Академический Документы

Профессиональный Документы

Культура Документы

2012 03 16 Finasta Rīta Apskats

Загружено:

FinastaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2012 03 16 Finasta Rīta Apskats

Загружено:

FinastaАвторское право:

Доступные форматы

(2012-03-16)

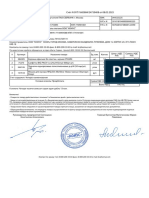

: US INITIAL JOBLESS CLAIMS

(thousands)

(2012-03-16)

( 9:00)

700

600

500

400

2011/09

2011/03

2010/09

2010/03

2009/09

2009/03

2008/09

2008/03

2007/09

200

2007/03

300

(2012-03-15)

(WTI)

USD/bar.

105.11

-0.30%

USD/bar.

119.99

1.13%

(Urals)

USD/OZ

1658.43

0.82%

USD/MT

8565.00

1.18%

USD/bu.

6.65

1.99%

USD/bu.

13.69

1.39%

(2012-03-15)

EUR / USD

1.308

USD / JPY

83.57

GBP / USD

1.5711

(2012-03-15)

Libor 6 . (USD)

0.74

Euribor 6 .

1.17

10

2.28

10

1.97

0.37%

-0.19%

0.23%

-0.10 bp

-0.90 bp

1.08 bp

1.40 bp

.

,

.

.

, ,

.

-0.55%

KOSPI 200 Index (

268.27

)

HANG SENG Index ()

21322.60

CSI 300 Index ()

2606.36

BSE Sensex Index ()

17699.84

NIKKEI 225 Index ()

10129.83

(2012-03-15)

Dow Jones Industrial Average

13252.76

S&P 500 Index

1402.60

NASDAQ Index

3056.37

(2012-03-15)

BOVESPA Index ()

67749.49

MEXBOL Index ()

38134.57

MERVAL Index ()

2744.09

IPSA Index ()

4580.63

(2012-03-15)

FTSE 100 Index

5940.72

()

-0.14%

0.80%

0.14%

0.06%

0.44%

0.60%

0.51%

-0.74%

0.43%

1.27%

0.64%

-0.08%

DAX Index ()

7144.45

0.92%

CAC 40 Index ()

3580.21

0.44%

(2012-03-15)

OMXV Index ()

315.4

0.24%

OMXR Index ()

394.94

0.39%

OMXT Index ()

600.34

0.25%

(2012-03-15)

RTS Index ()

1754.81

0.16%

BELEX Index ()

544.61

-0.52%

BET Index ()

5238.00

0.34%

PFTS Index ()

527.42

-0.64%

CROBEX Index ()

1830.45

0.63%

BUX Index ()

19378

0.00%

WIG Index ()

42281.33

0.51%

PX Index ()

993.1

-0.65%

SOFIX Index ()

314.11

1.12%

0.2%

75.8

0.2%

75.3

0.4%

0.0%

. ,

( ). Finasta .

( , ..)

, .

(2012-03-16)

,

,

.

351 ,

12,5 ,

.

, S&P 500 1

400 2008 .

" "

Dow Jones Industrial Average

0,44% 13252,76 ,

S&P 500 0,60%

1402,60

,

Nasdaq

0,51% 3056,37 .

" "

.

JPMorgan (+2,57%), General

Electric (+1,87%), DuPont (+1,71%), 3M (+1,27%),

Cisco Systems (-1,41%),

Home Depot (-0,55%), Chevron (-0,60%).

Dow Jones

,

.

.

1,57%,

- Citigroup (+3,01%), PNC Financial

Services (+2,69%), SunTrust Banks (+3,73%).

Guess

10,16% ,

2013 $2,65

,

($3,16 ).

Vera Bradley

-

9,59%- ,

1 -.

CSX 8,46% ,

,

1 .

15

:

FTSE 100 "" 4,71

(-0,08%) 5940,72 ,

Fitch

"".

,

" ".

,

. ,

, --

-,

,

.

DAX 65,03 (0,92%) -

7144,45 , CAC 40 - 15,70

(0,44%) - 3580,21 , SMI - 31,79

(0,50%) - 6332,22 , AEX -

1,90 (0,57%) - 335,10 .

