Академический Документы

Профессиональный Документы

Культура Документы

176253181

Загружено:

mir942Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

176253181

Загружено:

mir942Авторское право:

Доступные форматы

Product Launch Value Proposition

May 2009

Table of Content

Table of Content

1. Concept Definition and Key Challenges 2. Our Focus and Value Proposition 3. Our Approach 4. Why Frost & Sullivan 5. Case Studies and Key References

1. Concept Definition & Key Challenges

Companies seek out new product launch opportunities for strategic, commercial and operational reasons

Typical reasons for launching new products: Value-generation Additional revenue streams, reduction & diversification of risk Organic expansion Value of company, share price Opportunity for exponential and not just incremental sales Commercial Erosion of margins due to competition Changing market conditions or opportunities on growing markets Emerging markets Address changing customer needs Retaining leadership position/ be perceived as an industry shaper/ innovator Copying innovators

Generate additional revenue and margin

3

Operational Technology exploitation Capitalise on skills base Employee motivation and retention

1. Concept Definition & Key Challenges

Not all launches meet expectations. To be successful, 'classic' product launch pitfalls need to be avoided

External The product or service should be launched to address customer needs. This is obvious, but is probably the biggest cause of launch failures. In today's competitive world, there is a shortage of customers, not of products or capacity. The company launching the product should know what specific needs its product will address. Which customers (target)? What offering (position)? Why is it better (differentiate)? It's not only because it works that customers will pay for it. Companies tend to overestimate revenue forecasts for the new product. They have not fully understood the market they are addressing, their ability to deliver and provide service, and how their current situation may hinder the launch process. A product launch should be executed by a clearly defined, cross-functional Launch Team, integrating key members of Corporate Management, R&D, Sales, Service, Supply Chain. It is not just the job of Marketing. A product launch process should be supported by a clearly defined Launch Plan: objectives, goals, timelines, toll gates, tasks, responsibilities, report lines, performance measurements. A product launch is a process, not an event. Internal

1. Concept Definition & Key Challenges

NPL is the 2nd step of Product Lifecycle Management and it determines the business success of the new product

Scope: New Product Launch in the Product Lifecycle

Sales Value 0

Profit/ loss

New Product Development

New Product Launch

Product Management

Table of Content

1. Concept Definition and Key Challenges 2. Our Focus and Value Proposition 3. Our Approach 4. Why Frost & Sullivan 5. Case Studies and Key References

2. Our Focus & Value Proposition

Frost & Sullivan gives equal importance to building the fact foundation, marketing planning and implementation

Product Lifecycle & New Product Launch scope

Sales Value 0

Profit/ loss

New Product Development

New Product Launch

Product Management

Capability Assessment Market Assessment

Marketing Strategy Plan

Marketing Operations Plan

Launch Monitoring & Adjustments

2. Our Focus & Value Proposition

Frost & Sullivan focuses on fact-based and actionable analysis and recommendations

Capability Assessment

Working value proposition summary Resource analysis HR Production Assets Sourcing & Suppliers Logistics Sales & Marketing Network Budget analysis

Market Assessment

Segments: Rank target markets & segments Addressable market Customers: Needs/ unmet needs Price points, elasticity External factors (regulation, etc.) Competition Pricing, Positioning Distribution Differentiation strategies Adjustment by country/ region

Marketing Strategy

Value proposition confirmation Distribution strategies Draft critical pathway for launch Sales and margins forecasts, KPI's Impact of new product upon existing product portfolio

Marketing Operations Plan

Product & packaging adjustments Price levels Customer value Promotion plan Support tools to effective launch (sales, logistics, provisioning, crm, management)

Launch Monitoring & Adjustments

Performance dashboards Operation monitoring Product performance tracking Post launch product fine-tuning (bugs, customisation, targeting) Marketing plan adjustments

Table of Content

1. Concept Definition and Key Challenges 2. Our Focus and Value Proposition 3. Our Approach 4. Why Frost & Sullivan 5. Case Studies and Key References

3. Our Approach

The New Product Launch best practice programme is organised in 3 complementary and successive steps

Step 1: Create a strong fact foundation Step 2: Confirm new product launch strategy Step 3: Implement the strategy

Capability Assessment

Output: Opportunity validation

Marketing Strategy

Output: Value proposition + business case

Conclusions & Recommendations

Base case scenario GO/NO GO decision Implementation plan

Marketing Operations

Output: Marketing (launch) plan

Market Assessment

Output: Opportunity validation

Launch Monitoring & Adjustments .

