Академический Документы

Профессиональный Документы

Культура Документы

ME 291 Engineering Economy: Present Worth Analysis of Different Alternatives

Загружено:

Ehsan Ur Rehman0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров7 страницGIKI Engineering Economy Lectures

Оригинальное название

Lecture 14

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGIKI Engineering Economy Lectures

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров7 страницME 291 Engineering Economy: Present Worth Analysis of Different Alternatives

Загружено:

Ehsan Ur RehmanGIKI Engineering Economy Lectures

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

ME 291

Engineering

ME-291 Engineering Economy

Economy

Lecture 14

Present Worth Analysis of different

Alternatives

Faculty of Mechanical Engineering

Ghulam Ishaq Khan Institute, Topi, Swabi

© Faculty of Mechanical Engineering, GIKI

Present Worth analysis of different-life

alternatives

• The PW of the alternative must be compared

ME-291 Engineering Economy

over the same number of years.

• Compare the alternatives over a period of

time equal to the least common multiple

(LCM) of their lives

• Compare the alternatives using a study

period of length n years, which does not

necessarily take into consideration the useful

lives of the alternatives. This is also called

the planning horizon approach.

© Faculty of Mechanical Engineering, GIKI

LCM Approach

• The service provided by the alternatives will

ME-291 Engineering Economy

be needed for the LCM of years or more.

• The selected alternative will be repeated

over each life cycle of the LCM in exactly the

same manner.

• The cash flow estimates will be the same in

every life cycle.

© Faculty of Mechanical Engineering, GIKI

Study Period Approach

• A study period analysis is necessary if the first assumption

ME-291 Engineering Economy

about the length of time, the alternatives are needed, cannot

be made.

• A time horizon is chosen over which the economic analysis

is conducted, and only those cash flows, which occur during

that time period, are considered relevant to the analysis.

• All cash flows occurring beyond the study period are

ignored.

• An estimated market value at the end of the study period

must be made.

• It is useful when LCM of alternatives yields an unrealistic

evaluation period, for example, 5 and 9 years.

© Faculty of Mechanical Engineering, GIKI

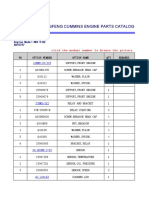

Example 5.2

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Future Worth Analysis

• The future worth analysis (FW) of an alternative may be

ME-291 Engineering Economy

determined directly from the cash flows by determining the

future worth value, or by multiplying the PW value by the

F/P factor, at the established MARR.

• Therefore, FWA is an extension of PW Analysis.

• FW values are especially applicable to large capital

investment decisions when a prime goal is to maximize the

future wealth of a corporation’s stockholders.

• It is often utilized if the assets might be sold or traded at

some time after its start-up, but before the expected life is

reached.

• Also FW can be used for the projects that will not come

online until the end of the investment period. e.g. electric

generation facilities, roads, hotels, can be analyzed using

the FW value of investment commitments made during

construction.

© Faculty of Mechanical Engineering, GIKI

Future Worth Analysis

• Once the future value is determined, the selection

ME-291 Engineering Economy

guideline is the same as the PW analysis;

• FW ≥ 0 means the MARR is met or exceeded (one

alternative).

• For two or more mutually exclusive alternatives, select

the one with the numerically larger (largest) FW value.

© Faculty of Mechanical Engineering, GIKI

Вам также может понравиться

- POGIL - Work, Power, and Kinetic Energy PDFДокумент5 страницPOGIL - Work, Power, and Kinetic Energy PDFEMERSON QUICHE VELASQUEZОценок пока нет

- Group 4-2 Construction Estimates and Values EngineeringДокумент48 страницGroup 4-2 Construction Estimates and Values EngineeringKristelCruzCayetano100% (4)

- Schulz Compressor Manual (English) FinalДокумент31 страницаSchulz Compressor Manual (English) FinalEhsan Ur RehmanОценок пока нет

- UPS Battery Systems - ENДокумент16 страницUPS Battery Systems - ENChris Tan100% (2)

- J H Hooper Confectionery Packaging EquipmentДокумент283 страницыJ H Hooper Confectionery Packaging Equipmentphucborso1Оценок пока нет

- Rockshox Reba 2015 Service Manual PDFДокумент30 страницRockshox Reba 2015 Service Manual PDFJose Luis GutierrezОценок пока нет

