Академический Документы

Профессиональный Документы

Культура Документы

Asset Allocation: Kolehiyo NG Lungsod NG Lipa

Загружено:

Joahnna Magaling ArandaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asset Allocation: Kolehiyo NG Lungsod NG Lipa

Загружено:

Joahnna Magaling ArandaАвторское право:

Доступные форматы

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

ASSET

ALLOCATION

Investment and Portfolio Management

1

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

1. To introduce the concept of Asset Allocation ;

2. To familiarize the students with the factors

affecting asset allocation ; and

3. To give of the importance of asset allocation

Investment and Portfolio Management

2

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

What is asset Allocation?

Investment and Portfolio Management

3

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

ASSET CLASSES :

STOCKS

BONDS

MONEY MARKET (CASH)

Investment and Portfolio Management

4

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

FINANCIAL GOALS and OBJECTIVES

•Buy a home

•Buy a new car

•Buy a boat

•Take a vacation

•Travel to exotic locations

•Establish an emergency fund

•Start your own business

•Fund children’s college education

Investment and Portfolio Management

5

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

ASSETS ALLOCATION FACTORS:

Age

Life expectancy

Financial milestones

Responsibilities and Financial

Obligations

Time Horizon

Investment and Portfolio Management

6

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

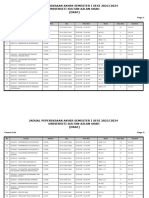

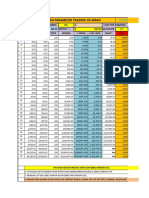

Compound Returns and Time horizon –

8 Percent Return

Years until Goal Investment needed Today

40 46,031

35 67,635

30 93,777

25 146,018

20 214,548

10 463,193

Investment and Portfolio Management

7

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

More Aggressive Investing

Compound Returns and Time horizon –

10 Percent Return

Years until Goal Investment needed Today

40 22,095

35 35,584

30 57,309

25 92,296

20 148,644

10 385,543

Investment and Portfolio Management

8

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

Conservative Approach

Compound Returns and Time horizon –

7 Percent Return

Years until Goal Investment needed Today

40 66,780

35 93,663

30 131,367

25 184,249

20 258,419

10 508,349

Investment and Portfolio Management

9

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

Financial Position

Income Sources

Expected Market Returns

Risk Tolerance

Investment and Portfolio Management

10

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

ADVANTAGE:

Develop and implement financial plan

Achieve optimal portfolio composition

Develop a disciplined approach to

investing and managing your money

Help increase return and take on less

risk

Investment and Portfolio Management

11

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

ALLOCATION vs DIVERSIFICATION

Divide investment Purchasing a

portfolio into number of securities

different asset within an asset

classes category or class to

reduce investment

Investment and Portfolio Management

12

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

Investment and Portfolio Management

13

08/11/20

KOLEHIYO NG LUNGSOD NG LIPA

Maraouy, Lipa City

Investment and Portfolio Management

14

Вам также может понравиться

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОт EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОценок пока нет

- Return and Risk: Kolehiyo NG Lungsod NG LipaДокумент16 страницReturn and Risk: Kolehiyo NG Lungsod NG LipaJoahnna Magaling ArandaОценок пока нет

- The Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyОт EverandThe Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyОценок пока нет

- Investment Fundamentals and Portfolio Management Process: Kolehiyo NG Lungsod NG LipaДокумент8 страницInvestment Fundamentals and Portfolio Management Process: Kolehiyo NG Lungsod NG LipaJoahnna Magaling ArandaОценок пока нет

- Return: Kolehiyo NG Lungsod NG LipaДокумент8 страницReturn: Kolehiyo NG Lungsod NG LipaJoahnna Magaling ArandaОценок пока нет

- Performance of Mutual Funds in Pakistan 2Документ4 страницыPerformance of Mutual Funds in Pakistan 2Muhammad WasifОценок пока нет

- Finance Division Elective Presentation MBA 2020-2022 FinalДокумент31 страницаFinance Division Elective Presentation MBA 2020-2022 FinalNancy SinhaОценок пока нет

- Reits in The Philippines: A Presentation To The Trading Participants of The Philippine Stock Exchange (PSE)Документ27 страницReits in The Philippines: A Presentation To The Trading Participants of The Philippine Stock Exchange (PSE)Ron FabiОценок пока нет

