Академический Документы

Профессиональный Документы

Культура Документы

Ch12 Fraud Scheme Detection

Загружено:

Panda Boars0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров18 страницОригинальное название

Ch12_Fraud_Scheme__Detection.ppt

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров18 страницCh12 Fraud Scheme Detection

Загружено:

Panda BoarsАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 18

Chapter 12:

Fraud Schemes &

Fraud Detection

IT Auditing & Assurance, 2e, Hall &

IT Auditing & Assurance,

Singleton2e, Hall & Singleton

FRAUD TREE

Asset misappropriation fraud

1. Stealing something of value – usually cash or inventory (i.e.,

asset theft)

2. Converting asset to usable form

3. Concealing the crime to avoid detection

4. Usually, perpetrator is an employee

Financial fraud

1. Does not involve direct theft of assets

2. Often objective is to obtain higher stock price (i.e., financial fraud)

3. Typically involves misstating financial data to gain additional

compensation, promotion, or escape penalty for poor performance

4. Often escapes detection until irreparable harm has been done

5. Usually, perpetrator is executive management

Corruption fraud

1. Bribery, etc.

IT Auditing & Assurance, 2e, Hall & Singleton

ACFE 2004 REPORT TO THE NATION

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUD SCHEMES

Fraudulent financial statements {5%}

Corruption {13%}

Bribery

Illegal gratuities

Conflicts of interest

Economic extortion

Asset misappropriation {85%}

Charges to expense accounts

Lapping

Kiting

Transaction fraud

Percentages per ACFE 2002 Report to the Nation – see Table 12-1

IT Auditing & Assurance, 2e, Hall & Singleton

COMPUTER FRAUD

SCHEMES

Data Collection

Data Processing

Database Management

Information Generation

IT Auditing & Assurance, 2e, Hall & Singleton

AUDITOR’S RESPONSIBILITY FOR

DETECTING FRAUD—SAS NO. 99

Sarbanes-Oxley Act 2002

SAS No. 99 – “Consideration of Fraud in a

Financial Statement Audit”

1. Description and characteristics of fraud

2. Professional skepticism

3. Engagement personnel discussion

4. Obtaining audit evidence and information

5. Identifying risks

6. Assessing the identified risks

7. Responding to the assessment

8. Evaluating audit evidence and information

9. Communicating possible fraud

10. Documenting consideration of fraud

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUDULANT FINANCIAL

REPORTING

Risk factors:

1. Management’s characteristics and

influence over the control environment

2. Industry conditions

3. Operating characteristics and financial

stability

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUDULANT FINANCIAL

REPORTING

Common schemes:

Improper revenue recognition

Improper treatment of sales

Improper asset valuation

Improper deferral of costs and

expenses

Improper recording of liabilities

Inadequate disclosures

IT Auditing & Assurance, 2e, Hall & Singleton

MISAPPROPRIATION OF

ASSETS

Risk factors:

1. Susceptibility of assets to

misappropriation

2. Controls

IT Auditing & Assurance, 2e, Hall & Singleton

MISAPPROPRIATION OF

ASSETS

Common schemes:

Personal purchases

Ghost employees

Fictitious expenses

Altered payee

Pass-through vendors

Theft of cash (or inventory)

Lapping

IT Auditing & Assurance, 2e, Hall & Singleton

ACFE 2004 REPORT TO THE NATION

IT Auditing & Assurance, 2e, Hall & Singleton

AUDITOR’S RESPONSE TO RISK

ASSESSMENT

Engagement staffing and extent of

supervision

Professional skepticism

Nature, timing, extent of procedures

performed

IT Auditing & Assurance, 2e, Hall & Singleton

AUDITOR’S RESPONSE TO DETECTED

MISSTATEMENTS DUE TO FRAUD

If no material effect:

Refer matter to appropriate level of management

Ensure implications to other aspects of the audit

have been adequately addressed

If effect is material or undeterminable:

Consider implications for other aspects of the audit

Discuss the matter with senior management and

audit committee

Attempt to determine if material effect

Suggest client consult with legal counsel

IT Auditing & Assurance, 2e, Hall & Singleton

AUDITOR’S DOCUMENTATION

Document in the working papers

criteria used for assessing fraud risk

factors:

1. Those risk factors identified

2. Auditor’s response to them

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUD DETECTION TECHNIQUES

USING ACL

Payments to fictitious vendors

Sequential invoice numbers

Vendors with P.O. boxes

Vendors with employee address

Multiple company with same address

Invoice amounts slightly below review

threshold

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUD DETECTION TECHNIQUES

USING ACL

Payroll fraud

Test for excessive hours worked

Test for duplicate payments

Tests for non-existent employee

IT Auditing & Assurance, 2e, Hall & Singleton

FRAUD DETECTION TECHNIQUES

USING ACL

Lapping A.R.