- ME 291 Engineering Economy: Capitalized Cost Calculation and AnalysisДокумент8 страницME 291 Engineering Economy: Capitalized Cost Calculation and AnalysisEhsan Ur RehmanОценок пока нет

- Lecture 16Документ11 страницLecture 16salmanshahidkhanОценок пока нет

- ME 291 Engineering Economy: Present Worth AnalysisДокумент13 страницME 291 Engineering Economy: Present Worth AnalysisEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: ROR: Multiple AlternativesДокумент12 страницME 291 Engineering Economy: ROR: Multiple AlternativessalmanshahidkhanОценок пока нет

- ME 291 Engineering Economy: Comparison On The Basis of CC and Payback Period AnalysisДокумент11 страницME 291 Engineering Economy: Comparison On The Basis of CC and Payback Period AnalysisEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: ROR: Multiple AlternativesДокумент12 страницME 291 Engineering Economy: ROR: Multiple AlternativesEhsan Ur RehmanОценок пока нет

- Lecture 8 9Документ15 страницLecture 8 9salmanshahidkhanОценок пока нет

- ME 291 Engineering Economy: Combining FactorsДокумент15 страницME 291 Engineering Economy: Combining FactorsEhsan Ur RehmanОценок пока нет

- ME 291 Engineering EconomyДокумент16 страницME 291 Engineering EconomyEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: ROR Evaluation Using PW & AWДокумент6 страницME 291 Engineering Economy: ROR Evaluation Using PW & AWEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: Lecture by Tariq S Khan Office # G-13 Phone: 2373 Email: Tariq@giki - Edu.pkДокумент9 страницME 291 Engineering Economy: Lecture by Tariq S Khan Office # G-13 Phone: 2373 Email: Tariq@giki - Edu.pkEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: Marr & Cash Flow DiagramsДокумент23 страницыME 291 Engineering Economy: Marr & Cash Flow DiagramsEhsan Ur RehmanОценок пока нет

- ME 291 Engineering Economy: ROR Evaluation Using PW & AWДокумент6 страницME 291 Engineering Economy: ROR Evaluation Using PW & AWsalmanshahidkhanОценок пока нет

- ME 291 Engineering Economy: Rate of Return Analysis: Single AlternativeДокумент9 страницME 291 Engineering Economy: Rate of Return Analysis: Single AlternativesalmanshahidkhanОценок пока нет

- Life Cycle Cost AnalysisДокумент6 страницLife Cycle Cost AnalysisLepanto SakyodОценок пока нет

- Wk9 - Ch6b - Comparison & Selection Among AlternativesДокумент13 страницWk9 - Ch6b - Comparison & Selection Among AlternativesrashiОценок пока нет

- Building Economics Life Cycle Cost AnalysisДокумент4 страницыBuilding Economics Life Cycle Cost AnalysisPrdeep SinghОценок пока нет

- IE440, MG440/TX 415: Engineering EconomicsДокумент23 страницыIE440, MG440/TX 415: Engineering Economicssteven johnОценок пока нет

- Enge 1013 Week 1 FinalsДокумент16 страницEnge 1013 Week 1 Finalsdarwin favilaОценок пока нет

- Submitted By: Nirdesh K. Sharma ROLL NO: 14102 Submitted To: Dr. Sumit AroraДокумент10 страницSubmitted By: Nirdesh K. Sharma ROLL NO: 14102 Submitted To: Dr. Sumit AroraPriya AggarwalОценок пока нет

- COEN 300 - Engineering Economy 1 Dr. Omar AlbataynehДокумент15 страницCOEN 300 - Engineering Economy 1 Dr. Omar Albataynehأزهار برديОценок пока нет

- EMG 2306 - Economic Considerations in Engineering DesignДокумент5 страницEMG 2306 - Economic Considerations in Engineering DesignZephaniah MuneneОценок пока нет

- 03 PDFДокумент11 страниц03 PDFSara BenavidesОценок пока нет

- 6 3 ReviewingmvplansДокумент16 страниц6 3 ReviewingmvplansAfiqОценок пока нет

- ME 291 Engineering Economy: Simple and Compound InterestДокумент15 страницME 291 Engineering Economy: Simple and Compound InterestEhsan Ur RehmanОценок пока нет

- Chapter 1 Introduction To Engineering EconomyДокумент10 страницChapter 1 Introduction To Engineering Economygar fieldОценок пока нет

