Академический Документы

Профессиональный Документы

Культура Документы

CHAPTER - 3 - Problems - Answers

Загружено:

Fahad MushtaqИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CHAPTER - 3 - Problems - Answers

Загружено:

Fahad MushtaqАвторское право:

Доступные форматы

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS

Problem 3.4

The Accounting Cycle: Journalizing, Posting, and Preparing a Trial Balance a.

Transaction June 1 June 2 June 4 June 15 June 15 June 18 June 25 June 30 June 30 June 30 June 30 Revenue NE NE NE I NE NE NE I NE NE NE Income Statement Expenses = Net Income NE NE I NE I I NE NE I I NE NE NE D I D D NE I D D NE Assets I I D I D D NE I D NE NE = Balance Sheet Liabilities + NE I NE NE NE NE NE NE NE I I Owners Equity I NE D I D D NE I D D D

b.

2005 June 1 Cash Capital Stock Issued stock to Wendy Winger 2 Aircraft Cash Notes Payable Purchased plane from Utility Aircraft 4 Rent Expense Cash Paid office and hangar rent for June.

General Journal

60,000 60,000 220,000 40,000 180,000 2,500 2,500 8,320 8,320 5,880 5,880 1,890 1,890 4,910 4,910 16,450 16,450 6,000 6,000 2,510 2,510 2,000 2,000

15

Accounts Receivable Aerial Photography Revenue Billed customers for first half of June. Salaries Expense Cash Paid salaries for first half of June. Maintenance Expense Cash Paid Hannigans Hangar for repair services Cash Accounts Receivable Collected portion of amount billed to customers

15

18

25

30

Accounts Receivable Aerial Photography Revenue Billed customers for services rendered through month-end Salaries Expense Cash Paid salaries through month-end Fuel Expense Accounts Payable Received bill for fuel used during June Dividends Dividends Payable Declared dividend payable July 15.

30

30

30

Page 1 of 6

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS

Cash

Date 2005 June 1 2 4 15 18 25 30 Explanation Debt 60,000 40,000 2,500 5,880 1,890 4,910 6,000 Credit Balance 60,000 20,000 17,500 11,620 9,730 14,640 8,640

Accounts Receivable

Date 2005 June 15 25 30 Explanation Debt 8,320 4,910 16,450 Credit Balance 8,320 3,410 19,860

Aircraft

Date 2005 June 2 Explanation Debt 220,000 Credit Balance 220,000

Notes Payable

Date 2005 June 2 Explanation Debt Credit 180,000 Balance 180,000

Accounts Payable

Date 2005 June 30 Explanation Debt Credit 2,510 Balance 2,510

Dividends Payable

Date 2005 June 30 Explanation Debt Credit 2,000 Balance 2,000

Capital Stock

Date 2005 June 1 Explanation Debt Credit 60,000 Balance 60,000

Dividends

Date 2005 June 1 Explanation Debt 2,000 Credit Balance 2,000

Aerial Photography Revenue

Date 2005 June 15 30 Explanation Debt Credit 8,320 16,450 Balance 8,320 24,770

Maintenance Expense

Date 2005 June 18 Explanation Debt 1,890 Credit Balance 1,890

Page 2 of 6

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS

Fuel Expense

Date 2005 June 30 Explanation Debt 2,510 Credit Balance 2,510

Salaries Expense

Date 2005 June 15 30 Explanation Debt 5,880 6,000 Credit Balance 5,880 11,880

Rent Expense

Date 2005 June 4 Explanation Debt 2,500 Credit Balance 2,500

d.

AERIAL VIEWS Trial Balance June 30, 2005

Cash Accounts receivable Aircraft Notes payable Accounts payable Dividends payable Capital stock Retained earnings Dividends Aerial Photography revenue Maintenance expense Fuel expense Salaries expense Rent expense (Rs.) 8,640 19,860 220,000 (Rs.)

180,000 2,510 2,000 600,000 0 2,000 24,770 1,890 2,510 11,880 2,500 269,280

_______ 269,280

e.

