Академический Документы

Профессиональный Документы

Культура Документы

Capital Structure

Загружено:

gagihИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Structure

Загружено:

gagihАвторское право:

Доступные форматы

CAPITAL STRUCTURE

Capital Structure

Capital structurecombination of various types of

capital the firm uses to finance assets.

Does it matter in what proportion of each type of

capital the firm is financed?

WACC is affected the the weightsthat is, w

d

, w

ps

, and w

s

Perhaps the component coststhat is, r

dT

, r

ps

, and r

s

also

are affected by the weights

)

e

r or

s

(r

s

w

ps

r

ps

w

dT

r

d

w

stock

preferred %

debt

%

WACC

equity common

of Cost

equity

common %

stock preferred

of Cost

debt of cost

tax - After

+ + =

|

.

|

\

|

|

.

|

\

|

|

.

|

\

|

|

|

.

|

\

|

|

.

|

\

|

|

.

|

\

|

=

(

+ +

Capital Structure

Objectivemaximize the firms value, which means

to minimize WACC = r.

=

Firms

Value

CF

1

(1 + r)

1

^

+

CF

2

(1 + r)

2

^

+ +

CF

4

(1 + r)

4

^

+

+ +

+

+

+

=

^ ^ ^

WACC) (1

CF

WACC) (1

CF

WACC) (1

CF

2

2

1

1

L

Target Capital Structure

Proportion of debt and equity a firm wants to use to finance

investmentsa benchmark when raising funds for investing in new

projects.

Debt

Using more debt generally increases the risk associated with future earnings

Debt has a fixed cost (that is, interest), so more debt allows the firm to earn a

higher expected rate of return.

Equity

Less risky to financial operations than debt, because there is no contractual

obligation to pay dividends

Higher cost, because stock is a riskier investment for investors

There is a risk/return tradeoff associated with increasing (decreasing)

debt relative to equity.

Best, or optimal, capital structure, is where the value of the firm is

maximized because the overall WACC, or r, is minimized.

Capital Structure

Riskgreater risk means greater costs to raise funds

Financial flexibilitya stronger financial positionthat is,

stronger balance sheetgenerally implies the firm is

better able to raise funds in the capital markets, especially

in slumping economies

Managerial attitude (conservatism or aggressiveness)

some financial managers are more conservative than

others when it comes to using debt, thus they are inclined

to use less debt, all else equal.

Factors that should be considered when making

decisions about the appropriate capital structure:

Capital StructureRisk

Business riskstability of a firms operations and its ability

to maintain operating income in the competitive arena in

which the firm operates.

Compared to firms with higher business risk, firms that have

lower business risk exhibit greater stability in sales,

operating expenses, and the like, greater flexibility in the

ability to change selling prices, and less relative fixed

operating costs.

Financial riskrisk associated with the ability of a firm to

meet its financial obligations

This form of risk arises when the firm uses sources of

financing that require fix payments or obligations, which we

term financial leverage.

Capital Structure

Introduction

EBIT/EPS Analysis

Stock Price & WACC

Leverage (risk measure)

Capital Structure Theory

Liquidity/Variations in Capital

Structures

Determining the Optimal Capital

Structure

The firm wants to choose a capital structure that

maximizes the price of the firms stockthat is, its

value.

EBIT/EPS analysis can be used to evaluate the

attractiveness of a particular capital structure by

examining how different proportions of debt affect a

firms EPS.

Although maximizing EPS does not maximize value

exactly, we should be able to approximate the

optimal capital structure using EBIT/EPS analysis.