- Lecture 3Документ23 страницыLecture 3ayesha zahidОценок пока нет

- Submitted To:: Mam AmmaraДокумент6 страницSubmitted To:: Mam AmmaraFahad KamranОценок пока нет

- Application of Value Management To Refurbishment Projects: A Sri Lankan Case StudyДокумент10 страницApplication of Value Management To Refurbishment Projects: A Sri Lankan Case StudyJM PanganibanОценок пока нет

- LN C1Документ61 страницаLN C1Sivanesh KumarОценок пока нет

- Engineering Economy 8 AnsДокумент31 страницаEngineering Economy 8 Ansgazzie rayОценок пока нет

- Eng233ch3 141001100602 Phpapp01 PDFДокумент38 страницEng233ch3 141001100602 Phpapp01 PDFLibyaFlowerОценок пока нет

- Lecture 09Документ3 страницыLecture 09api-26315128Оценок пока нет

- Time and Cost Comparision of PSC and RCCДокумент4 страницыTime and Cost Comparision of PSC and RCCmahakОценок пока нет

- Financial Evaluation of ProjectsДокумент14 страницFinancial Evaluation of ProjectsAnonymous ZF5XFjHL2UОценок пока нет

- ME 291 Engineering Economy: Rate of Return Analysis: Single AlternativeДокумент9 страницME 291 Engineering Economy: Rate of Return Analysis: Single AlternativeEhsan Ur RehmanОценок пока нет

- Feasibility Study, Economic Evaluation: and Preliminary DesignДокумент15 страницFeasibility Study, Economic Evaluation: and Preliminary DesignMike NderituОценок пока нет

- 01 86 26 Energy and Energy Analysis FinalДокумент3 страницы01 86 26 Energy and Energy Analysis FinalABAYNEGETAHUN getahunОценок пока нет

- Aiac 2009 115Документ13 страницAiac 2009 115Mehreen AzamОценок пока нет

- Department of Quantity Surveying Construction Economics: Life Cycle CostingДокумент17 страницDepartment of Quantity Surveying Construction Economics: Life Cycle Costing2024545171Оценок пока нет

- Chapter 1 Introduction To Engineering EconomyДокумент10 страницChapter 1 Introduction To Engineering EconomyCẩm Tú Trần ThịОценок пока нет

- Engineering Economins-Replacement and Retention DecisionsДокумент74 страницыEngineering Economins-Replacement and Retention DecisionsAlbany SmashОценок пока нет

- Lect-04 Engineering Economics and ManagmentДокумент29 страницLect-04 Engineering Economics and ManagmentAnas SheikhОценок пока нет

- Establishing Engineering S-Curves To Evaluate SupeДокумент13 страницEstablishing Engineering S-Curves To Evaluate SupePatrice AudetОценок пока нет

- Engineering Cost and Cost Estimating ch2 Lecture 5 (B)Документ19 страницEngineering Cost and Cost Estimating ch2 Lecture 5 (B)Doha anaОценок пока нет

- School of Mechanical Engineering: MEE 1904 Capstone Project Presentation-Review-B.Tech. Mechanical Engineering - SMECДокумент13 страницSchool of Mechanical Engineering: MEE 1904 Capstone Project Presentation-Review-B.Tech. Mechanical Engineering - SMECTarun magantiОценок пока нет

- Value Management in Construction ProjectДокумент6 страницValue Management in Construction ProjectLawal Abdul-Rasheed AyindeОценок пока нет

- Value ManagementДокумент6 страницValue ManagementAsankaОценок пока нет

- Strategic Mine Planning Flexible Mine Planning To Meet Changes in The Business EnvironmentДокумент18 страницStrategic Mine Planning Flexible Mine Planning To Meet Changes in The Business Environment11804Оценок пока нет

- Construction Estimates and Values EngineeringДокумент50 страницConstruction Estimates and Values EngineeringMark Austria100% (2)

- Value Engineering Application in Highway ProjectsДокумент5 страницValue Engineering Application in Highway Projectsthan zawОценок пока нет

- D. Present Worth Computation. The Present WorthДокумент3 страницыD. Present Worth Computation. The Present WorthCarlos AndradeОценок пока нет

- Value Engineering in Project FINALДокумент14 страницValue Engineering in Project FINALRaval ShivamОценок пока нет

- Mine Development - MN 2001 - v3 - Study MaterialДокумент50 страницMine Development - MN 2001 - v3 - Study MaterialalexstlensikiОценок пока нет

