Академический Документы

Профессиональный Документы

Культура Документы

RBI's Monetary Policy - Final Version

Загружено:

tannyjohnyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RBI's Monetary Policy - Final Version

Загружено:

tannyjohnyАвторское право:

Доступные форматы

What is the Monetary Policy?

The Monetary and Credit Policy is the policy statement, traditionally announced twice a year, through which the Reserve Bank of India seeks to ensure price stability for the economy. These factors include - money supply, interest rates and the inflation. In banking and economic terms money supply is referred to as M3 - which indicates the level (stock) of legal currency in the economy.

When is the Monetary Policy announced?

Historically, the Monetary Policy is announced twice a year - a slack season policy (AprilSeptember) and a busy season policy (OctoberMarch) in accordance with agricultural cycles. These cycles also coincide with the halves of the financial year.

What are the objectives of the Monetary Policy?

The objectives are to maintain price stability and ensure adequate flow of credit to the productive sectors of the economy. Stability for the national currency (after looking at prevailing economic conditions), growth in employment and income are also looked into. The monetary policy affects the real sector through long and variable periods while the financial markets are also impacted through short-term implications.

Terms related to monetary policy

Cash reserve ratio Statutory liquidity ratio Bank rate Inflation Money supply Repo rate Open market operation

A case for easing monetary policy in India

In January 2007, a meeting with all bank chiefs , the Finance Minister requested them to soften interest rates, so as to maintain the current growth rates. While oil prices continue to move upwards, Central Banks have to exercise their monetary policy levers by keeping a balance between the - growth and inflation.

In early 2007, with inflation threatening to touch 7% and the Government facing coalition uncertainty,RBI was facing a difficult situation. The rising inflation in the early part of the year, coupled with the surge in foreign investments, both FDI and FPI, resulting in rising forex reserves raised major concerns within both the RBI and the Government.

The RBI responded with a series of monetary tightening measures. The repo rate (at which RBI lends to banks) rose to 7.75%. the CRR went up to 7.5%.

This monetary tightening has yielded results in the last six months, as inflation has been brought down below 4%. This means the RBI should ease the monetary controls and encourage investment. It is the time for aggressively cutting rates. A loose monetary policy which is essential for sustaining the high 9-10% growth rates.

The US and Europe are easing their monetary policy out of compulsions arising from the sub-prime mortgage related credit squeeze and the imminent dangers of a recession. In an increasingly integrated global economy, any US recession and low interest rates presents a great opportunity for India to sustain high economic growth without inflationary pressures.

A hard landing in the US and recession elsewhere in the developed world, will cause a fall in global aggregate demand, which will adversely affect the export-led growth economies. This will in turn dampen global oil, energy, food, and other commodity prices, and force down inflationary trends and lower import costs.

1. Low interest rates are critical for sustaining the rapidly increasing investment rate. Indian economic growth is extremely interest rate sensitive. The limitations imposed on accessing external borrowings, also increases the dependence on local bank credit.

A recession in the US and elsewhere will reduce consumption demand and hence lower aggregate demand, which in turn is likely to put downward pressure on import prices. 6. In the event of a recession in the US causing drop in FII inflows into emerging markets, a loose monetary policy could help provide the internal thrust to sustain and stabilize the stock markets.

In the event of a capital flight into emerging markets, low interest rates will reduce the incentives for financial market distortions that could encourage undesirable, hot money inflows. By making rupee investments less attractive compared to the other currencies, low interest rates will reduce capital inflows and thereby control the exchange rate appreciation of rupee.

A low rate will leave the RBI with enough flexibility to maneuver without compromising on growth concerns, when the economy starts overheating. The prevailing high interest rate regime had crowded in the overwhelming share of domestic savings into bank deposits, and crowded out the development of alternate investment avenues in the financial markets. A low rate regime could provide the opportunity for development of such market.

A lower rate will ease the demand for External Commercial Borrowings, which crossed $30 bn in 2007. While ECBs are to be welcomed as a source of investment alternatives, an over reliance on them, especially on certain categories, can have harmful medium and long term implications .

