Академический Документы

Профессиональный Документы

Культура Документы

Types of Business Organization

Загружено:

Gladzangel Loricabv50%(2)50% нашли этот документ полезным (2 голоса)

1K просмотров37 страницОригинальное название

types of business organization.pptx

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

50%(2)50% нашли этот документ полезным (2 голоса)

1K просмотров37 страницTypes of Business Organization

Загружено:

Gladzangel LoricabvАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 37

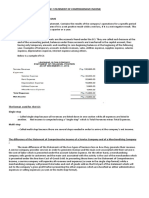

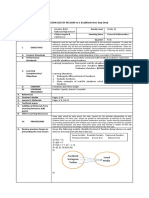

1.

The learners should compare and

contrast the types of business

according to activities

2. identify the advantages and business

requirements of each type

•Sole / Single proprietorship – owned by one

person

•Partnership – owned by partners (two or

more persons)

•Corporation – owned by shareholders

•The types of business organizations differ

on the presentation of the equity side but the

accounting for assets and liabilities are

essentially the same

•This topic, types of business operations,

differs in terms of the presentation of the

statement of comprehensive income

(income statement) and the content

statement of financial position (balance

sheet)

1. Give Local Example and Application

•How the following earn profits:

•Bruno’s Barber Shop •Wash Your Problem

Laundry Shop

•Clean Ko Place Mo

Cleaning Services •Bread Pit Bakery

•Tutorial Services •Cut and Face Parlor

•Cynthia’s Food Vendor •Fish Be With You Fish

Shop

2. Because of the nature of their

operations, the presentation of their

statement of comprehensive income

and the content of the statement of

financial position may differ from each

other possible Answers.

•by providing services

•by selling goods

3 TYPES OF BUSINESS ORGANIZATIONS:

•Service Business

This type of business offers professional

skills, advice and consultations.

Examples: barber shops and beauty

parlors, repair shops, banks, accounting

and law firms

•Merchandising Business

This type of business buys at wholesale

and later sells the products at retail. They

make a profit by selling the merchandise

or products at prices that are higher than

their purchase costs. This type of

business is also known as "buy and sell".

Examples are: book stores, sari-sari

stores, hardware stores

•Manufacturing Business

This type of business buys raw materials

and uses them in making a new product,

therefore combining raw materials, labour

and expenses into a product for sale later

on.

Examples are: shoe manufacturing

businesses, car manufacturing plants

Additional information:

There are businesses that may be

classified under more than one type of

business. A bakery, for example, combines

raw materials in making loaves of bread

(manufacturing), sells hot pan de sal

(merchandising), and caters customers’

orders in small coffee table servings of

ensaymada and hot coffee (service).

ENRICHMENT (5 MINUTES)

Provide local examples.

1.Ask the learners to think of five companies/

stores who do service, merchandising and

manufacturing

2. Call on a learner and ask why those businesses

were categorized as service, merchandising or

manufacturing .

Homework activity:

1. Look for a business that is either a

service, merchandising or manufacturing

business. Interview the owner by asking

the following questions.

.

“Suppose you want to open your own sari-sari

store that will need PHP10,000 to start and

you used your PHP10,000 savings to start

the said business.

You are the sole owner of the said sari-sari

store. This type of business is called

sole/single proprietorship.”

Sole/Single proprietorship.”

• A form of business is owned by one person;

the simplest, and the most common form of

business organization.

•It is not separate from the owner. The

business and the owner are inseparable.

Advantages of sole/single proprietorship.

•The owner keeps all the profits.

•The owner makes all the decisions.

•It is easy to form and operate.

Disadvantages of sole/single

proprietorship.

•The life of the business is limited to the life

of the owner. Once the owner dies, the

business will cease to operate under the

name of the proprietor.

Department of Trade and Industry is the government

agency that regulates the trade names of sole/single

proprietorship businesses.

Disadvantages of sole/single

proprietorship.

•The amount of capital is limited only by the

wealth of the proprietor.

“What if the needed amount to start your dream sari-

sari store is PHP50,000 and you only have

PHP25,000 cash savings. You ask Juan, your friend

if he is willing to invest his PHP25,000 and become

part owner of the sari-sari store. Assuming he

agrees, what form of business organization was

created?”

“This type of business is

called partnership.”