- Course Code ME-325: Engineering EconomicsДокумент29 страницCourse Code ME-325: Engineering EconomicsGet-Set-GoОценок пока нет

- Asphalt Design 4Документ3 страницыAsphalt Design 4Ina RoseОценок пока нет

- Career Change From Real Estate to Oil and Gas ProjectsОт EverandCareer Change From Real Estate to Oil and Gas ProjectsРейтинг: 5 из 5 звезд5/5 (1)

- Professional Solar Mounting SystemДокумент20 страницProfessional Solar Mounting SystemEhsan Ur RehmanОценок пока нет

- Mounting Structure PV SystemsДокумент36 страницMounting Structure PV SystemsEhsan Ur RehmanОценок пока нет

- Factory Accepting TestДокумент2 страницыFactory Accepting TestEhsan Ur RehmanОценок пока нет

- Section 1Документ4 страницыSection 1Ehsan Ur RehmanОценок пока нет

- Boundary Layer - Wind EnergyДокумент27 страницBoundary Layer - Wind EnergyEhsan Ur RehmanОценок пока нет

- Zwick Armaturen GMBH - Company ProfileДокумент2 страницыZwick Armaturen GMBH - Company ProfileEhsan Ur RehmanОценок пока нет

- Zwick Armaturen GMBH - Double Block & Bleed ValveДокумент2 страницыZwick Armaturen GMBH - Double Block & Bleed ValveEhsan Ur RehmanОценок пока нет

- Sr. No. Description Location Address Qty PO No. PO DateДокумент1 страницаSr. No. Description Location Address Qty PO No. PO DateEhsan Ur RehmanОценок пока нет

- Zwick Armaturen GMBH - Reference List MOL - Hungary (2010-2015)Документ1 страницаZwick Armaturen GMBH - Reference List MOL - Hungary (2010-2015)Ehsan Ur RehmanОценок пока нет

- Aip 15 32Документ1 страницаAip 15 32shakir hussainОценок пока нет

- Shell MESC Number 774133.010.1 (NEAREST)Документ2 страницыShell MESC Number 774133.010.1 (NEAREST)Ehsan Ur Rehman100% (1)

- Wind Turbine BladesДокумент5 страницWind Turbine BladesEhsan Ur RehmanОценок пока нет

- Sample Papers DPE 2017Документ73 страницыSample Papers DPE 2017sajidmughal333Оценок пока нет

- Lecture Frequency ControlДокумент35 страницLecture Frequency ControlEhsan Ur RehmanОценок пока нет

- Iecex Certification: Certified Ex EquipmentДокумент1 страницаIecex Certification: Certified Ex EquipmentEhsan Ur RehmanОценок пока нет

- PVWatts Calculator11Документ1 страницаPVWatts Calculator11IslamОценок пока нет

- Procedure For Recruitment, Selection & Mobilization of ManpowerДокумент6 страницProcedure For Recruitment, Selection & Mobilization of ManpowerEhsan Ur RehmanОценок пока нет

- NERC Balancing and Frequency Control 040520111Документ53 страницыNERC Balancing and Frequency Control 040520111pongpumОценок пока нет

- Return On Solar InverstmentДокумент27 страницReturn On Solar InverstmentEhsan Ur RehmanОценок пока нет

- Structural Considerations For Solar Installers PDFДокумент144 страницыStructural Considerations For Solar Installers PDFTarik AhasanОценок пока нет

- Design of Electrical Power Supply System in An Oil and Gas RefineryДокумент70 страницDesign of Electrical Power Supply System in An Oil and Gas Refinerydaniel_silabanОценок пока нет

- Optimal Rotor Tip Speed Ratio PDFДокумент10 страницOptimal Rotor Tip Speed Ratio PDFHani M. El-TouniОценок пока нет

- Land - Use RequirementsДокумент47 страницLand - Use RequirementsgaddipatimalliОценок пока нет

- Abb Furse Earthing A4 8pp Brochure FinalДокумент8 страницAbb Furse Earthing A4 8pp Brochure FinalTony BombataОценок пока нет

- 7 Ways To Achieve Operations Reliability: Asset Performance ManagementДокумент11 страниц7 Ways To Achieve Operations Reliability: Asset Performance ManagementEhsan Ur RehmanОценок пока нет

- Design of Earthing System For HV Ac SubstationДокумент9 страницDesign of Earthing System For HV Ac Substationwas00266Оценок пока нет

