Академический Документы

Профессиональный Документы

Культура Документы

Budget of Jammu & Kashmir (J&K) 2012-13

Загружено:

sher_azmatИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Budget of Jammu & Kashmir (J&K) 2012-13

Загружено:

sher_azmatАвторское право:

Доступные форматы

Welfare initiatives

Rs 130 crore for return

and rehabilitation of kashmiri migrants.

Rs 8 crore set apart for

migrants group mediclaim insurance

Rs 90 Crore for Sher-ekashmir employment & Welfare Programme for the youth.

Welfare initiatives

Rs 21 crore for welfare of

SCs and OBCs.

Rehbar-e-Talim to get

uniform remuneration of Rs 3000/- per month.

Child & Women Empowerment

Rs 5 crore provision for

beti-anmol scheme.

Rs 10 crore for

empowering skilled young women.

Rs 16 Crore for training of

women in Handicafts and Handlooms trade

Initiatives in agriculture sector

Exemption from levy of VAT on

all types of chemical fertilizers, bio-fertilizers and micro nutrients. Fungicides akso exempt from levy of VAT. Insurance services covering agriculture, horticulture crops exempt from service tax. Insurance services providing cover to cattle wealth, poultry, birds, fish, sheep, goat and dairy units also exempt from service tax.

Welfare initiatives

Rs 723 crore for expanding

Investment of Rs 343 crore

in Agriculture Sector for improving seed replacement rate, farm mechanization, post harvest management and marketing facilitation of fruit, vegetables, commercial floriculture and sericulture produce.

irrigation network in the state

Initiative for tourism sector

List of areas and

locations qualifying for incentives under tourism package liberalized and expanded.

Capital investment

subsidy limit raised to Rs 100 lakh in case of prestigious units investing Rs 25 crore or more

TAX Concessions

Atta, maida, suji, besan, rice,

paddy outside VAT net for one more year. Tax concessions to individual units extended for further one year. Concessions and exemptions enjoyed by tourism sector to continue for yet another year. Besides exemption of water usage charges for ten years, independent power producers also to enjoy exemptionof entry taxon import of all power generation and transmission equipment, building material.

Initiative for tourism sector

Service tax exemption for

private hospitals, nursing homes, diagnostic centres, pathological services to human beings and animals.

Consideration for youth & students

Desktop, laptops, palmtops etc.

exempt from VAT. Computer peripherals like pen drives, CDc, memory cards, chips, headphones, electronic diaries, computer cleaning kits and other IT peripherals also exempt from VAT Stationery items like adhesive solutions, gum pastes, lapping compounds, tapes, sealing wax, paper envelopes, pencils, highlighters, erasers, sharpeners, pencil boxes etc exempt form tax.

Consideration for youth & students

Vat on sales of cigarettes

and related items further hiked to 30% Sales tax on liquor, beer etc. enhanced to 30% Security and placement services, Pnadal and shamiana Services, annual maintenance contracts brought under service tax net. Five paisa per kilometer increase in the rate of toll.

Thank You For Your

Kind Attention

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Fvs 9-02-2022 Carolina TapiaДокумент1 страницаFvs 9-02-2022 Carolina Tapiajorge fravega ammannОценок пока нет

- Badminton Court ProjectДокумент5 страницBadminton Court ProjectPrince GeraldОценок пока нет

- Neopost Franking Machines Cut CostsДокумент3 страницыNeopost Franking Machines Cut CostsNeopostUKОценок пока нет

- Reformulared SoR For The Year 2008-09Документ19 страницReformulared SoR For The Year 2008-09T T RAMA RAOОценок пока нет

- Management Accountant - September 2011 PDFДокумент120 страницManagement Accountant - September 2011 PDFSubir ChakrabartyОценок пока нет

- Business PlanДокумент43 страницыBusiness PlanVimithraОценок пока нет

- Ebiz Tax Test FlowДокумент4 страницыEbiz Tax Test FlowTim TomОценок пока нет

- FINANCE ManualДокумент123 страницыFINANCE ManualcakotyОценок пока нет

- BMI Middle East and Africa Oil and Gas Insight March 2016Документ10 страницBMI Middle East and Africa Oil and Gas Insight March 2016Anonymous pPpTQrpvbrОценок пока нет

- Transfer Taxes and VATДокумент3 страницыTransfer Taxes and VATDianne Medel GumawidОценок пока нет

- TAX HO1002 Individual Taxation StudentДокумент12 страницTAX HO1002 Individual Taxation StudentYuri CaguioaОценок пока нет

- Grant Thornton-Startups ReportДокумент52 страницыGrant Thornton-Startups ReportMahesh PanigrahyОценок пока нет

- The Haryana Value Added Tax ACT, 2003Документ83 страницыThe Haryana Value Added Tax ACT, 2003adwiteya groverОценок пока нет

- NEPAL Tax Reform Strategic PlanДокумент44 страницыNEPAL Tax Reform Strategic PlanPaxton Walung LamaОценок пока нет

- Reliance Retail Limited: Tax InvoiceДокумент3 страницыReliance Retail Limited: Tax InvoiceNewton GogoiОценок пока нет

- Revenue Guidance Understanding Your BillДокумент89 страницRevenue Guidance Understanding Your BillBenny BerniceОценок пока нет

- Computer Skill Test: Total Time Allowed: 30 Minutes Maximum Total Marks: 50 General Instructions To The CandidatesДокумент6 страницComputer Skill Test: Total Time Allowed: 30 Minutes Maximum Total Marks: 50 General Instructions To The CandidatesDHANUSH DRAVIDОценок пока нет

- VenkatapurДокумент14 страницVenkatapurBUKA RAMAKANTHОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Himanshu JainОценок пока нет

- Documentary Requirements of Budgetary RequestsДокумент5 страницDocumentary Requirements of Budgetary RequestsSheryl Balualua Mape-SalvatierraОценок пока нет

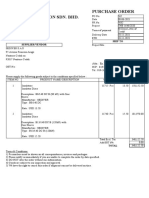

- Ambc Transmission Sdn. Bhd. Purchase Order: Supplier/Vendor Ship ToДокумент2 страницыAmbc Transmission Sdn. Bhd. Purchase Order: Supplier/Vendor Ship ToQALIОценок пока нет

- Fico S/4 Hana: Igrow SoftДокумент12 страницFico S/4 Hana: Igrow SoftVenkat Ramireddy Basam100% (1)

- Post Graduate Certificate in Finance: (Taxation Laws) - PGCF (TL) ProgramcurriculumДокумент1 страницаPost Graduate Certificate in Finance: (Taxation Laws) - PGCF (TL) ProgramcurriculumSanjayОценок пока нет

- Panasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010Документ2 страницыPanasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010idolbondoc100% (1)

- MTP 2 TaxДокумент10 страницMTP 2 TaxPrathmesh JambhulkarОценок пока нет

- Chapter 2 VAT On ImportationxxДокумент4 страницыChapter 2 VAT On ImportationxxMicko LagundinoОценок пока нет

- Digests Non-Impairement ClauseДокумент3 страницыDigests Non-Impairement ClauseMikkoОценок пока нет

- Acca P6Документ11 страницAcca P6novetanОценок пока нет

- HBC 2211 TaxationДокумент105 страницHBC 2211 TaxationMAYENDE ALBERTОценок пока нет

- Terp Asia Construction Corp.: Statement of AccountДокумент4 страницыTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoОценок пока нет