Partnership

•A form of business owned by two or more

persons. The details of the arrangement

between the partners are outlined in a

written document called articles of

partnership.

•Profits are divided among partners based on

their agreed sharing.

•The owner is called a partner.

Advantages of Partnership

•Higher capital because two or more

persons will contribute to the common fund.

•It is easy to operate like a sole/single

proprietorship

Disadvantages of Partnership

•The profits are divided among the partners.

•A partner can be held liable for the acts of

the other partners.

•In a lawsuit, the personal properties of the

partners can be held beyond their

contributions and may be used to answer

for any liability of the partnership.

“Assuming your dream is to open a grocery store

and not just a sari-sari store but you will need

PHP1,000,000 to start the said business. You

have only PHP25,000, your friend Juan has

PHP25,000, and your mother is willing to invest her

PHP50,000, but still these are not enough to start

your dream grocery store. Where will you get the

money to raise the PHP1 million? What type of

business will you considered?

You may

consider setting up a corporation?”

Corporation

•A corporation is a business organized as a separate

legal entity (artificial person) under the corporation law

with ownership divided into transferable shares of

stocks

•Emphasize that it is the law (Corporation Code of the

Philippines) that creates a corporation.

•The corporation begins its existence from the date

the Articles of Incorporation is approved by the

Securities and Exchange Commission (SEC).

Corporation

•The SEC (Securities and Exchange Commission) is

the government agency primarily tasked to regulate

private corporations in the Philippines.

•The owners are called stockholders or shareholders.

•The word ‘Corporation/Incorporation/Corp./Inc.’

appears in the name of the entity.

•The voting rights of a shareholder is generally based

on the percentage of ownership.

Corporation

•The management of the business is delegated by the

shareholders to the Board of Directors

•The ownership is divided into shares and the value of

one share may be denominated at a smaller amount,

for example at

PHP10 per share.

•The proof of ownership is evidenced by a stock

certificate.

Advantage of Corporation

•Can easily raise additional funds by selling shares of

stocks to the public.

•Shareholders are not personally liable for the debts

of the corporation. The extent of their liability is limited

to their equity

(ownership) in the corporation.

Disadvantage of Corporation

•It is relatively complicated to set up.

•Subject to several legal restrictions as listed

in the Corporation Code of the Philippines

“Assuming all the mothers in your barangay decided to open a sari-

sari store where all the members can buy in cash or in credit.

Some mothers were also taught how to sew dresses and bags as

part of the project of the group. These bags are then sold to a

certain company. Aside from that, the organization provides

seminars to the members on various topics involving mothers and

their roles. At the end of the year, the profits are distributed among

the members based on their capital contribution. The amount of

their purchases in the sari-sari store during the year is also

computed and they receive something out of the profit/surplus

based on their purchases.

This form of business organization is

called a COOPERATIVE

COOPERATIVE

•A cooperative is a duly registered association of

persons with a common bond of interest, voluntarily

joining together to achieve their social, economic and

cultural needs.

•The owners are called members who contribute

equitably to the capital of the cooperative.

•The members are expected to patronize their

products and services.

COOPERATIVE

•The word ‘cooperative’ appears in the name

of the entity.

•This form of business organization is

regulated by the Cooperative Development

Authority (CDA).

Advantage of a Cooperative

•Enjoys certain tax exemption privilege

•Promotes the concept of sharing

resources

Disadvantage of a Cooperative

•Limited distribution of surplus

•Requires continuous education programs

for members.

•The members have active and direct

participation in the business of the

cooperative.

Summarize all the form of accounting

1. Sole / Single Proprietorship

2. Partnership

3. Corporation

4. Cooperatives

give a brief description of each form and the

advantage of creating such forms.

“Your PHP10 daily allowance may be used to

buy shares of stocks, thus making you an

owner of a Corporation.”

Group Activity:

1. Assign each group a form of business organization.

2. Assign a group leader/reporter for every group.

3. List down at least three businesses in their locality

or in the country

4. For every business, identify the business activities,

products or services offered by each business.

5. You may Identify the owners of every businesses

listed.

6. Leader or reporter to present the output of each

group.