- Prospekt BGF PDFДокумент150 страницProspekt BGF PDFreacharunkОценок пока нет

- Prospectus: Blackrock Global FundsДокумент156 страницProspectus: Blackrock Global FundsInmaОценок пока нет

- Astoria Integrated Annual Report 31 December 2021Документ87 страницAstoria Integrated Annual Report 31 December 2021JEAN MICHEL ALONZEAUОценок пока нет

- SL Investment Opportunities 2022Документ40 страницSL Investment Opportunities 2022Hiranya SamarasekeraОценок пока нет

- Keystone Fund Prospectus 03 2019Документ74 страницыKeystone Fund Prospectus 03 2019Georgio RomaniОценок пока нет

- Investing in Cambdia GuideДокумент90 страницInvesting in Cambdia GuideJoe bilouteОценок пока нет

- Investment CorporationДокумент21 страницаInvestment CorporationPolasi AkterОценок пока нет

- Philequity Fund: Value of P5,000 Invested Since 1998Документ1 страницаPhilequity Fund: Value of P5,000 Invested Since 1998jovz castillonesОценок пока нет

- IL&FS - The Crisis That Has India in Panic Mode - What Is Infrastructure Leasing & Finance Services - The Economic TimesДокумент2 страницыIL&FS - The Crisis That Has India in Panic Mode - What Is Infrastructure Leasing & Finance Services - The Economic TimesAshutosh SharmaОценок пока нет

- Kryptons Singapore VCC Guide June 2021Документ33 страницыKryptons Singapore VCC Guide June 2021Gilberto CalvliereОценок пока нет

- Skraps White PaperДокумент28 страницSkraps White Paperapi-446082592Оценок пока нет

- Third Point Q3 2019 Letter TPOIДокумент13 страницThird Point Q3 2019 Letter TPOImarketfolly.com100% (1)

- BIMB Vs BSN PDFДокумент10 страницBIMB Vs BSN PDFIelts TutorОценок пока нет

- Master Prospectus - Public Series of Shariah-Based FundsДокумент234 страницыMaster Prospectus - Public Series of Shariah-Based FundsFayZ ZabidyОценок пока нет

- Sapm Cia 3Документ37 страницSapm Cia 3Nagori SejalОценок пока нет

- Fact Sheet QEF July 2023Документ1 страницаFact Sheet QEF July 2023Chamara PrasannaОценок пока нет

- Energy Mineral ExtrДокумент33 страницыEnergy Mineral ExtryaklyОценок пока нет

- Syndicate Institute of Bank Management, ManipalДокумент67 страницSyndicate Institute of Bank Management, ManipalProf Dr Chowdari PrasadОценок пока нет

- Investment News: Marei BenefitsДокумент28 страницInvestment News: Marei BenefitsKim at MAREIОценок пока нет

- UCG7p2g3rF SBICAPsДокумент31 страницаUCG7p2g3rF SBICAPsHarapriyaPandaОценок пока нет

- Chapter 5 - FSAДокумент16 страницChapter 5 - FSALuu Nhat MinhОценок пока нет

- Lagaw Lokal Tours and ServicesДокумент90 страницLagaw Lokal Tours and ServicesJu-enBroОценок пока нет

- Project of Y.shankar RaoДокумент40 страницProject of Y.shankar Raorajesh.rajbabu123Оценок пока нет

- World Selection Portfolios ProspectusДокумент71 страницаWorld Selection Portfolios Prospectusmr_3647839Оценок пока нет

- Third Point Q3 2019 LetterДокумент13 страницThird Point Q3 2019 LetterZerohedge100% (2)

- Current Issues Related To Mutual FundsДокумент49 страницCurrent Issues Related To Mutual Fundssonam1616100% (2)

- Co./Pwc: More Value For Your BusinessДокумент36 страницCo./Pwc: More Value For Your Business레 이Оценок пока нет

- Bank LendingДокумент2 страницыBank LendingRanjith RamanОценок пока нет

- LGU Investment Guarantees, Municipal Bonds and Creditworthiness: Challenges and OpportunitiesДокумент26 страницLGU Investment Guarantees, Municipal Bonds and Creditworthiness: Challenges and OpportunitiesThe Outer MarkerОценок пока нет