" " FTSEurofirst 300

0,28% 1101,46 .

: Lloyds Banking Group

2,8%, Kazakhmys 1,9%.

, 8 ,

.

DAX

0,9% - 7144,5 ,

,

, -,

,

.

K+S 7,2%,

HeidelbergCement 5,1%

2011

2012

.

ThyssenKrupp 4,2%, Lufthansa

0,9%

AUA.

16

Nikkei,

, 10123,3 .

, Nikkei

,

- 10129,83 (+0,06%).

16

,

.

""

,

(2012-03-16)

,

.

,

Sony

Corp.

0,05%,

Honda Motor Co. - 0,91%,

Fanuc -

0,2%.

(

)

. , 15

2012.

0,5%

. ,

(US

Department of Labor), ,

351 ., ,

355 . .

Nikkei

,

Astellas Pharma (-0,29%),

Bridgestone (-1,01%), Fast Retailing (1,17%) Konica Minolta

(-0,28%).

,

, OMX Tallinn OMX

Riga 0,25 0,39, . OMX Vilnius

0,24%.

2012

5%,

.

,

29,7%,

6,6%. ,

.

OMX Tallinn. Tallinna Vesi

, 739 . EUR, Baltika

2,84%,

, Ekspress Grupp 1,57%.

OMX Riga.

, Grindeks 58 . EUR,

2,09%, Olainfarm 154 . EUR,

.

OMX Vilnius.

Snaig +(1,92%) Invalda (+2,20%)

, 61 . EUR 51 . EUR.

, :

0,28% - 1626,63 ,

0,15% 1754,67 .

-

552,65 .

. 0,12%,

1752,77 , - 0,27% - 1622,23

. 0,13% -

170680 .

Brent

0,21%, 124,24 ./.

. ""

0,8%, "" - 0,21%, 0,7%. ""

"" - 0,7%.

:

0,93%, -

0,08%, "" - 0,37%.

S&P 500

1400 - 2008.

,

.

,

,

-

- .

7,6%

.

,

.

,

.

, , .

: Bloomberg, CNN Money, Reuters, DailyFX, MarketWatch, Wall Street Journal,

Finam, .

(2012-03-16)

WTI (USD/bar.)

(USD/MMBtu)

5.3

120

4.8

110

4.3

100

3.8

90

3.3

2.8

80

2.3

70

2011/3/17

2011/6/17

2011/9/17

1.8

2011/3/17

2011/12/17

2011/6/17

(USD/OZ)

880

1850

820

1750

760

1650

700

1550

640

1450

580

2011/6/17

2011/9/17

2011/12/17

(USD/bu.)

1950

1350

2011/3/17

2011/9/17

520

2011/3/17

2011/12/17

Reuters/Jefferies

2011/6/17

2011/9/17

2011/12/17

10 - (%)

380

4.0

3.6

360

3.2

340

2.8

2.4

320

2.0

300

280

2011/3/17

1.6

2011/6/17

2011/9/17

1.2

2011/3/17

2011/12/17

(%)

7.0

1.8

6.0

1.6

5.0

1.4

Euribor 6 .

1.0

Libor (USD) 6 .

2011/12/17

4.0

3.0

2.0

0.8

1.0

0.6

0.0

2009/5/23

0.4

0.2

2011/3/15

2011/9/17

(%)

2.0

1.2

2011/6/17

2011/6/15

2011/9/15

2011/12/15

2012/3/15

2010/2/23

2010/11/23

2011/8/23

Вам также может понравиться

- КомусДокумент1 страницаКомусАнастасия ИванкинаОценок пока нет

- Log 957 WP1AC29P48LA83884Документ5 страницLog 957 WP1AC29P48LA83884Vetalec GalatsanОценок пока нет

- итоги отборочного этапа 11 класс литератураДокумент20 страницитоги отборочного этапа 11 класс литератураEugeniaОценок пока нет

- Tinkov - Ya Takoyi Kak VseДокумент260 страницTinkov - Ya Takoyi Kak VseVictoriaОценок пока нет

- Газпром МСФО 4 квартал 2009Документ445 страницГазпром МСФО 4 квартал 2009stanislaw_schwefelОценок пока нет