Академический Документы

Профессиональный Документы

Культура Документы

BCG Matrix: Presented By: Osama Nasir Qureshi and Hoor Shahid

Загружено:

Osama Nasir Qureshi0 оценок0% нашли этот документ полезным (0 голосов)

23 просмотров9 страницBCG Matrix Presentation

Оригинальное название

BCG Matrix1

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBCG Matrix Presentation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

23 просмотров9 страницBCG Matrix: Presented By: Osama Nasir Qureshi and Hoor Shahid

Загружено:

Osama Nasir QureshiBCG Matrix Presentation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

BCG MATRIX

Presented by: Osama Nasir Qureshi and Hoor Shahid.

WHAT ACTUALLY IS A BCG MATRIX

The BCG Growth-Share Matrix is a portfolio planning model developed by

Bruce Henderson of the Boston Consulting Group in the early 1970's.

The Boston Consulting group’s product portfolio matrix (BCG matrix) is

designed to help with long-term strategic planning, to help a business

consider growth opportunities by reviewing its portfolio of products to decide

where to invest, to discontinue or develop products.

The technique is particularly useful for multi-divisional or multi-product

companies. The divisions or products compromise the organizations “Business

Portfolio”. The composition of this portfolio can be critical to the growth and

success of the company.

COMPOSITION OF THE BCG

MATRIX

• The Matrix is divided into 4 quadrants derived on two variables namely,

market growth and relative market share.

•

It is based on the observation that a company’s business units can be

classified into four categories based on combinations of market growth and

relative market share to the largest competitor. The market growth rate is

shown on the vertical (y) axis and the relative market share is shown on the

horizontal (x) axis.

• Market growth serves as a proxy for industry attractiveness, and relative

market share serves as a proxy for competitive advantage. The growth-share

matrix thus maps the business unit positions within these two important

determinants of profitability.

• There are four quadrants into which firms brands are classified:-

• Dogs. Dogs hold low market share compared to competitors and operate in

a slowly growing market. In general, they are not worth investing in because

they generate low or negative cash returns. But this is not always the truth.

Some dogs may be profitable for long period of time, they may provide

synergies for other brands or SBUs or simple act as a defense to counter

competitors moves.

• Strategies for Dogs – Depending on the amount of cash which is already

invested in this quadrant, the company can either divest the product

altogether or it can revamp the product through rebranding / innovation /

adding features etc. However, moving a dog towards a star or a cash cow is

very difficult. It can be moved only to the question mark region where again

the future of the product is unknown. Thus in cases of Dog products,

divestment strategy is used.

• Cash Cows. The cornerstone of any multi product business, cash cows are

products which are having a high market share in a low growing market. As

the market is not growing, that cash cow gains the maximum advantage by

generating maximum revenue due to its high market share. Thus for any

company, the cash cows are the ones which require least investment but at

the same time give higher returns.

• Strategies for cash cow – The cash cows are the most stable for any business

and hence the strategy generally includes retention of the market share. As

the market is not growing, acquisition is less and customer retention is high.

Thus customer satisfaction programs, loyalty programs and other such

promotional methods form the core of the marketing plan for a cash cow

product / SBU.

• Stars. Stars operate in high growth industries and maintain high market share.

Stars are both cash generators and cash users. They are the primary units in

which the company should invest its money, because stars are expected to

become cash cows and generate positive cash flows. Yet, not all stars

become cash flows. This is especially true in rapidly changing industries,

where new innovative products can soon be outcompeted by new

technological advancements, so a star instead of becoming a cash cow,

becomes a dog.

• Strategies for Stars – All types of marketing, sales promotion and advertising

strategies are used for Stars. This is because in cash cow, already these

strategies have been used and they have resulted in the formation of a cash

cow. Similarly in Stars, because of the high competition and rising market

share, the concentration and investment needs to be high in

marketing activities so as to increase and retain market share.

• Question Marks. Question marks are the brands that require much closer

consideration. They hold low market share in fast growing markets

consuming large amount of cash and incurring losses. It has potential to gain

market share and become a star, which would later become cash cow.

Question marks do not always succeed and even after large amount of

investments they struggle to gain market share and eventually become

dogs. Therefore, they require very close consideration to decide if they are

worth investing in or not.

• Strategies for Question marks – As they are new entry products with high

growth rate, the growth rate needs to be capitalized in such a manner that

question marks turn into high market share products. New Customer

acquisition strategies are the best strategies for converting Question marks to

Stars or Cash cows. Furthermore, time to time market research also helps in

determining consumer psychology for the product as well as the possible

future of the product and a hard decision might have to be taken if the

product goes into negative profitability.

SEQUENCES IN THE MATRIX

• Successive Sequences in BCG Matrix. The Success sequence of BCG matrix

happens when a question mark becomes a Star and finally it becomes a

cash cow. This is the best sequence which really give a boost to the

companies profits and growth. The success sequence unlike the disaster

sequence is entirely dependent on the right decision making.

• Disaster Sequences in BCG Matrix. Disaster sequence of BCG matrix happens

when a product which is a cash cow, due to competitive pressure might be

moved to a star. It fails out from the competition and it is moved to a

question mark and finally it may have to be divested because of its low

market share and low growth rate. Thus the disaster sequence might happen

because of wrong decision making.