(Rs.) Total assets: Cash Accounts receivable Aircraft Total assets Total liabilities: Notes payable Accounts payable Dividends payable Total liabilities Total stockholders equity: Total assets total liabilities (Rs. 248,500 Rs. 184,510) (Alternates computation net all owners equity accounts, permanent and temporary: The above figures are most likely not the amounts to be reported in the balance sheet dated June 30. The accounting cycle includes adjustments that must be made to the trial balance figures before financial statements are prepared. The adjusting process is covered in Chapter 4. 8,640 19,860 220,000 248,500 180,000 2,510 2,000 184,510 63,990 (Rs.)

Page 3 of 6

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS

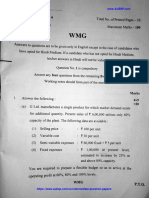

Problem 3.5

The Accounting Cycle: Journalizing, Posting and Preparing and Preparing a Trial Balance a.

Transaction May 1 May 4 May 9 May 16 May 21 May 24 May 27 May 28 May 31 Revenue NE NE NE NE NE I NE NE NE Income Statement Expenses = Net Income NE NE NE NE NE NE I NE I NE NE NE NE NE I D NE D Assets I I NE I NE I NE NE D = Balance Sheet Liabilities + NE I NE I NE NE I NE NE Owners Equity I NE NE NE NE I D NE D

b.

2005 May 1 Cash Capital Stock Issued 5,000 shares of capital stock 4 Land Building Cash Notes Payable Purchased land and building 9 Medical Instruments Cash Purchased medical instruments. Office Fixtures & Equipment Cash Accounts Payable Purchased fixtures and equipment Office Supplies Cash Purchased office supplies.

General Journal

400,000 400,000 70,000 180,000 100,000 150,000 130,000 130,000 50,000 20,000 30,000 5,000 5,000 1,900 300 2,200 400 400 100 100 2,800 2,800

10

21

24

Cash Accounts Receivable Veterinary Service Revenue Recorded veterinary service revenue earned. Advertising Expense Accounts Payable Recorded advertising expense incurred in May. Cash Accounts Receivable Collected cash for May 24 services.

27

28

31

Salary Expense Cash Paid May salary expense

Page 4 of 6

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS c. May 1 May 24 May 28 May 31 Bal. Cash 400,000 1,900 100 144,200 Accounts Receivable 300 May 28 200 Office Supplies 5,000 5,000 Medical Instruments 130,000 130,000 Office Fixtures & Equipment 50,000 50,000 Land 70,000 70,000 Building 180,000 180,000 May 27 May 31 Bal. May 4 May 9 May 16 May 21 May 31 100,000 130,000 20,000 5,000 2,800 Notes Payable May 4 150,000

May 31 Bal. Accounts Payable May 16 May27 May 31 Bal. Capital Stock May 1 May 31 Bal. Veterinary Service Revenue May 24 May 31 Bal. Advertising Expense 400 400 Salary Expense 2,800 2,800

150,000

May 24 May 31 Bal. May 21 May 31 Bal. May 5 May 31 Bal. May 31 May 31 Bal.

100

30,000 400 30,400 400,000 400,000 2,200 2,200

May 04 May 31 Bal. May 04 May 31 Bal.

May 31 May 31 Bal.

d.

AERIAL VIEWS Trial Balance June 30, 2005

Cash Accounts receivable Office supplies Medical Instruments Office fixtures & equipment Land Building Notes pyable Accounts payable Capital stock Retained earnings Veterinary service revenue Advertising expense Salary expense (Rs.) 144,200 200 5,000 130,000 50,000 70,000 180,000 (Rs.)

150,000 30,400 400,000 0 2,200 400 2,800 582,600 ________ 582,600

Page 5 of 6

FINANCIAL ACCOUNTING (CHAPTER # 3) PROBLEMS - ANSWERS

e.

(Rs.) Total assets: Cash Accounts receivable Office supplies Medical instruments Office fixtures & equipment Land Building Total assets Total liabilities: Notes payable Accounts payable Total liabilities Total owners (stockholders) equity: Total assets total liabilities (Rs. 579,400 Rs. 180,400) As shown below, the business was not profitable in its first month of operations: Veterinary service revenue Less: Advertising expense Salary expense Net loss 400 2,800 2,200 3,200 (1,000) 144,200 200 5,000 130,000 50,000 70,000 180,000 579,400 150,000 30,400 180,400 399,000 (Rs.)