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Example: A firm that has no debt and assets equal to

$400,000 can issue debt and repurchase shares of stock at

$10 per share based on the following schedule:

Amount Debt/Asset Cost of Shares of Stock

Equity of Debt Ratio Debt, r

d

Outstanding

$400,000 $ 0 0.0% 0.0% 40,000

320,000 80,000 20.0 6.0 32,000

240,000 160,000 40.0 9.0 24,000

160,000 240,000 60.0 20.0 16,000

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Assuming that operating expenses, such as cost of goods

sold, depreciation, and so forth, are not affected by capital

structure decisions, the firm is expected to generate the

operating income, EBIT, as follows:

Boom 0.1 $200,000

Normal 0.6 120,000

Recession 0.3 40,000

Type of Economy Probability EBIT = NOI

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Debt/Assets = 0:

Debt = $0 Equity = $400,000

Interest = $0 Shares of stock = $400,000/$10 = 40,000

EBIT $200,000 $120,000 $40,000

Interest ( 0) ( 0) ( 0)

Taxable income, EBT 200,000 120,000 40,000

Taxes (40%) ( 80,000) ( 48,000) (16,000)

Net income $120,000 $72,000 $24,000

Type of Economy Boom Normal Recession

Probability 0.1 0.6 0.3

EPS = NI/(40,000 shrs) $3.00 $1.80 $0.60

Expected EPS $1.56

o

EPS

$0.72

EBIT $200,000 $120,000 $40,000

Interest ( 4,800) ( 4,800) ( 4,800)

Taxable income, EBT 195,200 115,200 35,200

Taxes (40%) ( 78,080) ( 46,080) (14,080)

Net income $117,120 $69,120 $21,120

Type of Economy Boom Normal Recession

Probability 0.1 0.6 0.3

EPS = NI/(32,000 shrs) $3.66 $2.16 $0.66

Expected EPS $1.86

o

EPS

$0.90

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Debt/Assets = 20%:

Debt = 0.2($400,000) = $80,000 Equity = $400,000 - $80,000 = $320,000

Interest = 0.06($80,000) = $4,800 Shares of stock = $320,000/$10 = 32,000

EBIT $200,000 $120,000 $40,000

Interest ( 14,400) ( 14,400) ( 14,400)

Taxable income, EBT 185,600 105,600 25,600

Taxes (40%) ( 74,240) ( 42,240) (10,240)

Net income $111,360 $63,360 $15,360

Type of Economy Boom Normal Recession

Probability 0.1 0.6 0.3

EPS = NI/(24,000 shrs) $4.64 $2.64 $0.64

Expected EPS $2.24

o

EPS

$1.20

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Debt/Assets = 40%:

Debt = 0.4($400,000) = $160,000 Equity = $400,000 - $160,000 = $240,000

Interest = 0.09($160,000) = $14,400 Shares of stock = $240,000/$10 = 24,000

EBIT $200,000 $120,000 $40,000

Interest ( 48,000) ( 48,000) ( 48,000)

Taxable income, EBT 152,000 72,000 ( 8,000)

Taxes (40%) ( 60,800) ( 28,800) 3,200

Net income $ 91,200 $43,200 ( $4,800)

Type of Economy Boom Normal Recession

Probability 0.1 0.6 0.3

EPS = NI/(16,000 shrs) $5.70 $2.70 $(0.30)

Expected EPS $2.10

o

EPS

$1.80

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Debt/Assets = 60%:

Debt = 0.6($400,000) = $240,000 Equity = $400,000 - $240,000 = $160,000

Interest = 0.20($240,000) = $48,000 Shares of stock = $160,000/$10 = 16,000

Determining the Optimal Capital

StructureEBIT/EPS Analysis

Summarizing the results, we have:

0.0% $1.56 $0.72

20.0 1.86 0.90

40.0 2.24 1.20

60.0 2.10 1.80

Proportion Expected Standard

of Debt EPS Deviation

0.0% $1.56 $0.72

20.0 1.86 0.90

40.0 2.24 1.20

60.0 2.10 1.80

EPS Indifference Analysis

0.20

0.40

0.60

0.80

1.00

-0.20

-0.40

2 2.1 2.2

EPS($)

Sales

($ millions)

0

Fixed operating costs = $600,000

Variable cost ratio = 70%

100% Stock

Financing

40% Debt

Financing

EPS Indifference

$2.12 million

0.54

Capital StructureStock Price

The optimal capital structure is the mix of debt and

equity that maximizes the value of the firmthat is, its

stock pricenot the EPS.