Output: Implementation roll out & impact measurement

Using the components of this framework, careful diagnosis of client challenges and opportunities allows a tailor-made approach to be recommended

10

3. Our Approach

Capability Assessment (1)

Capability Assessment Key drivers Key questions

What expectations are common to key stakeholders? What are key challenges and opportunities? Who is on steering committee?

Working version of value proposition

Cross-functional stakeholder buy-in Priorities for validation and planning Assign Launch team

Capability gap analysis: Production, Sourcing & Suppliers Sales & Marketing, other HR

Manufacturing needed Partner network, suppliers & platform needed Organisation structure & RACI Investment needed (human capital, financial, technologies, assets) Promotion resources required

What are our capability & expertise gaps to target these product and customer segments? What are the required changes? What are the key success factors?

Budget Analysis

Key financials: Revenue streams CAPEX, OPEX, margins

What are ROI scenarios? How do we manage the risks? What are the key milestones? What are the critical success factors?

11

3. Our Approach

Capability Assessment (2) - Budget Analysis, illustrative

Question: What levels of ROI can be expected and when?

Return on Investment $35m $30m $25m $20m $15m $10m $5m 0 -$5m Year 1 Year 2 Year 3 Year 4 Year 5 Quarterly Revenue Highest negative in investment cycle $2.6m Cumulative Revenue

An estimate of implementation costs suggests payback could begin after 24 months Key Assumptions -Transitional costs tail off after 24 months -Ongoing costs after change remain the same as now. Any cost savings taken as benefit, any new staff taken on through restructuring -Average total cost to employ project team is $1,200 per day during implementation Incremental revenue p.a. by year 5 $800k-$1m $480k-$600k $5m-$7.5m (IT $1m-$1.5m) $5-$6m (IT $500k-$600k) Currently unquantified $1.24m in lost IT share

12

Benefits of the proposed changes will come from six areas and initial forecasts suggest they are significant: 1. Increased stand alone Solution XYZ sales 2. Increased XYZ sales to current customers 3. Increased XYZ and technology sales to high-end customers 4. Increased XYZ and technology sales to following market by developing a targeted proposition 5. Improved margin 6. Protection from business erosion

3. Our Approach

Market Assessment

Market Assessment

Segments: Rank target markets & segments Addressable market

Key drivers

Segmentation Size & growth; forecast Market penetration Product switch

Key issues and questions

How is the market segmented? What are the opportunities? Which ones should be captured? What share can be reached?

Customers: Needs/ unmet needs Price points, elasticity External factors (regulation, etc.)

Regulatory & certifications Characteristics (intrinsic environment) Features/ technologies required Existing technologies & limits Decision making Usage trends; sensitivity

What are the trends/ behaviours/ expectations? Interests in new approach? What are the opportunities? What are the key success factors?

Competition Pricing, Positioning Distribution Differentiation strategies

Key players, offering Distinctive advantages, barriers Best practices Economics Go-to market routes

Key competitors SWOT Most likely scenarios for supply/demand balance, implications Transferable best practices?

Adjustment by country/ region

Features Segments Distribution

Does the product need to be adjusted to local specificities? Whats the impact?

13

3. Our Approach

Market Assessment (2) - Competitive Analysis, Illustrative

Question: How does breadth of portfolio translate into revenues and revenue growth?

