Академический Документы

Профессиональный Документы

Культура Документы

Erpm 2

Загружено:

Nivethitha NarayanasamyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Erpm 2

Загружено:

Nivethitha NarayanasamyАвторское право:

Доступные форматы

ERPM

Unit 2

Equity valuation

Basic Types of Models

Balance Sheet Models

Dividend Discount Models

Price/Earning Ratios

Estimating Growth Rates and

Opportunities

Models of Equity Valuation

Balance sheet Models

Book Value Method = NW of Co./ No.of

shares

Liquidation Value Method = (Value realised

by liquidating all assets of firm- Amt paid to

creditors & pref. shareholders)/No.of shares

Replacement cost

Intrinsic Value

Self assigned Value

Variety of models are used for estimation

Market Price

Consensus value of all potential traders

Trading Signal

IV > MP Buy

IV < MP Sell or Short Sell

IV = MP Hold or Fairly Priced

Intrinsic Value and Market Price

V

D

k

o

t

t

t

=

+

=

( ) 1

1

V

0

= Value of Stock

D

t

= Dividend

k = required return

Dividend Discount Models: General

Model

V

D

k

o =

Stocks that have earnings and dividends that are

expected to remain constant.

Preferred Stock

No Growth Model

E

1

= D

1

= Rs. 5.00

k = .15

V

0

= Rs. 5.00 / .15 = Rs. 33.33

V

D

k

o =

No Growth Model: Example

Vo

D g

k g

o

=

+

( ) 1

g = constant perpetual growth rate

Constant Growth Model

Vo

D g

k g

o

=

+

( ) 1

E

1

= Rs. 5.00 b = 40% k = 15%

(1-b) = 60% D

1

= Rs. 3.00 g = 8%

V

0

= 3.00 / (.15 - .08) = Rs. 42.86

Constant Growth Model: Example

g ROE b =

g = growth rate in dividends

ROE = Return on Equity for the firm

b = plough back or retention percentage rate

(1- dividend payout percentage rate)

Estimating Dividend Growth Rates

) 1 ( ) 1 ( ) 1 (

...

2

2

1

1

0

k

P D

k

D

k

D

V N

N N

+ + +

+

+ + =

P

N

= the expected sales price for the stock at time N

N = the specified number of years the stock is

expected to be held

Specified Holding Period Model

V

E

k

PVGO

PVGO

D g

k g

E

k

o

o

= +

=

+

1

1 1 ( )

( )

PVGO = Present Value of Growth

Opportunities

E

1

= Earnings Per Share for period 1

Growth & No Growth Components of

Value

ROE = 20% d = 60% b = 40%

E

1

= Rs. 5.00 D

1

= Rs. 3.00 k = 15%

g = .20 x .40 = .08 or 8%

Partitioning Value: Example

Partitioning Value: Example

Vo = 3/(0.15 0.08) = Rs. 42.86

NGVo = 5/0.15 = Rs. 33.33

(No Growth Value)

PVGo = Rs. 42.86 33.33 = Rs. 9.52

(Present value of Growth Opportunities)

P/E Ratios are a function of two factors

Required Rates of Return (k)

Expected growth in Dividends

Uses

Relative valuation

Extensive Use in industry

Price Earnings Ratios

P

E

k

P

E k

0

1

0

1

1

=

=

E

1

- expected earnings for next year

E

1

is equal to D

1

under no growth

k - required rate of return

P/E Ratio: No Expected Growth

) (

1

) (

) 1 (

1

0

1 1

0

ROE b k

b

E

P

ROE b k

b E

g k

D

P

=

b = retention ratio

ROE = Return on Equity

P/E Ratio with Constant Growth

E

0

= Rs. 2.50 g = 0 k = 12.5%

P

0

= D/k = Rs. 2.50/.125 = Rs. 20.00

PE = 1/k = 1/.125 = 8

Numerical Example: No Growth

b = 60% ROE = 15% (1-b) = 40%

E

1

= Rs. 2.50 (1 + (.6)(.15)) = Rs. 2.73

D

1

= Rs. 2.73 (1-.6) = Rs. 1.09

k = 12.5% g = 9%

P

0

= 1.09/(.125-.09) = Rs. 31.14

PE = 31.14/2.73 = 11.4

PE = (1 - .60) / (.125 - .09) = 11.4

Numerical Example with Growth

Pitfalls in P/E Analysis

Use of accounting earnings

Historical costs

May not reflect economic earnings

Reported earnings fluctuate around the

business cycle.

Other Valuation Ratios

Price-to-Book

Price-to-Cash Flow

Price-to-Sales

Inflation and Equity Valuation

Inflation has an impact on equity

valuations.

Historical costs underestimate economic

costs.

Empirical research shows that inflation has

an adverse effect on equity values.

Research shows that real rates of return are

lower with high rates of inflation.

