Академический Документы

Профессиональный Документы

Культура Документы

Chap 03

Загружено:

Vivek ThotaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chap 03

Загружено:

Vivek ThotaАвторское право:

Доступные форматы

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc.

,

1999

Managerial Economics

& Business Strategy

Chapter 3

Quantitative Demand

Analysis

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Overview

I. Elasticities of Demand

Own Price Elasticity

Elasticity and Total Revenue

Cross-Price Elasticity

Income Elasticity

II. Demand Functions

Linear

Log-Linear

III. Regression Analysis

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Elasticities of Demand

How responsive is variable G

to a change in variable S

+ S and G are directly related

- S and G are inversely related

S

G

E

S G

A

A

=

%

%

,

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Own Price Elasticity of

Demand

Negative according to the law

of demand

Elastic: (sensitive)

Inelastic: (insensitive)

Unitary:

X

d

X

P Q

P

Q

E

X X

A

A

=

%

%

,

1

,

>

X X

P Q

E

1

,

<

X X

P Q

E

1

,

=

X X

P Q

E

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Perfectly Elastic &

Inelastic Demand

Perfectly

Elastic

D

Price

Quantity

Perfectly

Inelastic

D

Price

Quantity

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Own-Price Elasticity

and Total Revenue

Elastic

Increase in price leads to a decrease in

total revenue.

Inelastic

Increase in price leads to an increase

in total revenue.

Unitary

Total revenue is maximized at the point

where demand is unitary elastic.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Factors Affecting

Price Elasticity

Available Substitutes

The more substitutes available for the

good, the more elastic the demand.

Time

Demand tends to be more inelastic in the

short term than in the long term.

Time allows consumers to seek out

available substitutes.

Expenditure Share

Goods that comprise a small share of

consumers budgets tend to be more

inelastic than goods for which consumers

spend a large portion of their incomes.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Cross Price Elasticity

of Demand

+ Substitutes

- Complements

Y

d

X

P Q

P

Q

E

Y X

A

A

=

%

%

,

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Income Elasticity

+ Normal Good

- Inferior Good

M

Q

E

d

X

M Q

X

A

A

=

%

%

,

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Uses of Elasticities

Pricing

Managing cash flows

Impact of changes in

competitors prices

Impact of economic booms and

recessions

Impact of advertising

campaigns

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Example 1: Pricing and

Cash Flows

According to an FTC Report by

Michael Ward, AT&Ts price

elasticity of demand for long

distance services is -8.64.

AT&T needs to boost revenues

in order to meet its marketing

goals.

To accomplish this goal, should

AT&T raise or lower its price?

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Answer:Reduce the

price!

Since demand is elastic, a

reduction in price will increase

quantity demanded by a greater

percentage than the price

decline, resulting in more

revenues for AT&T.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Quantifying the

Change

If AT&T lowered price by 3

percent, what would happen to

the volume of long distance

telephone calls routed through

AT&T?

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Answer

Calls would increase by 25.92

percent!

( )

% 92 . 25 %

% 64 . 8 % 3

% 3

%

64 . 8

%

%

64 . 8

,

= A

A =

A

=

A

A

= =

d

X

d

X

d

X

X

d

X

P Q

Q

Q

Q

P

Q

E

X X

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Impact of a change in a

competitors price

According to an FTC Report by

Michael Ward, AT&Ts cross

price elasticity of demand for

long distance services is 9.06.

If MCI and other competitors

reduced their prices by 4

percent, what would happen to

the demand for AT&T services?

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Answer

AT&Ts demand would fall by 36.24

percent!

% 24 . 36 %

% 06 . 9 % 4

% 4

%

06 . 9

%

%

06 . 9

,

= A

A =

A

=

A

A

= =

d

X

d

X

d

X

Y

d

X

P Q

Q

Q

Q

P

Q

E

Y X

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Demand Functions

Mathematical representations of

demand curves

Example:

X and Y are substitutes (coefficient

of P

Y

is positive)

X is an inferior good (coefficient of

M is negative)

M P P Q

Y X

d

X

2 3 2 10 + =

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Specific Demand

Functions

Linear Demand

H M

P P Q

H M

Y Y X X

d

X

o o

o o o

+ +

+ + =

0

Price

Elasticity

Cross Price

Elasticity

Income

Elasticity

X

X

X P Q

Q

P

E

X X

o =

,

X

M M Q

Q

M

E

X

o =

,

X

Y

Y P Q

Q

P

E

Y X

o =

,

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Example of Linear

Demand

Q

d

= 10 - 2P

Own-Price Elasticity: (-2)P/Q

If P=1, Q=8 (since 10 - 2 = 8)