Balance forward method

Open invoice method

IT Auditing & Assurance, 2e, Hall & Singleton

Chapter 12:

Fraud Schemes &

Fraud Detection

IT Auditing & Assurance, 2e, Hall &

IT Auditing & Assurance,

Singleton 2e, Hall & Singleton

Вам также может понравиться

- m3 Ethics, Fraud & Internal ControlДокумент57 страницm3 Ethics, Fraud & Internal ControliiyoОценок пока нет

- M1 Accountancy ProfessionДокумент8 страницM1 Accountancy ProfessionAshley Breva100% (1)

- 2 Inventory Cost Flow Intermediate Accounting ReviewerДокумент3 страницы2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyОценок пока нет

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVДокумент56 страницModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoОценок пока нет

- I Am Sharing 'UPDATED' With YouДокумент258 страницI Am Sharing 'UPDATED' With Youjessamae gundanОценок пока нет

- Module 1A - ACCCOB2 - Introduction To Financial Accounting - FHVДокумент25 страницModule 1A - ACCCOB2 - Introduction To Financial Accounting - FHVCale Robert RascoОценок пока нет

- Cash and Cash EquivalentsДокумент52 страницыCash and Cash EquivalentsDeryl GalveОценок пока нет

- 2009 F-1 Class NotesДокумент4 страницы2009 F-1 Class NotesgqxgrlОценок пока нет

- Closing EntriesДокумент10 страницClosing EntriesFranco DexterОценок пока нет

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Документ18 страницReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydОценок пока нет

- Chapter 22Документ19 страницChapter 22Betelehem GebremedhinОценок пока нет

- Pfrs 7 Financial Instruments DisclosuresДокумент3 страницыPfrs 7 Financial Instruments DisclosuresR.A.Оценок пока нет

- Accounts Receivable - Demo TeachingДокумент59 страницAccounts Receivable - Demo TeachingNicole Flores100% (1)

- Fundamentals of Accounting I Conceptual FrameworkДокумент12 страницFundamentals of Accounting I Conceptual FrameworkericacadagoОценок пока нет

- Chapter 3-4 QuestionsДокумент5 страницChapter 3-4 QuestionsMya B. Walker0% (1)

- H2 Accounting ProfessionДокумент9 страницH2 Accounting ProfessionTrek ApostolОценок пока нет

- APC 403 PFRS For SEs (Section 1-2)Документ3 страницыAPC 403 PFRS For SEs (Section 1-2)AnnSareineMamadesОценок пока нет

- The Public Accounting Profession EnvironmentДокумент3 страницыThe Public Accounting Profession EnvironmentBianca LizardoОценок пока нет

- Ch04 - COMPLETING THE ACCOUNTING CYCLEДокумент46 страницCh04 - COMPLETING THE ACCOUNTING CYCLEMahmud TazinОценок пока нет

- Module 2 Conceptual Frameworks and Accounting Standards PDFДокумент7 страницModule 2 Conceptual Frameworks and Accounting Standards PDFJonabelle DalesОценок пока нет

- CH 01Документ24 страницыCH 01Salsabila SaviraОценок пока нет

- 8 Conceptual Payroll Sytem ProcedureДокумент2 страницы8 Conceptual Payroll Sytem ProcedureEva DagusОценок пока нет

- Quiz SIA - SolvedДокумент5 страницQuiz SIA - SolvedShinta AyuОценок пока нет

- CH 06Документ72 страницыCH 06Lenny FransiskaОценок пока нет

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Документ4 страницыAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainОценок пока нет

- Articles 1319 1346 Essential Requisites of Contracts Consent or Meeting of MindsДокумент68 страницArticles 1319 1346 Essential Requisites of Contracts Consent or Meeting of MindsBenjamin Jr VidalОценок пока нет

- Practice Set - Analysis of FS1Документ1 страницаPractice Set - Analysis of FS1marissa casareno almueteОценок пока нет

- Chapter 10Документ10 страницChapter 10The makas AbababaОценок пока нет

- LECTURE 6 - Suspense - Accounts - and - Error - CorrectionДокумент7 страницLECTURE 6 - Suspense - Accounts - and - Error - CorrectionJafari SelemaniОценок пока нет

- Chapter 5 Computer FraudДокумент5 страницChapter 5 Computer FraudChenyi GuОценок пока нет