Lower Equity Values with Inflation

Shocks cause expectation of lower earnings by

market participants.

Returns are viewed as being riskier with higher

rates of inflation.

Real dividends are lower because of taxes.

Bonds

Face or par value

Coupon rate

Zero coupon bond

Compounding and payments

Accrued Interest

Indenture

Bond Characteristics

Different Issuers of Bonds

Treasury

Notes and Bonds

Corporations

Municipalities

International Governments and Corporations

Innovative Bonds

Indexed Bonds

Floaters and Inverse Floaters

Secured or unsecured

Call provision

Convertible provision

Put provision (putable bonds)

Floating rate bonds

Sinking funds

Provisions of Bonds

) 1 (

) 1 (

1 r

ParValue

r

C

P

T

T

T

t

t

t

B

+

+

+ =

=

P

B

= Price of the bond

C

t

= interest or coupon payments

T = number of periods to maturity

r = semi-annual discount rate or the semi-annual

yield to maturity

Bond Pricing

C

t

= 40 (SA)

P = 1000

T = 20 periods

r = 3% (SA)

Price: 10-yr, 8% Coupon, Face = Rs.1,000

( )

77 . 148 , 1 .

) 03 . 1 (

1000

03 . 1

1

40

20

20

1

Rs P

P

t

t

=

+ =

=

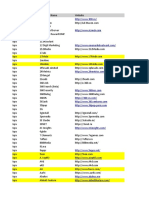

Investment related websites

www.myiris.com

www.moneycontrol.com

www.indiainfoline.com

www.valuenotes.com

www.karvy.com

www.siainvestor.com

www.sebi.gov.in

www.amfiindia.com

www.freddiemac.com

www.sharekhan.com

www.motilaloswal.com

www.capitalmarket.com

www.trendwatch.com

www.nsdl.co.in

www.stcionline.com

www.icicidirect.com

www.bseindia.com

www.nse-india.com

Investment related websites cont

www.capitalideasonline.com

www.centraldepository.com

www.bondmarkets.com

www.bonds-online.com

www.debtonnet.com

Prices and Yields (required rates of return)

have an inverse relationship

When yields get very high the value of the

bond will be very low.

When yields approach zero, the value of

the bond approaches the sum of the cash

flows.

Bond Prices and Yields

Price

Yield

Prices and Coupon Rates

Yield to Maturity

Interest rate that makes the present value of

the bonds payments equal to its price.

Solve the bond formula for r

) 1 (

) 1 (

1 r

ParValue

r

C

P

T

T

T

t

t

t

B

+

+

+ =

=

Yield to Maturity Example

) 1 (

1000

) 1 (

35

950

20

1

r

r

T

t

t

+

+

+ =

=

10 yr Maturity Coupon Rate = 7%

Price = Rs.950

Solve for r = semiannual rate

r = 3.8635%

Yield Measures

Bond Equivalent Yield

7.72% = 3.86% x 2

Effective Annual Yield

(1.0386)

2

- 1 = 7.88%

Current Yield

Annual Interest / Market Price

Rs.70 / Rs.950 = 7.37 %

Realized Yield versus YTM

Reinvestment Assumptions

Holding Period Return

Changes in rates affects returns

Reinvestment of coupon payments

Change in price of the bond

Holding-Period Return: Single Period

HPR = [ I + ( P

0

- P

1

)] / P

0

where

I = interest payment

P

1

= price in one period

P

0

= purchase price

Holding-Period Example

CR = 8% YTM = 8% N=10 years

Semiannual Compounding P

0

= Rs.1000

In six months the rate falls to 7%

P

1

= Rs.1068.55

HPR = [40 + ( 1068.55 - 1000)] / 1000

HPR = 10.85% (semiannual)

Holding-Period Return: Multiperiod

Requires actual calculation of

reinvestment income

Solve for the Internal Rate of Return using

the following:

Future Value: sales price + future value of

coupons

Investment: purchase price

Rating companies

Moodys Investor Service

Standard & Poors

Duff and Phelps

Fitch

Rating Categories

Investment grade

Speculative grade

Default Risk and Ratings

Coverage ratios

Leverage ratios

Liquidity ratios

Profitability ratios

Cash flow to debt

Factors Used by Rating Companies

Sinking funds

Subordination of future debt

Dividend restrictions

Collateral

Protection Against Default

Default Risk and Yield

Risk structure of interest rates

Default premiums

Yields compared to ratings

Yield spreads over business cycles

Bonds recap

Reasons for issue

Reduce cost of capital

Leverage

Tax saving

Widen sources of funds

Preserve control

Bonds recap

Attributes

Length of time until maturity

Coupon rate

Call provision premature redemption above par

Tax status deep discount bonds

Marketability / liquidity

Likelihood of default risk premium

Y

T

M

{

Bonds - recap

Current yield = Annual interest / Market price

Holding period yield = (r + P) / Po

YTM yield, purchase to maturity

PV of all cash flows

Approx YTM = Int Discount / Premium

(Current price + Par value)/2

Bonds recap

Risks in bonds

Purchasing power

Interest rate

Price

Time period volatility

Coupon rate volatility

Yield volatility

Reinvestment

Bonds recap

Term structure

Structure of yields observed for bonds with

different terms to maturity (but no other difference)