Revenue growth Company C Company B

Company D Company G

Company F Company H Revenue from segment (000's) Company E

Company A

(US only)

Size of the bubble: relative breadth of portfolio

14

3. Our Approach

Marketing Strategy

Marketing Strategy Plan Key drivers

Segment to be targeted Product characteristics Unmet needs to be covered by the new product Distinctive advantage Strategic fit with portfolio

Key questions

How is the market segmented? What is the proposition to customers? What is the unique selling point? How can the product best complement the portfolio? What is most effective way to reach, sell to and retain customers? What adjustments are needed to current model? What are the pitfalls to avoid? What are the key actions to be launched? What is the business scenario? What are the key assumptions? What are the key success indicators to monitor? Fit with current strategy, objectives and projects? Impact on existing projects?

Validation of value proposition

Distribution strategy

Distribution and channel model

Draft critical pathway for launch

Roadmap (short, mid, long term) Action plan (quarterly plan for the first year) Sales scenarios Margin scenarios KPIs relevant to the business (NPV) Cannibalisation/ substitution Existing product/ project lifecycle Impact over current investments

Sales and margins forecasts, KPI's

Impact of new product on existing product portfolio

15

3. Our Approach

Marketing Strategy (2) - Value Proposition, Illustrative

Question: what set of features and benefits are most likely to lead to purchase? Conjoint Analysis of Customer Priorities, Medical Technologies

Category Q Top long term complications Top short term side effects Top target values Middle long term complications Middle short term side effects C Top cost of disposables Top machine purchase cost E C Standard size Top learning time Top staffing time Middle cost of disposables Middle learning time Utility/Score Category

Utility/Score

100 85 62 48 47 26 23 20 19 17 14 14 14 13 6

Q Quality C Cost E Ease of Use

16

Quality of Treatment Total Cost

27

100

Ease of Use/Ergonomics

15

Customers overwhelmingly traded Cost and Ease of E Use for Quality of Treatment. The ranking of sublevels showed meaningful variations per country. Conjoint analysis tests the criteria buyers use to make purchase decisions by forcing them to make tradeoffs between different features/benefits.

C Middle machine purchase cost E Small size Top integration

3. Our Approach

Marketing Operations

Marketing Operations Plan Key drivers

Local Product usage & preferences Product features specific to targeted local market Packaging specific to targeted local market Competitor price Churn rate Production costs Customer price acceptance Brand Product features & quality level Warranty Packaging

Key questions

What product adjustments are required to adapt locally? Any certification required? What are local regulatory requirements? How price sensitive are customers? Whats the price elasticity? Do we target premium position? What is our unique selling point? What are the priorities of our target customer? Do we target premium position? Which message will resonate best with the customer segment? Which media provide optimal access to our target? How do we roll it out over time? Who will sell/ distribute and how? What are the tangible/ intangible assets needed? What are the projected results & boundaries?

Product & packaging adjustments

Price levels

Customer value

Promotion plan

Promotional mix: advertising, sales, promotions, PR Budget Program & targeted impact CRM model Sales force, tools & training Distribution & logistics CRM tools Product management tools & KPIs

Support tools for effective launch

17

3. Our Approach

Launch Monitoring & Adjustments

Launch Monitoring & Adjustments

Post-launch product fine-tuning

Key drivers

Product features & quality level Packaging Market penetration Customer satisfaction Actual sales, costs & margin Promotion Distribution Price levels

Key questions

Is product delivering as expected? What adjustments are required? Is product delivering as expected? Are we progressing according to plan? Which KPIs need strengthening? Is performance in line with forecasts? Have unforeseen external factors impacted progression? What adjustment are required?

Post-launch product tracking

Post-launch product operation monitoring

Post-launch product marketing plan adjustment

Sales, costs and margin forecast Targeted customer segment Promotion Distribution Price levels

What evidence is available to support marketing and promotional efficacy? How do we address the weakest links? Any adjustment required to our forecast plan as a result?

18

Table of Content

1. Concept Definition and Key Challenges 2. Our Focus and Value Proposition 3. Our Approach 4. Why Frost & Sullivan 5. Case Studies and Key References

19

Why Frost & Sullivan?