Вам также может понравиться

- Business FinanceДокумент109 страницBusiness FinanceLuz Soriano91% (53)

- LESSON 4 Forms of Business OrganizationsДокумент3 страницыLESSON 4 Forms of Business OrganizationsUnamadable Unleomarable100% (4)

- Nature of Business Types of BusinessДокумент24 страницыNature of Business Types of Businesslisa langstonОценок пока нет

- 1 Statement of Financial PositionДокумент46 страниц1 Statement of Financial Positionapi-267023512100% (1)

- Introduction To Investment: Business FinanceДокумент43 страницыIntroduction To Investment: Business Financenovelia santiago100% (2)

- FABM 2 Statement of Financial PositionДокумент20 страницFABM 2 Statement of Financial PositionVictoria Manalaysay100% (1)

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Документ17 страницFundamentals of Accountancy, Business and Management 1 (FABM 1)Gladzangel Loricabv50% (2)

- SHS Entrepreneurship PDFДокумент59 страницSHS Entrepreneurship PDFmaria lovella batara100% (3)

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Документ17 страницFundamentals of Accountancy, Business and Management 1 (FABM 1)Gladzangel Loricabv50% (2)

- ABM1 Forms of OrganizationsДокумент21 страницаABM1 Forms of OrganizationsKassandra KayОценок пока нет

- FABM 2 Module 4 Income and Business TaxationДокумент19 страницFABM 2 Module 4 Income and Business TaxationOkim MikoОценок пока нет

- Forms of Business OrganizationДокумент19 страницForms of Business OrganizationMylene Candido100% (2)

- Business Finance (Soft Copy of Chapter 7 Managing Personal Finance)Документ7 страницBusiness Finance (Soft Copy of Chapter 7 Managing Personal Finance)KOUJI N. MARQUEZОценок пока нет

- Business Ethics Quarter 3 Module 1Документ16 страницBusiness Ethics Quarter 3 Module 1Criscia De LeonОценок пока нет

- SLHT Besr Q1 Week 910Документ4 страницыSLHT Besr Q1 Week 910Ian OcheaОценок пока нет

- Statement of Changes in Equity (SCE)Документ72 страницыStatement of Changes in Equity (SCE)GSOCION LOUSELLE LALAINE D.100% (1)

- ActivityДокумент4 страницыActivityRain Vicente100% (1)

- Cieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Документ10 страницCieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Venus Frias-Antonio100% (1)

- Fabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Документ2 страницыFabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Cameron VelascoОценок пока нет

- Gerona Catholic School finance guideДокумент9 страницGerona Catholic School finance guideArianne Joy Villamor Mallari100% (1)

- Lesson Title: Most Essential Learning Competencies (Melcs)Документ4 страницыLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda Tumbaga100% (2)

- Chapter 3Документ9 страницChapter 3queencyfaithОценок пока нет

- Week 1-2 - Scanning The MarketДокумент12 страницWeek 1-2 - Scanning The MarketZybel RosalesОценок пока нет

- 1.statement of Financial Position (SFP)Документ29 страниц1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- Introduction To AccountingДокумент12 страницIntroduction To AccountingchristineОценок пока нет

- Forms of Business OrganizationsДокумент20 страницForms of Business OrganizationsJc campos50% (2)

- Bes q3 Module 53 PDF FreeДокумент20 страницBes q3 Module 53 PDF FreeGraciously Elle100% (1)

- Normal Balance For AssetsДокумент2 страницыNormal Balance For AssetsAshhyyОценок пока нет

- Industry and Environmental AnalysisДокумент10 страницIndustry and Environmental AnalysisEricson R. OrnalesОценок пока нет

- Business Finance Module 1Документ10 страницBusiness Finance Module 1Adoree RamosОценок пока нет

- Abm DLP Part 3Документ10 страницAbm DLP Part 3lyndon ReciñaОценок пока нет

- Business Finance Quarter 2 Week 2Документ5 страницBusiness Finance Quarter 2 Week 2Von Violo BuenavidesОценок пока нет

- The Corporate Social Responsibility: Lesson 9Документ9 страницThe Corporate Social Responsibility: Lesson 9KrisshaОценок пока нет

- Business Finance Week 1Документ6 страницBusiness Finance Week 1cjОценок пока нет

- CashflowДокумент6 страницCashflowAizia Sarceda Guzman71% (7)

- Business Ethics and Social Responsibility ExplainedДокумент11 страницBusiness Ethics and Social Responsibility ExplainedCatherine CambayaОценок пока нет

- Business Finance - Midterm Exams Problem 3Документ2 страницыBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroОценок пока нет