Page 6 of 6

Вам также может понравиться

- 35 Ipcc Accounting Practice ManualДокумент218 страниц35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Документ9 страниц11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Comprehensive Accounting Cycle Review ProblemДокумент11 страницComprehensive Accounting Cycle Review Problemapi-253984155Оценок пока нет

- Chapter 2 - The Accounting CycleДокумент36 страницChapter 2 - The Accounting CycleAlan Lui50% (2)

- Chemilite Case StudyДокумент12 страницChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- Brief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceДокумент6 страницBrief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceRakibul Islam Khan83% (6)

- Accounting ProblemsДокумент7 страницAccounting Problemspammy313100% (1)

- Gaap vs. IfrsДокумент5 страницGaap vs. Ifrsمحاسب.أحمد شعبانОценок пока нет

- Accounting Cycle Problem Question No.1.1Документ2 страницыAccounting Cycle Problem Question No.1.1kmillat33% (3)

- Accounts Assignment 2Документ12 страницAccounts Assignment 2shoaiba167% (3)

- Comprehensive ProblemДокумент11 страницComprehensive Problemapi-295660192Оценок пока нет

- FI504 Case Study 1 The Complete Accounting CycleДокумент16 страницFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- Corporate LiquidationДокумент7 страницCorporate LiquidationJemarie Alamon100% (1)

- Accounting Concepts Case Study and SolutionДокумент8 страницAccounting Concepts Case Study and SolutionAlok Biswas100% (1)

- Complete Accounting Cycle ExerciseДокумент28 страницComplete Accounting Cycle ExerciseBrian Dillard94% (17)

- Corporate LiquidationДокумент7 страницCorporate LiquidationNathallie CabalunaОценок пока нет

- Chapter # 5 - Exercise & Problems - AnswersДокумент13 страницChapter # 5 - Exercise & Problems - AnswersHumza Abbasi0% (3)

- Chapter - 2 - Exercise & Problems ANSWERSДокумент5 страницChapter - 2 - Exercise & Problems ANSWERSFahad Mushtaq100% (2)

- Jesse Taylor Comprehensive Accounting ProblemДокумент9 страницJesse Taylor Comprehensive Accounting Problemapi-311367219Оценок пока нет

- 3-Work Sheet - Cash AccountДокумент4 страницы3-Work Sheet - Cash AccountMonu NehraОценок пока нет

- Chapter 5 Accounting For Merchandising OperationsДокумент15 страницChapter 5 Accounting For Merchandising OperationsSantun Pi TOen100% (2)

- Company Accounting 9th Edition Solutions PDFДокумент37 страницCompany Accounting 9th Edition Solutions PDFatup12367% (9)

- Managing Interest Rate RiskДокумент32 страницыManaging Interest Rate RiskHenry So E Diarko100% (1)

- Chapter 12Документ57 страницChapter 12frq qqr75% (4)

- Entrep Module 3Документ10 страницEntrep Module 3JOHN PAUL LAGAOОценок пока нет

- Week 6 - Solutions (Some Revision Questions)Документ13 страницWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- Case Study 2Документ3 страницыCase Study 2edookati100% (1)

- Closing EntsДокумент20 страницClosing EntsEmma Ria100% (1)

- Alpine Expeditions Operates A Mountain Climbing School in Colorado SomeДокумент2 страницыAlpine Expeditions Operates A Mountain Climbing School in Colorado Sometrilocksp SinghОценок пока нет

- Party Wagon Inc Provides Musical Entertainment at Weddings Dances andДокумент2 страницыParty Wagon Inc Provides Musical Entertainment at Weddings Dances andAmit PandeyОценок пока нет

- Poa Week 7 Lecture - Problem No 4.4aДокумент13 страницPoa Week 7 Lecture - Problem No 4.4aSaad Khan67% (3)

- Ac Solve PaperДокумент59 страницAc Solve PaperHaseeb ShadОценок пока нет

- Selective PagesДокумент13 страницSelective PagesQuality Assurance Manager0% (2)

- Comprehensive ProblemДокумент13 страницComprehensive ProblemUmair Zoberi100% (8)

- JournalsДокумент4 страницыJournalsAkash Srikumar0% (1)

- CH 04Документ4 страницыCH 04vivien33% (3)

- 7110 June 2006Документ12 страниц7110 June 2006Kristen NallanОценок пока нет

- CH 04Документ4 страницыCH 04Nusirwan Mz50% (2)