Frost & Sullivan assets for a successful new product launch project :

Frost & Sullivan is the Growth strategy consulting firm

Dedicated focus on growth and how new product launches contribute to growth. Track record of successful new product launch consulting projects over 45 years. Industry expertise supported by an international pool of functional experts Best-in-class consulting methodologies proven to be effective through experience in multiple new product launch projects International organisation with 32 offices across all key regional markets Strong understanding of the local issues which underpin the success of new product launch strategies and roll-out Experience gained across a complete range of industries and services used to advantage in product launch projects Capability to identify new product launch opportunities across different industries and markets

20

Frost & Sullivan combines both Consulting and Research expertise

Frost & Sullivan offers both global and local perspectives

Frost & Sullivan generates synergies across different sectors and markets

Table of Content

1. Concept Definition and Key Challenges 2. Our Focus and Value Proposition 3. Our Approach 4. Why Frost & Sullivan 5. Case Studies and Key References

21

5. Case Studies & Key References

Develop Value Proposition - Medical Technology

The client: A global medical technology and healthcare company with leading positions in renal care markets The challenge Steady decline in market share of a core revenue-generator Product perceived as less reliable than competition Gaps in their product line and pipeline Hence a need to redefine the product portfolio and establish the value proposition for new products due for launch midterm. The Objectives Develop a market-entry/ development roadmap Undertake end-user analysis to support the value proposition Complement its business planning with a robust business case

Our approach & work Stage 1 - Validate the existing processes and assumptions Stage 2 - Define the Value Proposition by understanding user requirements and perceptions (Conjoint & Qualitative Analyses). Stage3 - Develop a business case to define the product mix, generate addressable market plan, identify risks and generate input for making business plan. Outcome & business impact Clear value proposition to focus all pre-launch initiatives Shift in focus from product to market Market-driven business case for Board Investment in key product features to support the value proposition

Cross-functional team alignment around market needs and client value proposition Best practice precedent for ongoing product portfolio assessments

22

5. Case Studies & Key References

International launch, innovative ultrasound system, market potential assessment

The Client Our client was created in 2005 by ultrasound medical imaging experts. Funded by venture capital firms, our client had already performed early-stage clinical studies which demonstrated significant improvements in diagnostic specificity. The Challenge They were about to launch their first system for use in breast cancer diagnosis. To support further investment decisions and attract further investors, the client and their key VC partner needed to validate both the price premium for the new technology and their corresponding business case for launch. Our approach & work Supported with secondary research, markets were modelled based on information gathered from key opinion leaders in leading breast centres, ultrasound manufacturers and distributors. Market models were drafted for multifunction, breast-dedicated and the client ultrasound system. Market penetration scenarios were drafted based on weighted competitive, quantitative and qualitative factors Outcome & business impact Key success factors were identified for our client and price premium ranges were validated. The detailed market scenarios highlighted the impact of validated clinical evidence short-term and of price pressures longterm. The improved understanding of regional variants helped validate go-to-market strategy. The client will use the assessment as objective, third-party validation when raising further capital and during marketing launch at the RSNA annual congress.

23

The Objectives Validate key points of clients business case for EU and US: Validate price points for novel system across 6 countries Validate volume and value market potential and estimate five-year adoption curve Identify distributor remuneration models

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

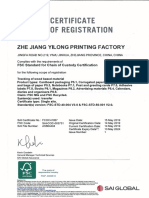

- FSC CertificateДокумент1 страницаFSC CertificateKSBОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Calabera Cuernos 31Документ31 страницаCalabera Cuernos 31fax bro100% (1)

- Product & Brand ManagementДокумент51 страницаProduct & Brand ManagementAnonymous uxd1ydОценок пока нет

- Agile E0 AnswersДокумент43 страницыAgile E0 AnswersSuraj Subash46% (105)

- Elekta Interlocks ManualДокумент300 страницElekta Interlocks ManualCarlos PimentelОценок пока нет

