Академический Документы

Профессиональный Документы

Культура Документы

Chapter 6

Загружено:

Toto Subagyo0 оценок0% нашли этот документ полезным (0 голосов)

116 просмотров44 страницыstrategic

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документstrategic

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

116 просмотров44 страницыChapter 6

Загружено:

Toto Subagyostrategic

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 44

Copyright ©2015 Pearson Education, Inc 6-1

Copyright ©2015 Pearson Education, Inc 6-2

1. Describe a three-stage framework for

choosing among alternative strategies.

2. Explain how to develop a SWOT Matrix,

SPACE Matrix, BCG Matrix, IE Matrix, and

QSPM.

3. Identify important behavioral, political,

ethical, and social responsibility

considerations in strategy analysis and

choice.

Copyright ©2015 Pearson Education, Inc 6-3

►A manageable set of the most attractive

alternative strategies must be developed

► The advantages, disadvantages, trade-offs,

costs, and benefits of these strategies should

be determined

Copyright ©2015 Pearson Education, Inc 6-4

► Identifyingand evaluating alternative

strategies should involve many of the

managers and employees who earlier

assembled the organizational vision and

mission statements, performed the external

audit, and conducted the internal audit.

Copyright ©2015 Pearson Education, Inc 6-5

► Alternative strategies proposed by participants

should be considered and discussed in a series

of meetings.

► Proposed strategies should be listed in writing.

► When all feasible strategies identified by

participants are given and understood, the

strategies should be ranked in order of

attractiveness.

Copyright ©2015 Pearson Education, Inc 6-6

Copyright ©2015 Pearson Education, Inc 6-7

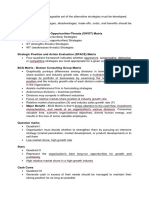

► Stage 1 - Input Stage

► summarizes the basic input information needed

to formulate strategies

► consists of the EFE Matrix, the IFE Matrix, and

the Competitive Profile Matrix (CPM)

Copyright ©2015 Pearson Education, Inc 6-8

► Stage 2 - Matching Stage

► focuses on generating feasible alternative

strategies by aligning key external and internal

factors

► techniques include the Strengths-Weaknesses-

Opportunities-Threats (SWOT) Matrix, the

Strategic Position and Action Evaluation (SPACE)

Matrix, the Boston Consulting Group (BCG) Matrix,

the Internal-External (IE) Matrix, and the Grand

Strategy Matrix

Copyright ©2015 Pearson Education, Inc 6-9

► Stage 3 - Decision Stage

► involves the Quantitative Strategic Planning

Matrix (QSPM)

► reveals the relative attractiveness of alternative

strategies and thus provides objective basis for

selecting specific strategies

Copyright ©2015 Pearson Education, Inc 6-10

► The Strengths-Weaknesses-

Opportunities-Threats (SWOT) Matrix

helps managers develop four types of

strategies:

► SO (strengths-opportunities) Strategies

► WO (weaknesses-opportunities) Strategies

► ST (strengths-threats) Strategies

► WT (weaknesses-threats) Strategies

Copyright ©2015 Pearson Education, Inc 6-11

► SO Strategies ► WO Strategies

► use a firm’s internal ► aim at improving internal

strengths to take weaknesses by taking

advantage of external advantage of external

opportunities opportunities

Copyright ©2015 Pearson Education, Inc 6-12

► ST Strategies ► WT Strategies

► use a firm’s strengths to ► defensive tactics

avoid or reduce the directed at reducing

impact of external internal weakness and

threats avoiding external threats

Copyright ©2015 Pearson Education, Inc 6-13

1. List the firm’s key external opportunities

2. List the firm’s key external threats

3. List the firm’s key internal strengths

4. List the firm’s key internal weaknesses

5. Match internal strengths with external

opportunities

Copyright ©2015 Pearson Education, Inc 6-14

6. Match internal weaknesses with external

opportunities, and record the resultant WO

Strategies

7. Match internal strengths with external threats,

and record the resultant ST Strategies

8. Match internal weaknesses with external

threats, and record the resultant WT Strategies

Copyright ©2015 Pearson Education, Inc 6-15

Copyright ©2015 Pearson Education, Inc 6-16

6-17

Copyright ©2015 Pearson Education, Inc Copyrigh

t ©2013

Copyright ©2015 Pearson Education, Inc 6-18

► Strategic

Position and Action Evaluation

(SPACE) Matrix

► four-quadrant framework indicates whether

aggressive, conservative, defensive, or

competitive strategies are most appropriate for a

given organization

Copyright ©2015 Pearson Education, Inc 6-19

► Two internal dimensions (financial position

[FP] and competitive position [CP])

► Two external dimensions (stability position

[SP] and industry position [IP])

► Most important determinants of an

organization’s overall strategic position

Copyright ©2015 Pearson Education, Inc 6-20

Copyright ©2015 Pearson Education, Inc 6-21

1. Select a set of variables to define financial

position (FP), competitive position (CP),

stability position (SP), and industry position

(IP).

Copyright ©2015 Pearson Education, Inc 6-22

2. Assign a numerical value ranging from +1

(worst) to +7 (best) to each of the variables

that make up the FP and IP dimensions.

Assign a numerical value ranging from –1

(best) to –7 (worst) to each of the variables

that make up the SP and CP dimensions.

Copyright ©2015 Pearson Education, Inc 6-23

3. Compute an average score for FP, CP, IP,

and SP.

4. Plot the average scores for FP, IP, SP, and

CP on the appropriate axis in the SPACE

Matrix.

5. Add the two scores on the x-axis and plot

the resultant point on X. Add the two scores

on the y-axis and plot the resultant point on

Y. Plot the intersection of the new xy point.

Copyright ©2015 Pearson Education, Inc 6-24

6. Draw a directional vector from the origin of

the SPACE Matrix through the new

intersection point.

► This vector reveals the type of strategies

recommended for the organization: aggressive,

competitive, defensive, or conservative

Copyright ©2015 Pearson Education, Inc 6-25

Copyright ©2015 Pearson Education, Inc 6-26

Copyright ©2015 Pearson Education, Inc 6-27

► BCG Matrix

► graphically portrays differences among divisions

in terms of relative market share position and

industry growth rate

► allows a multidivisional organization to manage

its portfolio of businesses by examining the

relative market share position and the industry

growth rate of each division relative to all other

divisions in the organization

Copyright ©2015 Pearson Education, Inc 6-28

Copyright ©2015 Pearson Education, Inc 6-29

► Question marks – Quadrant I

► Organizationmust decide whether to strengthen

them by pursuing an intensive strategy (market

penetration, market development, or product

development) or to sell them

► Stars – Quadrant II

► representthe organization’s best long-run

opportunities for growth and profitability

Copyright ©2015 Pearson Education, Inc 6-30

► Cash Cows – Quadrant III

► generate cash in excess of their needs

► should be managed to maintain their strong

position for as long as possible

► Dogs – Quadrant IV

► compete in a slow- or no-market-growth industry

► businesses are often liquidated, divested, or

trimmed down through retrenchment

Copyright ©2015 Pearson Education, Inc 6-31

Copyright ©2015 Pearson Education, Inc 6-32

► The IE Matrix is based on two key

dimensions: the IFE total weighted scores on

the x-axis and the EFE total weighted scores

on the y-axis

► Three major regions

► Grow and build

► Hold and maintain

► Harvest or divest

Copyright ©2015 Pearson Education, Inc 6-33

Copyright ©2015 Pearson Education, Inc 6-34

► Grand Strategy Matrix

► based on two evaluative dimensions: competitive

position and market (industry) growth

Copyright ©2015 Pearson Education, Inc 6-35

Copyright ©2015 Pearson Education, Inc 6-36

► Quadrant I

► continuedconcentration on current markets (market

penetration and market development) and products

(product development) is an appropriate strategy

► Quadrant II

► unable to compete effectively

► need to determine why the firm’s current approach is

ineffective and how the company can best change to

improve its competitiveness

Copyright ©2015 Pearson Education, Inc 6-37

► Quadrant III

► must make some drastic changes quickly to avoid

further decline and possible liquidation

► Extensive cost and asset reduction (retrenchment)

