Академический Документы

Профессиональный Документы

Культура Документы

Super Annuation Schemes

Загружено:

Swapnali RajputИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Super Annuation Schemes

Загружено:

Swapnali RajputАвторское право:

Доступные форматы

SUPER ANNUATION SCHEMES

Superannuation

superannuation refer to a pension granted upon retirement In general, a pension is an arrangement to provide people with an income when they are no longer earning a regular income from employment Retirement plans may be set up by employers, insurance companies, the government or other institutions such as employer associations or trade unions.

Superannuation is a retirement Benefit by employer . It is a contribution made by employer each year on your behalf towards the group superannuation policy held by the employer. This is an important part of creating wealth for your retirement.

Superannuation Fund is a retirement benefit given to employees by the Company. Normally the Company has a link with agencies like LIC Superannuation Fund, where their contributions are paid. The Company pays 15% of basic wages as superannuation contribution. There is no contribution from the employee. This contribution is invested by the Fund in various securities as per investment pattern prescribed. Interest on contributions is credited to the members account. Normally the rate of interest is equivalent to the PF interest rate.

On attaining the retirement age, the member is eligible to take 25% of the balance available in his/her account as a tax free benefit.

The balance 75% is put in a annuity fund, and the agency (LIC) will pay the member a monthly/quarterly/periodic annuity returns depending on the option exercised by the member. This payment received regularly is taxable.

In the case of resignation of the employee, the employee has the option to transfer his amount to the new employer. If the new employer does not have a Superannuation scheme, then the employee can withdraw the amount in the account, subject to deduction of tax and approval of IT department, or retain the amount in the Fund, till the superannuation age.

TWO TYPES OF BENEFITS - ADVANCE FIXATION OF BENEFITS AND MONEY

PURCHASE SCHEME. EVERY COMPANY IS SUBSCRIBING TO MONEY PURCHASE SCHEME (WITH THE FIXED PERCENTAGE OF CONTRIBUTIONS PER MONTH TRANSFER FROM PREVIOUS EMPLOYER CAN ALSO BE RECEIVED (TAX FREE).

TRANSFER TO OTHER'S TRUST CAN ALSO BE PAID (TAX FREE).

NEW EMPLOYER CAN HAVE MINIMUM MANDATORY SERVICE CLAUSES FOR THEIR OWN CONTRIBUTION BUT THEY CANNOT TOUCH PREVIOUS TRANSFERRED FUNDS. 15% CONTRIBUTION TAX FREE IS THE BIGGEST TOOL OF TAX PLANNING. EMPLOYEES IN THE HIGHEST BRACKETS ARE MOST BENEFITED. NOT ONLY CONTRIBUTION IS TAX FREE BUT THE INTEREST @ 12% IS TAX FREE. 12% TAX FREE INTEREST IS EQUAL TO 18% TAXABLE INTEREST.

Rules of Superannuation on Maturity Once the employee completes 3 years of service and works till his/her retirement, he/she can make use of superannuation balance as a form of pension. He/She can withdraw 1/3rd of the accumulated balance after retirement and the rest can be availed as monthly pension till end of life.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Confirmation Review Form - Bharat MehrotraДокумент2 страницыConfirmation Review Form - Bharat MehrotraSwapnali RajputОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Induction & Orientation FinalДокумент32 страницыInduction & Orientation FinalSwapnali RajputОценок пока нет

- MCS Telecom Sector MPДокумент19 страницMCS Telecom Sector MPSwapnali RajputОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Three-Stage International Product Life CycleДокумент4 страницыThree-Stage International Product Life CycleSwapnali RajputОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- ECO-2-D11 - Compressed PDFДокумент6 страницECO-2-D11 - Compressed PDFAkshay kumarОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalДокумент4 страницыThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Linear Programming FormulationДокумент27 страницLinear Programming FormulationDrama ArtОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Business Intelligence and BankingДокумент12 страницBusiness Intelligence and BankingniklasОценок пока нет

- Summary - Rule 68 71Документ32 страницыSummary - Rule 68 71Allana NacinoОценок пока нет

- Presentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTДокумент15 страницPresentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTMAHENDRA SHIVAJI DHENAK33% (3)

- PDF#23 - A New Real Estate Deal Enters The MixДокумент3 страницыPDF#23 - A New Real Estate Deal Enters The MixMatthew Tyrmand100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- SECTION 4.1 Payment or PerformanceДокумент6 страницSECTION 4.1 Payment or PerformanceMars TubalinalОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Macroeconomics Assignment 2Документ4 страницыMacroeconomics Assignment 2reddygaru1Оценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Break Even Point, Forecasting, and DecisionДокумент23 страницыBreak Even Point, Forecasting, and DecisionidnodОценок пока нет

- Highway EngineeringДокумент14 страницHighway EngineeringJake Santos100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Project Report LissstДокумент6 страницProject Report LissstShivareddyОценок пока нет

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Документ5 страницRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- A Study On Stock and Investment Decision Using Fundamental and Technical AnalysisДокумент12 страницA Study On Stock and Investment Decision Using Fundamental and Technical AnalysispavithragowthamnsОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Journal of Business Economics and ManagementДокумент21 страницаJournal of Business Economics and Managementsajid bhattiОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Islamic Banking: Financial Institutions and Markets Final ProjectДокумент27 страницIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalОценок пока нет

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillДокумент36 страницThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- BS Delhi English 27-12-2023Документ20 страницBS Delhi English 27-12-2023rajkumaryogi6172Оценок пока нет

- Acctg Equity Practice QuizДокумент16 страницAcctg Equity Practice QuizJyОценок пока нет

- Schedule of New Fees - RetooledДокумент2 страницыSchedule of New Fees - RetooledRaymund Fernandez CamachoОценок пока нет

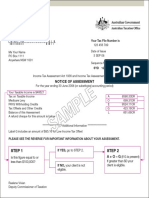

- Step 1 Step 2: Notice of AssessmentДокумент1 страницаStep 1 Step 2: Notice of Assessmentabinash manandharОценок пока нет

- Mananquil, Julieta P. - Jeths JefrenДокумент12 страницMananquil, Julieta P. - Jeths JefrenMarissa Bucad GomezОценок пока нет

- Auditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHДокумент27 страницAuditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHWinnie ToribioОценок пока нет

- Day CareДокумент21 страницаDay CareSarfraz AliОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Management Hierarchy: Askari Bank LimitedДокумент14 страницManagement Hierarchy: Askari Bank LimitedEeshaa MalikОценок пока нет

- Mays Mba Resume - Korbin King v8Документ1 страницаMays Mba Resume - Korbin King v8api-478389721Оценок пока нет

- Partnership & ClubsДокумент8 страницPartnership & ClubsGary ChingОценок пока нет

- Practica Del Modulo 2Документ5 страницPractica Del Modulo 2Campusano MelanieОценок пока нет

- MCQ - LiabilitiesДокумент4 страницыMCQ - LiabilitiesEshaОценок пока нет

- 2316 Jan 2018 ENCS FinalДокумент2 страницы2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)