Академический Документы

Профессиональный Документы

Культура Документы

Variable & Absorption Costing

Загружено:

Robin DasИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Variable & Absorption Costing

Загружено:

Robin DasАвторское право:

Доступные форматы

variable & Absorption costing

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Variable & Absorption costing

Variable & Absorption costing - Not job , Batch , Process costing system Variable Costing : (VC) Used for = Internal reporting for decision making w.r.t

a) b) c) d) e) Price fixing on special orders Optional sales mix Adding new product line Dropping new product line Developing production plans if certain input are in short supply f) Buy or make decision g) Selling in a limited market h) Sales mix with constraints i) Sales mix with no constraints

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Absorption Costing : (AC) (Full costing , Traditional costing , Conventional costing) Used for = Income statement for external reporting / IT purposes VC & AC are not mutually exclusive complementary in nature Variable Costing :Recognises only variable costs as production and selling costs

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Fixed manufacturing Over Head are excluded from product cost , not inventoriable , period costs and matches against the revenue for the period. Absorption Costing:Absorbs all cost necessary to product and have it in a saleable form. Manufacturing Over Head are inventoriable , product costs matches against the revenue for the year in which sales are made

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Per year

Normal production (Kg) Actual Production (Kg) Over Head at normal production Other expenses SFR (Standard Fix Over Head rate) Variable cost Sales volume 4000 4800 Rs 16000 Rs 1000 Rs 4/ Unit

R.S.Rengasamy, Dept. of Textile Technology

Rs 6/ Unit Nil

Variable & Absorption costing

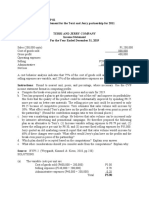

Income statement (Absorption Costing) Particulars A) Sales Revenue Less : Total cost of manufacturing Variable costs (64800) Fix Over Head (44800) Total B) Cost of goods manufactured Plus : Operational Inventory Less : Cost of closing Inventory (480010) 48000 Amount (Rs) 00 = 28800 = 19200 = 48000 = 0000 =

R.S.Rengasamy, Dept. of Textile Technology

C) Cost of goods manufacturing & sold = Nil D) Gross margin (A-C) (Unadjusted) E) Capacity variance (Favourable) (over absd) *8004 ( Fixed costs inventoriable) Nil 3200

Variable & Absorption costing

Income statement (Absorption cost) F) Gross margin (adjusted) (D+E) G) Less other expenses H) Net income before taxes continued 3200 1000 2200 ..

R.S.Rengasamy, Dept. of Textile Technology

* Matched against revenue of the year in which sales are made

Variable & Absorption costing

Income statement (Variable costing)

Particulars A) Sales revenue B) Variable production cost 48006 + opening inventory (variable cost) - closing inventory (variable cost) 48006 C) Cost of goods manufactured & sold D) Contribution (A-C) (Manufacturing) E) Less : Fixed costs Fixed Over Head Others Total * Non-inventoriable * At normal level F) Net income before taxes * Matched against the revenue of that year 17000 = *16000 = 1000 = 17000 = 28800 = Nil = 28800 = Nil Nil Amount (Rs) Nil

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Data

P=S Year 1 Production (Units) Sales (Units) 10000 10000 P>S Year 2 10000 5000 P<S Year 3 10000 15000

R.S.Rengasamy, Dept. of Textile Technology

Sale price @ Rs 12 Variable cost Rs 6/ unit Fixed costs/year Rs 40000(At normal capacity 10000 unit)

Variable & Absorption costing

Income statement ( Year 1) P= S Particulars Sales (1000012) Less cost of goods manufactured Variable cost (100006) Fixed cost (100004) Cost of goods manufactured & sold Gross margin Contribution Less : Fixed cost Net income before taxes 20000 60000 40000 100000 20000 60000 40000 20000 60000 60000 Absorption cost 120000 Variable cost 120000

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Income statement (Year 2) , P>S Particulars A) Sales (500012) Less : cost of goods manufactured (a) Variable cost (100006) (b) Fixed cost (i) Less : Cost of C.I 500010 500006 C) Cost of goods manufactured & sold D) G.M (A-C) Contribution Less Fixed cost Net income 10000 50000 (a+b-i) 10000 30000 40000 10000 50000 30000 30000 ( 100004) B) Cost of goods manufactured (a+b) 60000 40000 100000 60000 60000 Absorption cost 60000 Variable cost 60000

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Income statement (Year 3) ,P<S