should be pursued first

► Quadrant IV

► have characteristically high cash-flow levels and

limited internal growth needs and often can pursue

related or unrelated diversification successfully

Copyright ©2015 Pearson Education, Inc 6-38

► Quantitative Strategic Planning Matrix

(QSPM)

► objectively indicates which alternative strategies

are best

► uses input from Stage 1 analyses and matching

results from Stage 2 analyses to decide

objectively among alternative strategies

Copyright ©2015 Pearson Education, Inc 6-39

Copyright ©2015 Pearson Education, Inc 6-40

1. Make a list of the firm’s key external

opportunities/threats and internal strengths/

weaknesses in the left column of the QSPM.

2. Assign weights to each key external and internal

factor.

3. Examine the Stage 2 (matching) matrices, and

identify alternative strategies that the organization

should consider implementing.

Copyright ©2015 Pearson Education, Inc 6-41

4. Determine the Attractiveness Scores (AS).

5. Compute the Total Attractiveness Scores.

6. Compute the Sum Total Attractiveness Score.

Copyright ©2015 Pearson Education, Inc 6-42

Copyright ©2015 Pearson Education, Inc 6-43

Copyright ©2015 Pearson Education, Inc 6-44

Вам также может понравиться

- Flight. The Complete History of Aviation PDFДокумент454 страницыFlight. The Complete History of Aviation PDFcrisanfernana88% (8)

- Esna CatalogДокумент12 страницEsna Catalogbalaji_jayadeva9546Оценок пока нет

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationОт EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationОценок пока нет

- David Sm13 PPT 06Документ44 страницыDavid Sm13 PPT 06qaisarz100% (11)

- David SMCC16ge Ppt08Документ53 страницыDavid SMCC16ge Ppt08Çağla Kutlu100% (2)

- Tool PresettingДокумент22 страницыTool PresettingAtulMaurya100% (1)

- Space & QSPMДокумент41 страницаSpace & QSPMRadhik Kalra50% (2)

- Netbackup UsefulДокумент56 страницNetbackup Usefuldnyan123Оценок пока нет

- Strategic Analysis of Internal Environment of a Business OrganisationОт EverandStrategic Analysis of Internal Environment of a Business OrganisationОценок пока нет

- David - sm15 - Inppt - 07Документ44 страницыDavid - sm15 - Inppt - 07Book BuddyОценок пока нет

- Strategic Management - 15e - Global Edition (DavidDavid) David Sm15ge PPT CH01Документ32 страницыStrategic Management - 15e - Global Edition (DavidDavid) David Sm15ge PPT CH01Francis MumuluhОценок пока нет

- Building A Gate Way Service Using A SEGW TransactionДокумент10 страницBuilding A Gate Way Service Using A SEGW Transactionswamy_yalamanchiliОценок пока нет

- XPath PresentationДокумент14 страницXPath PresentationJantrik ShopnoОценок пока нет

- Instrumentation For Measurement of Roof Convergence in Coal MinesДокумент9 страницInstrumentation For Measurement of Roof Convergence in Coal MinessamratОценок пока нет

- Strategy Formulation. Strategy Analysis & Choice (8-10M)Документ45 страницStrategy Formulation. Strategy Analysis & Choice (8-10M)Muhammad FaisalОценок пока нет

- 9868 - Procedures For Air Navigation Services Training Second Edition 2016Документ214 страниц9868 - Procedures For Air Navigation Services Training Second Edition 2016Vincent Grondin100% (2)

- TM 9-792 M21 AMMUNITION TRAILERДокумент128 страницTM 9-792 M21 AMMUNITION TRAILERAdvocate100% (1)