The low interest rates will give a fillip to consumption growth as hire purchase and home loan markets will go up. The importance of the consumption driven growth multiplier for the economy is enormous. x

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 3 - PPT On Fiscal and MonetaryДокумент21 страница3 - PPT On Fiscal and MonetaryMarvin Cabantac100% (5)

- Return Note - BRH12188307Документ1 страницаReturn Note - BRH12188307JamesОценок пока нет

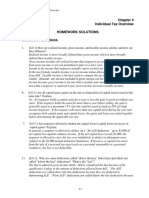

- Homework Chapter 4Документ10 страницHomework Chapter 4ChaituОценок пока нет

- CAPE Economics 2015 U2 P1 PDFДокумент9 страницCAPE Economics 2015 U2 P1 PDFamrit100% (1)

- Harmonized System 2017Документ55 страницHarmonized System 2017Abdul Ghaffar100% (1)

- Introduction To Economic TheoryДокумент11 страницIntroduction To Economic TheoryEyhla Mae GalopeОценок пока нет

- Chapter 15 International Trade in Goods and AssetsДокумент25 страницChapter 15 International Trade in Goods and AssetsYousef KhanОценок пока нет

- Financial Institutions and Markets - Foreign Exchange MarketsДокумент19 страницFinancial Institutions and Markets - Foreign Exchange MarketsSiddhartha saiОценок пока нет

- Shyla Inner PDFДокумент1 страницаShyla Inner PDFNowshadОценок пока нет

- Gold Bonds May of 1875Документ2 страницыGold Bonds May of 1875Mike OwensОценок пока нет

- RR No. 02-2006 - Annex AДокумент1 страницаRR No. 02-2006 - Annex AMichelle Go100% (1)

- Import QuotasДокумент2 страницыImport QuotasRyan SimОценок пока нет

- II. Fiscal Policy in Relation To Overall Development PolicyДокумент8 страницII. Fiscal Policy in Relation To Overall Development PolicyOliver SantosОценок пока нет

- Keynesian ApproachДокумент15 страницKeynesian ApproachJasmine NandaОценок пока нет

- 11 Economics Notes Ch12 Economic Reforms Since 1991Документ3 страницы11 Economics Notes Ch12 Economic Reforms Since 1991raghu8215Оценок пока нет

- ECB & Fed A Comparison A Comparison: International Summer ProgramДокумент40 страницECB & Fed A Comparison A Comparison: International Summer Programsabiha12Оценок пока нет

- Lec-1 - Introduction To MacroeconomicsДокумент29 страницLec-1 - Introduction To MacroeconomicsMsKhan0078Оценок пока нет

- Balance of PaymentsДокумент27 страницBalance of PaymentsJayaChandra VissamsettiОценок пока нет

- Strategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralДокумент4 страницыStrategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralGupta JeeОценок пока нет

- Inflation in PakistanДокумент7 страницInflation in PakistanUmar Abbas BabarОценок пока нет

- Business Environment Analysis Of: Aryal International Hotel Private LimitedДокумент26 страницBusiness Environment Analysis Of: Aryal International Hotel Private LimitedManish bhattaОценок пока нет

- IPF 1 - LatestДокумент5 страницIPF 1 - LatestNur Afifah ShahrizalОценок пока нет

- Inflation NoteДокумент3 страницыInflation NoteKeith FernándezОценок пока нет

- Ec 5 Japans EconomyДокумент51 страницаEc 5 Japans EconomysudiptaОценок пока нет

- Amendments Introduced RR 16-2005 (Tax)Документ2 страницыAmendments Introduced RR 16-2005 (Tax)Maria Olivia Repulda AtilloОценок пока нет

- Implementation of GST in MalaysiaДокумент2 страницыImplementation of GST in MalaysiashanursofОценок пока нет

- How To Do Country AnalysisДокумент22 страницыHow To Do Country Analysisdisp867100% (1)

- Elimination of Double TaxationДокумент36 страницElimination of Double TaxationNitin Pal SinghОценок пока нет

- Chapter 17Документ31 страницаChapter 17ManalFayezОценок пока нет

- Regional Economic IntegrationДокумент1 страницаRegional Economic IntegrationSale BrankovicОценок пока нет