Particulars Sales 1500012 Less : cost of goods manufactured VC 100006 FC 100004 Cost of goods manufactured Plus a I 500010 500006 Cost of goods manufactured and sold Goods manufactured Contribution Less Fixed cost Net income before taxes 30000 150000 30000 90000 40000 50000 60000 40000 100000 50000 30000 90000 60000 60000 Absorption cost 180000 Variable cost 180000

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Information for year 1 and 2

Year 1 Production (units) Sales (units) 170000 140000 Year 2 140000 160000

R.S.Rengasamy, Dept. of Textile Technology

Standard variable production cost = Rs 6/Unit Sale Price = Rs 10/Unit Fixed production Over Head at normal capacity 150000 unit = 300000 Rs So, SFR = Rs 2.00 Selling & Administrative expenses:Fixed Rs 130000 Variable 5% of sales

Variable & Absorption costing

Absorption costing

Particulars

Sales revenue Cost of manufacturing + cost of O.I - Cost of C.I Cost of goods manufactured &sold G.M (Unadjusted) Capacity variance G.M (Adjusted) Less Non production costs Net income before taxes Less income tax (35%) Net income after tax 240000(300008) 1120000 280000 40000(200002) 320000 200000 (5% of 14 Lakh+1.3 Lakh) 120000 42000 78000

R.S.Rengasamy, Dept. of Textile Technology

Year 1

1400000 1360000 (81.7 Lakh)

Year 2

1600000 1120000(81.4 Lakh) 240000(80.3 Lakh) 80000(80.1 Lakh) 1280000 320000 20000(100002) 300000 210000 (5% of 16 Lakh+1.3 Lakh) 90000 31500 58500

Variable & Absorption costing

Variable costing

Particulars

Sales revenue Cost of manufacturing + cost of O.I - Cost of C.I Cost of goods manufactured & sold Contribution (manufacturing) Less V. non production cost Contribution (final) Less Fixed cost Fixed Over Head Fixed selling etc. Net income before tax I-Tax Net income after tax 180000 840000 560000 70000 490000 300000 130000 60000 21000 39000

R.S.Rengasamy, Dept. of Textile Technology

Year 1

1400000 1020000

Year 2

1600000 840000 180000 60000 960000 640000 80000 560000 300000 130000 130000 45500 84500

Variable & Absorption costing

Reconcilation statement

Particulars Net income before tax Absorption cost Variable cost Difference Changes in inventory O.I C.I (A) Increase / Decrease in net income (SFRA),(SFR = Rs 2) 60000 40000 20000 30000 30000 30000 10000 20000 10000 10000 120000 60000 60000 90000 130000 40000 210000 190000 20000 Year 1 Year 2 Combined

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Reconcilation statement(VC)

Particulars Increased in sales revenue in year 2 (20000Rs 10) Less Increased manufactured V.C (20000Rs 6) Increased contribution Less Increased selling & Administrative expense (5% of sales) Amount (Rs) 200000 120000 80000 10000

R.S.Rengasamy, Dept. of Textile Technology

Increased contribution (final)

70000

Variable & Absorption costing

Decision making using variable costing

Special order & special price You are operating at lower than normal capacity Some one gives extra order which boost your sales capacity But his offer in selling price is below normal price and contribution from this new offer is positive. Will you accept the order? Your normal capacity is 15000 units Your current capacity is 12000 units (beyond which you don t have local market) Your variable cost per unit is Rs.20 and selling price (Local) is Rs.30 Fixed Overhead at normal capacity = Rs 45000 Your SFOR is Rs 4500/15000 = Rs 3 Extra order is 3000 units at SP/unit = Rs 22

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Using Variable costing

Additional sales revenue is (300022) = 66000 = 60000 = 6000

R.S.Rengasamy, Dept. of Textile Technology

Less variable cost (300020) Additional contribution is

Without this special order SR (1200030) VC (1200020) Contribution Using Absorption costing Sales revenue (300022) = 360000 = 240000 = 120000

= 66000

Variable & Absorption costing

Make or buy a component Annual requirement of a component = 20000 If the component is manufactured in-house (Company has spare capacity and no additional investment is required the cost structure per unit is Direct material = Rs 50 Direct labour = Rs 20 Variable OH = Rs 12 Fixed FOH allocated = Rs 5 Total = Rs 87 If you are outsource it the cost structure is Price = Rs 80 Ordering = Rs 3

R.S.Rengasamy, Dept. of Textile Technology

Variable & Absorption costing

Particular

Direct material (5020000) Direct labour (2020000) Variable OH (1220000) Purchase price (8020000) Ordering/inspection cost(320000) Total cost 1640000

R.S.Rengasamy, Dept. of Textile Technology

Make

1000000 400000 240000

Buy

1600000 60000 1660000

Variable & Absorption costing

Optimal sales mix (No demand constraints)

Particulars X Selling price / unit Less variable cost / unit Contribution margin /unit Time to produce /unit , hrs. (including stoppage time) CM/hour 108 60 48 24 2 Product Y 81 45 36 12 3 Z 72 40 32 8 4

R.S.Rengasamy, Dept. of Textile Technology

If there is no manufacturing constraints (materials , labour, machine, technical competency, layout) What the firm do ?