- Balance SheetДокумент7 страницBalance Sheetmhrscribd014Оценок пока нет

- Ta-1004q1 Cash and Cash EquivalentsДокумент3 страницыTa-1004q1 Cash and Cash Equivalentsleonardo alis100% (1)

- Pfrs 2 Share-Based PaymentsДокумент3 страницыPfrs 2 Share-Based PaymentsR.A.Оценок пока нет

- Partnership LiquidationДокумент37 страницPartnership LiquidationDe Gala ShailynОценок пока нет

- MODULE DWCC - Obligation and Contracts Part1 OnlineДокумент17 страницMODULE DWCC - Obligation and Contracts Part1 OnlineCharice Anne VillamarinОценок пока нет

- Chapter 25 Borrowing CostsДокумент17 страницChapter 25 Borrowing CostsKendall JennerОценок пока нет

- Chapter 9 InvestmentsДокумент18 страницChapter 9 InvestmentsChristian Jade Lumasag NavaОценок пока нет

- OBLICON BSBA 221 Group 5Документ46 страницOBLICON BSBA 221 Group 5Chad Daniel Morgado100% (1)

- Chapter One Accounting Principles and Professional PracticeДокумент22 страницыChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- #02 Conceptual FrameworkДокумент5 страниц#02 Conceptual FrameworkZaaavnn VannnnnОценок пока нет

- Quiz No. 7: A. MULTIPLE CHOICE: Write The Correct Letter Choice BeforeДокумент6 страницQuiz No. 7: A. MULTIPLE CHOICE: Write The Correct Letter Choice BeforeJOHN MITCHELL GALLARDOОценок пока нет

- Pas 16 Property, Plant, and Equipment: I. NatureДокумент2 страницыPas 16 Property, Plant, and Equipment: I. NatureR.A.Оценок пока нет

- A-Standards of Ethical Conduct For Management AccountantsДокумент4 страницыA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathОценок пока нет

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitДокумент5 страницSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiОценок пока нет

- Writing Up A Case StudyДокумент3 страницыWriting Up A Case StudyalliahnahОценок пока нет

- 3SW1Документ1 страница3SW1Reniel Millar100% (1)

- Chapter 11 Capital Budgeting: Answers To QuestionsДокумент35 страницChapter 11 Capital Budgeting: Answers To Questionsafsdasdf3qf4341f4asDОценок пока нет

- Accounting Is A Process of Analyzing (Business Transactions, Recording and Communicating Information To UsersДокумент12 страницAccounting Is A Process of Analyzing (Business Transactions, Recording and Communicating Information To UsersAnne BustilloОценок пока нет

- Review of The Accounting ProcessДокумент10 страницReview of The Accounting ProcessFranz TagubaОценок пока нет

- Accounting and Its Environment - PowerPoint PresentationДокумент30 страницAccounting and Its Environment - PowerPoint PresentationBhea G. ManaloОценок пока нет

- 2nd Year Accounting NotesДокумент4 страницы2nd Year Accounting NotesMumtazAhmadОценок пока нет

- The Making of A CpaДокумент46 страницThe Making of A CpaMark Alyson NginaОценок пока нет

- Chapter 1 THE INFORMATION SYSTEM AN ACCOUNTANT'S PERSPECTIVEДокумент11 страницChapter 1 THE INFORMATION SYSTEM AN ACCOUNTANT'S PERSPECTIVEAngela Marie PenarandaОценок пока нет

- Comparison of IAS 7 and PAS 7Документ2 страницыComparison of IAS 7 and PAS 7Julia Villanueva100% (1)

- Philippine Accounting Standard No. 16: Property, Plant and EquipmentДокумент101 страницаPhilippine Accounting Standard No. 16: Property, Plant and EquipmentCoco MartinОценок пока нет

- Fraud Schemes & Fraud Detection: IT Auditing & Assurance, 2e, Hall & SingletonДокумент18 страницFraud Schemes & Fraud Detection: IT Auditing & Assurance, 2e, Hall & SingletonKaren UmaliОценок пока нет

- FAFP Backgroud PDFДокумент165 страницFAFP Backgroud PDFRahul KhannaОценок пока нет

- EDP Auditing Week 13 - Business Ethics and FraudДокумент23 страницыEDP Auditing Week 13 - Business Ethics and FraudSHYAILA ANISHA DE LAVANDAОценок пока нет

- Livent Inc 3Документ42 страницыLivent Inc 3maxОценок пока нет

- Chapter 7Документ59 страницChapter 7Muhammed EmbabyОценок пока нет

- R&RДокумент62 страницыR&RPanda BoarsОценок пока нет

- Ch11 Business Ethics FraudДокумент26 страницCh11 Business Ethics FraudPanda BoarsОценок пока нет