- Company Profile Metro GoldrichДокумент29 страницCompany Profile Metro GoldrichBids and Awards CommitteeОценок пока нет

- SAP Workflow Interview Questions - MindmajixДокумент25 страницSAP Workflow Interview Questions - MindmajixsudhОценок пока нет

- Hazard Identification SKYbrary Aviation SafetyДокумент13 страницHazard Identification SKYbrary Aviation SafetyToto SubagyoОценок пока нет

- Strategy Generation and Selection: Chapter EightДокумент53 страницыStrategy Generation and Selection: Chapter EightMarie BlackОценок пока нет

- Founder-CEO Succession at Wily TechnologyДокумент12 страницFounder-CEO Succession at Wily TechnologyMayank Saini100% (1)

- CH 12Документ38 страницCH 12HIMANSHU AGRAWALОценок пока нет

- IATA - Competence-Based Training and AssessmentДокумент2 страницыIATA - Competence-Based Training and AssessmentToto SubagyoОценок пока нет

- Strategy Analysis and Choice: Chapter SixДокумент35 страницStrategy Analysis and Choice: Chapter SixShahadОценок пока нет

- David Sm15 Inppt 06Документ57 страницDavid Sm15 Inppt 06Halima SyedОценок пока нет

- Strategy Selection ReportДокумент56 страницStrategy Selection ReportmadhelleОценок пока нет

- Strategic Management Chap 6Документ26 страницStrategic Management Chap 6Aman AhujaОценок пока нет

- Chapter 6 - Strategy Analysis and ChoiceДокумент53 страницыChapter 6 - Strategy Analysis and ChoiceDarshene ChandrasegaranОценок пока нет

- 5 6168128775759331348Документ53 страницы5 6168128775759331348Nora AnisaОценок пока нет

- Strategy Selection ReportДокумент49 страницStrategy Selection ReportmadhelleОценок пока нет

- Acknowledgement: Sesi 11-12 Strategy Generation and Selection Semester: Genap 2019/2020Документ56 страницAcknowledgement: Sesi 11-12 Strategy Generation and Selection Semester: Genap 2019/2020Cornelita Tesalonika R. K.Оценок пока нет

- The Nature of Strategic Management: Chapter OneДокумент48 страницThe Nature of Strategic Management: Chapter Onesnow fiОценок пока нет

- Strategy Review, Evaluation and Control: Lesson 5: Quantitative Techniques in BusinessДокумент35 страницStrategy Review, Evaluation and Control: Lesson 5: Quantitative Techniques in BusinessRhanneОценок пока нет

- Strategy Analysis & Choice: Publishing As Prentice HallДокумент69 страницStrategy Analysis & Choice: Publishing As Prentice HallSiva KumarОценок пока нет

- The Internal AssessmentДокумент51 страницаThe Internal AssessmentJerome MogaОценок пока нет

- Strategic Management Case Method Knowledge and Tools 15e 3Документ59 страницStrategic Management Case Method Knowledge and Tools 15e 3Muqaddas IsrarОценок пока нет

- Strategy Generation and Selection: Chapter EightДокумент62 страницыStrategy Generation and Selection: Chapter EightChristy MachaalanyОценок пока нет

- The Internal Assessment: Chapter FourДокумент51 страницаThe Internal Assessment: Chapter FourBook BuddyОценок пока нет

- SM - Ch6Документ73 страницыSM - Ch6Ahmed Khaled MansourОценок пока нет

- استراتيجية 5Документ63 страницыاستراتيجية 5ShahadОценок пока нет

- David Sm15ge PPT CH11Документ34 страницыDavid Sm15ge PPT CH11didiОценок пока нет

- Strategy Generation and Selection: Chapter EightДокумент53 страницыStrategy Generation and Selection: Chapter EightAwesomely FairОценок пока нет

- David Sm15 Inppt 04Документ51 страницаDavid Sm15 Inppt 04Henry Andino VelásquezОценок пока нет