- Booth Making ContestДокумент2 страницыBooth Making ContestEYELENE PONIOОценок пока нет

- Scrum PDFДокумент6 страницScrum PDFAlejandro Garza GarcíaОценок пока нет

- Corrugated Box Manufacturer 10052021 CoimbatoreДокумент42 страницыCorrugated Box Manufacturer 10052021 CoimbatoreBusiness Loan SyndicateОценок пока нет

- Agile Methodology - What Is Agile Software Development ModelДокумент15 страницAgile Methodology - What Is Agile Software Development ModelSyed Hamza Ibrar ShahОценок пока нет

- P.P. AssignmentДокумент1 страницаP.P. AssignmentShivanee KhoteleОценок пока нет

- G Shock Ga 150bw 1aer - 7078Документ8 страницG Shock Ga 150bw 1aer - 7078NITORYОценок пока нет

- Software Licensing Guide VMware IT AcademyДокумент2 страницыSoftware Licensing Guide VMware IT AcademyDIOGO DIOGO.LPSSMОценок пока нет

- Ignou Ma Public Admin Mpap 002 Final Year Project Report and SynopsisДокумент3 страницыIgnou Ma Public Admin Mpap 002 Final Year Project Report and SynopsisallignouprojectОценок пока нет

- GB Template 01 Kano AnalysisДокумент4 страницыGB Template 01 Kano AnalysisharshalОценок пока нет

- AKZ Creative Studio Pres. ENGДокумент25 страницAKZ Creative Studio Pres. ENGXhenisa ShehuОценок пока нет

- Contents Go ViralДокумент32 страницыContents Go ViralKien LoongОценок пока нет

- دور الأسرة الإماراتية الفعال في التنشئة الاجتماعية السلي...Документ12 страницدور الأسرة الإماراتية الفعال في التنشئة الاجتماعية السلي...a201407181Оценок пока нет

- Agile Modeling and PrototypingДокумент42 страницыAgile Modeling and PrototypingAli Goher ShabirОценок пока нет

- Articulo2 - DevOps Enabled Agile Combining Agile and DevOps Methodologies For Software DevelopmentДокумент7 страницArticulo2 - DevOps Enabled Agile Combining Agile and DevOps Methodologies For Software DevelopmentLucrecia HerreraОценок пока нет

- Ida Aryanie BahrudinДокумент44 страницыIda Aryanie BahrudinBDzikri HidayatОценок пока нет

- Fairchild Medium Power MosfetsДокумент1 страницаFairchild Medium Power MosfetsAmirОценок пока нет

- Number Worksheets - Your Therapy SourceДокумент12 страницNumber Worksheets - Your Therapy SourceKeerthanaОценок пока нет

- Mosfet Cross Reference Guide - FairchildДокумент7 страницMosfet Cross Reference Guide - FairchildCintya CardozoОценок пока нет

- Astm A 105Документ22 страницыAstm A 105jijuikruОценок пока нет

- Amazon Packaging Support and Supplier Network (APASS)Документ40 страницAmazon Packaging Support and Supplier Network (APASS)Steven HouОценок пока нет

- Official Scrum at Scale GuideДокумент23 страницыOfficial Scrum at Scale GuideABCD EFGHIОценок пока нет

- SCORE Suite of The DayДокумент23 страницыSCORE Suite of The Dayjosenet02Оценок пока нет

- Actividad 4 - AMEFДокумент15 страницActividad 4 - AMEFBrandon VidalОценок пока нет

- Continuous Scrum: A Framework To Enhance Scrum With Devops: Saliya Sajith Samarawickrama, Indika PereraДокумент7 страницContinuous Scrum: A Framework To Enhance Scrum With Devops: Saliya Sajith Samarawickrama, Indika Pereraroi AlarconОценок пока нет

- Materials Management Packaging: by Kudzanayi ChitekaДокумент18 страницMaterials Management Packaging: by Kudzanayi ChitekaKUDZANAYIОценок пока нет