Variable & Absorption costing

Demand constraints

Operating capacity of company is 300 days/Year X Demand /annum 300 Y 1200 Z 1500

R.S.Rengasamy, Dept. of Textile Technology

Total hours available = 300243 (3 lines) = 21600 All three lines can produce any of X, Y, Z For Z of 1500 unit requires 15008 Remaining hrs. available (21600-12000) Units of Y that can be produced One line exclusively allotted to Z 7200 hrs. = 12000 hrs. = 9600 = 9600/12=800 = 900 units = 600 units = 200 units

2nd line 2/3rd of time (4800 hrs.) allotted to Z 2nd line 1/3rd of time (2400 hrs.) allotted to Y 3rd line fully allotted to Y

7200 hrs.(30024 hrs.) = 600 units

Вам также может понравиться

- Chapter 7 - Accounting For Joint and by ProductsДокумент8 страницChapter 7 - Accounting For Joint and by ProductsJoey LazarteОценок пока нет

- 2024 Becker CPA Financial (FAR) NotesДокумент51 страница2024 Becker CPA Financial (FAR) NotescraigsappletreeОценок пока нет

- Transaction CyclesДокумент7 страницTransaction CyclesJames LopezОценок пока нет

- Solution Manual - RANTE COST ACCДокумент127 страницSolution Manual - RANTE COST ACCray57% (7)

- Revenue Recognition Cookbook 2021-04Документ140 страницRevenue Recognition Cookbook 2021-04Ashok BezawadaОценок пока нет

- Answer Key FPBДокумент74 страницыAnswer Key FPBJoy Gutierrez100% (2)

- Feu Notes 231Документ7 страницFeu Notes 231Naiv Yer NagaliОценок пока нет

- @cmalogics Paper 8 Cost AccountingДокумент260 страниц@cmalogics Paper 8 Cost AccountingMehak Kaushikk100% (1)

- Difference Between GAAP and IFRSДокумент3 страницыDifference Between GAAP and IFRSGoutam SoniОценок пока нет

- Cost Accounting 2013Документ3 страницыCost Accounting 2013GuruKPO0% (1)

- Basic Consideration in MAS Management Accounting EnvironmentДокумент25 страницBasic Consideration in MAS Management Accounting EnvironmentLeslie Beltran Chiang100% (1)

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesДокумент3 страницыResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaОценок пока нет

- ENTREPRENEURIAL MIND REPORTING (Production of Goods and Services-Marketing The Small Business)Документ18 страницENTREPRENEURIAL MIND REPORTING (Production of Goods and Services-Marketing The Small Business)IC SevillanoОценок пока нет

- Absorption and Variable Costing Income Statement: Reporter: Sharmaine Laye M. PascualДокумент20 страницAbsorption and Variable Costing Income Statement: Reporter: Sharmaine Laye M. PascualPatrick LanceОценок пока нет

- Borrowing Cost CH 25 Ia Ppe GGДокумент4 страницыBorrowing Cost CH 25 Ia Ppe GGZes OОценок пока нет

- R12 PJC Student Guide Ed 2 (1) .0 Vol 1 D56806Документ286 страницR12 PJC Student Guide Ed 2 (1) .0 Vol 1 D56806Siva KumarОценок пока нет

- CPA Reviewer in Taxation (2022) - Tabag SearchableДокумент628 страницCPA Reviewer in Taxation (2022) - Tabag SearchableTOBIT JEHAZIEL SILVESTREОценок пока нет

- Cost Concepts and ClassificationsДокумент15 страницCost Concepts and ClassificationsMae Ann KongОценок пока нет

- Module 11 - Standard Costing and Variance AnalysisДокумент10 страницModule 11 - Standard Costing and Variance AnalysisAndrea Valdez100% (1)

- Gross Profit AnalysisДокумент4 страницыGross Profit AnalysisLady Lhyn LalunioОценок пока нет

- Mas Test Bank QuestionДокумент20 страницMas Test Bank QuestionAsnor RandyОценок пока нет

- 19733ipcc CA Vol2 Cp4Документ70 страниц19733ipcc CA Vol2 Cp4m kumar100% (1)