The proportion of debt in the optimal capital structure

will be less than the proportion of debt needed to

maximize EPS because the market valuation of the

stock, P

0

, considers the risk associated with the firms

operations expected well into the future and EPS is

based only on the firms operations expected for the

next few years.

Capital StructureStock Price, Cost of

Equity, r

s

, and WACC

Estimated WACC =

% Debt E(EPS) r

dT

=r

d

(1-0.4) Beta,

s

r

s

=4%+(5%)

s

%D(r

dT

)+%E(r

s

)

(1) (2) (3) (4) (5) (6) (7)

s

0

r

EPS

P =

0.0 $1.56 0.0%

10.0 1.70 3.3

20.0 1.86 3.6

30.0 2.05 4.2

40.0 2.24 5.4

50.0 2.22 9.0

60.0 2.10 12.0

1.1

1.2

1.3

1.4

1.7

1.9

2.2

0.0 $1.56 0.0%

10.0 1.70 3.3

20.0 1.86 3.6

30.0 2.05 4.2

40.0 2.24 5.4

50.0 2.22 9.0

60.0 2.10 12.0

9.5%

9.3

9.1

9.0

9.7

11.3

13.2

$16.42

16.97

17.71

18.62

17.92

16.44

14.00

$16.42

16.97

17.71

18.62

17.92

16.44

14.00

9.5%

9.3

9.1

9.0

9.7

11.3

13.2

9.5%

10.0

10.5

11.0

12.5

13.5

15.0

30.0 2.05 4.2 1.4 11.0 18.62 9.0

Capital StructureStock Price and the

Cost of Equity, r

s

The relationship of the cost of equity, r

s

, and the amount of

debt the firm uses to finance its assets can be illustrated as

follows:

r

RF

% Debt in

Capital Structure

Required Return on

Equity, r

s

(%)

Risk-free rate of return

r

s

= r

RF

+ Risk Premium

Total Risk

Premium

Premium for business risk at a

particular level of operations

Premium for

financial risk

0

Capital StructureStock Price and the

Cost of Equity, r

s

The relationship of the after-tax cost of debt, r

dT

, cost of

equity, r

s

, and WACC might be:

% Debt in

Capital Structure

Cost of

Capital, WACC (%)

Cost of

equity, r

s

After-tax

cost of debt,

r

dT

WACC

Minimum

WACC

Optimal Amount

of Debt (30%)

0

Capital StructureWACC

If the firm uses only equity to finance its assets (that is, zero

debt is used) then WACC = r

s

As the firm begins to use some debt for financing, WACC

declines, primarily because the tax benefit offered by the debt

more than offsets the increased cost of equity

At some point the tax benefit associated with debt is more than

offset by increases in the before-tax cost of debt and the cost of

equity that result from increases in the risk associated with the

additional debt and, at this point, WACC begins to increase

The point where WACC is the lowest is the optimal capital

structurethis is the point where the value of the firm is

maximized

Capital Structure and Leverage

Leveragefixed costs

Operating leveragefixed operating costs, such as depreciation

Financial leveragefixed financial costs, such as interest and

preferred dividends

Leverage, or fixed costs, result in a magnification effectthat

is a small change in sales will result in a larger change in

income (operating income, net income, or both)

The degree of leverage associated with a firm often is used to

indicate the degree of risk associated with the firm

Operating leverageoperating risk

Financial leveragefinancial risk

Operating Leverage

All else equal, if a firm can reduce its operating leverage, it can use

more debt (that is, increase its financial leverage), and vice versa, and

maintain the same degree of risk.

Degree of operating leverage (DOL) refers to the percentage change

in operating incomedesignated either NOI or EBITthat results from

a particular percentage change in sales.