- Chapter 5Документ54 страницыChapter 5JulianОценок пока нет

- Strategy Generation and Selection: Chapter EightДокумент37 страницStrategy Generation and Selection: Chapter EightGeorges ChouchaniОценок пока нет

- Chapter 6 Strategy Analysis and Choice Summary 17132120-002Документ6 страницChapter 6 Strategy Analysis and Choice Summary 17132120-002NOORI KhanaОценок пока нет

- Chapter 4 Strategy Analysis and ChoiceДокумент13 страницChapter 4 Strategy Analysis and Choicemelvin cunananОценок пока нет

- David sm13 PPT 06Документ40 страницDavid sm13 PPT 06Adam OngОценок пока нет

- David - sm15 - Inppt - 05Документ49 страницDavid - sm15 - Inppt - 05Book BuddyОценок пока нет

- Strat Reviewer Chapter 6Документ20 страницStrat Reviewer Chapter 6Ross John JimenezОценок пока нет

- Wheelan 14e ch06 UpdatedДокумент47 страницWheelan 14e ch06 UpdatedSultana AlhqbaniОценок пока нет

- Strategic Management - Chapter 6Документ56 страницStrategic Management - Chapter 6juan faustian siregarОценок пока нет

- David Sm15ge PPT CH06Документ50 страницDavid Sm15ge PPT CH06didiОценок пока нет

- Matching StageДокумент3 страницыMatching StageSittie Islah Hadji FaisalОценок пока нет

- Bt31303 Chapter 5, 6 8 CPM Swot Tows AnalysisДокумент16 страницBt31303 Chapter 5, 6 8 CPM Swot Tows AnalysisAMAL WAHYU FATIHAH BINTI ABDUL RAHMAN BB20110906Оценок пока нет

- Strategy Generation and Selection: Chapter EightДокумент29 страницStrategy Generation and Selection: Chapter EightMohamed Shawky El ShamyОценок пока нет

- David - sm15 - Inppt - 01Документ33 страницыDavid - sm15 - Inppt - 01ibeОценок пока нет

- David Sm14 Inppt06 Ch6cДокумент24 страницыDavid Sm14 Inppt06 Ch6cAishiterru Gurl'sОценок пока нет

- Strategy Analysis and SelectingДокумент26 страницStrategy Analysis and SelectingNyadroh Clement MchammondsОценок пока нет

- Strama Mod 6Документ13 страницStrama Mod 6Jaysah BaniagaОценок пока нет

- MGT603 Final Term Solved Papers 08 Papers SolvedДокумент83 страницыMGT603 Final Term Solved Papers 08 Papers SolvedMurad Khan100% (1)

- SPACE Matrix: Strategic Position & Action Evaluation MatrixДокумент46 страницSPACE Matrix: Strategic Position & Action Evaluation Matrix292atcОценок пока нет

- WK 8Документ55 страницWK 8Muhammad AmryОценок пока нет

- David - sm15 - Inppt - 08Документ48 страницDavid - sm15 - Inppt - 08hero alomОценок пока нет

- Wk3-4 External Audit David Sm15ge PPT Ch07Документ57 страницWk3-4 External Audit David Sm15ge PPT Ch07mulianithamrin432Оценок пока нет

- Strategy Formulation: Situation Analysis and Business StrategyДокумент37 страницStrategy Formulation: Situation Analysis and Business Strategylnd cmroОценок пока нет

- Wheelan 14e ch02Документ38 страницWheelan 14e ch02Sozia TanОценок пока нет

- Strategy Formulation: Situation Analysis and Business StrategyДокумент37 страницStrategy Formulation: Situation Analysis and Business Strategytareq safiОценок пока нет

- FInal Part STRAMAДокумент18 страницFInal Part STRAMAHannah Kate ToledoОценок пока нет

- Chapter 7Документ52 страницыChapter 7saliha mumtazОценок пока нет

- David - Sm15ge PPT ch01Документ32 страницыDavid - Sm15ge PPT ch01KevinОценок пока нет

