницIkea 6My PhamОценок пока нет

- Financial Performance Evaluation Using RATIO ANALYSISДокумент31 страницаFinancial Performance Evaluation Using RATIO ANALYSISGurvinder Arora100% (1)

- The Meatpacking Factory: Dardenbusinesspublishing:228401Документ2 страницыThe Meatpacking Factory: Dardenbusinesspublishing:228401354Prakriti SharmaОценок пока нет

- Design Thinking: by Cheryl Marlitta Stefia. S.T., M.B.A., QrmaДокумент18 страницDesign Thinking: by Cheryl Marlitta Stefia. S.T., M.B.A., QrmaRenaldiОценок пока нет

- Hrmsr83pay b1001Документ988 страницHrmsr83pay b1001Vinay KuchanaОценок пока нет

- Ihc Insight Aug 2015Документ21 страницаIhc Insight Aug 2015Advan ZuidplasОценок пока нет

- Kalyan Pharma Ltd.Документ33 страницыKalyan Pharma Ltd.Parth V. PurohitОценок пока нет

- Walmart Research PlanДокумент7 страницWalmart Research PlanErin TurnerОценок пока нет

- CH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third EditionДокумент15 страницCH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third Editionapi-3699912Оценок пока нет

- Export Manager or Latin America Sales ManagerДокумент3 страницыExport Manager or Latin America Sales Managerapi-77675289Оценок пока нет

- Yamaha Piano Contract DisputeДокумент11 страницYamaha Piano Contract DisputeGalvin ChongОценок пока нет

- Wilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Документ140 страницWilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Mantenimiento CoinogasОценок пока нет

- Electronic Banking ModelsДокумент7 страницElectronic Banking Modelserger88100% (1)

- Basel III Capital Regulations and Liquidity StandardsДокумент40 страницBasel III Capital Regulations and Liquidity Standardsrodney101Оценок пока нет

- 3.time Value of Money..F.MДокумент21 страница3.time Value of Money..F.MMarl MwegiОценок пока нет

- MIC 2e Study Guide Complete 2Документ230 страницMIC 2e Study Guide Complete 2anna_jankovskaОценок пока нет

- Ofada Rice ProductionДокумент97 страницOfada Rice ProductionPrince Oludare AkintolaОценок пока нет

- Lectura 2 - Peterson Willie, Reinventing Strategy - Chapters 7,8, 2002Документ42 страницыLectura 2 - Peterson Willie, Reinventing Strategy - Chapters 7,8, 2002jv86Оценок пока нет

- BAC Resolution For AMPДокумент2 страницыBAC Resolution For AMPMark Gene SalgaОценок пока нет

- The Science Behind The 4lifetm Pay PlanДокумент24 страницыThe Science Behind The 4lifetm Pay Planapi-282063528Оценок пока нет

- Marketing Management Chapter on Introducing New Market OfferingsДокумент24 страницыMarketing Management Chapter on Introducing New Market OfferingslokioОценок пока нет

- GST 310319Документ66 страницGST 310319Himmy PatwaОценок пока нет

- CV B Sahoo (AGM) 101121Документ4 страницыCV B Sahoo (AGM) 101121Benudhar SahooОценок пока нет

- ASSIGNMENT LAW 2 (TASK 1) (2) BBBДокумент4 страницыASSIGNMENT LAW 2 (TASK 1) (2) BBBChong Kai MingОценок пока нет

- E Channel Product FinalДокумент100 страницE Channel Product Finalakranjan888Оценок пока нет

- RFI Vs eRFIДокумент6 страницRFI Vs eRFITrade InterchangeОценок пока нет

- Cases On CommodatumДокумент10 страницCases On CommodatumAlfons Janssen MarceraОценок пока нет