DOL can be computed as follows:

EBIT

profit Gross

F VC S

VC S

F V) Q(P

V) Q(P

sales in change %

NOI in change %

DOL =

=

= =

Q = number of products (units) the firm currently sells

P = sales price per unit

V = variable cost per unit

F = fixed operating costs

S = current sales stated in dollars such that S = Q P

VC = total variable costs of operations such that VC = Q V

Operating Leverage

Expected Sales = 5%

Outcome of Expectations %

Sales

Variable operating costs (60%)

Gross profit

Fixed operating costs

Net operating income = EBIT

$250,000

(150,000)

100,000

(75,000)

$237,500

4.0x

$25,000

$100,000

EBIT

profit Gross

DOL = = =

-5.0%

-5.0%

(142,500)

95,000

-5.0

(75,000)

0.0

20,000

-20.0

25,000

Risk = variability

Financial Leverage

Degree of financial leverage refers to the percentage

change in EPS that results from a particular percentage

change in earnings before interest and taxes, EBIT.

DFL is computed as follows:

I F VC S

F VC S

I EBIT

EBIT

EBIT in change %

EPS in change %

DFL

=

= =

I = dollar interest paid on debt

Financial Leverage

Expected Sales = 5%

Outcome of Expectations %

Sales $250,000 $237,500 -5.0%

Variable operating costs (60%) (150,000) (142,500) -5.0

Gross profit 100,000 95,000 -5.0

Fixed operating costs (75,000) (75,000) 0.0

Net operating income = EBIT 25,000 20,000 -20.0

Interest

Earnings Before Taxes

Taxes (40%)

Net Income

(12,500)

12,500

(5,000)

7,500

(12,500) 0.0

7,500

-40.0

(3,000)

-40.0

4,500 -40.0

2.0x

$12,500

$25,000

$12,500 - $25,000

$25,000

I - EBIT

EBIT

DFL = = = =

Risk = variability

Total Leverage

Degree of total leverage (DTL) refers to the

percentage change in EPS that results from a

particular percentage change in sales.

DTL combines DOL and DFL, and it is computed as

follows:

I EBIT

profit Gross

I F VC S

VC S

I F V) Q(P

V) Q(P

DFL DOL

sales in change %

EPS in change %

DTL

=

=

=

= =

Total Leverage

Expected Sales = 5%

Outcome of Expectations %

Sales $250,000 $237,500 -5.0%

Variable operating costs (60%) (150,000) (142,500) -5.0

Gross profit 100,000 95,000 -5.0

Fixed operating costs (75,000) (75,000) 0.0

Net operating income = EBIT 25,000 20,000 -20.0

Interest (12,500) (12,500) 0.0

Earnings Before Taxes 12,500 7,500 -40.0

Taxes (40%) (5,000) (3,000) -40.0

Net Income 7,500 4,500 -40.0

8.0x

$12,500

$100,000

$12,500 - $25,000

$100,000

I - EBIT

profit Gross

DTL = = = =

Risk = variability; thus the greater the degree of leverage (operating,

financial, or both), the greater the risk associated with the firm

Leverage

Expected Sales = +10%

Outcome of Expectations %

Sales $250,000 $275,000 +10.0%

Variable operating costs (60%) (150,000) (165,000) +10.0

Gross profit 100,000 110,000 +10.0

Fixed operating costs (75,000) (75,000) 0.0

Net operating income = EBIT 25,000 35,000 +40.0

Interest (12,500) (12,500) 0.0

Earnings Before Taxes 12,500 22,500 +80.0

Taxes (40%) (5,000) (9,000) +80.0

Net Income 7,500 13,500 +80.0

Risk = variability; thus the greater the degree of leverage (operating,

financial, or both), the greater the risk associated with the firm

DOL = 4.0x; DFL = 2.0x; DTL = 8.0x

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Fees Structure For Government Sponsored (KUCCPS) Students: University of Eastern Africa, BaratonДокумент3 страницыFees Structure For Government Sponsored (KUCCPS) Students: University of Eastern Africa, BaratonGiddy LerionkaОценок пока нет

- Trend Graphs - Sample AnswerДокумент4 страницыTrend Graphs - Sample AnswerannieannsОценок пока нет