- ppt2aCCOUNTING LESSON 3Документ17 страницppt2aCCOUNTING LESSON 3Rojane L. Alcantara100% (1)

- Learning Objectives:: in This Lesson, You Will Be Able To: A) Explain Tools in Managing Cash, Receivables and InventoryДокумент30 страницLearning Objectives:: in This Lesson, You Will Be Able To: A) Explain Tools in Managing Cash, Receivables and InventoryAlecs ContiОценок пока нет

- Shs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeДокумент14 страницShs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeKye RauleОценок пока нет

- Lesson 1 Origins and Roles of Business OrganizationДокумент7 страницLesson 1 Origins and Roles of Business Organizationerrorollllllllllll100% (1)

- Preparing SFP of Single Propriertorship BusinessДокумент18 страницPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Accounting EquationДокумент33 страницыAccounting Equationrandy magbudhiОценок пока нет

- Chapter 1 Intro Fin MGTДокумент49 страницChapter 1 Intro Fin MGTMelissa BattadОценок пока нет

- Accounting Mod1Документ16 страницAccounting Mod1Rojane L. AlcantaraОценок пока нет

- 3 Types of BusinessДокумент3 страницы3 Types of BusinessMichelle GoОценок пока нет

- Elements of SFPДокумент11 страницElements of SFPMylene Salvador71% (7)

- Principles of Fairness, Accountability, and Transparency in BusinessДокумент11 страницPrinciples of Fairness, Accountability, and Transparency in BusinessSherren Marie Nala100% (1)

- Abm-12 Midterm ExamДокумент4 страницыAbm-12 Midterm ExamMich Valencia100% (2)

- Business Finance Module 4Документ9 страницBusiness Finance Module 4Lester MojadoОценок пока нет

- Abm Income TaxationДокумент8 страницAbm Income TaxationNardsdel RiveraОценок пока нет

- Lesson 1: The Nature and Forms of Business OrganizationsДокумент5 страницLesson 1: The Nature and Forms of Business OrganizationsKelvin Jay Sebastian SaplaОценок пока нет

- Business Ethics and Social Responsibility Grade 12Документ106 страницBusiness Ethics and Social Responsibility Grade 12Kryzel Siscar100% (1)

- Week-1-7 CM MDL 3q EthicsДокумент20 страницWeek-1-7 CM MDL 3q EthicsCharls Jose100% (1)

- BusinessFinance12 Q1 Mod4 Basic Long Term Financial Concepts V5 FSДокумент28 страницBusinessFinance12 Q1 Mod4 Basic Long Term Financial Concepts V5 FSEllah OllicetnomОценок пока нет

- Lesson 11: Stakeholder Theory: A Comprehensive Approach To Corporate Social ResponsibilityДокумент17 страницLesson 11: Stakeholder Theory: A Comprehensive Approach To Corporate Social ResponsibilityMerlanie MaganaОценок пока нет

- Mark Jeremy Bombita Case Study 1 To 3.Документ12 страницMark Jeremy Bombita Case Study 1 To 3.Mark Jeremy Alejo BombitaОценок пока нет

- Firm Environment ForcesДокумент3 страницыFirm Environment ForcesCatherine Rivera75% (4)

- Belief Systems Influence Business EthicsДокумент4 страницыBelief Systems Influence Business EthicsEvangeline AgtarapОценок пока нет

- Activity 3 Functions and Importance of Compensation, Wages and Performance Evaluation, Appraisal, Employee Relations and Movement and Reward SystemДокумент2 страницыActivity 3 Functions and Importance of Compensation, Wages and Performance Evaluation, Appraisal, Employee Relations and Movement and Reward SystemRachellyn Limentang100% (1)

- Lesson 4 Forms of Business OrganizationsДокумент4 страницыLesson 4 Forms of Business OrganizationsANDREA LAREGOОценок пока нет

- Week # 4: Accounting 1 Forms of Business OrganizationsДокумент6 страницWeek # 4: Accounting 1 Forms of Business OrganizationsJane Caranguian AgarroОценок пока нет

- Forms and Activities of BusinessДокумент45 страницForms and Activities of Businessandrea jane hinaОценок пока нет

- Forms of Business Organizations ExplainedДокумент28 страницForms of Business Organizations ExplainedHaina Aquino100% (2)