Own price elasticity at P=1,

Q=8:

(-2)(1)/8= - 0.25

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

H M

P P Q

H M

Y Y X X

d

X

log log

log log log

0

| |

| | |

+ +

+ + =

M

Y

X

: Elasticity Income

: Elasticity Price Cross

: Elasticity Price Own

|

|

|

Log-Linear Demand

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Example of Log-Linear

Demand

log Q

d

= 10 - 2 log P

Own Price Elasticity: -2

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

P

Q

P

Q

D

D

Linear

Log Linear

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Regression Analysis

Used to estimate demand

functions

Important terminology

Least Squares Regression: Y = a + bX

+ e

Confidence Intervals

t-statistic

R-square or Coefficient of

Determination

F-statistic

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

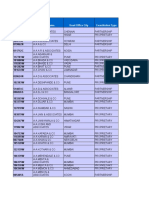

Interpreting the

Output

Estimated demand function:

log Q

x

= 7.58 - 0.84 logP

x

Own price elasticity: -0.84 (inelastic)

How good is our estimate?

t-statistics of 5.29 and -2.80 indicate

that the estimated coefficients are

statistically different from zero

R-square of .17 indicates we explained

only 17 percent of the variation

F-statistic significant at the 1 percent

level.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. ,

1999

Summary

Elasticities are tools you can use to

quantify the impact of changes in

prices, income, and advertising on sales

and revenues.

Given market or survey data, regression

analysis can be used to estimate:

Demand functions

Elasticities

A host of other things, including cost

functions

Managers can quantify the impact of

changes in prices, income, advertising,

etc.

Вам также может понравиться

- I. Elasticities of Demand: Own Price Elasticity Elasticity and Total Revenue Cross-Price Elasticity Income ElasticityДокумент27 страницI. Elasticities of Demand: Own Price Elasticity Elasticity and Total Revenue Cross-Price Elasticity Income ElasticitySree MahalakshmiОценок пока нет

- Baye CH01 - The Fundamentals of Managerial Economics - RevДокумент18 страницBaye CH01 - The Fundamentals of Managerial Economics - RevAldan TasiwaОценок пока нет

- Accounting Vs Economic ProfitДокумент8 страницAccounting Vs Economic ProfitAmit ThapaОценок пока нет

- II. The Economics of Effective ManagementДокумент16 страницII. The Economics of Effective ManagementSree MahalakshmiОценок пока нет

- Demand and SupplyДокумент38 страницDemand and SupplyEYmran RExa XaYdiОценок пока нет

- Overview Managerial EconomicsДокумент16 страницOverview Managerial EconomicsAnonymous yy8In96j0rОценок пока нет

- Managerial Economics & Business Strategy: Quantitative Demand AnalysisДокумент28 страницManagerial Economics & Business Strategy: Quantitative Demand AnalysisReno Prima Dirgantara100% (1)

- Managerial Economics Chapter03Документ28 страницManagerial Economics Chapter03bella scribdОценок пока нет

- CH 11 Pricing StrategyДокумент43 страницыCH 11 Pricing StrategytunggaltriОценок пока нет

- I. Consumer Behavior: Indifference Curve Analysis Consumer Preference OrderingДокумент14 страницI. Consumer Behavior: Indifference Curve Analysis Consumer Preference OrderingSree MahalakshmiОценок пока нет

- Managerial Economics Chapter1Документ34 страницыManagerial Economics Chapter1bella scribdОценок пока нет

- Managerial Economics & Business Strategy: Market Forces: Demand and SupplyДокумент36 страницManagerial Economics & Business Strategy: Market Forces: Demand and SupplychandasumaОценок пока нет

- Managerial Economics Assignment AnalysisДокумент8 страницManagerial Economics Assignment AnalysissreetcОценок пока нет

- Baye Chap005Документ29 страницBaye Chap005Sagita SimanjuntakОценок пока нет

- Optimasi Ekonomi Manajerial S5Документ32 страницыOptimasi Ekonomi Manajerial S5RusminОценок пока нет

- Hard Copy Business Case Kellog SchoolДокумент5 страницHard Copy Business Case Kellog SchoolLugard WoduОценок пока нет