- Creature Loot PDF - GM BinderДокумент97 страницCreature Loot PDF - GM BinderAlec0% (1)

- S 20A Specification Forms PDFДокумент15 страницS 20A Specification Forms PDFAlfredo R Larez0% (1)

- Audit AP TestsДокумент3 страницыAudit AP TestsSweet Emme100% (1)

- Cursos Link 2Документ3 страницыCursos Link 2Diego Alves100% (7)

- Research Chapter 1Документ7 страницResearch Chapter 1Aryando Mocali TampubolonОценок пока нет

- Candida by Shaw, George Bernard, 1856-1950Документ61 страницаCandida by Shaw, George Bernard, 1856-1950Gutenberg.orgОценок пока нет

- Living in a digital age unit review and digital toolsДокумент1 страницаLiving in a digital age unit review and digital toolsLulaОценок пока нет

- Data Structures LightHall ClassДокумент43 страницыData Structures LightHall ClassIwuchukwu ChiomaОценок пока нет

- Personality, Movie Preferences, and RecommendationsДокумент2 страницыPersonality, Movie Preferences, and RecommendationsAA0809Оценок пока нет

- 1 FrameworkДокумент26 страниц1 FrameworkIrenataОценок пока нет

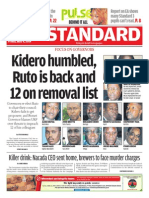

- The Standard 09.05.2014Документ96 страницThe Standard 09.05.2014Zachary Monroe100% (1)

- Sheet Metal FormingДокумент13 страницSheet Metal FormingFranklin SilvaОценок пока нет

- Organization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcДокумент32 страницыOrganization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcManny HermosaОценок пока нет

- PuppetsДокумент11 страницPuppetsShar Nur JeanОценок пока нет

- Key Personnel'S Affidavit of Commitment To Work On The ContractДокумент14 страницKey Personnel'S Affidavit of Commitment To Work On The ContractMica BisaresОценок пока нет

- Generic Strategies: Lessons From Crown Cork & Seal and Matching DellДокумент16 страницGeneric Strategies: Lessons From Crown Cork & Seal and Matching DellavaОценок пока нет

- Ôn tập và kiểm tra học kì Tiếng anh 6 ĐÁP ÁNДокумент143 страницыÔn tập và kiểm tra học kì Tiếng anh 6 ĐÁP ÁNThùy TinaОценок пока нет

- Cases 39 45 PDFДокумент11 страницCases 39 45 PDFYvette Marie VillaverОценок пока нет

- Ted Hughes's Crow - An Alternative Theological ParadigmДокумент16 страницTed Hughes's Crow - An Alternative Theological Paradigmsa46851Оценок пока нет

- Neuroimaging - Methods PDFДокумент372 страницыNeuroimaging - Methods PDFliliana lilianaОценок пока нет

- Axis Bank Placement Paper Interview Questions 48072Документ3 страницыAxis Bank Placement Paper Interview Questions 48072Ravi RanjanОценок пока нет

- Affidavit of 2 Disinterested Persons (Haidee Gullodo)Документ1 страницаAffidavit of 2 Disinterested Persons (Haidee Gullodo)GersonGamasОценок пока нет

- CSIR AnalysisДокумент1 страницаCSIR Analysisசெபா செல்வாОценок пока нет

- Hydroponics SummaryДокумент4 страницыHydroponics SummaryJose NovoaОценок пока нет

- Coca Cola Live-ProjectДокумент20 страницCoca Cola Live-ProjectKanchan SharmaОценок пока нет

- Case Study OrthoДокумент21 страницаCase Study Orthojoshua_santiago_5Оценок пока нет

- Optra - NubiraДокумент37 страницOptra - NubiraDaniel Castillo PeñaОценок пока нет

- Introduction To South Korean History, Cultures, Traditions, & BeliefsДокумент8 страницIntroduction To South Korean History, Cultures, Traditions, & BeliefsKatriceОценок пока нет