- Solving Problems Involving FunctionsДокумент3 страницыSolving Problems Involving FunctionsGladzangel LoricabvОценок пока нет

- My IGPДокумент11 страницMy IGPGladzangel LoricabvОценок пока нет

- Mask 4TH Quarter G12 - EmeraldДокумент3 страницыMask 4TH Quarter G12 - EmeraldGladzangel LoricabvОценок пока нет

- Performance IndicatorsДокумент2 страницыPerformance IndicatorsGladzangel LoricabvОценок пока нет

- Management TheoryДокумент20 страницManagement TheoryGladzangel LoricabvОценок пока нет

- Gen Math - Lesson1&2Документ5 страницGen Math - Lesson1&2Gladzangel LoricabvОценок пока нет

- Teacher's Program-2022Документ1 страницаTeacher's Program-2022Gladzangel LoricabvОценок пока нет

- Bmi g12 EmeraldДокумент487 страницBmi g12 EmeraldGladzangel LoricabvОценок пока нет

- Teacher's Program-2022Документ1 страницаTeacher's Program-2022Gladzangel LoricabvОценок пока нет

- Calculating the mean of discrete random variablesДокумент1 страницаCalculating the mean of discrete random variablesGladzangel LoricabvОценок пока нет

- DLL W1 Fundamentals of Abm 1Документ4 страницыDLL W1 Fundamentals of Abm 1Gladzangel Loricabv100% (1)

- MPS FormulaДокумент1 страницаMPS FormulaGladzangel LoricabvОценок пока нет

- KPI REPORT FOR G12-EMERALD Q2Документ1 страницаKPI REPORT FOR G12-EMERALD Q2Gladzangel LoricabvОценок пока нет

- Fractions, Decimals, and Percent: Business Mathematics - SHS Grade 11Документ6 страницFractions, Decimals, and Percent: Business Mathematics - SHS Grade 11Gladzangel LoricabvОценок пока нет

- Stat Q3 WK4 Las3Документ1 страницаStat Q3 WK4 Las3Gladzangel LoricabvОценок пока нет

- Stat Q3 WK5 Las1Документ1 страницаStat Q3 WK5 Las1Gladzangel LoricabvОценок пока нет

- Stat Q3 WK3 Las1Документ1 страницаStat Q3 WK3 Las1Gladzangel LoricabvОценок пока нет

- SHS E-Technologies PDFДокумент54 страницыSHS E-Technologies PDFshanaiah AbellaОценок пока нет

- Stat Q3 WK3 Las2Документ1 страницаStat Q3 WK3 Las2Gladzangel Loricabv0% (1)

- Probability Distribution of Discrete Random VariableДокумент1 страницаProbability Distribution of Discrete Random VariableGladzangel LoricabvОценок пока нет

- Stat Q3 WK2 Las1Документ1 страницаStat Q3 WK2 Las1Gladzangel LoricabvОценок пока нет

- Calculating the mean of discrete random variablesДокумент1 страницаCalculating the mean of discrete random variablesGladzangel LoricabvОценок пока нет

- Statistics and Probability - Q2 - M1Документ14 страницStatistics and Probability - Q2 - M1Gladzangel Loricabv86% (7)

- X,, X X (X, X,, X: Janrie M. Raguine, Mat Values of A Random Variable (Q3 - Wk. 1, LAS 2)Документ1 страницаX,, X X (X, X,, X: Janrie M. Raguine, Mat Values of A Random Variable (Q3 - Wk. 1, LAS 2)Gladzangel LoricabvОценок пока нет

- SHS Practical Research 2 (1st Three Melcs) PDFДокумент26 страницSHS Practical Research 2 (1st Three Melcs) PDFshanaiah AbellaОценок пока нет

- Stat Q3 WK1 Las1Документ1 страницаStat Q3 WK1 Las1Gladzangel LoricabvОценок пока нет

- Working Capital ManagementДокумент63 страницыWorking Capital ManagementVimala Selvaraj VimalaОценок пока нет

- Banking Law and Practise 30112018 PDFДокумент526 страницBanking Law and Practise 30112018 PDFSuchith BОценок пока нет