- UNIT 3 Market Eqilibrium - PART 2Документ29 страницUNIT 3 Market Eqilibrium - PART 2Rhea Tupan PradoОценок пока нет

- Managerial Economics & Business Strategy: Pricing Strategies For Firms With Market PowerДокумент43 страницыManagerial Economics & Business Strategy: Pricing Strategies For Firms With Market PowerPRA MBAОценок пока нет

- 3 - Demand Estimation and Forecasting - Dr. MakuyanaДокумент23 страницы3 - Demand Estimation and Forecasting - Dr. MakuyanasimbaОценок пока нет

- Cost-Volume-Profit Relationships: The Mcgraw-Hill Companies, Inc. 2008 Mcgraw-Hill/IrwinДокумент25 страницCost-Volume-Profit Relationships: The Mcgraw-Hill Companies, Inc. 2008 Mcgraw-Hill/IrwinCharina Jenine T. TraqueñaОценок пока нет

- TN05 4eДокумент68 страницTN05 4eAnggrainni RahayuОценок пока нет

- Alealiana Indi Assignment 1 Eco745Документ12 страницAlealiana Indi Assignment 1 Eco745alea azmiОценок пока нет

- Section 10 - BMIK 2023 - final - CopyДокумент38 страницSection 10 - BMIK 2023 - final - Copy10622006Оценок пока нет

- Unit 2 STMДокумент114 страницUnit 2 STMSARAVANANОценок пока нет

- Corporate-Level Strategy:: Creating Value Through DiversificationДокумент9 страницCorporate-Level Strategy:: Creating Value Through DiversificationAyShaRafiQueОценок пока нет

- Pricing Techniques and Analysis: Cost-Based, Value-Based, and Price DiscriminationДокумент20 страницPricing Techniques and Analysis: Cost-Based, Value-Based, and Price DiscriminationZaid ChelseaОценок пока нет

- Managerial Economics & Business Strategy: Market Forces: Demand and SupplyДокумент36 страницManagerial Economics & Business Strategy: Market Forces: Demand and Supplyh1072hОценок пока нет

- Special Pricing PracticesДокумент42 страницыSpecial Pricing PracticesJermaine Montaque100% (1)

- Name Roll No.Документ6 страницName Roll No.Shakeel ShahОценок пока нет

- Pr8e Ge Ch09Документ30 страницPr8e Ge Ch09Sup AkiОценок пока нет

- Introduction To Managerial EconomicsДокумент36 страницIntroduction To Managerial Economicsabhishek nigamОценок пока нет

- K1 - Ch.1.The Fundamentals of Managerial EconomicsДокумент19 страницK1 - Ch.1.The Fundamentals of Managerial EconomicsPutri Iva watiОценок пока нет

- H17PI AUG P2021-2022solsДокумент7 страницH17PI AUG P2021-2022solsCsec helper1Оценок пока нет

- Managerial Economics - Units-IV & V-For Students-BAUДокумент60 страницManagerial Economics - Units-IV & V-For Students-BAUBabon MandalОценок пока нет

- Advertising Dynamics QME2005Документ38 страницAdvertising Dynamics QME2005Pravin YeluriОценок пока нет

- MOD 11 ACED1 Without EvalДокумент8 страницMOD 11 ACED1 Without EvalJerickho JОценок пока нет

- Chapter 3 Quantitative Demand AnalysisДокумент25 страницChapter 3 Quantitative Demand AnalysisRosa WillisОценок пока нет

- Semester - 1 MBO026: Managerial EconomicsДокумент10 страницSemester - 1 MBO026: Managerial Economicspara2233Оценок пока нет

- How a price cut impacts profitsДокумент12 страницHow a price cut impacts profitssajeerothayiОценок пока нет

- Macro Economics Chapter 4Документ58 страницMacro Economics Chapter 4Abeer ShamiОценок пока нет

- Lect 3 Part 1. The Econ of Prodn Cost and Profit MaximizationДокумент17 страницLect 3 Part 1. The Econ of Prodn Cost and Profit MaximizationkonchojОценок пока нет

- MB0026: Managerial Economics: (Assignment - SET1 & SET2)Документ16 страницMB0026: Managerial Economics: (Assignment - SET1 & SET2)SrinathОценок пока нет