STRATEGIES BASED ON BCG

MATRIX

• There are four strategies possible for any product / SBU and these are the strategies

which are used after the BCG analysis. These strategies are

• 1) Build – By increasing investment, the product is given an impetus such that the

product increases its market share. Example – Pushing a Question mark into a Star and

finally a cash cow (Success sequence)

• 2) Hold – The company cannot invest or it has other investment commitments due to

which it holds the product in the same quadrant. Example – Holding a star there itself as

higher investment to move a star into cash cow is currently not possible.

• 3) Harvest – Best observed in the Cash cow scenario, wherein the company reduces the

amount of investment and tries to take out maximum cash flow from the said product

which increases the overall profitability.

• 4) Divest – Best observed in case of Dog quadrant products which are generally divested

to release the amount of money already stuck in the business.

• Thus the BCG matrix is the best way for a business portfolio analysis. The strategies

recommended after BCG analysis help the firm decide on the right line of action and

help them implement the same.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Keywords:-Career Levels, Employee Competency, Job: Satisfaction, Organizational CapabilityДокумент9 страницKeywords:-Career Levels, Employee Competency, Job: Satisfaction, Organizational CapabilityInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- PWC Taxavvy 18 2020 Mco PDFДокумент12 страницPWC Taxavvy 18 2020 Mco PDFMichael YapОценок пока нет

- Tribebook Wendigo Revised Edition 6244638Документ109 страницTribebook Wendigo Revised Edition 6244638PedroОценок пока нет

- Synopsis On Employee LifecycleДокумент12 страницSynopsis On Employee LifecycleDeepak SinghОценок пока нет

- Stock Market Prediction Using Machine Learning ProposalДокумент10 страницStock Market Prediction Using Machine Learning ProposalBilal AhmedОценок пока нет

- 659.69 BM67 2018-02-06 02 Im Beu-UsaДокумент88 страниц659.69 BM67 2018-02-06 02 Im Beu-UsaIrakli JibladzeОценок пока нет

- Divorce: in The PhilippinesДокумент4 страницыDivorce: in The PhilippinesKidMonkey2299Оценок пока нет

- 6 Cathay vs. VazquezДокумент2 страницы6 Cathay vs. VazquezErwin BernardinoОценок пока нет

- Creative WritingДокумент13 страницCreative WritingBeberly Kim AmaroОценок пока нет

- Italian Companies Eastern China - JAN 2014Документ139 страницItalian Companies Eastern China - JAN 2014AndresОценок пока нет

- Ermita Malate Hotel Motel Operators V City Mayor DigestДокумент1 страницаErmita Malate Hotel Motel Operators V City Mayor Digestpnp bantay100% (2)

- IX Paper 2Документ19 страницIX Paper 2shradhasharma2101Оценок пока нет

- John Lear UFO Coverup RevelationsДокумент30 страницJohn Lear UFO Coverup RevelationscorneliusgummerichОценок пока нет

- (NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019Документ80 страниц(NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019rthedthbdeth100% (1)

- 3 - Accounting For Loans and ImpairmentДокумент1 страница3 - Accounting For Loans and ImpairmentReese AyessaОценок пока нет

- Effects of Changes in Foreign Exchange Rates Ias 21Документ11 страницEffects of Changes in Foreign Exchange Rates Ias 21cykenОценок пока нет

- Click To Enlarge (The Skeptic's Annotated Bible, Hosea)Документ11 страницClick To Enlarge (The Skeptic's Annotated Bible, Hosea)Philip WellsОценок пока нет

- Wp406 DSP Design ProductivityДокумент14 страницWp406 DSP Design ProductivityStar LiОценок пока нет

- Theory of Design 2Документ98 страницTheory of Design 2Thirumeni MadavanОценок пока нет

- browningsong 안동Документ68 страницbrowningsong 안동yooОценок пока нет

- Look 4 - Unit 4Документ14 страницLook 4 - Unit 4Noura AdhamОценок пока нет

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Документ7 страницAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Big Game Guide: - Antelope - Bighorn Sheep - Deer - ElkДокумент46 страницBig Game Guide: - Antelope - Bighorn Sheep - Deer - ElkRoeHuntingResourcesОценок пока нет

- Loneliness in Carson Mcculler's The Heart Is A Lonely HunterДокумент3 страницыLoneliness in Carson Mcculler's The Heart Is A Lonely HunterRahul SharmaОценок пока нет

- Personal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulДокумент6 страницPersonal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulKanchanОценок пока нет

- Full Download Book The Genus Citrus PDFДокумент41 страницаFull Download Book The Genus Citrus PDFwilliam.rose150100% (14)

- Using Open-Ended Tools in Facilitating Mathematics and Science LearningДокумент59 страницUsing Open-Ended Tools in Facilitating Mathematics and Science LearningDomina Jayne PagapulaanОценок пока нет

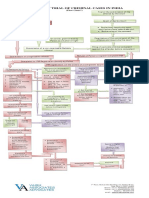

- Process of Trial of Criminal Cases in India (Flow Chart)Документ1 страницаProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Full Download Test Bank For Ethics Theory and Contemporary Issues 9th Edition Mackinnon PDF Full ChapterДокумент36 страницFull Download Test Bank For Ethics Theory and Contemporary Issues 9th Edition Mackinnon PDF Full Chapterpapismlepal.b8x1100% (16)

- Flore Bridoux CV Sep 2016 Short VersionДокумент10 страницFlore Bridoux CV Sep 2016 Short Versionbayu_pancaОценок пока нет