- ExcelДокумент10 страницExcelWaseem TajОценок пока нет

- 2008 ch1 ExsДокумент21 страница2008 ch1 ExsamatulmateennoorОценок пока нет

- Introduction To Accounting - Fall 2011 Example - Merchandising Recording TransactionsДокумент4 страницыIntroduction To Accounting - Fall 2011 Example - Merchandising Recording Transactionsq0% (1)

- Problems On Cash Flow StatementsДокумент12 страницProblems On Cash Flow StatementsAnjali Mehta100% (1)

- FI504 Case Study 1Документ16 страницFI504 Case Study 1hereforanswersОценок пока нет

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsДокумент14 страницAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- Accounting Principle Kieso 8e - Ch04Документ45 страницAccounting Principle Kieso 8e - Ch04Sania M. JayantiОценок пока нет

- Acct1501 Tut 4 HWДокумент5 страницAcct1501 Tut 4 HWjroflcopterОценок пока нет

- FI504 Case Study 1Документ17 страницFI504 Case Study 1Scott SmithОценок пока нет

- Analysis of Financial StatementsДокумент33 страницыAnalysis of Financial StatementsKushal Lapasia100% (1)

- BT NhómДокумент28 страницBT NhómTrần Hường100% (1)

- NotesДокумент40 страницNotesTicktactoe100% (1)

- 11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Документ14 страниц11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Rishabh SethiaОценок пока нет

- Sample Problem of Corporation LiquidationДокумент11 страницSample Problem of Corporation LiquidationAnne Camille Alfonso50% (4)

- Roxanne Robinson - FI504 Case Study 1 The Complete Accounting CycleДокумент16 страницRoxanne Robinson - FI504 Case Study 1 The Complete Accounting CycleroxannerobinsonОценок пока нет

- Week 3Документ14 страницWeek 3John PerkinsОценок пока нет

- ACCT504 Case Study 1Документ15 страницACCT504 Case Study 1sinbad97100% (1)

- Accounting Week 1Документ4 страницыAccounting Week 1Muhammad Fikri MaulanaОценок пока нет

- 2012Документ21 страница2012Mohammad Salim HossainОценок пока нет

- 1101AFE Final Exam Practice Paper SEM 1Документ10 страниц1101AFE Final Exam Practice Paper SEM 1张兆宇Оценок пока нет

- ACCT5101Pretest PDFДокумент18 страницACCT5101Pretest PDFArah OpalecОценок пока нет

- Acct504 w3 Case Study NoorДокумент20 страницAcct504 w3 Case Study NoorNoorehira Naveed100% (2)

- CCC 4 - AnsДокумент31 страницаCCC 4 - AnsPramod Dubey100% (1)

- Marking Scheme: Section AДокумент8 страницMarking Scheme: Section Aaegean123Оценок пока нет

- Case Study The Complete AccounДокумент16 страницCase Study The Complete Accoundeepak.agarwal.caОценок пока нет

- Advanced AccountingДокумент13 страницAdvanced AccountingprateekfreezerОценок пока нет

- Hamza Engineering Services: QuotationДокумент1 страницаHamza Engineering Services: QuotationFahad MushtaqОценок пока нет

- NestleДокумент6 страницNestleFahad MushtaqОценок пока нет

- CS - FormatДокумент2 страницыCS - FormatFahad MushtaqОценок пока нет

- Presentation On: Women Entrepreneurship: Scope and Challenges of Beauty Parlor Business Prepared By: MutualДокумент17 страницPresentation On: Women Entrepreneurship: Scope and Challenges of Beauty Parlor Business Prepared By: MutualFahad MushtaqОценок пока нет

- Infinity Engineering (PVT) LTDДокумент8 страницInfinity Engineering (PVT) LTDFahad MushtaqОценок пока нет

- Rupees: Required Space Required Land 2,250 10 RENT For 10 Marla Space 50,000.00Документ8 страницRupees: Required Space Required Land 2,250 10 RENT For 10 Marla Space 50,000.00Fahad MushtaqОценок пока нет

- BHG PowerpointДокумент23 страницыBHG PowerpointFahad MushtaqОценок пока нет

- Organogram Marketing & Sales (OBS Pharma)Документ5 страницOrganogram Marketing & Sales (OBS Pharma)Fahad MushtaqОценок пока нет