- The Impact of Human Performance On Business PerformanceДокумент3 страницыThe Impact of Human Performance On Business PerformanceToto SubagyoОценок пока нет

- From Co-Pilot To Captain: Pilot Ranks and Seniority (2024)Документ5 страницFrom Co-Pilot To Captain: Pilot Ranks and Seniority (2024)Toto SubagyoОценок пока нет

- Mgi Performance Through People Full Report VFДокумент40 страницMgi Performance Through People Full Report VFToto SubagyoОценок пока нет

- CBTA Instructional System DesignДокумент4 страницыCBTA Instructional System DesignToto SubagyoОценок пока нет

- How Can Human Factors Affect The Profitability of Your Company? - ITS AcademyДокумент5 страницHow Can Human Factors Affect The Profitability of Your Company? - ITS AcademyToto SubagyoОценок пока нет

- Best Captains ? A Survey of Characteristics and Skills of AirlineДокумент7 страницBest Captains ? A Survey of Characteristics and Skills of AirlineToto SubagyoОценок пока нет

- AVIY0026 - R1 Conduct Aerial Application Operations Using Remote Pilot Aircraft SystemsДокумент6 страницAVIY0026 - R1 Conduct Aerial Application Operations Using Remote Pilot Aircraft SystemsToto SubagyoОценок пока нет

- The Cost-Benefit of Human FactorsДокумент12 страницThe Cost-Benefit of Human FactorsToto SubagyoОценок пока нет

- AVIW0007 - R1 Perform Aerial Mapping and Modelling Using Remote Piloted Aircraft SystemsДокумент5 страницAVIW0007 - R1 Perform Aerial Mapping and Modelling Using Remote Piloted Aircraft SystemsToto SubagyoОценок пока нет

- AVIY0028 - R1 Operate Remotely Piloted Aircraft in Excluded Category Sub-2 KG OperationsДокумент5 страницAVIY0028 - R1 Operate Remotely Piloted Aircraft in Excluded Category Sub-2 KG OperationsToto SubagyoОценок пока нет

- Annex I Project LogframeДокумент8 страницAnnex I Project LogframeToto SubagyoОценок пока нет

- Aviation Training Proposing A Training SДокумент16 страницAviation Training Proposing A Training SToto SubagyoОценок пока нет

- 235 654 1 PBДокумент14 страниц235 654 1 PBToto SubagyoОценок пока нет

- Competency Based Education FrameworkДокумент19 страницCompetency Based Education FrameworkToto SubagyoОценок пока нет

- Promoting Campetency-Based Training ICAO-Meshesha-Belayneh-1Документ17 страницPromoting Campetency-Based Training ICAO-Meshesha-Belayneh-1Toto SubagyoОценок пока нет

- P03 Module3IntrotoCBTv2Документ22 страницыP03 Module3IntrotoCBTv2Toto SubagyoОценок пока нет

- Kirkpatrick Evaluation MethodДокумент13 страницKirkpatrick Evaluation MethodToto SubagyoОценок пока нет

- Process Guide Instructional Systems Development Methodology For: AQP Curriculum Developers and Program ManagementДокумент55 страницProcess Guide Instructional Systems Development Methodology For: AQP Curriculum Developers and Program ManagementToto SubagyoОценок пока нет

- Penta Helix Model For Sustainable Coastal Area Management in Bangka IslandsДокумент6 страницPenta Helix Model For Sustainable Coastal Area Management in Bangka IslandsToto SubagyoОценок пока нет

- ICAO Workshop - SWIM Integration - D MULLERДокумент17 страницICAO Workshop - SWIM Integration - D MULLERToto SubagyoОценок пока нет

- 5 Elements of The Aviation Ecosystem That Will Impact The Future of The Industry - Connected Aviation TodayДокумент4 страницы5 Elements of The Aviation Ecosystem That Will Impact The Future of The Industry - Connected Aviation TodayToto SubagyoОценок пока нет