- Chap8 PDFДокумент63 страницыChap8 PDFFathinus SyafrizalОценок пока нет

- 0461 MAS Preweek QuizzerДокумент32 страницы0461 MAS Preweek QuizzerWinter SummerОценок пока нет

- Relevant Costing - HandoutДокумент10 страницRelevant Costing - HandoutUsra Jamil SiddiquiОценок пока нет

- Impairment of AssetsДокумент19 страницImpairment of AssetsTareq SojolОценок пока нет

- MAS CVP Analysis HandoutsДокумент8 страницMAS CVP Analysis HandoutsMartha Nicole MaristelaОценок пока нет

- Chapter On CVP 2015 - Acc 2Документ16 страницChapter On CVP 2015 - Acc 2nur aqilah ridzuanОценок пока нет

- IAS 23 Borrowing CostsДокумент6 страницIAS 23 Borrowing CostsSelva Bavani SelwaduraiОценок пока нет

- Theory of Accounts On Business CombinationДокумент2 страницыTheory of Accounts On Business CombinationheyОценок пока нет

- 2-Quiz Chapter 9 Foreign Currency TransactionДокумент2 страницы2-Quiz Chapter 9 Foreign Currency Transactionnoproblem 5555Оценок пока нет

- Introduction To Accounting For Construction ContractsДокумент4 страницыIntroduction To Accounting For Construction ContractsJohn TomОценок пока нет

- Ex2 Accounting For MaterialsДокумент6 страницEx2 Accounting For MaterialsCHACHACHA100% (1)

- Job Costing and Process CostingДокумент3 страницыJob Costing and Process CostingUmair Siyab100% (1)

- Segment ReportingДокумент12 страницSegment ReportingChloe Miller100% (1)

- Cost and Cost ClassificationДокумент10 страницCost and Cost ClassificationAmod YadavОценок пока нет

- Afar Corporate Liquidation: Problem 1: The Statement of AffairsДокумент5 страницAfar Corporate Liquidation: Problem 1: The Statement of AffairsCha EsguerraОценок пока нет

- CVP AssignmentДокумент5 страницCVP AssignmentAccounting MaterialsОценок пока нет

- Topic 1: Statement of Financial PositionДокумент10 страницTopic 1: Statement of Financial Positionemman neri100% (1)

- Standard Costing 1.1Документ3 страницыStandard Costing 1.1Lhorene Hope DueñasОценок пока нет

- CA5 Accounting For Factory OverheadДокумент15 страницCA5 Accounting For Factory OverheadhellokittysaranghaeОценок пока нет

- Study Guide 3030Документ14 страницStudy Guide 3030arsenal2687100% (1)

- Differential Cost AnalysisДокумент7 страницDifferential Cost AnalysisSalman AzeemОценок пока нет

- 2.1 Trade and Other ReceivablesДокумент4 страницы2.1 Trade and Other ReceivablesShally Lao-unОценок пока нет

- Ma Bep01Документ4 страницыMa Bep01Grace SimonОценок пока нет

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFДокумент22 страницы05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalОценок пока нет

- Activity 3Документ3 страницыActivity 3Alexis Kaye DayagОценок пока нет

- Cost Accounting ReviewerДокумент2 страницыCost Accounting ReviewerHenry Cadano HernandezОценок пока нет

- AT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFДокумент12 страницAT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFJohn Carlo CruzОценок пока нет

- 1 ++Marginal+CostingДокумент71 страница1 ++Marginal+CostingB GANAPATHYОценок пока нет

- ACCT 102 CH 23 PP Wild 7e CH23 AccessibleДокумент50 страницACCT 102 CH 23 PP Wild 7e CH23 AccessibleSHARAD K PAWARОценок пока нет

- Cost Accumulation Comp PDFДокумент29 страницCost Accumulation Comp PDFGregorian JerahmeelОценок пока нет

- Financial Asset MILLANДокумент6 страницFinancial Asset MILLANAlelie Joy dela CruzОценок пока нет

- Introduction To Branch Lecture NotesДокумент3 страницыIntroduction To Branch Lecture Notespladop100% (1)

- Sale of Operation (Binding Sale Agreement) B. Closure or ReorganizationДокумент3 страницыSale of Operation (Binding Sale Agreement) B. Closure or ReorganizationkimОценок пока нет

- Summary Notes - Review Far - Part 3: 1 A B C D 2Документ10 страницSummary Notes - Review Far - Part 3: 1 A B C D 2Fery AnnОценок пока нет