- Towards An Individual Customer Profitability Model - B.libay, Narayandas C.humbyДокумент9 страницTowards An Individual Customer Profitability Model - B.libay, Narayandas C.humbyMarian Și Ligia ZamfiroiuОценок пока нет

- Mcgraw-Hill © 2000 The Mcgraw-Hill CompaniesДокумент25 страницMcgraw-Hill © 2000 The Mcgraw-Hill Companiesabhishek fanseОценок пока нет

- Microeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth EditionДокумент35 страницMicroeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth EditionRais Mitra Mahardika0% (1)

- Pricing DecisionsДокумент29 страницPricing DecisionsLive Love100% (1)

- MARK SCHEME For The June 2004 Question PapersДокумент17 страницMARK SCHEME For The June 2004 Question PapersKarmen ThumОценок пока нет

- The Public Accounting Industryproduction Function: Rajiv D. Banker, Hsihui Chang, Reba CunninghamДокумент27 страницThe Public Accounting Industryproduction Function: Rajiv D. Banker, Hsihui Chang, Reba CunninghamReni ListyawatiОценок пока нет

- How Firms Estimate Product Demand FunctionsДокумент46 страницHow Firms Estimate Product Demand Functionsmyra100% (1)

- MBS 1st Sem Model Question 2019Документ14 страницMBS 1st Sem Model Question 2019prakash chauagainОценок пока нет

- Mark To Market AccountingДокумент12 страницMark To Market AccountingAnnie AnОценок пока нет

- Chapter 4Документ32 страницыChapter 4Nokulunga ManyangaОценок пока нет

- Dealership Competition in The U. S. Automobile Industry by Lall B. RamrattanДокумент13 страницDealership Competition in The U. S. Automobile Industry by Lall B. RamrattanGift G NyikayarambaОценок пока нет

- Eco CH 5Документ6 страницEco CH 5hajra khanОценок пока нет

- Supply Chain Excellence: The AIM and DRIVE Process for Achieving Extraordinary ResultsОт EverandSupply Chain Excellence: The AIM and DRIVE Process for Achieving Extraordinary ResultsОценок пока нет

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageОт EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- Title Agency NameДокумент6 страницTitle Agency NameVivek ThotaОценок пока нет

- Companies Email IdsДокумент23 страницыCompanies Email IdsVivek Thota100% (1)

- Sr. Market ResearchДокумент2 страницыSr. Market ResearchVivek Thota100% (1)

- Corporate AgentsДокумент1 023 страницыCorporate AgentsVivek Thota0% (1)

- (114370327) All India Stamp Duty Ready ReckonerДокумент8 страниц(114370327) All India Stamp Duty Ready ReckonerVivek ThotaОценок пока нет

- Companies in Delhi NCR With ContactsДокумент77 страницCompanies in Delhi NCR With ContactsVivek Thota77% (13)

- Chennai IT Companies HR EmailsДокумент23 страницыChennai IT Companies HR EmailsPrasanth Kumar60% (10)

- DelhiДокумент22 страницыDelhiVivek Thota100% (1)

- 58 - 15 - List - of - Ca - Firms - 843Документ306 страниц58 - 15 - List - of - Ca - Firms - 843vijayxkumarОценок пока нет

- Real Estate - August 2013Документ37 страницReal Estate - August 2013IBEFIndiaОценок пока нет

- List of Software Companies in India PDFДокумент44 страницыList of Software Companies in India PDFsanthoshinou50% (2)

- Crime in Delhi-Final (PRESS) 17!01!13Документ26 страницCrime in Delhi-Final (PRESS) 17!01!13Vivek ThotaОценок пока нет

- BaristaДокумент40 страницBaristaVivek Thota100% (1)

- Dominos ReportДокумент20 страницDominos Reportkuntaljariwala100% (1)

- Letter of AllotmentДокумент6 страницLetter of AllotmentVivek Thota50% (2)

- Chapter - 1 Crime Survey: Rule of LawДокумент19 страницChapter - 1 Crime Survey: Rule of LawVivek ThotaОценок пока нет

- Rockwell Automation OverviewДокумент13 страницRockwell Automation OverviewVivek ThotaОценок пока нет

- Agreement To Sell and PurchaseДокумент2 страницыAgreement To Sell and PurchaseMuhammad DarwishОценок пока нет

- EAPP Module 5Документ10 страницEAPP Module 5Ma. Khulyn AlvarezОценок пока нет

- Feyzin Oil Refinery DisasterДокумент8 страницFeyzin Oil Refinery DisasterDavid Alonso Cedano EchevarriaОценок пока нет