- Program Outcomes and Performance Indicators PDFДокумент4 страницыProgram Outcomes and Performance Indicators PDFRedge John Sarsale JalotjotОценок пока нет

- How To Measure Competency-Based Training - Elearning IndustryДокумент6 страницHow To Measure Competency-Based Training - Elearning IndustryToto SubagyoОценок пока нет

- How Higher Education Can Better Serve The Airline Industry - The EvoLLLution The EvoLLLutionДокумент13 страницHow Higher Education Can Better Serve The Airline Industry - The EvoLLLution The EvoLLLutionToto SubagyoОценок пока нет

- Importance of Aviation in Higher EducationДокумент4 страницыImportance of Aviation in Higher EducationToto SubagyoОценок пока нет

- All You Need To Know About Resource-Based ViewДокумент7 страницAll You Need To Know About Resource-Based ViewToto SubagyoОценок пока нет

- Automatic Transmission: Models FA and FB With Allison AT542Документ22 страницыAutomatic Transmission: Models FA and FB With Allison AT542nguyenxuanvinhv3Оценок пока нет

- ABB REL5xx RIOConverterДокумент10 страницABB REL5xx RIOConverterzinab90100% (1)

- Oracle Linux 6 InstallationДокумент35 страницOracle Linux 6 InstallationendaleОценок пока нет

- 2020.04.24 BC thamtratonghop TKCS Trường Fulbright Lần 1Документ32 страницы2020.04.24 BC thamtratonghop TKCS Trường Fulbright Lần 1Khac Hoang PhamОценок пока нет

- Q4X Stainless Steel Laser Sensor: Instruction ManualДокумент42 страницыQ4X Stainless Steel Laser Sensor: Instruction Manualtigres1Оценок пока нет

- Akta Satelit On Astra 4A at 4Документ6 страницAkta Satelit On Astra 4A at 4Amirul AsyrafОценок пока нет

- Invoice Cod Invoice Cod: Agen Pos Agen PosДокумент4 страницыInvoice Cod Invoice Cod: Agen Pos Agen Poswahids0204Оценок пока нет

- SAP ABAP ResumeДокумент3 страницыSAP ABAP Resumeshakti1392821Оценок пока нет

- CVДокумент21 страницаCVAngelica chea NatividadОценок пока нет

- ETG3000 BrochureДокумент9 страницETG3000 BrochureMayolo MartinezОценок пока нет

- GEO ExPro V11i6Документ104 страницыGEO ExPro V11i6OsmanОценок пока нет

- Blue Brain-The Future TechnologyДокумент27 страницBlue Brain-The Future TechnologyZuber MdОценок пока нет

- Pumps: Vane Type Single PumpsДокумент2 страницыPumps: Vane Type Single PumpsFernando SabinoОценок пока нет

- Company in India" DTDC Constantly Endeavours To Meet & Exceed Customers'Документ7 страницCompany in India" DTDC Constantly Endeavours To Meet & Exceed Customers'Vinod KumarОценок пока нет

- Lec 2 - Tall Building Criteria and Loading-2003Документ30 страницLec 2 - Tall Building Criteria and Loading-2003JibonGhoshPritomОценок пока нет

- Snare Drum: Some Entries From Various Sources (Loosely Cited)Документ6 страницSnare Drum: Some Entries From Various Sources (Loosely Cited)gljebglejebОценок пока нет

- HTTP StreamsДокумент8 страницHTTP StreamsMarcelo Castro MartinoОценок пока нет

- OpenCV 3.0 Computer Vision With Java - Sample ChapterДокумент27 страницOpenCV 3.0 Computer Vision With Java - Sample ChapterPackt PublishingОценок пока нет

- Tutorial 9Документ4 страницыTutorial 9fawwazfauzi2004Оценок пока нет

- Growth of Escherichia Coli in A 5 Litre Batch Fermentation VesselДокумент15 страницGrowth of Escherichia Coli in A 5 Litre Batch Fermentation VesselAs'ad Mughal100% (2)