- Student Notes, LeasesДокумент59 страницStudent Notes, LeasesGreg SaundersОценок пока нет

- Acct 3Документ25 страницAcct 3Diego Salazar100% (1)

- AC 10 - MODULE 5 - Joint Products and By-Products - FINALДокумент7 страницAC 10 - MODULE 5 - Joint Products and By-Products - FINALAnne Danica TanОценок пока нет

- Responsibility Accounting and TP Transfer PricingДокумент8 страницResponsibility Accounting and TP Transfer PricingAmdcОценок пока нет

- Variable Costing - Lecture NotesДокумент22 страницыVariable Costing - Lecture NotesRaghavОценок пока нет

- Module1 - Foreign Currency Transaction and TranslationДокумент3 страницыModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Process Costing and Hybrid Product-Costing SystemsДокумент17 страницProcess Costing and Hybrid Product-Costing SystemsWailОценок пока нет

- Mockboard (Mas)Документ3 страницыMockboard (Mas)Nezhreen MaruhomОценок пока нет

- Chap 2 Management AccountingДокумент14 страницChap 2 Management AccountingAldrin Frank ValdezОценок пока нет

- Responsibility Accounting, Segment Reporting, and Common Cost AllocationДокумент7 страницResponsibility Accounting, Segment Reporting, and Common Cost AllocationGilbert TiongОценок пока нет

- MasДокумент27 страницMaskevinlim186Оценок пока нет

- All Sums CostingДокумент14 страницAll Sums Costingshankarinadar100% (1)

- Operating CostingДокумент34 страницыOperating CostingGanesh NikamОценок пока нет

- Solutions ManualДокумент5 страницSolutions ManualMd Sajid RahmanОценок пока нет

- Associate Degree of Accounting: Examination Question BookletДокумент11 страницAssociate Degree of Accounting: Examination Question BookletfernandarvОценок пока нет

- Consumer Buying MotivesДокумент22 страницыConsumer Buying Motiveshareesh13hОценок пока нет

- Midterm Exam Solution Fall 2013Документ17 страницMidterm Exam Solution Fall 2013Daniel Lamarre100% (3)

- Life Cycle Costing (LLC) in Value EngineeringДокумент37 страницLife Cycle Costing (LLC) in Value EngineeringanantarajkhanalОценок пока нет

- Makerere University College of Business and Management Studies Master of Business AdministrationДокумент15 страницMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidОценок пока нет

- CM121.COAIL I Question CMA September 2022 Exam.Документ8 страницCM121.COAIL I Question CMA September 2022 Exam.newazОценок пока нет

- The Expenditure Cycle 2Документ12 страницThe Expenditure Cycle 2Princess Nicole Posadas OniaОценок пока нет

- ACC116 - Chapter 1Документ26 страницACC116 - Chapter 1SHARIFAH NOORAZREEN WAN JAMURIОценок пока нет

- Nutribatatas-ChipsДокумент13 страницNutribatatas-Chipsglecelyn yantoОценок пока нет

- BM1805 Service Costing and Retail Inventory MethodДокумент5 страницBM1805 Service Costing and Retail Inventory MethodMaria Anndrea MendozaОценок пока нет

- 2 Final Acc. Manu.Документ24 страницы2 Final Acc. Manu.caprerna2022Оценок пока нет

- The Transfer Pricing ProblemДокумент3 страницыThe Transfer Pricing ProblemnisaОценок пока нет

- CVP Analy & Dec Making ProblemsДокумент4 страницыCVP Analy & Dec Making ProblemsRahul SinghОценок пока нет

- Notes - Reasons For High Inventory Holding CostsДокумент4 страницыNotes - Reasons For High Inventory Holding Costsmaria luzОценок пока нет

- Powerpoint - Cost AccountingДокумент24 страницыPowerpoint - Cost AccountingDan RyanОценок пока нет

- 2018 HCI C2H2 Economics - Prelim CSQ1 Suggested AnswersДокумент4 страницы2018 HCI C2H2 Economics - Prelim CSQ1 Suggested Answerstrizillion12Оценок пока нет

- Project SynopsisДокумент4 страницыProject SynopsisSourindranath MaityОценок пока нет

- Cost Notes by Miss Ravina InchalkarДокумент2 страницыCost Notes by Miss Ravina Inchalkarravina inchalkarОценок пока нет

- Incremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsДокумент43 страницыIncremental Analysis: Summary of Questions by Objectives and Bloom'S Taxonomy True-False StatementsMarcus MonocayОценок пока нет

- Strat Cost Ass 4Документ2 страницыStrat Cost Ass 4Sunghoon SsiОценок пока нет