ST r fluctuates more

LT P fluctuates more

Bonds recap

Term structure arises due to

Expectation hypothesis

1 year bond 6%, 2 years bond 7%

If investor believes that r will go up to 8%, he will buy

only 1 year bond

Liquidity premium hypothesis

LT more risk, more premium expected

Segmented market hypothesis

Different groups prefer different bonds

LIC LT

Banks ST

Examples

What is the YTM for a 12%, 15 year bond

selling at Rs.120 and par value of Rs. 100

What will be the YTM in the above case if the

bond was issued at a discount of 20%

Find the current yield, YTM & YTC for a 16%,

20 years bond callable after 10 years at Rs.

116. The selling price is Rs. 125 and par

value is Rs. 100.

Examples

What will be the price of a 12%, 15 year bond

with an YTM of 10%?

Find the price of a Zero coupon, 15 year

bond with YTM of 8 %. The par value is Rs.

1000

Find out

Duration

Immunization

Passive strategy

Bond ladder strategy

Derivatives

Options

Rights

Warrants

Futures

Terminology

Options agreement

Contract

Writer grants right to sell/buy

Designated instrument

Exercise price / strike price / striking price

Specified time period

Option premium

Call option right to purchase

Put option right to sell

Profit / Loss

Value at expiration

Stock price ~ Exercise Price

Profit

Final value ~ Original investment

American & European Options

American option

Holder exercises the right to purchase / sell the

underlying asset on or before the expiration

More valuable

NSE

European option

Holder can exercise the right only on the

expiration date

S&P Nifty

Listed options

Stocks

Foreign currency

Agro products

Gold

Silver

Fixed income securities

Option value determining factors

Effect of increase

Put Call

Current stock price (S)

Striking price (K)

Time to expiration (t)

Volatility

Interest rates

Cash dividends

Find the equivalents of

Long put

Long stock

Long call

Short call

Short stock

Short put

Positions & Strategies

Buy short-term securities

Buy stock

Sell stock short

Purchase a put

Buy a call

Write a call

Purchase the stock and sell a call

Sell a put

Call option value

Option

value

X

Stock Price

Value of Call

Intrinsic Value

Time value

Find out

Straddle

Strip

Spread

Strap

In-the-money contract

At-the money contract

Out-of-the-money contract

Contango

Backwardation

Black-Scholes Option Valuation

Pc = [Ps] [N(d1)] [Pe] [antiln (-Rf t)][Nd2]

Pc = market value of the call option

Ps = price of the stock

Pe = striking price of the option

Rf = annualized interest rate

Antiln = antilog (base e)

T = time to expiration in years

d1 = ln (Ps/Pe) + (Rf + 0.5o

2

) t / t

d2 = d1 - o t

Example

Ps = 54.38

Pe = 55

T = 0.5416

Rf= 3%

o = 19

Right

Option with very short life

Originate in new issue

Right given to current shareholders

Warrant

Call option

Longer shelf life

Trade Statistics for NSE

Trade Statistics for 13-Jul-2009

Product

No. of

contracts

Turnover

(Rs. cr.) *

Index Futures 6,60,362 12,516.99

Stock Futures 4,90,381 12,281.38

Index Options 11,78,647 24,287.94

Stock Options 43438 1,212.19

Interest Futures 0 0

F&O Total 23,72,828 50,298.51

Modern Portfolio Theories

Portfolio Theory

CAPM & APT

CML

SML

Efficient Market Hypothesis

Random Walk

Forms of efficiency

All information / Public information / No relation

Behavioural Finance

CAPM

Risk is measure by variance of expected

returns

Return = R.F. + Beta (MR RF)

The unsystematic risk is taken care of

diversification (SML)

Beta < 1 defensive securities

Beta > 1 aggressive scrips

CAPM

Empirical tests have not given support to the

theory

Many non-Beta factors also affect the returns

Calculation of Beta is itself doubtful, because

historical Beta may not reflect the future risk

or return

It also assumes that market is in equilibrium

Arbitrage Pricing Theory

Equilibrium model similar to CAPM

Investors do not look at expected returns and

SD

If price of an asset is different in different

markets, arbitrage brings them to the same

price

APT is based on the return generated by

factor models

APT

Pure factor portfolios depend on only one

factor

But in practice only impure factor portfolios

can be created

Synthesis of CAPM and APT is more realistic

Beta = Cov (Ri Rm) / Market variance

Portfolio Management

Sharpes measure

SI = (Avg Return RF) / SD total risk

Treynors Measure

TI = (Portfolio return RF) / Beta systematic risk

Jensens Model

Avg return RF = Alpha + Beta (MF RF)