- ExportДокумент18 страницExportDolon MukherjeeОценок пока нет

- Henderson PresentationДокумент17 страницHenderson Presentationapi-577539297Оценок пока нет

- Theories of Translation12345Документ22 страницыTheories of Translation12345Ishrat FatimaОценок пока нет

- Application of Carbon-Polymer Based Composite Electrodes For Microbial Fuel CellsДокумент26 страницApplication of Carbon-Polymer Based Composite Electrodes For Microbial Fuel Cellsavinash jОценок пока нет

- French Revolution ChoiceДокумент3 страницыFrench Revolution Choiceapi-483679267Оценок пока нет

- ScreenwritingДокумент432 страницыScreenwritingkunalt09100% (4)

- Flow Through Pipes: Departmentofcivilengineering Presidency University, Bangalore-64 BY Santhosh M B Asstistant ProfessorДокумент15 страницFlow Through Pipes: Departmentofcivilengineering Presidency University, Bangalore-64 BY Santhosh M B Asstistant ProfessorSanthoshMBSanthuОценок пока нет

- Advanced Financial Accounting Chapter 2 LECTURE - NOTESДокумент14 страницAdvanced Financial Accounting Chapter 2 LECTURE - NOTESAshenafi ZelekeОценок пока нет

- Analysis I - SyllabusДокумент3 страницыAnalysis I - SyllabusJUan GAbrielОценок пока нет

- CANAVAN' and VESCOVI - 2004 - CMJ X SJ Evaluation of Power Prediction Equations Peak Vertical Jumping Power in WomenДокумент6 страницCANAVAN' and VESCOVI - 2004 - CMJ X SJ Evaluation of Power Prediction Equations Peak Vertical Jumping Power in WomenIsmenia HelenaОценок пока нет

- The Seasons of Life by Jim RohnДокумент111 страницThe Seasons of Life by Jim RohnChristine Mwaura97% (29)

- Chapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsДокумент10 страницChapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsALANKRIT TRIPATHIОценок пока нет

- Facelift at Your Fingertips - An Aromatherapy Massage Program For Healthy Skin and A Younger FaceДокумент136 страницFacelift at Your Fingertips - An Aromatherapy Massage Program For Healthy Skin and A Younger Faceugur gebologluОценок пока нет

- SRT95 Engine Power TakeoffДокумент20 страницSRT95 Engine Power TakeoffoktopusОценок пока нет

- Land Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationДокумент10 страницLand Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationsardinetaОценок пока нет

- Journey To The ARI-ARhAyas AL-Uma-UN Core of The Krystar Seed Atom FileДокумент14 страницJourney To The ARI-ARhAyas AL-Uma-UN Core of The Krystar Seed Atom FileSungwon Kang100% (2)

- Nodelman 1992Документ8 страницNodelman 1992Ana Luiza RochaОценок пока нет

- BCMEДокумент9 страницBCMEVenkateshwaran VenkyОценок пока нет

- Camp ApplianceДокумент1 страницаCamp ApplianceflyzalОценок пока нет

- No-Till For Micro Farms: The Deep-Mulch Method (Lean Micro Farm)Документ20 страницNo-Till For Micro Farms: The Deep-Mulch Method (Lean Micro Farm)Chelsea Green PublishingОценок пока нет

- Rules & Guidelines of Elliott WaveДокумент12 страницRules & Guidelines of Elliott WaveNd Reyes100% (2)

- DX DiagДокумент42 страницыDX DiagVinvin PatrimonioОценок пока нет

- 1.9 Bernoulli's Equation: GZ V P GZ V PДокумент1 страница1.9 Bernoulli's Equation: GZ V P GZ V PTruong NguyenОценок пока нет

- 74VHCU04Документ6 страниц74VHCU04Alexandre S. CorrêaОценок пока нет

- Optimize Supply Network DesignДокумент39 страницOptimize Supply Network DesignThức NguyễnОценок пока нет

- 1ST Periodical Test ReviewДокумент16 страниц1ST Periodical Test Reviewkaren rose maximoОценок пока нет

- Genigraphics Poster Template 36x48aДокумент1 страницаGenigraphics Poster Template 36x48aMenrie Elle ArabosОценок пока нет

- Food 8 - Part 2Документ7 страницFood 8 - Part 2Mónica MaiaОценок пока нет