- Yakov Amihud, Haim Mendelson, Lasse Heje Pedersen-Market Liquidity - Asset Pricing, Risk, and Crises-Cambridge University Press (2012) PDFДокумент293 страницыYakov Amihud, Haim Mendelson, Lasse Heje Pedersen-Market Liquidity - Asset Pricing, Risk, and Crises-Cambridge University Press (2012) PDFsam100% (1)

- The Bamboo Bond IP 08 July 2011Документ18 страницThe Bamboo Bond IP 08 July 2011Antonio De GregorioОценок пока нет

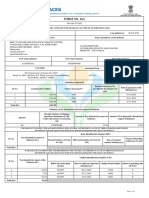

- Instructions / Checklist For Filling KYC FormДокумент22 страницыInstructions / Checklist For Filling KYC FormRohit JadhavОценок пока нет

- Esigned Kyc Stock PDF PDFДокумент27 страницEsigned Kyc Stock PDF PDFMukesh KewlaniОценок пока нет

- TDS Certificate SummaryДокумент2 страницыTDS Certificate SummaryAkriti JhaОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент26 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledYuri SisonОценок пока нет

- Unit 10 SECP (Complete)Документ21 страницаUnit 10 SECP (Complete)Zaheer Ahmed SwatiОценок пока нет

- BANKING LAW OF 2000Документ25 страницBANKING LAW OF 2000Princess VieОценок пока нет

- GHDДокумент21 страницаGHDAmitGurgyОценок пока нет

- Ross12e Chapter30 TB AnswerkeyДокумент57 страницRoss12e Chapter30 TB AnswerkeyHà HoàngОценок пока нет

- Alabama-Slander-Of-title-etc-Amended Complaint - (Marcia Morgan, Richard E. Price - Argent Mortgage)Документ27 страницAlabama-Slander-Of-title-etc-Amended Complaint - (Marcia Morgan, Richard E. Price - Argent Mortgage)Kourtney TuckerОценок пока нет

- Securities Markets and Regulation of Securities Markets in NepalДокумент50 страницSecurities Markets and Regulation of Securities Markets in NepalShivam KarnОценок пока нет

- Business Finance Lecture NotesДокумент118 страницBusiness Finance Lecture NotesSmitaОценок пока нет

- 167839-2012-Express Investments III Private Ltd. V.Документ38 страниц167839-2012-Express Investments III Private Ltd. V.Inigo MiguelОценок пока нет

- Insider Trading at LordstownДокумент8 страницInsider Trading at LordstownKirk HartleyОценок пока нет

- Research Report For ARG As of 6/23/11 - Chaikin Power ToolsДокумент4 страницыResearch Report For ARG As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Accounting of Share CapitalДокумент102 страницыAccounting of Share Capitalmohanraokp22790% (1)

- DSP BlackRock US Flexible Equity Fund - NFO Application From With KIM FormДокумент16 страницDSP BlackRock US Flexible Equity Fund - NFO Application From With KIM FormprajnacapiralОценок пока нет

- Compile Invt. Project-1Документ25 страницCompile Invt. Project-1Prashant yadavОценок пока нет

- Multiple Choice and Problems on Cost of CapitalДокумент12 страницMultiple Choice and Problems on Cost of CapitalAnsleyОценок пока нет

- FijiTimes - September 30 2016 PDFДокумент22 страницыFijiTimes - September 30 2016 PDFfijitimescanadaОценок пока нет

- M11 MishkinEakins3427056 08 FMI C11Документ33 страницыM11 MishkinEakins3427056 08 FMI C11potatonaОценок пока нет

- Amendment For Law-Nov 21 by AoДокумент12 страницAmendment For Law-Nov 21 by AoConsultant NОценок пока нет

- Order in The Matter of Sunheaven Agro India LimitedДокумент12 страницOrder in The Matter of Sunheaven Agro India LimitedShyam SunderОценок пока нет

- 2020CDO Pay AsianДокумент12 страниц2020CDO Pay AsianPending_nameОценок пока нет

- Mrunal Sir's Economy 2020 Batch - Handout PDFДокумент21 страницаMrunal Sir's Economy 2020 Batch - Handout PDFssattyyaammОценок пока нет

- Eco1a Module5Документ53 страницыEco1a Module5Mel James Quigtar FernandezОценок пока нет

- Format of Balance Sheet and Profit and Loss As Per Com ActДокумент14 страницFormat of Balance Sheet and Profit and Loss As Per Com Actarunangshu_pal100% (1)