- Effective Executive: Muhammad Amir Mushtaq EX-MBA-Fall-12-058Документ6 страницEffective Executive: Muhammad Amir Mushtaq EX-MBA-Fall-12-058Fahad MushtaqОценок пока нет

- Develop PM Teams Out-Put In-Put Tools-TechniquesДокумент6 страницDevelop PM Teams Out-Put In-Put Tools-TechniquesFahad MushtaqОценок пока нет

- Unemployment and Inflation: Full Employment and Underemployment: A Society Is Almost Never FullyДокумент5 страницUnemployment and Inflation: Full Employment and Underemployment: A Society Is Almost Never FullyFahad MushtaqОценок пока нет

- HUL PPI - Area & Account Manager (BD) - CRM & MIS Head - B.Tech Top 10% (Mktng. Major)Документ2 страницыHUL PPI - Area & Account Manager (BD) - CRM & MIS Head - B.Tech Top 10% (Mktng. Major)Panchanan HalderОценок пока нет

- Chapter 9 Outline: Consumer and Producer SurplusДокумент46 страницChapter 9 Outline: Consumer and Producer SurplusSaahilSimhadОценок пока нет

- Main Market Forms: Micro EconomicsДокумент15 страницMain Market Forms: Micro EconomicsYASH VARDHAN TYAGIОценок пока нет

- (Resa2016) Afar (Quiz 1)Документ6 страниц(Resa2016) Afar (Quiz 1)PCОценок пока нет

- The Role of Accounting Information System On Business PerformanceДокумент9 страницThe Role of Accounting Information System On Business Performanceindex PubОценок пока нет

- Tax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaДокумент13 страницTax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDОценок пока нет

- AssignmentДокумент3 страницыAssignmentRonald GarciaОценок пока нет

- M M M M M: Arketing Arketing Arketing Arketing ArketingДокумент73 страницыM M M M M: Arketing Arketing Arketing Arketing ArketingRavindra SinghОценок пока нет

- Black BookДокумент148 страницBlack BookPratik MehtaОценок пока нет

- LLA Financing OverviewДокумент41 страницаLLA Financing OverviewCarlos Moscoso AllelОценок пока нет

- 5.main AssignmentДокумент17 страниц5.main AssignmentRajani SinghОценок пока нет

- Chapter 4 Cost AccountngДокумент4 страницыChapter 4 Cost AccountngFarah YasserОценок пока нет

- Zomato Equity Research ReportДокумент12 страницZomato Equity Research ReportShubhamShekharSinhaОценок пока нет

- Asset Acquisition Through Direct Capitalization in SAP CLOUDДокумент72 страницыAsset Acquisition Through Direct Capitalization in SAP CLOUDRaju Raj RajОценок пока нет

- Cost and Management AccountingДокумент5 страницCost and Management AccountingIbtehaj KayaniОценок пока нет

- Assignment TopicsДокумент2 страницыAssignment Topicsswarna lathaОценок пока нет

- International Marketing - 307Документ2 страницыInternational Marketing - 307Amol0150Оценок пока нет

- Economics 121: Zvika NeemanДокумент26 страницEconomics 121: Zvika NeemanMatteo GodiОценок пока нет

- Darwin Melendez - Ledger AccountsДокумент4 страницыDarwin Melendez - Ledger AccountsDarwin MelendezОценок пока нет

- Ca Inter Cost Paper Nov 2020 New SyllabusДокумент12 страницCa Inter Cost Paper Nov 2020 New SyllabusSushant S. ShuklaОценок пока нет

- Hair Salon Business PlanДокумент32 страницыHair Salon Business PlanLjupka JoshevskaОценок пока нет

- Case Study 3 (A00159525)Документ8 страницCase Study 3 (A00159525)Itmam Sanjid SparshanОценок пока нет

- Exercise 2b Financial AccountingДокумент23 страницыExercise 2b Financial AccountingkeziaОценок пока нет

- Business Plan 1Документ8 страницBusiness Plan 1Mimi Adriatico JaranillaОценок пока нет

- Value Chain Slides Powerpoint TemplateДокумент20 страницValue Chain Slides Powerpoint TemplateWidjaya HarahapОценок пока нет

- Bank of The Philippine IslandsДокумент40 страницBank of The Philippine IslandsRed Christian PalustreОценок пока нет