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Unit IIIДокумент40 страницUnit IIINivethitha NarayanasamyОценок пока нет

- Pricing 2Документ5 страницPricing 2Nivethitha NarayanasamyОценок пока нет

- Erpm 1Документ33 страницыErpm 1Nivethitha NarayanasamyОценок пока нет

- Retail AuditДокумент44 страницыRetail AuditNivethitha Narayanasamy50% (2)

- VCArticle ExitRoutesДокумент13 страницVCArticle ExitRoutesNivethitha NarayanasamyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- International Pricing StrategiesДокумент19 страницInternational Pricing StrategiesshailuОценок пока нет

- Entrepreneurship Module (G-12)Документ21 страницаEntrepreneurship Module (G-12)Eva Fe Vafz MojadoОценок пока нет

- Mission Vision and ObjectivesДокумент5 страницMission Vision and ObjectiveskarunaduОценок пока нет

- Guidelines For Extending Equity Support To Housing Finance CompaniesДокумент3 страницыGuidelines For Extending Equity Support To Housing Finance CompaniessrirammaliОценок пока нет

- Social Media Marketing PlaybookДокумент25 страницSocial Media Marketing PlaybookEcoterra AKAОценок пока нет

- V K 11 Create PricingДокумент9 страницV K 11 Create PricingNguyenkimthang86Оценок пока нет

- Module III: Growth and Development of Entrepreneurial VenturesДокумент21 страницаModule III: Growth and Development of Entrepreneurial VenturesShaifali GargОценок пока нет

- COURSE OUTLINE - Advanced Credit Adminstration - 2024Документ6 страницCOURSE OUTLINE - Advanced Credit Adminstration - 2024professionОценок пока нет

- Notas FA R12Документ75 страницNotas FA R12serjimgon2112Оценок пока нет

- Assignment 3Документ1 страницаAssignment 3University StudentОценок пока нет

- 2022 2023 Approved Lenders List 1Документ1 страница2022 2023 Approved Lenders List 1WaqasОценок пока нет

- ASPD 2 Scrapped FinalДокумент115 страницASPD 2 Scrapped FinaliqraОценок пока нет

- Product & Service Design-Operation ManagementДокумент4 страницыProduct & Service Design-Operation ManagementHtetThinzarОценок пока нет

- Strategic Business ManagementДокумент5 страницStrategic Business Managementchamila2345Оценок пока нет

- Financial Problems of StartupsДокумент65 страницFinancial Problems of StartupsSoham Dalvi100% (2)

- Indian Money MarketДокумент79 страницIndian Money MarketParth Shah100% (5)

- Case Assignment 2Документ5 страницCase Assignment 2Ashish BhanotОценок пока нет

- Curriculum Vitae: Purpose To DevelopДокумент2 страницыCurriculum Vitae: Purpose To DevelopDuc TuОценок пока нет

- Short Term & Long Term Decision MakingДокумент3 страницыShort Term & Long Term Decision MakingAditya Doshi100% (1)

- Chapter IVДокумент88 страницChapter IVNesri Yaya100% (1)

- Taxi Business Plan ExampleДокумент36 страницTaxi Business Plan ExampleARIF100% (1)

- Wheelen 14e Ch04-FinalДокумент52 страницыWheelen 14e Ch04-FinalEngMohamedReyadHelesyОценок пока нет

- 8 Identifying Market Segments and TargetsДокумент33 страницы8 Identifying Market Segments and TargetsSepti A. PratiwiОценок пока нет

- Cia 1 FRMДокумент4 страницыCia 1 FRMIMRAN KHAN 2127815Оценок пока нет

- Demat System in IndiaДокумент20 страницDemat System in IndiaRohit Lalwani100% (2)

- InventoriesДокумент3 страницыInventoriesJane TuazonОценок пока нет

- Financial Projection Analysis Report For StudentsДокумент6 страницFinancial Projection Analysis Report For StudentsArchie TonogОценок пока нет

- Southern Mindanao Colleges Pagadian City: Jeep Accel 2Документ8 страницSouthern Mindanao Colleges Pagadian City: Jeep Accel 2Gennyse Balmadres-Selaras Pantorilla-FernandezОценок пока нет

- Understanding Income Statements EPS CalculationsДокумент39 страницUnderstanding Income Statements EPS CalculationsKeshav KaplushОценок пока нет

- B Com/BBA: Accounting For ManagementДокумент15 страницB Com/BBA: Accounting For ManagementArchanaОценок пока нет