- 2016 Scholarship BookДокумент160 страниц2016 Scholarship BookTipitakaОценок пока нет

- Day 3 Master Class CS Rakesh Puri Securities Laws 29.06.2020 PDFДокумент119 страницDay 3 Master Class CS Rakesh Puri Securities Laws 29.06.2020 PDFsmchmpОценок пока нет

- Alfm Growth Fund: COL Key HighlightsДокумент1 страницаAlfm Growth Fund: COL Key Highlightsjovz castillonesОценок пока нет

- Sun Life Prosperity Equity FundДокумент1 страницаSun Life Prosperity Equity Fundjovz castillonesОценок пока нет

- First Metro Save & Learn Equity FundДокумент1 страницаFirst Metro Save & Learn Equity Fundjovz castillonesОценок пока нет

- Fund Twenty8: Offer ReviewДокумент20 страницFund Twenty8: Offer Reviewsky22blueОценок пока нет

- List of Licensees As at December 29 2021Документ13 страницList of Licensees As at December 29 2021Annette NgangaОценок пока нет

- Nishit Desai PEДокумент59 страницNishit Desai PEmehulОценок пока нет

- The Next Five Years: What Investors Can ExpectДокумент52 страницыThe Next Five Years: What Investors Can ExpectJonОценок пока нет

- 2010 09 30 PH S AliДокумент2 страницы2010 09 30 PH S AliscionchoОценок пока нет

- Lippo Research PaperДокумент174 страницыLippo Research Paperhakeem.maricanОценок пока нет

- Finance ProjectДокумент36 страницFinance ProjectAlishba KhanОценок пока нет

- White Paper: Premier SolanaДокумент33 страницыWhite Paper: Premier SolanaAFL ŸÄŚÜÖОценок пока нет

- InvestmentДокумент71 страницаInvestmentJon CarlОценок пока нет

- Regulations & Compliance: Presented byДокумент25 страницRegulations & Compliance: Presented byChulbul PandeyОценок пока нет

- ANU SMF - 2020 Annual ReportДокумент27 страницANU SMF - 2020 Annual Reportyinjara.buyerОценок пока нет

- Cryptoassets - Beyond The Hype-1Документ74 страницыCryptoassets - Beyond The Hype-1Pedro Guillermo Martínez FernándezОценок пока нет

- BlackRock LifePath Index2035Документ1 страницаBlackRock LifePath Index2035arrow1714445dongxinОценок пока нет

- Report On Foreign Exchange of AIBLДокумент22 страницыReport On Foreign Exchange of AIBLMd ShahnewazОценок пока нет

- Alternative Investments Become Part of MainstreamДокумент1 страницаAlternative Investments Become Part of MainstreamGanesh KumarОценок пока нет

- L29-Shadow and NBFCДокумент20 страницL29-Shadow and NBFCMrigankshi KapoorОценок пока нет

- Investment Companies Made Simple 2023Документ20 страницInvestment Companies Made Simple 2023quantridoanhnghiep360Оценок пока нет

- Date Amount / Round Valuation Lead Investor InvestorsДокумент2 страницыDate Amount / Round Valuation Lead Investor InvestorsPulkit AggarwalОценок пока нет

- Straman-Docu (Preassessment)Документ4 страницыStraman-Docu (Preassessment)Joahnna Magaling ArandaОценок пока нет

- The Old Tree SwingДокумент1 страницаThe Old Tree SwingJoahnna Magaling ArandaОценок пока нет

- Strategic Management / MissionДокумент12 страницStrategic Management / MissionJoahnna Magaling ArandaОценок пока нет

- What Is Mission?: Kolehiyo NG Lungsod NG LipaДокумент12 страницWhat Is Mission?: Kolehiyo NG Lungsod NG LipaJoahnna Magaling ArandaОценок пока нет

- Rizal Chapter 13-25Документ3 страницыRizal Chapter 13-25Joahnna Magaling Aranda74% (66)

- MC Kinseys 7'S MODELДокумент4 страницыMC Kinseys 7'S MODELJoahnna Magaling ArandaОценок пока нет

- Jadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)Документ53 страницыJadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)WajdiОценок пока нет

- Chapter 1 - The Investment EnvironmentДокумент13 страницChapter 1 - The Investment EnvironmentBùi Thái SơnОценок пока нет

- The Efficient Market Hypothesis: Bodie, Kane and Marcus 9 Global EditionДокумент39 страницThe Efficient Market Hypothesis: Bodie, Kane and Marcus 9 Global EditionFitriana Windi KinantiОценок пока нет

- Quiz 2 Partnership OperationsДокумент4 страницыQuiz 2 Partnership OperationsChelit LadylieGirl FernandezОценок пока нет

- Derivatives Disaster SumitomoДокумент3 страницыDerivatives Disaster SumitomopoojaОценок пока нет

- Allied Bank ReportДокумент53 страницыAllied Bank ReportAli HassanОценок пока нет

- Wachovia Securities DatabookДокумент44 страницыWachovia Securities DatabookanshulsahibОценок пока нет

- FIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Документ17 страницFIN 542 International Financial Management: Mechanics of Foreign Exchange Exchange Rate Parity Text p98Anonymous rcCVWoM8bОценок пока нет

- Marketing Strategy of HDFC Bank IndiaДокумент82 страницыMarketing Strategy of HDFC Bank IndiaAnonymous g7uPednI100% (2)

- 5 Structured Products Forum 2007 Hong KongДокумент11 страниц5 Structured Products Forum 2007 Hong KongroversamОценок пока нет

- Auditing ProblemsДокумент6 страницAuditing ProblemsMaurice AgbayaniОценок пока нет

- EXAM - IA2 ReviewerДокумент17 страницEXAM - IA2 ReviewerMohammad Raffe GuroОценок пока нет

- Untitled Form - Google FormsДокумент4 страницыUntitled Form - Google FormsPavan RoochandaniОценок пока нет

- 17106A1013 - Ratio Analysis of Apollo TyresДокумент14 страниц17106A1013 - Ratio Analysis of Apollo TyresNitin PolОценок пока нет

- 3.1 70. Exercise Loan Schedule UnsolvedДокумент8 страниц3.1 70. Exercise Loan Schedule UnsolvedAniket KarnОценок пока нет

- Forward RatesДокумент2 страницыForward RatesTiso Blackstar GroupОценок пока нет

- 2009 Valuation Handbook A UBS GuideДокумент112 страниц2009 Valuation Handbook A UBS Guidealmasy99100% (4)

- Vystar StatementДокумент13 страницVystar StatementPatsy Hilll100% (2)

- CIR vs. Sekisui Jushi Philippines, IncДокумент2 страницыCIR vs. Sekisui Jushi Philippines, IncCombat GunneyОценок пока нет

- Hedging of Forex Exposure Through Currency Derivatives-Evidence From Select Indian CorporateДокумент10 страницHedging of Forex Exposure Through Currency Derivatives-Evidence From Select Indian CorporateKumarJyotindra SharanОценок пока нет

- I - Eco. of Global Trade & FinanceДокумент256 страницI - Eco. of Global Trade & FinancePrateek UpadhyayОценок пока нет

- Mathematics Grade 3Документ6 страницMathematics Grade 3Micaella VenturaОценок пока нет

- BiiiimplmoniwbДокумент34 страницыBiiiimplmoniwbShruti DubeyОценок пока нет

- Composition of Cash and Cash EquivalentДокумент20 страницComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanОценок пока нет

- Chapter - 6: Economic Value Addition (EvaДокумент12 страницChapter - 6: Economic Value Addition (EvameenudarakОценок пока нет

- What Are Financial GoalsДокумент18 страницWhat Are Financial Goalssumit panchalОценок пока нет

- Dennis Lutz-World Banknote Book Collection A-EДокумент6 страницDennis Lutz-World Banknote Book Collection A-EJosé Luis Arrayás GonzálezОценок пока нет

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossДокумент42 страницыIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossArvind Harrah100% (1)

- Money Management TradingДокумент4 страницыMoney Management TradingBagus Krida0% (1)

- Capital StructureДокумент38 страницCapital StructureShil ShambharkarОценок пока нет