- AEE Webinar Green BuildingsДокумент1 страницаAEE Webinar Green BuildingsEhsan Ur RehmanОценок пока нет

- Eaton Motor Control Basic WiringДокумент14 страницEaton Motor Control Basic Wiringalmuamar5026100% (1)

- Automatic Float Switches 836 Series ABДокумент37 страницAutomatic Float Switches 836 Series ABJorge ReyesОценок пока нет

- SyllabusДокумент22 страницыSyllabusSohael AftabОценок пока нет

- Raw Mill Patroller Checklist Route 1Документ5 страницRaw Mill Patroller Checklist Route 1AbasiemekaОценок пока нет

- Ventilation CowlsДокумент12 страницVentilation CowlsShahadatuliskandar RosliОценок пока нет

- Application & Installation Guide Mounting: LEBW4974-06Документ44 страницыApplication & Installation Guide Mounting: LEBW4974-06Nicholas LindenfeldarОценок пока нет

- ECS416 Ammar Aiman (2020461314)Документ1 страницаECS416 Ammar Aiman (2020461314)Aniqah RushdaОценок пока нет

- Mxu 250 - Lb50ad (Ro) - 2009.06.23Документ150 страницMxu 250 - Lb50ad (Ro) - 2009.06.23serdeanuОценок пока нет

- Transport Phenomena PaperДокумент4 страницыTransport Phenomena Paperbhaskar5377100% (1)

- Intermot - Iam Complete CatalogueДокумент111 страницIntermot - Iam Complete CatalogueChristian StalinОценок пока нет

- Chapter-2 (Steel Design)Документ22 страницыChapter-2 (Steel Design)danica ledesmaОценок пока нет

- Asiatech Development & Builders (Adb) Corporation: Concrete Pouring ChecklistДокумент1 страницаAsiatech Development & Builders (Adb) Corporation: Concrete Pouring ChecklistGenevieve GayosoОценок пока нет

- 4B3.9G2 So10737Документ72 страницы4B3.9G2 So10737Alexis SanchezОценок пока нет

- DSI Mar03 UpdateДокумент437 страницDSI Mar03 UpdateAdel ALkhaligyОценок пока нет

- Hydraulic System: 5.1 Location of Main Hydraulic ComponentsДокумент53 страницыHydraulic System: 5.1 Location of Main Hydraulic ComponentsMinh TânОценок пока нет

- Asme Standards Specifications-1Документ72 страницыAsme Standards Specifications-1DHAVAL PANCHAL100% (1)

- Converting Pump Head To PressureДокумент3 страницыConverting Pump Head To PressureEngrArifОценок пока нет

- Millat Tractors Limited Final ReportДокумент15 страницMillat Tractors Limited Final ReportSaad SultanОценок пока нет

- Direct Inj L9707 Nissan PatrolДокумент36 страницDirect Inj L9707 Nissan PatrolRouba YounesОценок пока нет

- Workshop Manual Transporter 2016 10-29Документ109 страницWorkshop Manual Transporter 2016 10-29samueleОценок пока нет

- AccessTUNER Calibration & Tuning Guide Worksheet For Subarus v2.07Документ8 страницAccessTUNER Calibration & Tuning Guide Worksheet For Subarus v2.07Marcelo Tapia MaureiraОценок пока нет

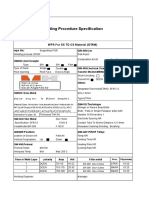

- Welding Procedure Specification: WPS For SS TO CS Material (GTAW)Документ1 страницаWelding Procedure Specification: WPS For SS TO CS Material (GTAW)Lipika GayenОценок пока нет

- Ufgs 41 22 13.15Документ60 страницUfgs 41 22 13.15Abdul wahid ButtОценок пока нет

- Industrial RoboticsДокумент77 страницIndustrial RoboticsIslam Fouad100% (4)

- Gas Dynamic Resonance Ignition For Repetitive StartsДокумент8 страницGas Dynamic Resonance Ignition For Repetitive StartsBrunno VasquesОценок пока нет

- HW 1 ForcesДокумент2 страницыHW 1 ForcesRebecca LuОценок пока нет

- SP 1212 Check SheetДокумент5 страницSP 1212 Check SheetDaniel MartinezОценок пока нет

- Range Rover Manual Service ToolsДокумент10 страницRange Rover Manual Service ToolsLouise RogersОценок пока нет