- Ch12 Fraud Scheme DetectionДокумент18 страницCh12 Fraud Scheme DetectionPanda BoarsОценок пока нет

- TopicsДокумент4 страницыTopicsAryadeep ChakrabortyОценок пока нет

- Bus TicketДокумент1 страницаBus TicketrrobertОценок пока нет

- Week6-Lecture v2 - MoIS - E-Business, E-Commerce, Mobile - T3 2022Документ51 страницаWeek6-Lecture v2 - MoIS - E-Business, E-Commerce, Mobile - T3 2022kepIT SolutionsОценок пока нет

- University of Agriculture Faisalabad UAF: Submitted To: Miss Zeenat Submitted byДокумент15 страницUniversity of Agriculture Faisalabad UAF: Submitted To: Miss Zeenat Submitted byMavia ZiaОценок пока нет

- Candidate Contact Information: Election and Information ServicesДокумент13 страницCandidate Contact Information: Election and Information ServicesnmpaccОценок пока нет

- ? Thanks!Документ6 страниц? Thanks!NYAM CYRIL MUNANGОценок пока нет

- E Commerce SecurityДокумент5 страницE Commerce SecurityAhmed KhalafОценок пока нет

- OneTwoTrip - Flying Smarter - Russia Beyond The HeadlinesДокумент3 страницыOneTwoTrip - Flying Smarter - Russia Beyond The HeadlinesKatrinaFetzerОценок пока нет

- Treasury Review Audit ReportДокумент118 страницTreasury Review Audit ReportAstalapulos ListestosОценок пока нет

- Abm Test PaperДокумент3 страницыAbm Test PaperNoel BanzuelaОценок пока нет

- Bicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & RuscoДокумент5 страницBicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & Ruscokim suarezОценок пока нет

- Putting The Fin' Back in Fintech: Cases - Insead.EduДокумент14 страницPutting The Fin' Back in Fintech: Cases - Insead.EduRishitha RapoluОценок пока нет

- 01 OSPF LAB SolutionДокумент53 страницы01 OSPF LAB SolutionMahmudul HaqueОценок пока нет

- Consolidated Balance Sheet: Annual Report 2013 - 2014Документ2 страницыConsolidated Balance Sheet: Annual Report 2013 - 2014mgajenОценок пока нет

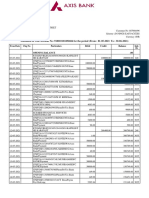

- Acct Statement - XX6717 - 18072023Документ11 страницAcct Statement - XX6717 - 18072023Mevaram GurjarОценок пока нет

- PowerPoint Presentation On Inventory ControlДокумент41 страницаPowerPoint Presentation On Inventory ControlSafwan Shaikh100% (2)

- 08.11.2022 NiteshДокумент1 страница08.11.2022 Niteshnitesh ramakrishnaОценок пока нет

- Battleface IPID GBPДокумент2 страницыBattleface IPID GBPmaria monsecaОценок пока нет

- Supply Chain Logistics PDFДокумент3 страницыSupply Chain Logistics PDFNadia Mezghani100% (1)

- Kathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityДокумент6 страницKathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityAnjo BalucasОценок пока нет

- FadsДокумент12 страницFadsLinky DooОценок пока нет

- Basics of Internet, Intranet, E-Mail, Audio and Video-Conferencing (ICT)Документ5 страницBasics of Internet, Intranet, E-Mail, Audio and Video-Conferencing (ICT)ambika venkateshОценок пока нет

- Account STMTДокумент3 страницыAccount STMTDhanush KumarОценок пока нет

- Annotated Bibliography Draft-1Документ5 страницAnnotated Bibliography Draft-1api-217663549Оценок пока нет

- Uninvoiced Receipt Accruals ReportДокумент5 страницUninvoiced Receipt Accruals ReportranvijayОценок пока нет

- Advantages and Disadvantages of The InternetДокумент6 страницAdvantages and Disadvantages of The InternetWahida Amalin100% (1)

- Introduction To Final AccountsДокумент38 страницIntroduction To Final AccountsCA Deepak Ehn88% (8)

- IA0998809Документ8 страницIA0998809krishnsgkОценок пока нет

- Return Card FormalДокумент13 страницReturn Card FormalJoshua C. CastilloОценок пока нет

- MM Case StudyДокумент2 страницыMM Case StudyRohit PanpatilОценок пока нет